Free Finance Mergers & Acquisitions Risk Statement

This statement is aimed at understanding and addressing the fundamental risks associated with finance mergers and acquisitions for [Your Company Name]. It offers a structured approach towards incorporating risk management during the process of finance mergers and acquisitions thereby enhancing the value of the organization.

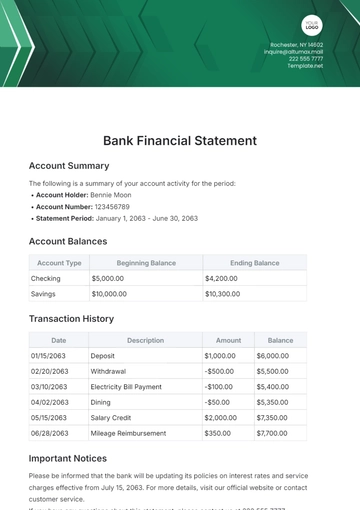

1. Strategic Risk

The risks and uncertainties associated with strategic decisions such as valuation and prospective synergies can lead to financial loss. It is critical to scrutinize business plans and make accurate forecasts to mitigate this risk.

2. Operational Risk

This risk emerges from the integration of operations post-merger or acquisition. The risk can be minimized through effective business processes and systems integration.

3. Reputational Risk

The reputation of the organization might be at stake due to potential disruptions and public sentiment. Regular stakeholder communications and management of expectations can help in mitigating this risk.

4. Regulatory Risk

This pertains to non-compliance with regulations in the country of operation, which can lead to legal consequences. Comprehensive legal and compliance due diligence is required to avoid such risks.

5. Cybersecurity Risk

This refers to the potential exposure to cyber threats post-merger or acquisition. By conducting thorough cybersecurity due diligence and implementing strong security practices, this risk can be mitigated.

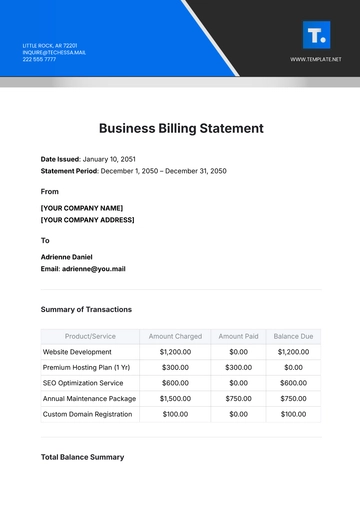

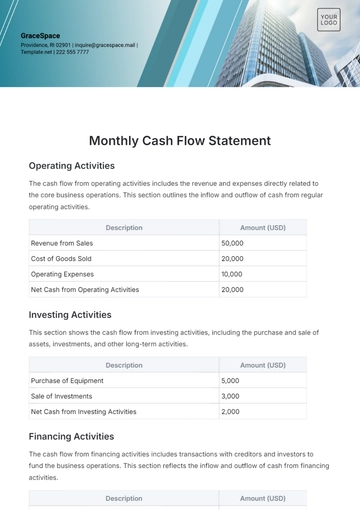

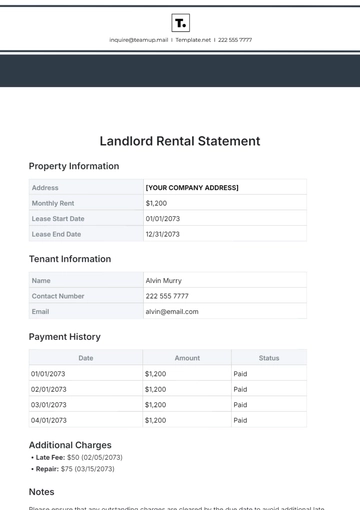

6. Financial Risk

Risk Type | Potential Impact | Mitigation Strategy |

|---|---|---|

Integration costs and unexpected expenses | This can lead to substantial financial loss | Implement robust financial control processes |

Complex financial reporting | This may lead to inaccurate financial statements | Keep transparency in financial dealings |

Fluctuating exchange rates | May impact the financial stability of the organization | Use of comprehensive hedging solutions |

Mergers and acquisitions, while offering significant opportunities for growth and expansion, come with a range of risks that must be carefully managed. [Your Company Name] is dedicated to a strategic approach in its M&A activities, recognizing the importance of thorough planning, risk assessment, and stakeholder engagement. By adhering to various risk mitigation strategies, we aim to not only avoid potential pitfalls but also to capitalize on the opportunities that arise from these complex transactions.

Prepared By: [Your Name]

Date: [MM-DD-YYYY]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Finance Mergers & Acquisitions Risk Statement Template from Template.net. This professional tool is designed to accurately identify and articulate risks in M&A transactions. Offering editable and customizable features, it provides a structured approach for thorough risk assessment, essential for informed decision-making in the dynamic field of finance mergers and acquisitions.