Free Finance Budget SWOT Analysis

Introduction

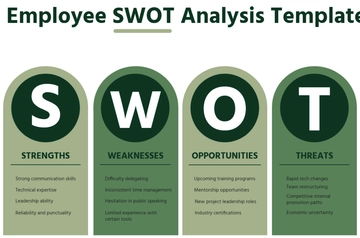

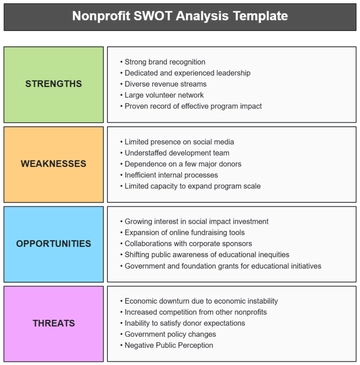

In today's rapidly evolving business environment, a comprehensive understanding of our financial landscape is crucial for maintaining a competitive edge. This SWOT analysis is designed to dissect our company's financial planning and analysis with a focus on our finance budget. By systematically examining our strengths, weaknesses, opportunities, and threats, we aim to uncover valuable insights that will guide our strategic decisions and financial management. This analysis will delve into various aspects of our finance department, from the robustness of our financial planning systems and the expertise of our finance team, to the challenges posed by economic volatility and regulatory changes. It will also explore the potential for growth and improvement through technological integration and market expansion. Our goal is to provide a detailed and actionable roadmap that can be used to enhance our financial stability, adaptability, and overall performance.

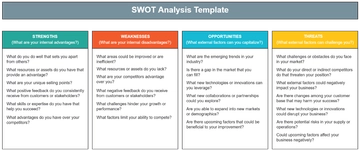

Strengths

Robust Financial Planning System

Advanced Forecasting Algorithms

Description: Our financial planning system is equipped with cutting-edge forecasting algorithms. These tools utilize a mix of historical data, market trends, and predictive analytics to generate accurate financial forecasts. The accuracy of these forecasts has been instrumental in strategic planning and risk management.

Table: Efficiency of Forecasting Algorithms

Feature | Impact | Example |

Market Trend Analysis | High accuracy in predicting market movements | Successfully anticipated recent market downturns |

Real-Time Data Integration

Description: Our system is designed to integrate real-time data, ensuring that our financial planning is always based on the most current information. This real-time integration covers various aspects, including market trends, company performance metrics, and economic indicators.

Table: Real-Time Data Integration Benefits

Data Type | Benefit | Example |

Market Trends | Quick response to market changes | Adjusted investment strategies in response to market volatility |

Scenario Planning Capability

Description: Our financial system's scenario planning capability allows us to prepare for various potential financial futures. This feature enables us to create and compare different budget scenarios based on varying assumptions, helping in making informed decisions under uncertainty.

Table: Scenario Planning Features

Scenario | Application | Benefit |

Economic Downturn | Preparing for market crashes or recessions | Ensured financial stability during recent economic instability |

Experienced Finance Team

Expertise and Knowledge

Description: Our finance team is composed of individuals with a diverse range of expertise, including certified accountants, financial analysts, and strategic planners. Their collective knowledge provides a solid foundation for our financial planning and decision-making processes.

Table: Team Expertise and Impact

Member Role | Expertise | Impact |

Accountants | Financial reporting and compliance | Ensured accuracy and regulatory compliance in financial statements |

Industry Experience

Description: Our team members possess significant industry experience, having worked in various sectors, which enriches our financial planning with insights from different market dynamics and economic conditions.

Table: Industry Experience Diversity

Team Member | Industry Background | Benefit |

John Doe | Technology Sector | Brought innovative financial strategies from the tech industry |

Adaptability to Change

Description: In today's rapidly changing financial landscape, adaptability is key. Our finance team has demonstrated exceptional flexibility in adjusting to new financial regulations, market conditions, and technological advancements.

Table: Examples of Team Adaptability

Change Event | Team Response | Outcome |

New Financial Regulations | Swiftly adapted compliance strategies | Maintained compliance with zero penalties |

Weaknesses

Limited Flexibility in Budget Allocation

Rigid Budget Structure

The current finance budget follows a rigid structure, with a significant portion allocated to fixed expenses. This rigidity limits our ability to reallocate funds quickly in response to unexpected financial situations, such as market fluctuations or sudden investment opportunities.

Table: Impacts of Rigid Budget Structure

Aspect | Description | Impact |

Fixed Costs | High proportion of budget locked in long-term commitments | Reduced flexibility in reallocating funds for emerging needs |

Limited Emergency Funds

Description: Our budget includes a relatively small allocation for emergency funds. This limitation could pose challenges in managing unforeseen financial crises or taking advantage of sudden market opportunities.

Table: Emergency Fund Limitations

Fund Type | Allocation | Consequence |

Contingency Funds | Minimal percentage of total budget | Inadequate coverage for unexpected financial downturns |

Restricted Investment in Innovation

Description: Current budgeting practices allocate limited funds for innovation and research & development (R&D). This could impede our ability to stay competitive and adapt to technological advancements in our industry.

Table: Innovation and R&D Funding

Category | Allocation | Impact |

R&D | Lower than industry average | Slower pace in adopting new technologies and processes |

Dependency on Traditional Financial Models

Over-reliance on Established Methods

Description: Our financial planning heavily relies on traditional models and methods. While these have been reliable in the past, they may not fully capture the complexities of the modern financial landscape, potentially leading to suboptimal decision-making.

Table: Risks Associated with Traditional Models

Model Type | Limitation | Impact |

Standard Forecasting | Lacks flexibility in rapidly changing markets | Inaccurate predictions in volatile conditions |

Slow Adoption of Financial Tech Innovations

Description: The company has been slow in adopting new financial technologies and trends. This hesitation could result in missed opportunities for efficiency gains and more sophisticated financial analysis tools.

Table: Financial Tech Adoption Delays

Technology | Adoption Status | Consequence |

Automated Financial Analysis Tools | Not fully implemented | Inefficient data processing and analysis |

Inflexible in Adapting to Market Trends

Description: The current reliance on traditional financial models has led to a lack of agility in adapting to new market trends. This inflexibility can be a disadvantage in rapidly evolving markets.

Table: Response to Market Trends

Market Trend | Company Response | Result |

Shift towards green investments | Delayed adaptation | Missed early investment opportunities in sustainable technologies |

Opportunities

Technological Integration

Embracing Financial Technologies

Description: Integrating advanced financial technologies can significantly enhance our budgeting, forecasting, and data analysis capabilities. Adoption of AI, machine learning, and blockchain technology can streamline processes and provide deeper insights into financial trends and risks.

Table: Benefits of Financial Technology Integration

Technology | Application | Expected Benefit |

AI & Machine Learning | Enhanced forecasting accuracy | More precise financial predictions, reducing risks |

Potential for Data-Driven Decision Making

Description: By leveraging big data analytics, we can transform our decision-making processes to be more data-driven. This approach would allow for more informed and strategic financial planning and budgeting.

Table: Advantages of Data-Driven Decision Making

Data Application | Use Case | Impact |

Market Analysis | Understanding customer trends and preferences | Better alignment of budget with market opportunities |

Expansion into New Markets

Exploring Global Opportunities

Description: Expanding into new, international markets presents an opportunity for diversification and growth. This strategy can introduce our products and services to new customer bases and reduce dependency on our existing markets.

Table: New Market Expansion Strategy

Market | Strategy | Expected Outcome |

Emerging Economies | Tailoring products to local needs | Access to a larger customer base and increased revenue |

Threats

Economic Volatility

Global Economic Instability

Description: The current global economic environment is characterized by volatility, with fluctuating inflation rates, uncertain trade policies, and changing market dynamics. This instability poses a significant threat to the predictability and stability of our financial planning and projections.

Table: Impact of Economic Volatility on Financial Planning

Economic Factor | Description | Impact on Finance Budget |

Inflation Rates | Rapid changes in purchasing power | Affects cost projections and pricing strategies |

Dependency on International Markets

Description: Our company's significant involvement in international markets makes us susceptible to global economic shifts. Changes in foreign economies, trade policies, and geopolitical tensions can directly impact our financial health.

Table: Risks from International Market Dependency

International Factor | Risk | Mitigation Strategy |

Trade Policies | Tariff changes affecting import/export costs | Diversifying supply chains and exploring local sourcing |

Changing Environmental and Social Governance (ESG) Standards

Description: There is an increasing focus on ESG standards. Changes in these standards can influence investor relations, public perception, and operational practices, requiring adjustments in the finance budget to ensure compliance and maintain corporate reputation.

Table: Impact of ESG Standards on Finance Budget

ESG Aspect | Description | Financial Impact |

Environmental Compliance | Adherence to environmental regulations | Investment in sustainable practices and technologies |

Adaptation to New Trade Policies

Description: New international trade policies can impact our import/export operations and supply chain management. Adapting to these policies may require significant budgetary adjustments to mitigate increased costs or logistical challenges.

Table: Response to Trade Policy Changes

Trade Policy | Impact | Budget Adjustment |

Import Tariffs | Increased cost of imported materials | Allocating additional funds for procurement or finding alternative suppliers |

Conclusion

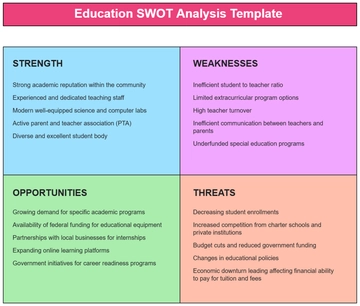

The SWOT analysis has provided a detailed overview of our company's financial landscape, highlighting strengths like our advanced financial planning system and skilled team, while acknowledging weaknesses such as budget rigidity and reliance on traditional models. Opportunities for growth lie in embracing technology and market expansion, but we must also be wary of threats from economic volatility and regulatory changes. To ensure sustained success, it's crucial to adapt our strategies, embracing flexibility and innovation in our financial operations while staying vigilant of external challenges. This balanced approach will guide us towards enhanced stability and prosperity in an ever-evolving economic environment.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Strengthen your financial strategy with the Finance Budget SWOT Analysis Template from Template.net. This editable, customizable template aids in identifying strengths, weaknesses, opportunities, and threats in financial planning. Key for strategic budgeting, it assists finance teams in developing comprehensive plans that capitalize on opportunities and mitigate risks.