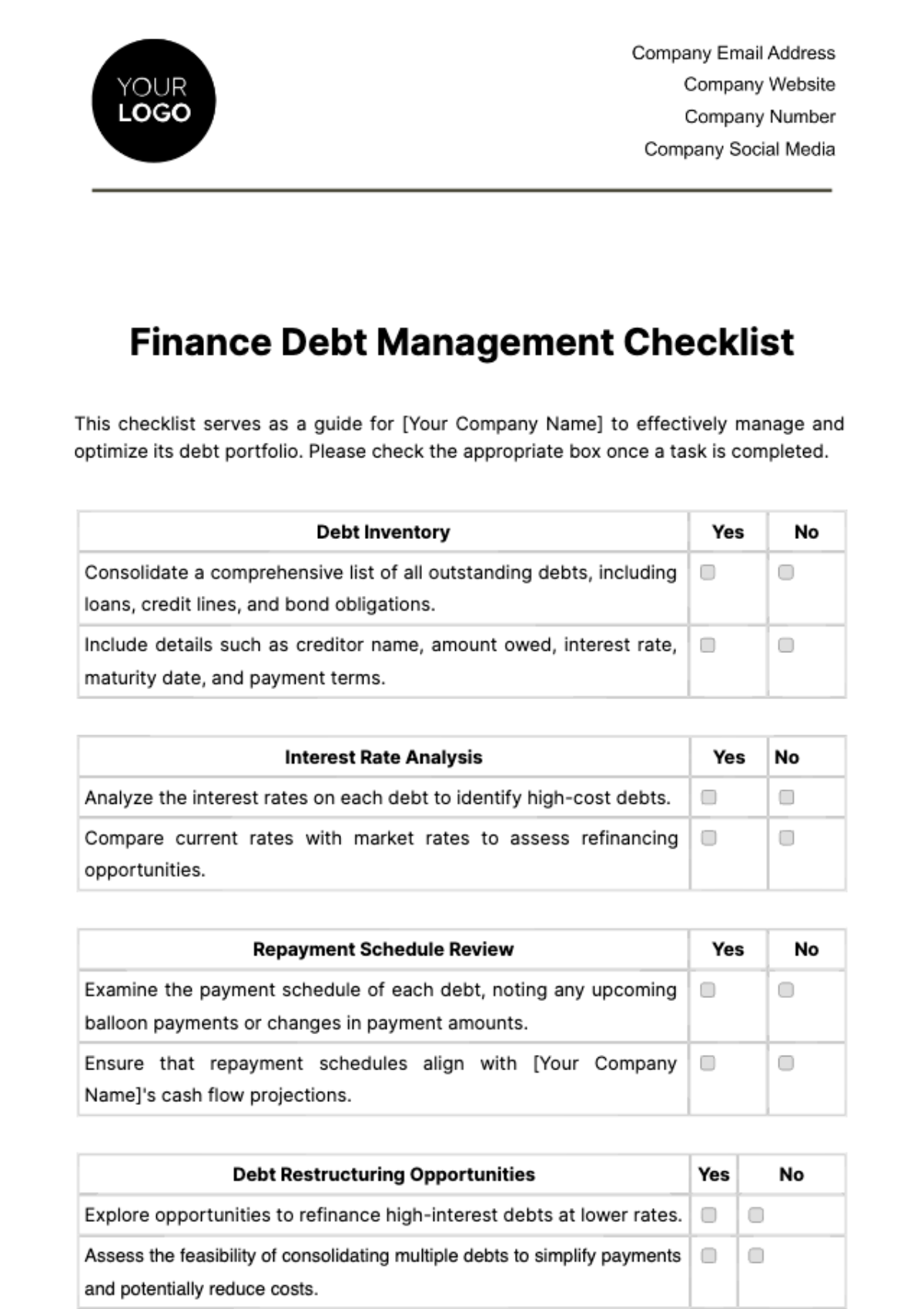

Free Finance Debt Management Checklist

This checklist serves as a guide for [Your Company Name] to effectively manage and optimize its debt portfolio. Please check the appropriate box once a task is completed.

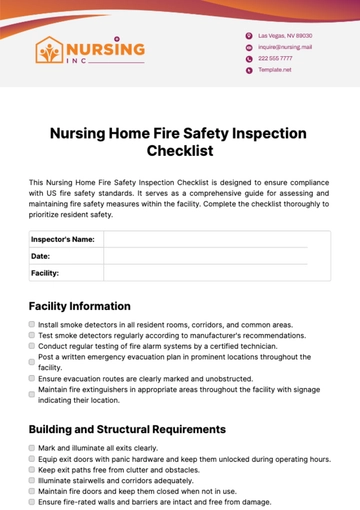

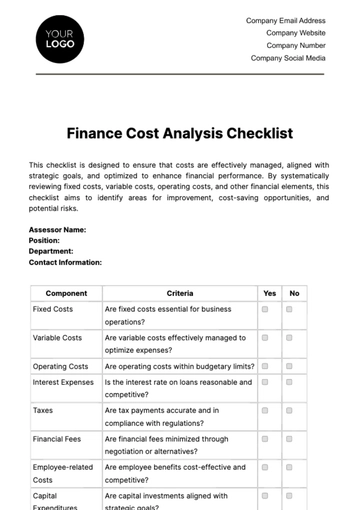

Debt Inventory | Yes | No |

Consolidate a comprehensive list of all outstanding debts, including loans, credit lines, and bond obligations. | ||

Include details such as creditor name, amount owed, interest rate, maturity date, and payment terms. |

Interest Rate Analysis | Yes | No |

Analyze the interest rates on each debt to identify high-cost debts. | ||

Compare current rates with market rates to assess refinancing opportunities. |

Repayment Schedule Review | Yes | No |

Examine the payment schedule of each debt, noting any upcoming balloon payments or changes in payment amounts. | ||

Ensure that repayment schedules align with [Your Company Name]'s cash flow projections. |

Debt Restructuring Opportunities | Yes | No |

Explore opportunities to refinance high-interest debts at lower rates. | ||

Assess the feasibility of consolidating multiple debts to simplify payments and potentially reduce costs. |

Debt Covenants Compliance | Yes | No |

Regularly review all debt covenants to ensure compliance. | ||

Develop contingency plans for potential covenant breaches. |

Credit Rating Implications | Yes | No |

Keep track of [Your Company Name]'s credit rating and understand factors affecting it. | ||

Assess how debt management strategies are impacting the credit rating. |

Long-Term Debt Strategy | Yes | No |

Analyze the maturity profile of [Your Company Name]'s debt portfolio and plan for future refinancing needs. | ||

Develop a long-term plan for reducing debt, including setting targets for debt-to-equity ratios and other financial metrics. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Finance Debt Management Checklist Template. Fully editable and customizable using our AI Editor Tool, this template provides a comprehensive guide for managing debt effectively. Take control of your finances with ease, ensuring a secure financial future. Explore innovative solutions with Template.net.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

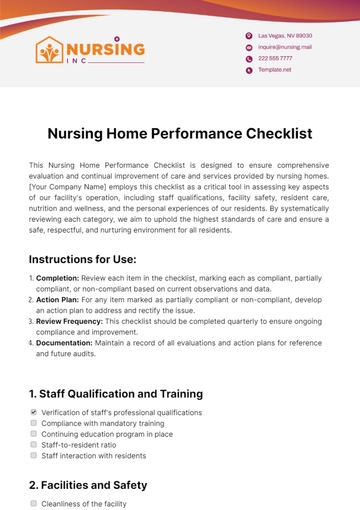

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

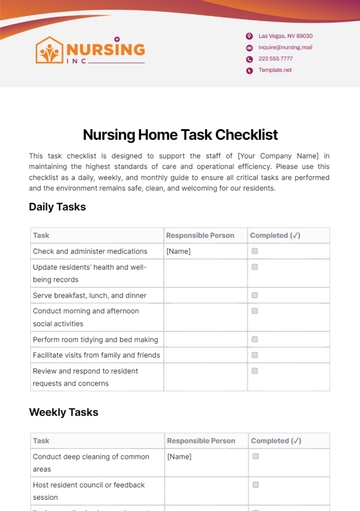

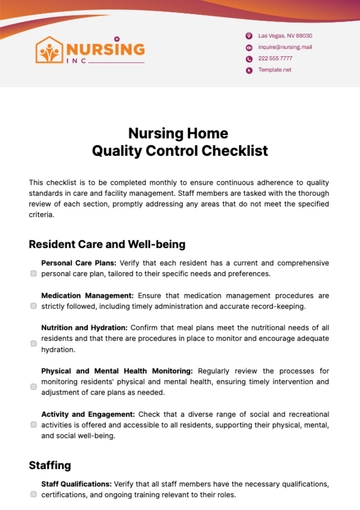

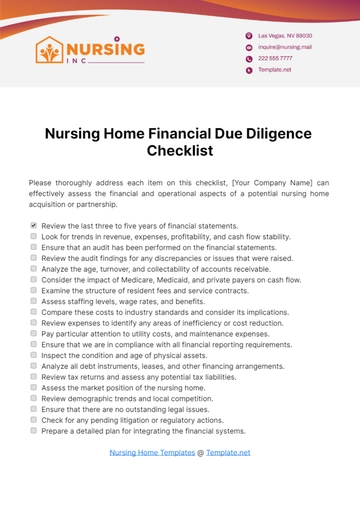

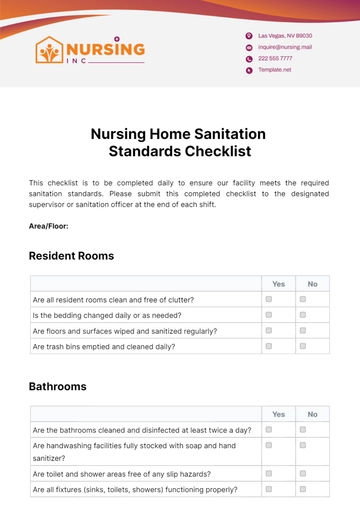

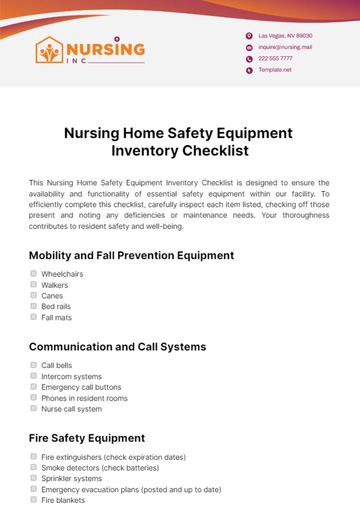

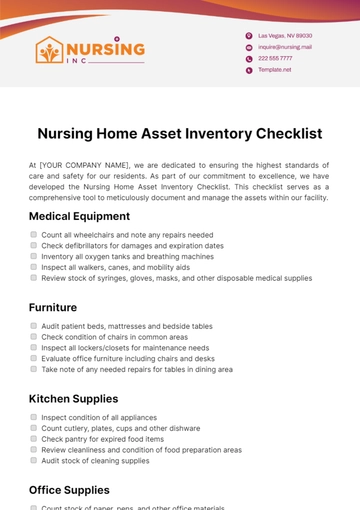

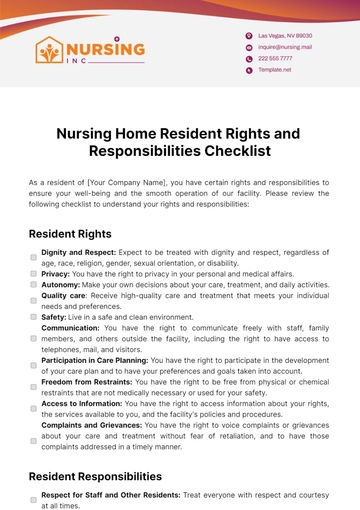

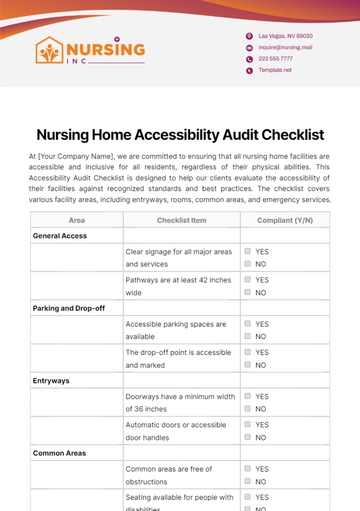

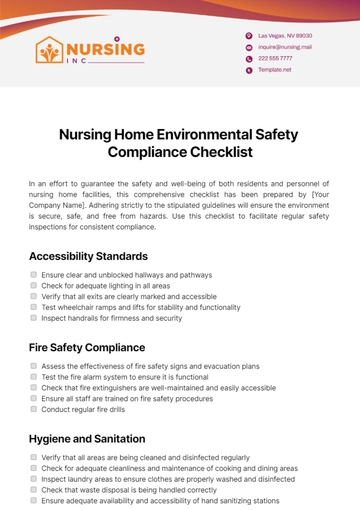

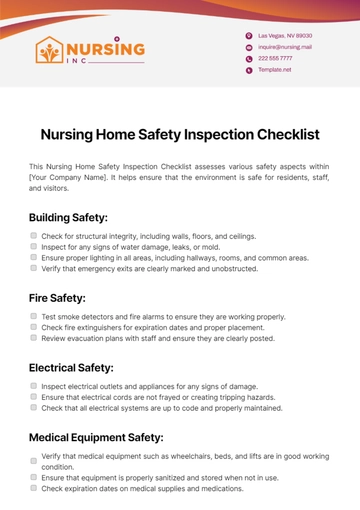

- Nursing Home Checklist

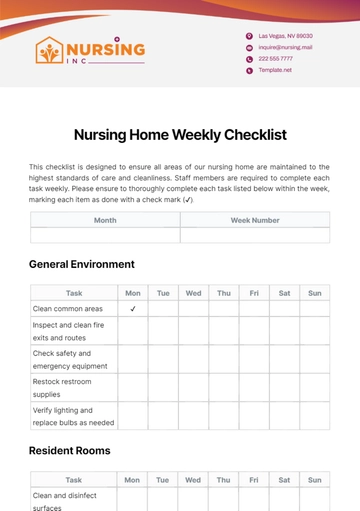

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist