Free Financial Review Minute

Date: | |

Minute Recorded By: | |

Attendees: |

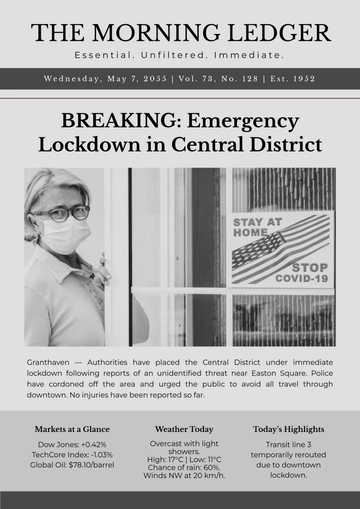

In this quarter's Financial Review Minute, we delve into the financial performance of our organization during the fourth quarter of [Year]. The objective is to offer a comprehensive overview of key financial metrics and trends, providing stakeholders with valuable insights for informed decision-making.

I. Financial Performance Overview

The quarter witnessed a substantial uptick in total revenue, reaching $[0] million and marking a notable [0]% increase from the same period last year. This growth is predominantly attributed to heightened sales within our software services division, fueled by successful client acquisitions. Operating expenses saw an [0]% rise, driven by increased marketing and promotional expenditures linked to the successful launch of a new product line. Despite these elevated costs, our operational efficiency improvements are reflected in a [0]% increase in the operating profit margin.

II. Balance Sheet Analysis

The balance sheet for Q4 [Year] reflects positive trends in both assets and liabilities. Total assets saw a commendable [0]% increase, reaching $20 million. This growth is primarily tied to a strategic investment in technology infrastructure and bolstered cash reserves. Meanwhile, liabilities increased modestly by [0]%, primarily attributable to a short-term working capital loan. The debt-to-equity ratio remains healthy at 0.4, indicating a balanced capital structure.

III. Cash Flow Analysis

Cash flow remained robust during the quarter, with net cash provided by operating activities amounting to $[0] million. This positive operating cash flow supported our day-to-day operational needs. Investing activities resulted in a net cash outflow of $[0] million, predominantly directed towards capital expenditures for facility upgrades. Financing activities saw a net cash outflow of $[0] million, reflecting debt repayments.

IV. Financial Ratios and KPIs

Liquidity ratios showcase our solid financial position, with a current ratio of 2.5 and a quick ratio of 1.8. Solvency ratios remain favorable, with a debt-to-equity ratio of 0.4, indicating prudent leverage. Efficiency ratios demonstrate effective management of resources, evidenced by an inventory turnover of 5 times and a receivables turnover of 8 times.

V. Business Outlook and Future Considerations

Looking ahead, market analysis predicts a [0]% growth in our product segment for the next fiscal year, presenting favorable conditions for continued expansion. Our strategic focus on innovation and customer satisfaction positions us well in a competitive landscape. While anticipating potential risks such as market volatility and supply chain disruptions, our proactive contingency plans mitigate these challenges.

VI. Conclusion

The fourth quarter of [Year] showcases a robust financial performance, highlighted by a [0]% increase in revenue and enhanced profitability. Our strategic initiatives, including the successful product launch and operational efficiency enhancements, have significantly contributed to these positive results. With total assets amounting to $[0] million and a healthy debt-to-equity ratio of 0.4, the company demonstrates solid financial resilience. As we look forward to the next fiscal year, the projected [0]% market growth offers promising opportunities for expansion. While we remain vigilant to potential risks like market fluctuations and supply chain disruptions, our proactive approach with comprehensive contingency plans ensures preparedness. This quarter's achievements reinforce our dedication to sustainable growth and financial stability.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net's Financial Review Minute Template offers a flexible and adaptable platform for documenting financial meetings. Enhanced by our Ai Editor Tool, it simplifies the process of capturing key discussions, decisions, and action items. Facilitate collaboration and conduct thorough financial reviews effortlessly with Template.net's streamlined solution.