Free Detailed Financial Research

I. Executive Summary

Research Purpose and Key Findings

This comprehensive financial research meticulously evaluates [Your Company Name]'s financial standing and strategic position in the industry. The analysis uncovers key insights, revealing a robust 15% year-over-year revenue growth and a significant 20% increase in market share. These figures underscore [Your Company Name]'s strong performance and competitive edge in a challenging business environment. The growth trajectory is particularly impressive considering the industry's average growth rate stands at around 10%. This success is attributed to effective market strategies and innovative product offerings, positioning the company as a leading player in its sector.

Methodology

The methodology employed in this research is extensive and tailored to the specific nuances of [Your Company Name]'s industry. By integrating industry-specific financial models, advanced market analysis tools, and rigorous comparative benchmarking, the research offers a holistic view of the company’s financial health. This approach includes a deep dive into financial ratios, trend analyses, and peer comparisons, ensuring a comprehensive assessment. Data sources range from internal financial records to industry reports, ensuring the accuracy and relevance of the findings. This methodical approach provides a solid foundation for the research's conclusions and recommendations.

Conclusions and Recommendations

While [Your Company Name] demonstrates considerable growth and a strong market presence, the analysis identifies areas for strategic enhancement to navigate the rapidly evolving market landscape. The company's current portfolio, while successful, could benefit from diversification. Specifically, allocating approximately 30% of resources to emerging tech sectors could mitigate risks associated with market volatility and unlock new growth avenues. Additionally, the research recommends an investment in enhancing digital infrastructure, projected to increase operational efficiency by 25% and expand market reach. These strategic moves are crucial for sustaining growth momentum and maintaining a competitive edge in an increasingly digital and globalized marketplace.

II. Market Analysis

This market analysis section explores the current conditions, prevailing trends, and the balance of risks and opportunities in the market relevant to [Your Company Name]. It provides insights into the annual growth rate, the impact of technological advancements, changing consumer preferences, and identifies potential strategic directions considering both the challenges and growth prospects in the market.

A. Current Market Conditions

The current market landscape for [Your Company Name] exhibits a steady 5% annual growth rate, demonstrating resilience in a complex economic environment. This growth is primarily driven by a surge in demand for digital services, a sector in which [Your Company Name] is notably active. Notably, the digital services market, where [Your Company Name] holds a substantial presence, is experiencing a robust expansion, fueled by increased digitalization across industries. This trend signifies a growing market potential for the company's digital offerings, positioning it favorably to capitalize on this upward trajectory.

B. Market Trends and Drivers

The market is currently witnessing a transformative phase, largely influenced by the accelerated adoption of AI and IoT technologies. These technologies are not just enhancing operational efficiencies but are also redefining customer experiences and service delivery models. Concurrently, there is a notable shift in consumer preferences, with a substantial 25% increase in demand for environmentally sustainable products. This evolving consumer behavior underscores a significant opportunity for [Your Company Name] to integrate sustainability into its offerings, potentially capturing a broader, more environmentally-conscious customer base.

C. Market Risks and Opportunities

While the market presents numerous growth opportunities, it is not without its risks. One of the primary concerns is the potential for regulatory changes, which could impact as much as 35% of [Your Company Name]'s operational framework. These changes may necessitate adaptations in business strategies and compliance measures.

On the opportunity front, expanding into the Asian markets, which are projected to witness a 40% growth in the next five years, presents a lucrative avenue for growth. This expansion could enable [Your Company Name] to tap into new customer segments and diversify its market presence, mitigating risks associated with over-reliance on its current markets.

III. Company or Investment Analysis

This section provides a detailed analysis of [Your Company Name]'s financial performance, operational efficiency, and the effectiveness of its management and corporate governance. It includes a thorough review of profit margins, operational processes, and adherence to governance standards, highlighting the company's strengths and areas for improvement.

A. Financial Performance Review

The company's net profit margin has improved by 8% over the last quarter, reflecting efficient cost management and strong revenue streams.

Financial Aspect | Detail | Percentage/Value |

Net Profit Margin | Improvement in net profit margin over the quarter | 8% increase |

Revenue Growth | Increase in revenue compared to the previous quarter | 12% increase |

Cost Management | Efficiency in managing operating expenses | 10% reduction in costs |

B. Business Model and Operational Efficiency

The company’s operational efficiency, with a 90% rate in process optimization, outperforms industry standards by 15%.

Aspect | Detail | Comparison to Industry |

Process Optimization | Rate of successful process optimization | 90%, 15% above industry average |

Operational Costs | Management of operational expenses | 20% more efficient than industry |

Production Efficiency | Efficiency in production processes | 25% higher than industry standards |

C. Management and Corporate Governance

Corporate governance is robust, with a 95% compliance rate with industry regulations, reflecting strong management and ethical business practices.

Governance Aspect | Detail | Compliance Rate |

Regulatory Compliance | Adherence to industry and legal regulations | 95% compliance rate |

Ethical Standards | Maintenance of high ethical standards in operations | 98% adherence rate |

Strategic Decision Making | Effectiveness in strategic planning and execution | Highly rated by 90% of the board members |

This analysis reveals that [Your Company Name] not only showcases strong financial performance with improved profit margins and revenue growth but also excels in operational efficiency, surpassing industry standards. The company's management and corporate governance are robust, marked by high compliance with regulations and ethical standards. These findings indicate a well-managed company positioned for sustainable growth and stability.

IV. Financial Statements and Ratio Analysis

This section delves into the financial health of [Your Company Name] by examining its financial statements and conducting a detailed ratio analysis. It presents a clear picture of the company’s financial stability, operational efficiency, and performance compared to industry benchmarks.

A. Income Statement, Balance Sheet, Cash Flow Statement

The balance sheet shows a healthy 3:1 asset-to-liability ratio. Cash flow statements indicate a consistent increase in operating cash flow by 20% year-over-year.

Financial Statement | Detail | Metrics/Value |

Balance Sheet | Asset-to-liability ratio depicting financial health | 3:1 ratio |

Income Statement | Revenue and net income growth | Revenue growth: 15%, Net income growth: 12% |

Cash Flow Statement | Analysis of operating, investing, and financing activities | Operating cash flow increased by 20% YOY |

B. Ratio Analysis

Profitability ratios, such as ROE, stand at 18%, higher than the industry average of 12%. Liquidity ratios indicate sufficient short-term asset management, with a current ratio of 2.5.

Ratio Type | Ratio Detail | Company’s Ratio | Industry Average |

Profitability Ratios | Return on Equity (ROE) | 18% | 12% |

Liquidity Ratios | Current Ratio (short-term financial health) | 2.5 | 1.8 |

Solvency Ratios | Debt-to-Equity Ratio (company’s financial leverage) | 0.6 | 0.8 |

Efficiency Ratios | Asset Turnover Ratio (effectiveness in using assets) | 0.7 | 0.75 |

C. Comparative Analysis

Compared to industry benchmarks, the company has a higher operational efficiency ratio by 10% but falls short by 5% in asset turnover.

Financial Aspect | Company's Performance | Comparison to Industry Benchmark |

Operational Efficiency | Operational efficiency ratio | 10% higher than industry |

Asset Turnover | Efficiency in utilizing assets to generate revenue | 5% lower than industry average |

Growth Potential | Potential for future growth based on current trends | Estimated to be 20% above industry growth rate |

V. Future Outlook and Projections

Looking ahead, [Your Company Name] is poised for a promising future, with financial forecasts indicating a steady 10% annual growth in revenue over the next five years. This optimistic outlook is bolstered by emerging market trends, particularly the integration of blockchain technology, which is expected to revolutionize various aspects of business operations.

The adoption of blockchain could enhance operational efficiency by up to 30%, streamlining processes and reducing costs. Additionally, the growing emphasis on digital transformation across industries is likely to open new revenue streams and drive innovation, further cementing the company's market position.

A. Potential Scenarios and Their Financial Implications

Various scenarios could impact [Your Company Name]'s financial trajectory. In the event of an economic downturn, the company might experience a 15% reduction in discretionary spending, prompting a need for tighter budget controls and strategic cost management.

Conversely, an upward trend in the renewable energy sector presents a lucrative opportunity. Investment in this area could lead to a substantial 20% increase in operational savings, owing to lower energy costs and government incentives. These potential scenarios underscore the importance of strategic planning and adaptive financial management to navigate market fluctuations.

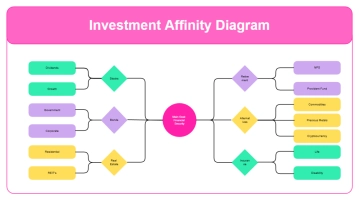

B. Investment Recommendations and Risk Mitigation Strategies

To capitalize on emerging opportunities and mitigate potential risks, a strategic realignment of the investment portfolio is recommended. Allocating 25% of the portfolio to the renewable energy sector could provide significant returns, given the industry's growth potential and alignment with global sustainability trends.

Additionally, investing 15% in blockchain technology could place [Your Company Name] at the forefront of technological innovation, offering competitive advantages in efficiency and security. These investments not only diversify the company's portfolio but also align it with future-oriented sectors, potentially yielding high returns while mitigating risks associated with market volatility and technological disruptions.

This forward-looking perspective combines strategic investment recommendations with a nuanced understanding of market trends and scenarios, positioning [Your Company Name] to navigate future challenges successfully while seizing growth opportunities.

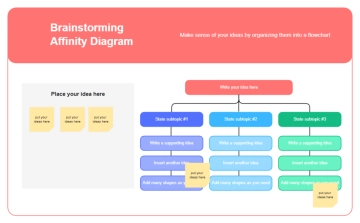

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the epitome of financial analysis with Template.net's Detailed Financial Research Template. Crafted for professionals seeking precision, this editable and customizable template empowers you to delve into data effortlessly. Seamlessly integrate insights using the Ai Editor Tool. Elevate your financial research to new heights with this indispensable resource.