Free Financial Investment Planning Memo

To: [Recipient's Name, Title]

From: [Your Name]

Date: [Month Day, Year]

Subject: Comprehensive Investment Plan for [Your Company Name]

I am pleased to present the Financial Investment Planning Memo for [Your Company Name] for the fiscal year [Year]. This memo is a culmination of detailed financial analysis and strategic planning, designed to align our investment endeavors with the company's long-term financial goals and current market opportunities. Our focus has been to create a balanced approach that navigates risks while seeking sustainable growth.

Current Financial Overview

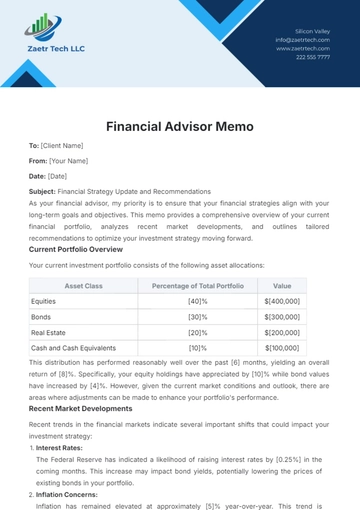

The company's financial standing, as of the last quarter, shows a strong net worth and liquidity position. Our current investment portfolio has performed commendably, delivering a 7% return. However, the analysis suggests a potential for greater diversification to mitigate risks and capitalize on emerging market trends.

Investment Objectives and Goals

In the short term, we aim to strengthen our working capital and support upcoming projects, targeting a 5% return rate. Our long-term objective is to achieve a consistent annual return of 8-10% over the next decade. Given our moderately conservative risk appetite, the plan proposes a balanced mix of growth and income-generating assets.

Proposed Asset Allocation Strategy

The strategy suggests an asset mix that includes a diverse range of equities, fixed income, real estate, and a small percentage in alternative investments. This allocation is designed to optimize returns while mitigating risk through broad diversification.

Investment Selection and Management

The investment selection will prioritize long-term growth and dividend consistency. We will implement an active management approach, regularly reviewing and adjusting the portfolio to align with market changes and our strategic goals.

Risk Management and Mitigation

Identified risks such as market volatility and interest rate fluctuations will be addressed through prudent hedging, diversified bond holdings, and maintaining a strategic cash reserve.

The proposed investment strategy for fiscal year [Year] is crafted to position [Your Company Name] for robust financial growth while safeguarding against market uncertainties. This plan requires your approval to move forward. Upon endorsement, we will proceed to develop specific action plans for each investment category and initiate the necessary steps for implementation.

I look forward to your feedback and am available for any further discussion or clarification needed regarding this strategy.

Best Regards,

Best Regards,

[Your Name]

[Job Title]

[Your Company Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Harness the power of strategic planning with Template.net's Financial Investment Planning Memo. This fully editable and customizable offering transforms your financial blueprint into easily understandable terms. Impart vital information with ease via our Ai Editor Tool. Achieve your investment goals, and optimize your financial journey with our professional and engaging template.