Free Finance Budget Management Journal

I. Executive Overview

Summary

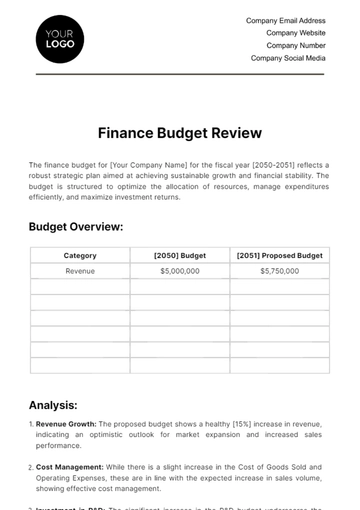

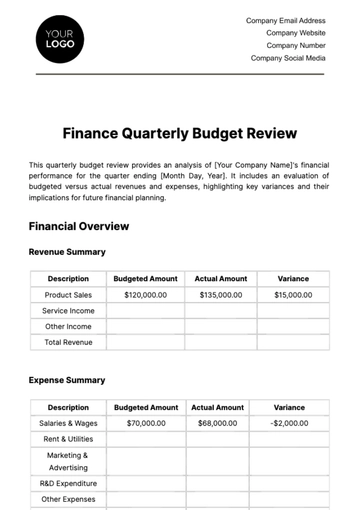

In this section, we provide a succinct summary of [Your Company Name]'s financial status for the current period. It captures the essence of our financial journey, highlighting a total income of $[00], driven largely by a [0]% increase in sales revenue and augmented by investment returns. Major expenses, totaling $[00], primarily constituted operational costs and strategic investments in marketing. This period culminated in a net profit of $[00], marking a significant improvement over the previous period and reflecting the effectiveness of our recent strategic initiatives.

Financial Highlights

The financial landscape of [Your Company Name] this period was marked by several key trends and changes. Notably, there was a remarkable increase in online sales revenue, growing by [0]% compared to the last period, attributed to our enhanced digital marketing strategies and expanded online presence. Another highlight was the unexpected increase in operational expenses, largely due to unanticipated costs in supply chain upgrades. These expenditures, while unforeseen, are investments in our operational efficiency and long-term sustainability. These highlights provide crucial insights into our financial performance and areas of focus.

II. Income Analysis

This section offers an in-depth analysis of [Your Company Name]'s income streams, breaking down various sources of revenue and comparing actual figures against projections and past performance, highlighting areas of overperformance or underperformance.

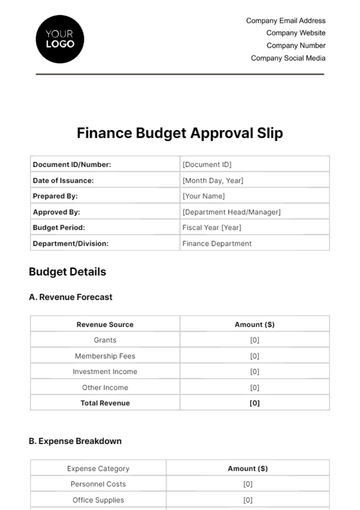

A. Income Breakdown

Detailed categorization of all income sources, including sales revenue, investment returns, and any other income streams.

Income Source | Amount ($) | Percentage of Total Income |

Sales Revenue | $500,000 | 60% |

B. Comparison with Projections

Analysis of how actual income figures compare with budget projections and previous periods, identifying any significant discrepancies and their causes.

Income Source | Projected Amount ($) | Actual Amount ($) | Variance (%) | Explanation for Variance |

Sales Revenue | $450,000 | $500,000 | 0.11 | Exceeded projections due to new product line success |

III. Expense Tracking

This section meticulously tracks and categorizes [Your Company Name]'s expenses, offering a comprehensive view of our spending patterns. It helps identify areas where we have exceeded or undershot our budget, providing valuable insights into the efficiency and effectiveness of our financial management.

A. Expense Details

Itemized record of all expenses incurred during the period, categorized by type (e.g., operational costs, marketing expenses, R&D).

Expense Category | Amount ($) | Percentage of Total Expenses |

Operational Costs | $300,000 | 40% |

B. Spending Analysis

Examination of spending patterns, highlighting areas where expenses have exceeded or stayed under budget, and analyzing the reasons behind these variances.

Expense Category | Budgeted Amount ($) | Actual Amount ($) | Variance (%) | Explanation for Variance |

Operational Costs | $280,000 | $300,000 | 0.07 | Increased due to unplanned maintenance and upgrades |

IV. Cash Flow Statement

This section of the journal provides an in-depth review of [Your Company Name]'s cash flow, encompassing all inflows and outflows. It's a critical tool for assessing our liquidity position and our efficiency in managing cash resources, crucial for maintaining operational stability and seizing growth opportunities.

A. Cash Flow Review

A statement detailing cash inflows and outflows, providing insights into [Your Company]'s liquidity position.

Type of Flow | Description | Amount ($) |

Cash Inflows | ||

Sales Revenue | Income from sales | $500,000 |

Cash Outflows | ||

Operational Costs | Costs of running business operations | $300,000 |

B. Liquidity Analysis

Analysis of the company’s ability to meet short-term obligations and invest in opportunities, with a focus on cash management efficiency.

Indicator | Amount ($) | Remarks |

Current Ratio | [Calculated Ratio] | Measures the ability to pay short-term obligations; a higher ratio indicates better liquidity. |

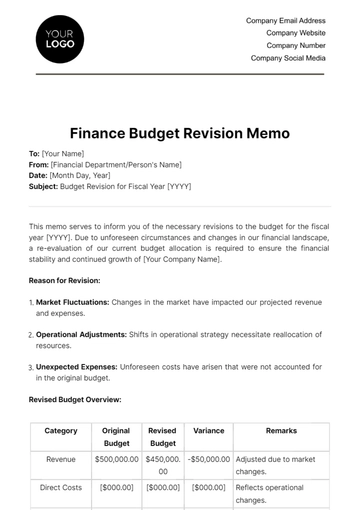

V. Budget Variance Analysis

This critical section offers a detailed analysis comparing [Your Company Name]'s budgeted figures against actual financial results. By identifying and understanding the causes of variances, we gain insights necessary for refining future budgeting processes and strategic decision-making.

A. Budget vs. Actual

Comparative analysis of budgeted figures against actual financial results, highlighting significant variances.

Budget Category | Budgeted Amount ($) | Actual Amount ($) | Variance ($) | Variance (%) |

Sales Revenue | 450,000 | 500,000 | +50,000 | 0.11 |

B. Variance Causes

Identifying and explaining the reasons for any major discrepancies between budgeted and actual figures, such as unexpected market conditions or internal operational changes.

Budget Category | Variance Cause | Explanation |

Sales Revenue | Market Success | Exceeded projections due to high demand for new product line |

VI. Forecasting and Projections

In this section, we delve into forecasting and projections, a crucial aspect of [Your Company Name]'s financial planning. We use current data and identified trends to revise our financial projections, ensuring they accurately reflect our expected performance. This process helps in fine-tuning our future budget plans, making them more aligned with realistic business expectations and market conditions.

A. Future Projections

Based on the latest financial data and market trends, [Your Company Name] projects a steady increase in revenue over the next fiscal year, with an estimated growth rate of [0]%. This projection is underpinned by our strong market presence and the successful launch of new products. We anticipate operational costs to rise by about [0]%, considering planned expansions and investments. These projections take into account both our current financial position and the dynamic market environment, providing a realistic view of our potential financial trajectory in the coming periods.

B. Budget Forecast Adjustments

Given the insights from our current financial performance and market analyses, we propose several adjustments to our future budgets. These include increasing our marketing budget by [0]% to capitalize on growing market opportunities, especially in digital channels. We also recommend boosting our R&D budget by [0]% to support innovation and stay ahead in a competitive industry. Additionally, plans are in place to enhance our operational efficiency, potentially reducing administrative costs by [0]%. These adjustments are aimed at leveraging our current strengths while strategically investing in areas that promise sustainable growth and profitability.

VII. Strategic Recommendations and Action Plans

This crucial section synthesizes the insights gleaned from our financial analysis into actionable recommendations and plans. These strategies are aimed at enhancing [Your Company Name]'s financial performance and addressing any identified issues, ensuring robust and sustainable growth.

Our financial analysis highlights several key areas for improvement. Firstly, we recommend implementing more aggressive cost-reduction strategies, particularly in procurement and operational logistics, where efficiencies can save up to [0]% in costs. We also see a significant opportunity in expanding our digital presence, suggesting an increased investment in digital marketing and e-commerce platforms. This approach is expected to enhance customer reach and increase sales revenue. Furthermore, diversifying our investment portfolio to include emerging technologies, such as AI and renewable energy, can provide long-term financial benefits and position [Your Company Name] at the forefront of innovation.

To address these recommendations, [Your Company Name] will initiate several action plans:

Cost Reduction: Launch a company-wide initiative to audit and streamline procurement processes, aiming for a [0]% reduction in supply chain costs over the next year.

Digital Expansion: Increase the digital marketing budget by [0]% and allocate funds for developing an e-commerce platform, with a target to boost online sales by [0]% in the next two years.

Investment Strategy Modification: Allocate [0]% of our investment funds into emerging technologies and renewable energy sectors, aiming to diversify revenue streams and tap into new market opportunities.

Financial Control Implementation: Introduce new financial controls, including stricter budgeting procedures and regular financial performance reviews, to enhance overall financial management and accountability.

By implementing these strategic recommendations and action plans, [Your Company Name] aims to not only address current financial challenges but also lay a strong foundation for future growth and success. These steps will ensure that the company remains financially robust and competitively positioned in the market.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unleash your financial savvy with Template.net's Finance Budget Management Journal. This fully editable and customizable template is rendered user-friendly through our Ai Editor Tool. Master financial planning easily with this professionally crafted tool, and make money management a breeze. Your key to financial literacy starts here- make it count!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising