Free Finance Budget Case Study

I. Introduction

Background Information

[Your Company Name], a trailblazer in the tech industry since its establishment in [Year], has navigated through waves of innovation and market evolution. Despite historical success, the company is currently grappling with a two-year decline in revenue growth, raising concerns about its adaptability to the swiftly changing technological landscape. This case study delves into the financial intricacies of [Your Company Name], aiming to uncover the root causes of its revenue challenges and propose strategic budgeting solutions.

Purpose of the Case Study

In an era of technological disruption, [Your Company Name]'s financial struggles underscore the imperative for organizations to proactively manage uncertainties. This case study serves a dual purpose: to dissect the financial complexities faced by [Your Company Name] and to provide a learning opportunity for stakeholders, offering insights into strategic budgeting practices amidst industry upheavals. By examining this scenario, we aim to equip professionals and students alike with practical financial management skills.

II. Company Overview

Brief History and Evolution

Founded in [Year] by visionary entrepreneurs, [Your Company Name] quickly ascended to prominence by pioneering cutting-edge software solutions. Over the years, it strategically diversified into hardware manufacturing, solidifying its position as an end-to-end technology solutions provider. The company's evolution reflects an innovative spirit, yet recent challenges necessitate a comprehensive examination of its financial strategies.

Organizational Structure

[Your Company Name] embraces a decentralized organizational structure, fostering agility and innovation. Business units, including software development, hardware manufacturing, and services, operate semi-autonomously. This organizational flexibility has historically enabled rapid adaptation, but the current financial downturn prompts a closer look at its effectiveness in times of market turbulence.

Products/Services Offered

[Your Company Name] boasts a diverse portfolio, encompassing cutting-edge software applications, innovative hardware products, and specialized consulting services. As a market leader, its products have catered to a wide array of industries, positioning the company as a one-stop shop for technological solutions. Understanding the dynamics of this product/service mix is crucial to unraveling the current financial challenges.

Market Position and Competitors

While [Your Company Name] has enjoyed a stronghold in the tech industry, emerging startups and industry giants have intensified competition. Recent market shifts have impacted the company's market share and profit margins, raising questions about its ability to maintain a competitive edge. A thorough analysis of the competitive landscape is essential to formulate effective budgetary strategies.

III. Financial Data

Historical Financial Performance:

Year | Revenue (in millions USD) | Net Income (in millions USD) |

|---|---|---|

[Year] | $[0] | $[0] |

[Year] | $[0] | $[0] |

[Year] | $[0] | $[0] |

Balance Sheets (in millions USD):

Year | Total Assets | Total Liabilities | Equity |

|---|---|---|---|

[Year] | $[0] | $[0] | $[0] |

[Year] | $[0] | $[0] | $[0] |

[Year] | $[0] | $[0] | $[0] |

Cash Flow Statements (in millions USD):

Year | Operating Cash Flow | Investing Cash Flow | Financing Cash Flow |

|---|---|---|---|

[Year] | $[0] | $[0] | $[0] |

[Year] | $[0] | $[0] | $[0] |

[Year] | $[0] | $[0] | $[0] |

IV. Budgeting Process

Overview of the Budgeting Process

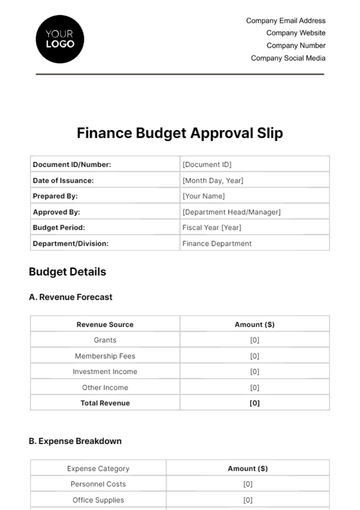

[Your Company Name]'s budgeting process is a collaborative effort that involves key stakeholders from various departments and the finance team. The process begins with a comprehensive assessment of market conditions, internal capabilities, and strategic goals. Department heads actively contribute input, aligning budgetary goals with overarching business objectives. Regular reviews and feedback loops ensure that the budget remains dynamic and responsive to changing circumstances. Despite the recent challenges, the company has historically relied on this participatory approach to allocate resources effectively and pursue strategic initiatives.

Evaluation of Past Budgeting Strategies

In assessing past budgeting strategies, [Your Company Name] has witnessed successes and encountered challenges. Successful strategies include prudent cost reductions in operational areas and the timely launch of innovative products. However, challenges emerged in the form of the company's inability to swiftly adapt to market changes and underestimations of competitive threats. This evaluation underscores the need for a more proactive and adaptive approach in future budgeting to mitigate risks and capitalize on emerging opportunities.

Budgeting Goals and Objectives

The overarching goal of [Your Company Name]'s budgeting process is to achieve a delicate balance between cost containment and strategic investments. Objectives include optimizing operational efficiency, enhancing product development capabilities, and fostering innovation. The budgeting framework aims to align departmental goals with the company's broader strategic vision, ensuring that financial resources are allocated to initiatives that drive sustainable growth and competitiveness.

Key Stakeholders Involved

Critical stakeholders in the budgeting process include department heads, finance executives, and senior management. Department heads contribute insights into the specific needs of their areas, ensuring that budget allocations support operational excellence. Finance executives play a pivotal role in synthesizing financial data, conducting scenario analyses, and providing a holistic view of the company's financial health. Senior management oversees the alignment of budgeting goals with the overall corporate strategy, balancing risk and reward in decision-making.

Impact of External Factors on Budgeting

External factors, such as economic conditions, regulatory changes, and technological advancements, significantly impact [Your Company Name]'s budgeting decisions. The company recognizes the need for flexibility in its budgetary approach to navigate uncertainties effectively. Periodic environmental scans and risk assessments inform the budgeting process, allowing the organization to proactively adjust financial strategies in response to external dynamics. The ability to adapt to these factors is integral to the success of [Your Company Name]'s budgeting process.

V. Financial Ratios and Metrics Analysis

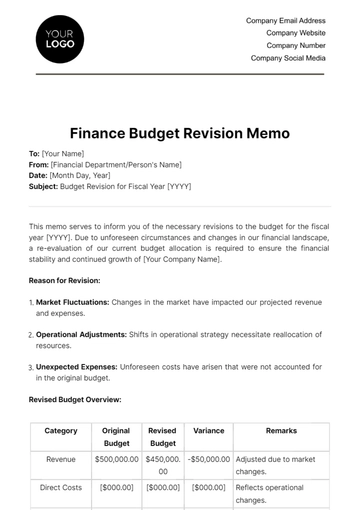

Profitability Ratios:

[Your Company Name]'s profitability ratios reveal a declining trend over the past three years. The gross profit margin has decreased from [0]% in [Year] to a projected [0]% in [Year], indicating challenges in maintaining product profitability. Similarly, the net profit margin has decreased from [0]% to a projected [0]%, suggesting increased operational and financial pressures. The return on investment (ROI) has experienced a notable decline from [0]% to a projected [0]%, reflecting the need for strategic reassessment to enhance overall profitability.

Liquidity Ratios

Liquidity ratios indicate [Your Company Name]'s ability to meet short-term obligations. The current ratio, while still healthy, has declined from 2.5 in [Year] to a projected 2.9 in [Year]. This suggests potential challenges in covering immediate liabilities with current assets. The quick ratio has also shown a slight decrease, signaling a need for careful management of liquidity resources to ensure financial stability amidst market uncertainties.

Efficiency Ratios

Efficiency ratios highlight [Your Company Name]'s effectiveness in managing assets. The inventory turnover has declined from 5.2 in [Year] to a projected 4.5 in [Year], indicating a potential inventory management challenge. The receivables turnover has followed a similar trend, dropping from 8.0 to a projected 7.0, raising concerns about the collection efficiency of accounts receivable. These declining efficiency ratios underscore the importance of streamlining operational processes.

Financial Leverage Ratios

Financial leverage ratios assess [Your Company Name]'s debt management and risk exposure. The debt-to-equity ratio has decreased from 0.52 in [Year] to a projected 0.40 in [Year], suggesting a reduction in financial leverage. This may indicate a conservative approach to debt management or decreased reliance on external financing. The interest coverage ratio has improved from 5.0 to a projected 7.5, signaling the company's ability to comfortably meet interest obligations. These ratios collectively point to a balanced approach to financial leverage.

Problem or Decision Scenario

Identification of the Financial Challenge

[Your Company Name] faces a multifaceted financial challenge characterized by a persistent decline in revenue, profitability, and key financial ratios. The company's inability to sustain historical levels of growth is rooted in various factors, including a slower adaptation to market changes, heightened competition, and potential operational inefficiencies. This confluence of challenges poses a threat to the company's financial sustainability and market competitiveness.

Factors Contributing to the Challenge

Several factors contribute to [Your Company Name]'s current financial challenge. The company's historic strength in innovation has been hampered by a lack of strategic investments in research and development. Additionally, inefficiencies in the supply chain and production processes have led to increased operational costs. The pricing strategy may not align with market realities, potentially impacting the company's ability to maintain competitive pricing and market share.

Implications for the Company

The financial challenges faced by [Your Company Name] have significant implications for its overall health and strategic trajectory. There is a risk of erosion of shareholder value due to declining profitability and market position. Limited financial resources may impede the company's ability to fund crucial strategic initiatives and necessary investments in technology and innovation. Moreover, the challenges could have a cascading effect on employee morale and retention, impacting the organization's talent pool and long-term sustainability. Addressing these implications requires a comprehensive strategic budgeting approach.

Recommendations

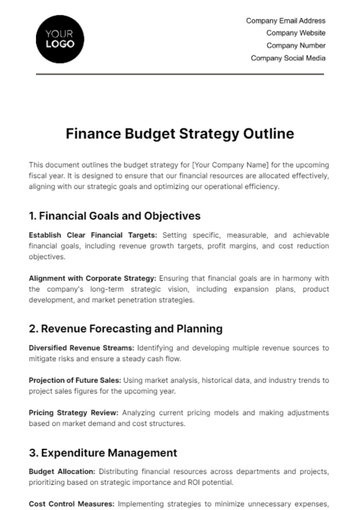

Strategic Cost Containment:

To address the declining profitability, [Your Company Name] should conduct a thorough review of operational expenses. Implementing cost containment measures, such as optimizing supply chain processes, renegotiating vendor contracts, and identifying areas for efficiency gains, can contribute to immediate savings. This strategic focus on cost containment will help mitigate the impact of declining profit margins and bolster the company's financial resilience.

Accelerated Investment in Research and Development:

Recognizing the importance of innovation, [Your Company Name] should increase investments in research and development (R&D). This entails fostering a culture of creativity, staying abreast of emerging technologies, and developing a robust pipeline of new products. By prioritizing R&D, the company can position itself as a market leader, regain competitiveness, and diversify its product portfolio to meet evolving customer needs.

Market-Driven Pricing Strategy:

A review of the company's pricing strategy is essential to align with market realities. Conducting a comprehensive analysis of competitors' pricing, consumer demand, and perceived product value will enable [Your Company Name] to establish a more competitive pricing structure. This market-driven approach ensures that prices reflect both the value delivered to customers and the need to maintain or increase market share.

Implementation Plan

Strategic Cost Containment:

Conduct a detailed analysis of current operational expenses and identify areas for immediate cost reduction.

Collaborate with department heads to implement cost-saving measures without compromising essential functions.

Monitor and evaluate the impact of cost containment measures regularly, adjusting strategies based on performance.

Accelerated Investment in Research and Development:

Allocate a specific budget for R&D initiatives, ensuring a dedicated focus on innovation.

Foster cross-functional collaboration between R&D teams, marketing, and sales to align product development with market needs.

Implement performance metrics to measure the success of R&D investments, including the launch of new products and improvements in market share.

Market-Driven Pricing Strategy:

Conduct a thorough market analysis to understand customer expectations, competitor pricing, and perceived product value.

Adjust pricing strategies accordingly, considering dynamic market conditions and the competitive landscape.

Communicate pricing changes transparently to customers and stakeholders, emphasizing the value proposition of products and services.

Operational Streamlining:

Conduct a comprehensive operational audit, identifying inefficiencies in the supply chain and production processes.

Implement technology solutions to automate routine tasks and improve overall operational efficiency.

Train employees on new processes and technologies, ensuring a smooth transition to streamlined operations.

Conclusion

In conclusion, [Your Company Name], facing a complex landscape of declining revenue and competitive pressures, stands at a critical juncture. The recommended strategic budgeting initiatives—focused on cost containment, intensified R&D investment, market-driven pricing, and operational streamlining—present a holistic approach to financial recovery. By implementing these measures, [Your Company Name] can fortify its position, adapt to market dynamics, and revitalize growth. This comprehensive strategy not only addresses immediate challenges but lays the groundwork for sustained success in an ever-evolving tech industry. Through strategic foresight and agile execution, [Your Company Name] can emerge resilient, competitive, and poised for future prosperity.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover financial acumen with the Finance Budget Case Study Template from Template.net. This editable and customizable resource, powered by our AI Editor Tool, streamlines your analysis process. Craft precise solutions to real-world scenarios effortlessly. Elevate your financial understanding with this dynamic template, designed for efficiency and effectiveness. Unleash your potential – transform data into decisive action!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising