Free Extensive Finance Budget Research

Introduction

As we embark on the fiscal year [Year], our company stands at a pivotal juncture, blending tradition with innovation in an ever-evolving global marketplace. This Finance Budget Research Report serves as a testament to our adaptability, foresight, and commitment to excellence. In the face of shifting economic tides and technological advancements, we have crafted a budget that not only addresses immediate fiscal needs but also lays the foundation for sustainable growth and long-term value creation.

This report encapsulates our strategic approach to economic challenges and opportunities, revenue and expense management, investment foresight, and the integration of cutting-edge financial technologies. Our commitment to sustainability, social responsibility, and workforce development is woven throughout our financial planning, reflecting our dedication to not just profitability, but ethical and responsible business practices.

Economic Overview and Market Trends

Global Economic Forecast

The global economy is expected to experience moderate growth, with a projected global GDP increase of [0%]. Inflation rates are anticipated to stabilize around [0%], influenced by a balance in commodity prices and technological advancements. Key market drivers include the rise of digital currencies, increased adoption of renewable energy sources, and significant advancements in artificial intelligence and robotics. The economic landscape will also be shaped by geopolitical shifts, with emerging markets in Southeast Asia and Africa gaining prominence.

Industry-Specific Trends

The industry is witnessing a paradigm shift towards digitization and sustainability. Key trends include:

Increased Adoption of AI and Machine Learning: Companies are leveraging AI for predictive analysis, customer service, and operational efficiency.

Sustainability Practices: There's a growing emphasis on reducing carbon footprints and embracing circular economy models.

Consumer Shift Towards Green Products: A significant rise in consumer demand for eco-friendly and sustainable products.

Sales Forecast

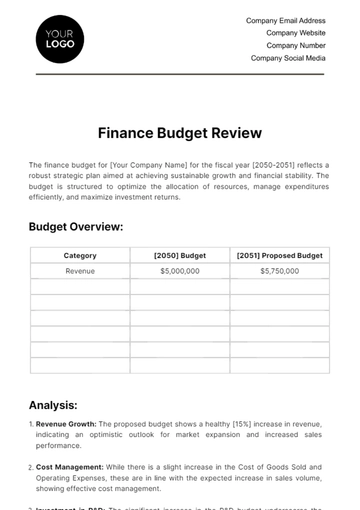

The sales forecast for [Year] projects a robust growth trajectory, driven by new product launches and expansion into emerging markets. The forecast is segmented by product lines and regions as follows:

Product Line | North America | Europe | Asia | Total Growth |

Product A | $120M | $80M | $90M | 15% |

Revenue Streams Analysis

Our revenue streams are diversifying, with a significant portion projected to come from online channels. Traditional sales remain strong, particularly in established markets. Emerging opportunities include licensing our proprietary technology and expanding into service-oriented offerings.

Traditional Sales: Expected to grow by [0%], with an emphasis on high-margin products.

Online Sales: Forecasted to increase by [0%], driven by enhanced digital marketing strategies and e-commerce platform improvements.

New Ventures: Anticipated to contribute [0%] to total revenue, including technology licensing and service expansion.

Expense Forecast

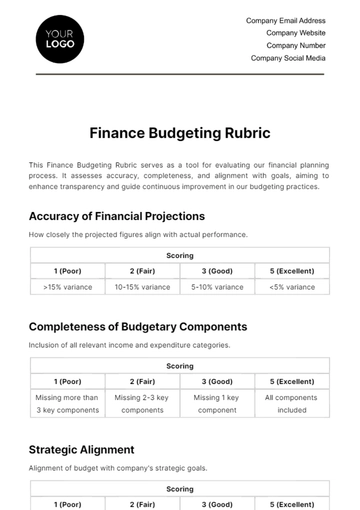

Operating Expenses

Our operating expenses are meticulously planned to align with our strategic goals. The focus remains on optimizing costs while investing in areas crucial for long-term success. Key areas of expenditure include:

Staffing Costs: With a focus on attracting top-tier talent, staffing costs are expected to rise by [0%]. We plan to invest in competitive salaries, comprehensive training programs, and employee wellness initiatives.

Research & Development (R&D): Aligned with our commitment to innovation, R&D expenses are set to increase by [0%], focusing on developing new products and enhancing existing ones.

Marketing and Sales: A [0%] increase in marketing and sales expenses will support our expanded digital presence and targeted advertising campaigns.

Operational Overheads: Operational costs, including utilities, rent, and maintenance, are projected to grow by [0%].

Expense Category | 2050 Expenditure | 2051 Budgeted Expenditure | Increase |

Staffing | $150M | $162M | 8% |

Capital Expenditure

Our capital expenditure is strategically focused on long-term asset development and technological upgrades. Significant investments include:

Technology Infrastructure: Allocating [$00] for upgrading our IT infrastructure to support advanced data analytics and cloud computing.

Facility Expansion: [$00] is earmarked for expanding manufacturing and office spaces to accommodate our growing workforce and production needs.

Equipment Upgrades: Investment of [$00] in state-of-the-art equipment to enhance operational efficiency and product quality.

Investment Strategy

Portfolio Diversification

Our investment strategy emphasizes portfolio diversification to balance risks and opportunities. We are allocating funds across a variety of assets:

Equities: [0%] of our investment portfolio will be in equities, focusing on tech and renewable energy sectors.

Bonds: [0%] in government and corporate bonds, providing stable income and reducing volatility.

Real Estate: Investing [0%] in commercial real estate as a hedge against inflation.

Emerging Markets: Allocating [0%] towards emerging markets, targeting high-growth potential areas.

Innovation Funds: [0%] reserved for venture capital investments in start-ups and innovative technologies.

Emerging Investment Opportunities

We are strategically targeting emerging investment opportunities, particularly in areas that align with our business objectives and future growth prospects:

Sustainable Technologies: Investing in green tech companies that focus on renewable energy and eco-friendly products.

Healthcare Innovations: Capitalizing on advances in telemedicine, personalized healthcare, and biotechnology.

Fintech Solutions: Exploring investments in financial technology startups that are innovating in digital payments, blockchain, and cybersecurity.

Investment Area | Description | Allocation | Expected ROI |

Sustainable Tech | Renewable energy and eco-products | 20% | 12% |

Risk Management

Risk Identification

Identifying potential risks is crucial for our financial stability. We have categorized risks into four major areas:

Market Risk: Includes fluctuations in market prices, interest rates, and foreign exchange rates. Heightened by the volatile global economic environment.

Credit Risk: Arises from potential defaults on payments by our clients and partners.

Operational Risk: Linked to internal processes, systems, and human errors. Increasingly relevant due to the rising complexity of our operations.

Geopolitical Risk: Pertains to political changes and instability, affecting our international operations.

Risk Type | Description | Potential Impact |

Market | Price fluctuations, interest rates | High |

Mitigation Strategies

Our approach to mitigating these risks involves a combination of proactive measures:

Market Risk: Implementing hedging strategies and diversifying investments to reduce exposure.

Credit Risk: Strengthening credit assessment processes and enhancing client diversification.

Operational Risk: Investing in advanced technology for automation and error reduction, alongside rigorous staff training.

Geopolitical Risk: Maintaining flexible international strategies and building resilient supply chains.

Financial Technology Integration

Automation and AI

The integration of automation and artificial intelligence is central to our financial planning and analysis:

Process Automation: Implementing robotic process automation (RPA) to streamline operations, reduce costs, and minimize errors.

Predictive Analytics: Utilizing AI for financial forecasting, trend analysis, and data-driven decision-making.

AI in Risk Management: Employing AI algorithms for real-time risk assessment and management.

Blockchain and Cybersecurity

Blockchain technology and cybersecurity are pivotal in our financial operations:

Blockchain Applications: Leveraging blockchain for secure transactions, smart contracts, and supply chain management.

Cybersecurity Enhancements: Strengthening our cybersecurity infrastructure to protect against data breaches and cyber threats. Investment in advanced encryption technologies and regular security audits are planned.

Technology | Application | Benefits |

Automation & AI | Operations, Analytics | Efficiency, Accuracy, Predictive Insight |

Sustainability and Corporate Social Responsibility (CSR)

CSR Initiatives

Our CSR initiatives are a cornerstone of our business strategy, reflecting our commitment to environmental sustainability and social responsibility. Key initiatives include:

Green Operations: Implementing eco-friendly practices in our operations, such as waste reduction, energy-efficient systems, and sustainable sourcing.

Community Engagement: Launching programs focused on education, healthcare, and social welfare in the communities we operate in.

Employee Wellness: Enhancing employee wellness programs that promote physical health, mental well-being, and work-life balance.

Financial Implications

The financial implications of our CSR initiatives are projected to be positive, contributing to long-term savings and enhanced brand value:

Cost Savings: Implementing energy-efficient practices and waste reduction strategies is expected to reduce operational costs by [0%].

Brand Value: Our commitment to CSR is anticipated to strengthen brand loyalty and attract socially conscious consumers, potentially increasing sales by [0%].

Employee Retention: Investing in employee wellness and development programs is likely to reduce turnover rates, saving on recruitment and training costs.

Workforce Planning and Development

Talent Acquisition and Retention

As our company grows, attracting and retaining top talent is critical. Our strategies for [Year] include:

Competitive Compensation: Offering competitive salaries, performance bonuses, and comprehensive benefits.

Flexible Work Arrangements: Encouraging flexible work hours and remote work options to appeal to a diverse workforce.

Career Development: Providing continuous learning opportunities, career advancement paths, and leadership development programs.

Training and Development

Investing in employee training and development is key to our success. Our focus areas for [Year] include:

Skill Enhancement Programs: Offering workshops, courses, and certifications to keep our workforce up-to-date with industry trends and technologies.

Leadership Training: Developing a leadership training program to cultivate the next generation of company leaders.

Cross-Functional Training: Encouraging cross-departmental training to foster a versatile and adaptable workforce.

Focus Area | Strategy | Expected Outcome |

Talent Acquisition | Competitive packages, flexibility | Higher talent attraction and retention |

Conclusion

It is evident that our company is poised for a year of dynamic growth and innovation as seen on this document. Through planning and strategic foresight, we have set in motion a series of initiatives that balance risk and opportunity, efficiency and sustainability, tradition and innovation. Our financial roadmap is more than a mere budget; it is a reflection of our aspirations and commitment to excellence in all facets of our operations.

The initiatives and strategies outlined in this report are designed to not only navigate the complexities of the current economic industry but to propel us towards a future where our company is synonymous with resilience, innovation, and unwavering commitment to our stakeholders. As we look ahead, we are confident that the plans laid out in this report will guide us to new heights of success and set new benchmarks in our industry.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Delve deep into financial planning with Template.net's Extensive Finance Budget Research Template. This editable and customizable template provides a comprehensive framework for conducting detailed budget research. Ideal for finance professionals, it facilitates thorough analysis of financial data, aiding in the development of robust and sustainable budget strategies. Download now!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising