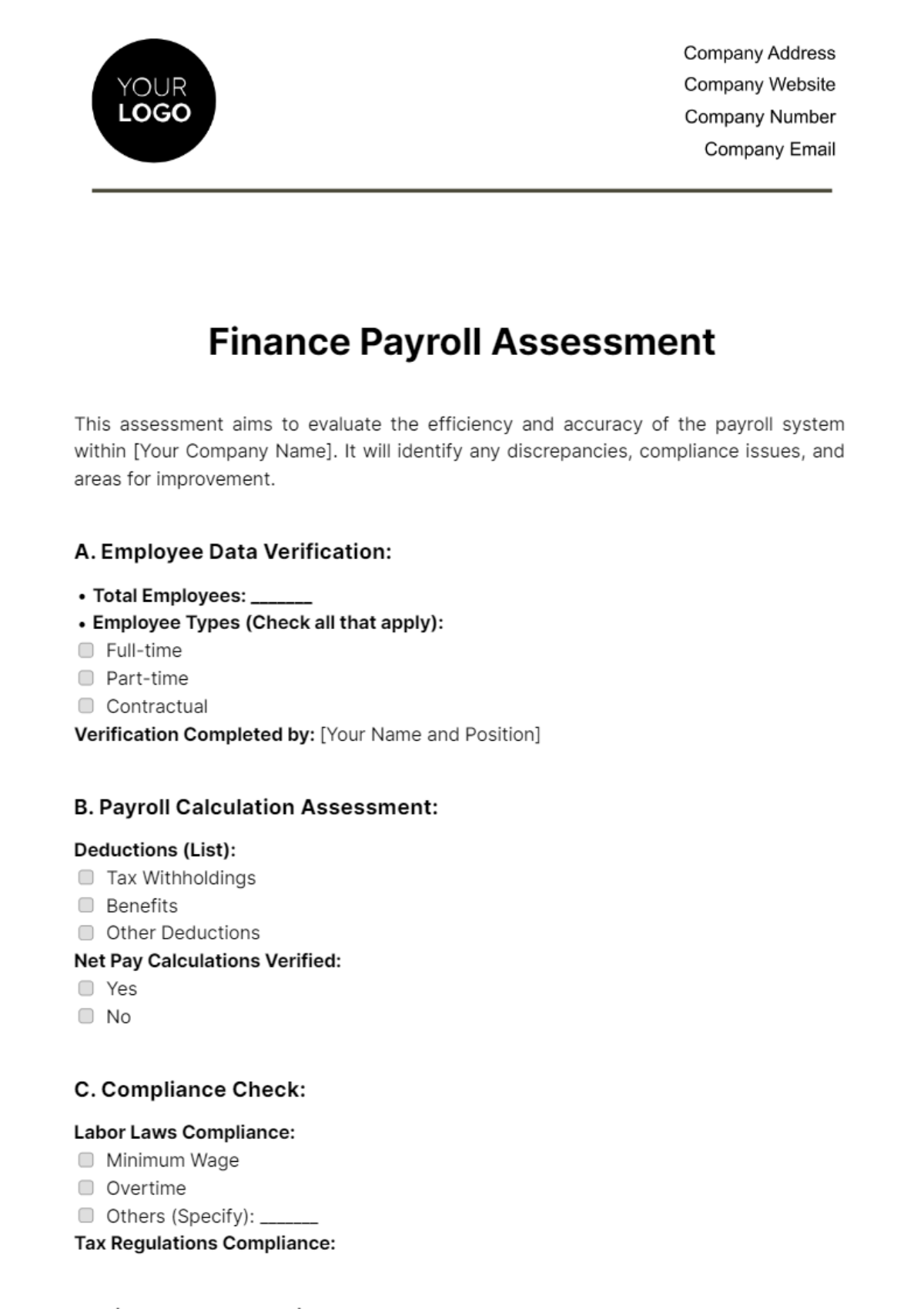

Free Finance Payroll Assessment

This assessment aims to evaluate the efficiency and accuracy of the payroll system within [Your Company Name]. It will identify any discrepancies, compliance issues, and areas for improvement.

A. Employee Data Verification:

Total Employees: _______

Employee Types (Check all that apply):

Full-time

Part-time

Contractual

Verification Completed by: [Your Name and Position]

B. Payroll Calculation Assessment:

Deductions (List):

Tax Withholdings

Benefits

Other Deductions

Net Pay Calculations Verified:

Yes

No

C. Compliance Check:

Labor Laws Compliance:

Minimum Wage

Overtime

Others (Specify): _______

Tax Regulations Compliance:

D. Disbursement Audit:

Payment Methods (Check all used):

Direct Deposit

Checks

Others (Specify): _______

Payment Schedule:

Bi-weekly

Monthly

Unauthorized Payments: Check for any discrepancies or unauthorized transactions.

E. Record Keeping & Reporting:

Payroll Records: Ensure all payroll records are maintained accurately and are easily accessible.

Reporting: Regularly review and report payroll summaries, tax reports, and any discrepancies to management.

F. Recommendations & Action Plan:

Provide a list of identified issues, risks, and recommendations.

Develop an action plan with timelines to address each recommendation.

G. Approval:

Assessment Completed by: [Your Name], [Your Position/Designation]

Reviewed and Approved by: [Management/Supervisor]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Navigate your payroll evaluations with Template.net's Finance Payroll Assessment Template. This professional, editable, and customizable tool is tailored for meticulous analysis of payroll processes. It aids in identifying discrepancies and planning for accurate and effective payroll management. Essential for finance teams, this template is editable using our Ai Editor Tool. Secure yours now at Template.net.