Free Financial Expense Assessment

This Financial Expense Assessment Document aims to analyze the financial expenses of [Company/Department Name] for the fiscal year [Year Range]. The analysis includes an overview of total expenses, a detailed breakdown by category, and a comparison with the budgeted figures to identify areas for cost efficiency improvements.

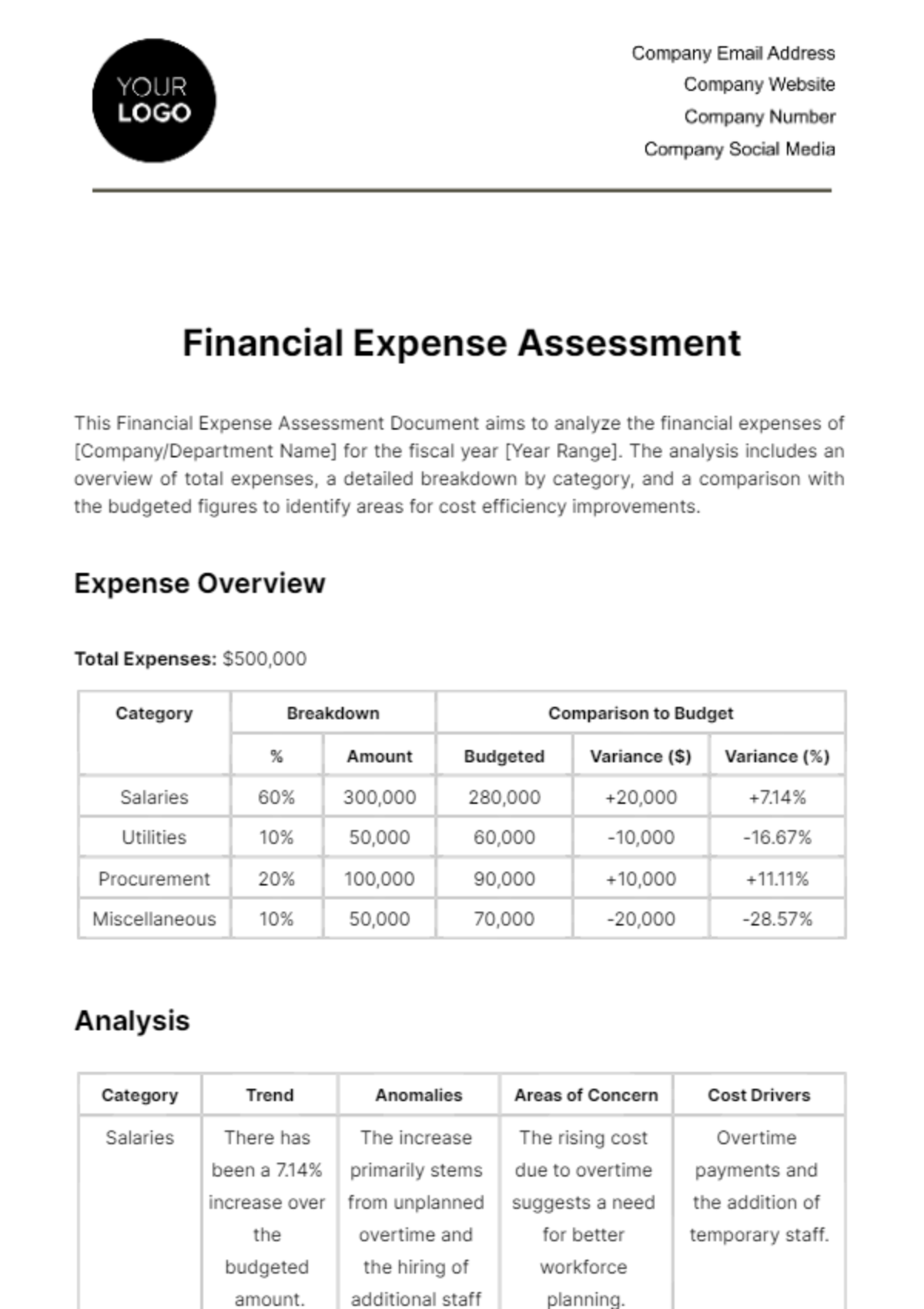

Expense Overview

Total Expenses: $500,000

Category | Breakdown | Comparison to Budget | |||

% | Amount | Budgeted | Variance ($) | Variance (%) | |

Salaries | 60% | 300,000 | 280,000 | +20,000 | +7.14% |

Utilities | 10% | 50,000 | 60,000 | -10,000 | -16.67% |

Procurement | 20% | 100,000 | 90,000 | +10,000 | +11.11% |

Miscellaneous | 10% | 50,000 | 70,000 | -20,000 | -28.57% |

Analysis

Category | Trend | Anomalies | Areas of Concern | Cost Drivers |

Salaries | There has been a 7.14% increase over the budgeted amount. | The increase primarily stems from unplanned overtime and the hiring of additional staff to meet project deadlines. | The rising cost due to overtime suggests a need for better workforce planning. | Overtime payments and the addition of temporary staff. |

Utilities | Spending on utilities is 16.67% lower than the budgeted figure. | The reduction is due to the implementation of energy-saving measures and a switch to more cost-effective service providers. | None currently, but continual monitoring of utility rates and consumption is advised. | Energy consumption and service provider rates. |

Procurement | There is an 11.11% increase over the budget. | The increase is mainly due to higher costs in raw materials and a few emergency purchases. | The volatility of raw material costs and lack of contingency in the budget for emergency purchases. | Prices of raw materials and the urgency of purchases. |

Misc | Expenditure is 28.57% lower than budgeted. | Lower spending in this category is attributed to reduced travel and entertainment expenses. | Ensuring that cost-cutting in this category doesn’t negatively impact employee morale or business opportunities. | Travel frequency and entertainment activities. |

Efficiency Assessment

Utilities: The implementation of energy-saving measures and the switch to more cost-effective service providers have resulted in a significant reduction in utility costs, demonstrating effective expense management in this category.

Miscellaneous Expenses: The decrease in travel and entertainment expenses indicates a successful effort to reduce non-essential spending, contributing positively to overall cost efficiency.

Salaries: The increase in salary expenses, primarily due to overtime and additional staffing, indicates a need for better workforce planning and project management to control labor costs.

Procurement: The volatility in raw material costs and emergency purchases suggest a need for improved procurement planning and establishing better supplier relationships to manage costs more effectively.

Recommendations

Salaries: Implement a more efficient project management system to reduce the need for overtime. Consider hiring permanent staff in place of temporary staff where feasible to control labor costs.

Procurement: Develop a more robust procurement strategy, including long-term contracts with suppliers to lock in prices and building a contingency budget for emergency purchases.

Reallocate Budget: Consider reallocating a portion of the budget from miscellaneous expenses to the salaries category to accommodate the need for additional staffing without overspending.

Review Utility Budget: Given the success in reducing utility costs, the budget for utilities can be adjusted downwards, freeing up funds for other critical areas.

Strategic Workforce Planning: Develop a long-term workforce plan that aligns with projected business growth and project timelines to manage salary expenses effectively.

Prepared By: [Your Name]

Date: [Month Day, Year]

Reviewed By: [Reviewer Name]

Date: [Month Day, Year]

Approved By: [Approver Name]

Date: [Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Financial Expense Assessment Template from Template.net provides a comprehensive solution for evaluating business expenditures. Easily editable and customizable in our AI Editor tool, this template is tailored to suit various financial assessment needs. It streamlines the process of analyzing expenses, offering a clear and detailed structure for financial review. Essential for financial planning, it’s valuable for effective expense management.