Free Finance Mergers & Acquisitions Due Diligence Assessment

Assessment Date: [DATE]

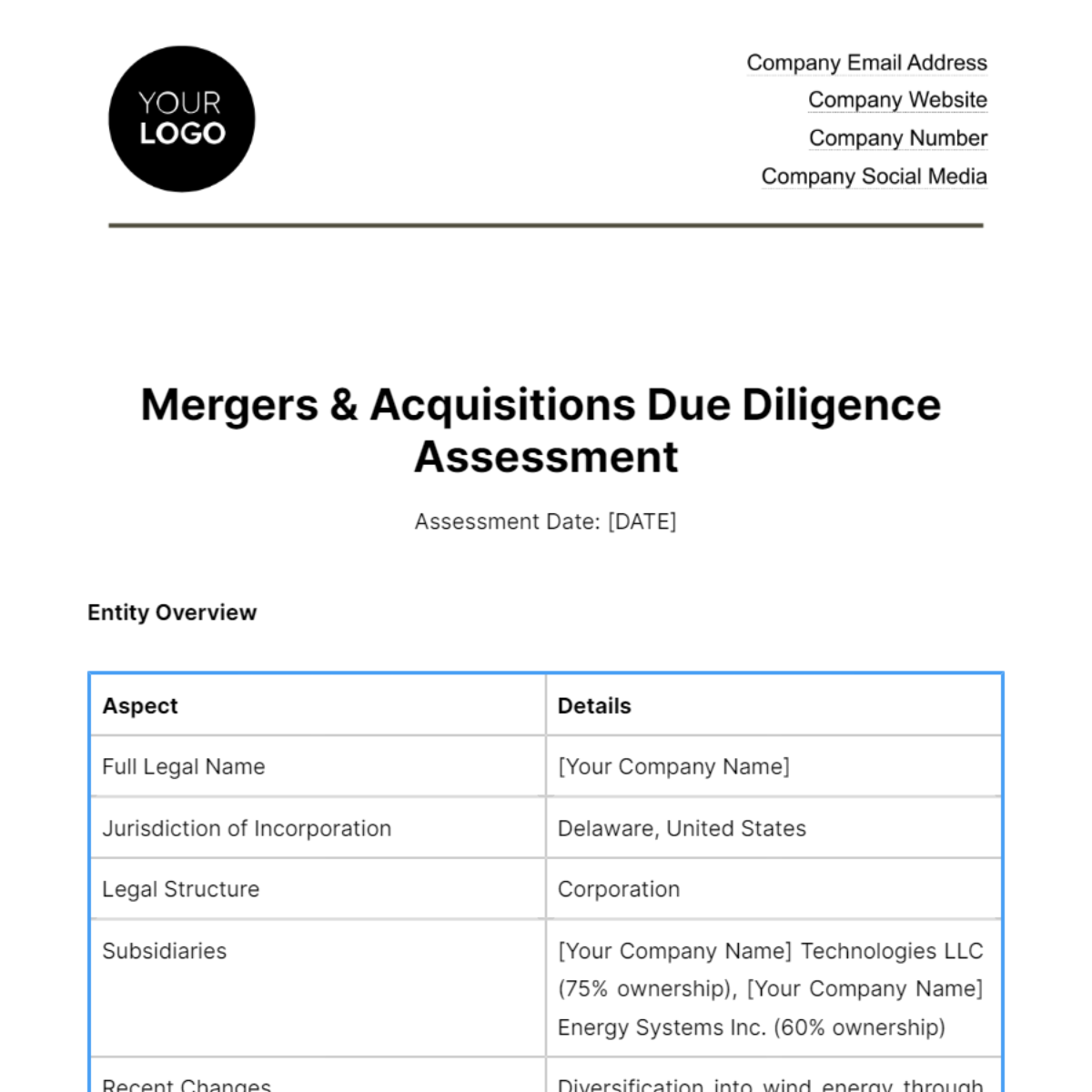

Entity Overview

Aspect | Details |

Full Legal Name | [Your Company Name] |

Jurisdiction of Incorporation | Delaware, United States |

Legal Structure | Corporation |

Subsidiaries | [Your Company Name] Technologies LLC (75% ownership), [Your Company Name] Energy Systems Inc. (60% ownership) |

Recent Changes | Diversification into wind energy through the acquisition of a wind energy-focused subsidiary |

II. Financial Assessment

Historical and Forecasted Financial Information

Year | Revenue Growth | EBITDA Margins | Cash Flow from Operations |

Last Three Years | CAGR of 12% | Improved from 18% to 24% | Increased by 30% |

Current Year-to-Date | 15% over the previous year | - | 20% increase in cash reserves |

Forecasts | 10% annually over the next three years | - | 25% increase in operational cash flow |

Revenue Breakdown

Revenue Stream | Percentage | Geographic Locations | Major Customers |

Solar Panel Sales | 55% | North America: 60%, Europe: 25%, Asia-Pacific: 15% | Utility companies: 40%, Industrial clients: 35%, Government contracts: 25% |

Battery Storage Solutions | 30% | - | - |

Wind Energy Projects | 15% | - | - |

III. Strategic Fit Assessment

Competitive Landscape

Strengths: Innovative technology, strong brand recognition, diversified energy solutions

Weaknesses: High capital expenditure, dependency on regulatory incentives

Opportunities: Growing global demand for renewable energy, potential for strategic partnerships

Threats: Regulatory changes, competition from traditional and new energy companies

Synergy Potential

Cost-Related Synergies:

Consolidation of manufacturing facilities could reduce operational costs

Shared R&D efforts can enhance innovation at a lower cost

Revenue-Related Synergies:

Cross-selling opportunities between [YOUR COMPANY NAME] and SolTech’s product lines

Joint ventures in emerging markets could accelerate market penetration

IV. Legal and Compliance Considerations

Litigation and Regulatory Conflicts: SolTech Innovations Inc. faced a patent infringement lawsuit two years ago, which was settled out of court. No significant regulatory issues have been reported in the past five years.

V. Management and Cultural Assessment

Organizational Structure: SolTech Innovations Inc. has a flat organizational structure with a strong emphasis on innovation and cross-functional teams.

Senior Management:

CEO: Dr. Emily Chen, Ph.D. in Renewable Energy Systems

CFO: Michael Rodriguez, with 20 years of experience in finance within the energy sector

CTO: Rajiv Singh, a pioneer in solar energy technologies

Company Culture: SolTech is known for its collaborative and entrepreneurial culture, with a strong commitment to sustainability and innovation.

Integration with [YOUR COMPANY NAME]: The cultural alignment in terms of innovation and sustainability presents a strong foundation for integration. Challenges may arise from merging operational processes and systems.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure a thorough examination of potential M&A opportunities with Template.net's Finance Mergers & Acquisitions Due Diligence Assessment Template. This editable, customizable template is designed for a comprehensive assessment of financial, legal, and operational aspects of target companies. Ideal for financial analysts and M&A advisors, it facilitates a detailed evaluation process, identifying risks, synergies, and value creation opportunities, essential for informed decision-making in mergers and acquisitions.