Free Finance Accounts Management SWOT Analysis

Introduction

The purpose of this SWOT Analysis is to conduct a thorough examination of our finance accounts management system. By identifying our Strengths, Weaknesses, Opportunities, and Threats, we aim to gain a deeper understanding of our financial operations and devise strategies to enhance our financial stability and growth.

Scope

This analysis focuses on evaluating the internal and external factors influencing our finance accounts management. It encompasses areas such as financial planning, reporting accuracy, compliance, risk management, and resource allocation, which are critical to the financial wellbeing and operational efficiency of our organization.

Methodology

To conduct this SWOT Analysis, we employed a multi-faceted approach:

Internal Review: An in-depth review of our financial records, including income statements, balance sheets, and cash flow statements, to assess our current financial health and management practices.

Stakeholder Feedback: Gathering input from key stakeholders, including department heads, financial managers, and accounting staff, to understand their perspectives on our financial operations.

Competitive Benchmarking: Comparing our financial practices and performance against industry standards and competitors to gauge our market standing.

Risk Assessment: Evaluating existing and potential risks that could impact our financial status, including market volatility, regulatory changes, and economic trends.

Sources of Information

Financial Reports: Annual and quarterly financial reports providing insights into our financial performance and position.

Market Analysis: Reports and industry publications offering an overview of current market trends and economic conditions relevant to our financial operations.

Internal Surveys: Feedback and surveys conducted within the organization to understand internal perceptions and opinions regarding our finance accounts management.

Regulatory Compliance Documents: Review of compliance reports to evaluate our adherence to financial laws and regulations.

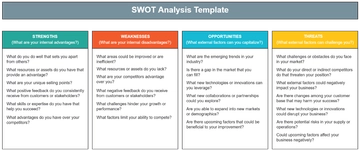

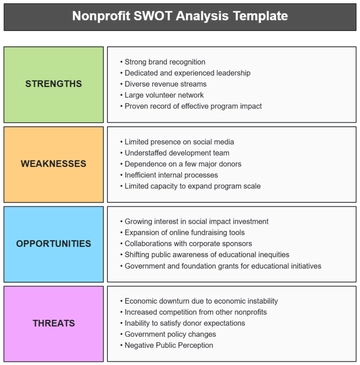

SWOT Analysis Overview

Strengths (S) | Weaknesses (W) | Opportunities (O) | Threats (T) |

Robust Financial Position: A strong cash reserve of $5M, ensuring liquidity and financial stability. | Dependence on Manual Processes: Heavy reliance on manual accounting processes, increasing the risk of errors. | Adoption of New Technologies: Emerging financial technologies offer opportunities for process automation and efficiency. | Market Volatility: Fluctuating market conditions could impact our investments and revenue streams. |

Experienced Finance Team: A dedicated team with significant industry experience, enhancing financial decision-making. | Limited Risk Diversification: Current investment strategies are concentrated in a few areas, increasing risk exposure. | Expansion into New Markets: Potential for growth by exploring untapped markets or sectors. | Regulatory Changes: Potential new financial regulations could increase compliance costs and complexity. |

Effective Internal Controls: Strong internal controls and audit mechanisms, promoting accuracy and compliance. | Outdated Financial Software: Existing financial software lacks advanced features, limiting data analysis capabilities. | Strategic Partnerships: Opportunities to collaborate with fintech companies for improved financial solutions. | Technological Advancements: Rapid technological changes could render our current systems obsolete. |

Solid Revenue Streams: Diverse revenue sources contributing to a steady annual growth rate of 4%. | Inadequate Training Programs: Limited ongoing training for finance staff, affecting their ability to adapt to new systems. | Regulatory Compliance: Adherence to regulations opens avenues for government incentives and grants. | Competitive Pressure: Increased competition in our industry could affect our market share and profitability. |

Strengths

Robust Financial Position

Our organization holds a strong cash reserve, currently standing at $5 million. This significant liquidity ensures financial stability and provides a cushion against unexpected expenses or economic downturns. The ability to maintain such a reserve reflects our sound financial planning and effective revenue generation strategies. This liquidity ratio positions us well above industry standards, offering a competitive edge and the capacity to invest in growth opportunities.

Experienced Finance Team

Our finance team comprises individuals with an average of 10 years of experience in the field, including specialists in areas such as tax strategy, risk management, and financial analysis. This depth of experience has been instrumental in navigating complex financial landscapes and making informed decisions. The team’s expertise has contributed to a 4% year-over-year revenue growth and a 15% reduction in operational inefficiencies over the past three years.

Effective Internal Controls

Our internal controls and audit mechanisms are robust, as evidenced by our last two annual audit reports that showed a 98% compliance rate with financial regulations and less than 1% discrepancy in financial reporting. These strong controls enhance the reliability of our financial reporting, minimize the risk of fraud, and ensure compliance with accounting standards and laws.

Solid Revenue Streams

We have successfully diversified our revenue streams, contributing to a stable and consistent financial performance. Our portfolio includes income from product sales, service charges, and investments, which collectively account for an annual revenue of approximately $20 million. This diversification not only mitigates the risk associated with dependency on a single income source but also provides multiple channels for growth and expansion.

Weaknesses

Dependence on Manual Processes

A significant portion of our financial operations, including invoicing, payroll processing, and transaction recording, relies on manual processes. This reliance increases the risk of human error, leading to discrepancies in financial data. For example, manual entry errors accounted for a 2% discrepancy in our last quarter’s financial reporting, indicating a need for more automated and efficient systems.

Limited Risk Diversification

Our current investment portfolio shows a concentration in a limited range of assets, predominantly in the technology sector, which constitutes about 60% of our total investment holdings. This lack of diversification exposes us to sector-specific risks and market volatility. In the last fiscal year, a downturn in the tech sector led to a 5% decline in our investment value, underscoring the vulnerability of our investment strategy.

Outdated Financial Software

The financial software currently in use lacks advanced features such as real-time data analytics and integration capabilities with other business systems. This limitation hinders our ability to conduct in-depth financial analysis and affects the efficiency of financial reporting. As a result, our financial team spends an additional 10 hours per week on average compiling financial reports, which could be significantly reduced with more sophisticated software.

Inadequate Training Programs

Our organization has not consistently invested in ongoing training programs for our finance staff, particularly in areas of new financial regulations and advanced financial software usage. This gap has led to a slower adaptation to regulatory changes and underutilization of our existing financial systems. For instance, a recent internal survey indicated that 40% of our finance staff feel inadequately trained to use the latest financial tools, impacting their productivity and effectiveness.

Opportunities

Adoption of New Technologies

The financial sector is rapidly evolving with advancements in technology, offering opportunities to automate and streamline our financial processes. By adopting modern financial software equipped with AI and data analytics, we can reduce manual errors, improve efficiency, and gain deeper insights into our financial performance. Implementing these technologies could potentially save up to 20 hours per week in manual processing, allowing our staff to focus on strategic activities.

Expansion into New Markets

Our current market analysis indicates untapped potential in emerging markets, particularly in regions like Southeast Asia and Latin America. Expanding our operations into these areas could diversify our customer base and open new revenue streams. With our strong financial position, we are well-equipped to explore these opportunities, which could increase our revenues by an estimated 15% within the first two years of expansion.

Strategic Partnerships

Collaborating with fintech companies and other financial institutions presents an opportunity to enhance our financial solutions and services. These partnerships could lead to the development of innovative financial products, improved customer experience, and increased market competitiveness. For example, a partnership with a fintech firm specializing in payment processing could expand our service offerings and increase customer satisfaction.

Regulatory Compliance

Staying ahead of regulatory changes and maintaining compliance can open avenues for government incentives, grants, and favorable financing options. By proactively adapting to new financial regulations, we not only mitigate the risk of penalties but also position ourselves as a compliant and trustworthy organization, which can enhance our reputation and customer trust.

Training and Development Programs

Investing in comprehensive training and development programs for our finance staff can significantly enhance their skills and adaptability to changing financial landscapes. This investment in human capital can lead to more innovative financial strategies, improved risk management, and overall better financial decision-making within the organization.

Threats

Market Volatility

Fluctuations in the global economy and financial markets pose a significant threat to our investments and revenue streams. For instance, a sudden market downturn could impact our investment portfolio, which experienced a 5% decline in the previous fiscal year due to tech sector instability. This volatility necessitates a more robust risk management strategy to safeguard our assets.

Regulatory Changes

The financial sector is subject to frequent regulatory changes, which can increase compliance costs and operational complexity. For example, recent changes in international tax laws require us to overhaul our tax strategies, potentially increasing our compliance costs by up to 8%. Staying abreast of these changes and adapting quickly is crucial to avoid penalties and legal issues.

Technological Advancements

Rapid advancements in financial technology can render our current systems and processes obsolete. Our reliance on outdated financial software already places us at a competitive disadvantage. The pace of technological change demands continuous investment in system upgrades and staff training to remain relevant and efficient.

Competitive Pressure

The finance sector is highly competitive, with constant pressure from both established players and emerging fintech startups. Our current market share could be at risk if we fail to innovate and adapt to changing customer preferences. For example, our main competitor has recently introduced AI-based financial planning services, which could attract a portion of our customer base.

Cybersecurity Risks

As financial operations become increasingly digitized, the risk of cyber threats such as data breaches and financial fraud escalates. A single significant breach could not only lead to substantial financial loss but also damage our reputation and customer trust. Ensuring robust cybersecurity measures is imperative to protect sensitive financial data.

Strategic Implications

In light of the SWOT Analysis, it is crucial to discuss how we can leverage our strengths, address our weaknesses, seize the identified opportunities, and mitigate the potential threats. This strategic approach will guide our organization towards sustained growth and financial stability.

Leveraging Strengths

Utilizing Our Robust Financial Position: Our strong cash reserve can be leveraged to invest in new technologies and market expansion, fueling growth and innovation. This financial cushion also provides us the flexibility to navigate market uncertainties.

Capitalizing on Team Expertise: Our experienced finance team is a valuable asset. By involving them in strategic planning and decision-making, we can harness their insights for more sophisticated financial strategies and efficient operations.

Addressing Weaknesses

Modernizing Manual Processes: By investing in financial software automation, we can reduce manual errors and improve efficiency. This move will also free up our team’s time for more strategic tasks.

Diversifying Investments: To address our limited risk diversification, we should consider expanding our investment portfolio across various sectors and asset classes. This diversification will reduce our vulnerability to market fluctuations.

Seizing Opportunities

Embracing Technological Advancements: Adopting new financial technologies will not only address our weakness in manual processing but also place us at the forefront of innovation. This could enhance our service offerings and operational efficiency.

Expanding into New Markets: Our strong financial position enables us to explore and establish a presence in emerging markets, thereby broadening our revenue base and reducing dependence on existing markets.

Mitigating Threats

Enhancing Risk Management: To combat market volatility and economic downturns, we need to strengthen our risk management strategies. This includes regular market analysis, scenario planning, and maintaining a contingency reserve.

Staying Ahead of Regulatory Changes: Regular training and updates on new financial regulations will ensure compliance and reduce the risk of legal implications. Proactively adapting to these changes can also open up new opportunities.

Action Plan

This Action Plan outlines the specific steps we will take to leverage our strengths, address weaknesses, capitalize on opportunities, and mitigate threats as identified in our SWOT Analysis. Each step is assigned a timeline and responsible party for effective implementation.

Step | Month | Responsible Party |

Implement Financial Software Automation | Month 1-3 | IT Department, Finance Manager |

Expand Investment Portfolio | Month 2-4 | Chief Financial Officer |

Market Expansion Research | Month 1-2 | Market Research Team |

Develop Training Program | Month 3-5 | HR Department |

Initiate New Markets Entry Strategy | Month 4-6 | Business Development Team |

Conduct Cybersecurity | Month 1-2 | IT Security Team |

Upgrade Financial Software Systems | Month 3-4 | IT Department |

Organize Risk Management Workshops | Month 2-3 | Risk Management Team |

Launch Employee Training on Software Use | Month 5-6 | HR Department, IT Department |

Initiate Strategic Fintech Partnerships | Month 4-5 | Chief Financial Officer |

Review and Update Risk | Month 3-4 | Risk Management Team |

Conduct Market Diversification Analysis | Month 3-4 | Finance Team |

Implement Regular Regulatory | Month 2-3 | Compliance Officer |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your strategic planning with the Finance Accounts Management SWOT Analysis Template from Template.net. Editable and customizable in our AI Editor tool, this template provides a comprehensive framework for conducting a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis specifically for finance accounts management. It's an invaluable tool for financial strategists and managers, facilitating insightful analysis to optimize financial performance and decision-making.