Free Account Budget Management Journal

Executive Summary

The Account Budget Management Journal meticulously documents our company's financial voyage over the past fiscal year, presenting a granular dissection of our budgetary allocations, financial outcomes, and the strategic maneuvers that underpin our fiscal management. This comprehensive report is pivotal in illustrating the significance of astute budget management as a lever for propelling the company toward the realization of its financial aspirations while ensuring the seamless operation of its business mechanisms.

In an era where economic unpredictability is the only certainty, our commitment to rigorous monitoring of our financial streams—both incoming and outgoing—has illuminated critical junctures for refinement and unearthed fertile grounds for potential expansion. The meticulous nature of this review process has not only enhanced our financial foresight but also bolstered our adaptability in the face of evolving market dynamics.

This executive summary is more than a mere synopsis of figures; it's a testament to our company's robust financial vitality, the precision of our budgetary execution, and the strategic acumen underlying our budget management methodologies. It encapsulates the essence of our financial journey, detailing how strategic foresight, coupled with meticulous budgetary oversight, has catalyzed our progression towards achieving both short-term operational benchmarks and long-term financial objectives.

By dissecting our financial performance with a fine-tooth comb, this report lays bare the efficacy of our financial governance, providing a transparent lens through which stakeholders can gauge the health and trajectory of our financial landscape. It's a narrative of resilience, strategic agility, and unwavering commitment to financial stewardship, underscoring our resolve to not just navigate but thrive in the complex tapestry of today's business ecosystem.

Budget Analysis

The budget analysis segment of this journal ventures deep into the fabric of our company's financial blueprint, juxtaposing meticulously laid budgetary projections with the tangible outcomes of our fiscal operations. This detailed scrutiny unravels the layers of our budgeting strategy, shedding light on the precision of our financial forecasting and the real-world ramifications of our fiscal decisions.

At the heart of this analysis lies a critical examination of variances—those pivotal points where expectation and reality diverge. These variances serve as beacons, guiding our strategic recalibrations and illuminating the path to enhanced fiscal stewardship. By dissecting these discrepancies, we gain invaluable insights into the robustness of our financial planning, the agility of our budgetary responses, and the overarching health of our fiscal architecture.

Each budget category is subjected to a thorough analysis, revealing stories of triumph where performance has eclipsed projections and cautionary tales where outcomes have fallen short of expectations. This granular examination extends beyond mere numerical assessments, delving into the strategic underpinnings of our financial maneuvers, the efficacy of our resource allocation, and the overarching impact of our budgetary practices on our company's financial equilibrium.

The utility of this section transcends mere fiscal evaluation; it serves as a strategic compass, steering our budgetary tactics and financial planning. By identifying areas of overperformance and underperformance, we can recalibrate our financial strategies, optimize resource distribution, and fortify our fiscal foundations against the unpredictable tides of the market.

This comprehensive budget analysis embodies our commitment to financial transparency, strategic accountability, and continuous improvement. It's a testament to our relentless pursuit of financial excellence, underscoring our dedication to not just meeting but exceeding our financial mandates. Through this meticulous fiscal introspection, we reaffirm our commitment to upholding the highest standards of financial discipline, ensuring that our budgetary practices not only reflect our strategic aspirations but also propel us towards achieving them.

Key Findings

The Key Findings section of our Account Budget Management Journal offers an in-depth analysis of our fiscal performance, particularly focusing on variances, cost-saving initiatives, and investment returns. This analysis is instrumental in understanding the dynamics between our financial forecasting, the execution of budgetary allocations, and the overall impact on our company’s growth trajectory.

Variances Analysis

The Variances Analysis is a cornerstone of our financial review, providing a meticulous examination of the gaps between our budgeted projections and the actual financial outcomes across various budget categories. This thorough scrutiny is not merely about quantifying discrepancies but delving into the underpinnings of each variance to gauge the precision of our financial forecasting and the effectiveness of our financial management strategies.

By dissecting these variances, we unlock a wealth of insights into our financial planning processes. For instance, underestimations in certain categories may reveal hidden growth opportunities or unanticipated market trends, while overestimations could highlight areas of overcautious allocation or missed operational efficiencies. This analysis serves as a feedback loop, refining our forecasting models and enhancing our budgetary adaptability to align more closely with the dynamic business environment.

The examination extends to evaluating the impact of these variances on our overall financial health. It involves assessing how deviations from the budget have influenced our liquidity, solvency, and investment capacity, thereby shaping our strategic financial decisions for the forthcoming periods.

Cost Savings Initiatives

Our focus on Cost Savings Initiatives underscores our commitment to financial prudence and operational efficiency. Throughout the year, we have implemented a series of cost-saving measures designed to streamline operations, reduce wasteful expenditure, and optimize resource allocation. This segment of the report highlights the most successful of these initiatives, detailing their implementation, the rationale behind their adoption, and the tangible benefits realized as a result.

These initiatives range from process automation and supply chain optimization to renegotiations of vendor contracts and energy efficiency improvements. Each measure is evaluated not only on the basis of the immediate financial savings it generated but also on its long-term impact on operational efficiency and productivity. This holistic approach ensures that cost-saving measures contribute positively to our operational ethos without compromising the quality of our offerings or our market competitiveness.

Investment Returns

The Investment Returns analysis provides a critical review of the financial yields from our investments over the year, encompassing new projects, technology upgrades, and market expansion efforts. This analysis is pivotal in understanding how our capital allocations have translated into tangible financial growth, offering a clear view of the return on investment (ROI) for each initiative.

We delve into the performance of each investment, assessing its contribution to revenue growth, market share expansion, and the enhancement of our competitive edge. This includes evaluating the success of new product launches, the efficiency gains from technology upgrades, and the market response to our expansion activities. The analysis not only measures the direct financial returns but also considers the strategic value added by each investment, such as enhanced brand recognition, access to new markets, and the development of new competencies.

In synthesizing these findings, the report not only highlights the successes and learnings of the past fiscal year but also lays the groundwork for more informed, strategic decision-making moving forward. Through this comprehensive analysis, we reaffirm our commitment to fiscal discipline, strategic investment, and continuous improvement, ensuring our company remains resilient, agile, and growth-oriented in the ever-evolving business landscape.

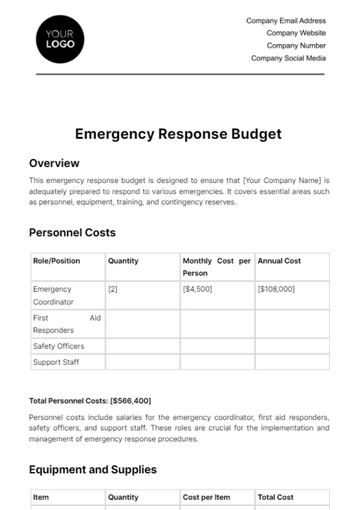

Expense Report

The expense report offers a comprehensive tabular overview of all company expenses incurred during the specified period. This section is meticulously organized to provide clarity on where company funds are being allocated, facilitating a transparent review of financial outflows. The report categorizes expenses into operational costs, salaries and benefits, marketing and sales expenses, research and development costs, and capital expenditures, among others.

Fig 1: Company Expense Report Example

Revenue Report

This section presents a detailed breakdown of the revenues generated from various business sectors, presented in a structured table format. By analyzing these figures, stakeholders can gain a clear understanding of which sectors are the most profitable and how different revenue streams contribute to the overall financial health of the company.

Fig 2: Company Revenue Report Example

Forecast and Planning

As we pivot towards the upcoming fiscal year, our Forecast and Planning segment lays out a meticulously crafted financial roadmap, anchored in the insights gleaned from current financial trends, comprehensive market analysis, and our overarching strategic business objectives. This forward-looking perspective is designed to navigate the complexities of the evolving economic landscape, ensuring that our financial strategies are both robust and responsive to emerging opportunities and challenges.

Anticipated Revenues

Our revenue projections for the next fiscal year are grounded in a dual approach—fortifying existing revenue streams while aggressively pursuing new ones. We anticipate a steady growth in our core business areas, bolstered by our ongoing customer retention and engagement strategies. Simultaneously, we are setting our sights on untapped markets and novel product offerings, aiming to diversify our revenue base and mitigate risks associated with market volatility.

Innovative pricing strategies, enhanced service offerings, and strategic partnerships are among the key drivers expected to fuel our revenue growth. These initiatives are complemented by targeted marketing campaigns and sales strategies, designed to penetrate deeper into existing markets and establish footholds in new ones.

Projected Expenses

Our expense forecast takes into account the strategic initiatives and operational needs that will underpin our business activities in the forthcoming year. Emphasis is placed on aligning our expenditure with strategic priorities, ensuring that each dollar spent is a step towards achieving our long-term goals.

Operational efficiency and cost-effectiveness remain at the core of our expense management philosophy. Investments in technology and process optimization are projected to yield significant cost savings, while strategic sourcing and vendor management initiatives are expected to further enhance our cost structure.

Capital Investments

The foundation of our growth strategy is a judicious approach to capital investments, with a focus on projects that promise to drive innovation, expand our market presence, and enhance our competitive edge. Significant allocations are earmarked for research and development, aimed at fueling product innovation and improving service delivery mechanisms.

Technology upgrades and infrastructure enhancements are also high on our investment agenda, designed to bolster our operational capabilities and improve customer experiences. Additionally, strategic acquisitions and geographic expansions are being considered as avenues for accelerated growth and market diversification.

Strategic Objectives

Our strategic objectives for the next fiscal year are crafted to propel the company towards a trajectory of sustainable growth, operational excellence, and market leadership.

Growth Initiatives

Our growth strategy is multi-faceted, encompassing aggressive market penetration efforts, strategic product line extensions, and geographic expansions. By leveraging our core competencies and market insights, we aim to capture increased market share and tap into new customer segments.

Product line extensions will focus on addressing unmet market needs and capitalizing on emerging trends, thereby enriching our value proposition. Geographic expansion efforts will be carefully calibrated, targeting markets with high growth potential and alignment with our business model.

Cost Management

Cost management strategies will be pivotal in maintaining financial health and supporting sustainable growth. Process reengineering, automation, and lean management principles will be at the forefront of our cost containment efforts.

We will also enhance our procurement strategies and supply chain efficiencies to achieve cost reductions without compromising on quality or service levels. A culture of cost consciousness will be fostered across the organization, encouraging innovation in cost-saving measures.

Investment in Innovation

Innovation remains a cornerstone of our strategic agenda, with substantial investments planned in research and development. These investments will focus on developing next-generation products and services, harnessing emerging technologies, and exploring new business models.

Collaborations with academia, industry partners, and innovation hubs will be intensified to augment our internal capabilities and accelerate our innovation cycle. These initiatives are expected to not only enhance our product offerings but also redefine market standards and elevate our competitive positioning.

Conclusion

The Account Budget Management Journal encapsulates a year of strategic financial stewardship, characterized by diligent management, strategic foresight, and adaptive planning. The comprehensive analyses, detailed reports, and strategic forecasts contained within this document reflect our unwavering commitment to financial prudence, strategic growth, and operational excellence.

The insights and learnings distilled from this year's financial journey are invaluable, laying a solid foundation for our future strategic endeavors. They underscore the importance of agility, resilience, and strategic vision in navigating the complexities of today's business environment.

As we stand on the threshold of a new fiscal year, we are equipped with deeper insights, refined strategies, and a clear vision for the future. Our financial roadmap is not just a plan for managing numbers but a blueprint for achieving our aspirations, driving innovation, and delivering value to our stakeholders.

In the spirit of continuous improvement and strategic advancement, we are poised to leverage the insights from this journal to scale new heights. Our journey ahead is shaped by the lessons of the past and the opportunities of the future, guiding us towards sustained growth, market leadership, and financial excellence.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net offers the Account Budget Management Journal Template, a versatile tool designed to streamline financial tracking. With our intuitive AI editor, effortlessly customize and edit this template to suit your business needs. Keep your finances organized, budgets on track, and gain valuable insights with this user-friendly solution. Simplify budget management with Template.net's editable template today!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising