Free Payroll Accounting Practices Journal

Purpose

This Payroll Accounting Practices Journal is designed to serve as a comprehensive guide and reference for our organization’s payroll system. The purpose of this journal is manifold:

Documentation: To document our current payroll practices and procedures, ensuring consistency and clarity in our payroll processes.

Compliance: To assist in maintaining compliance with all relevant payroll-related laws and regulations.

Training and Reference: To provide a training resource for new staff and a reference for existing staff in the payroll department.

Continuous Improvement: To identify areas for improvement in our payroll processes and track the implementation of these improvements over time.

Overview of the Organization's Payroll System

Our payroll system is a critical component of our organization's financial operations, designed to ensure accurate and timely compensation to our employees while complying with all legal and regulatory requirements. Here is an overview:

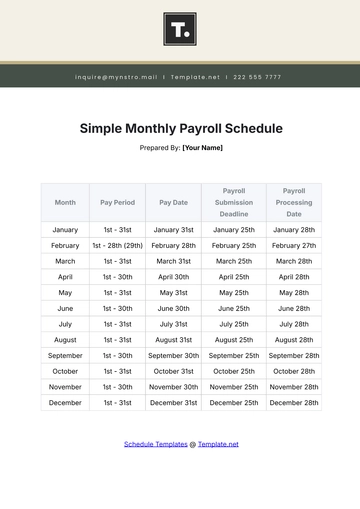

Payroll Frequency: We process payroll on a bi-weekly basis, ensuring timely payment of wages to our employees.

Employee Categories: Our workforce is categorized into full-time, part-time, and contract employees, each with distinct payroll considerations.

Compensation Structures: Our compensation includes hourly wages for part-time employees, salaries for full-time employees, and project-based payments for contract workers. Overtime pay is calculated at 1.5 times the regular hourly rate for hours worked beyond 40 hours per week.

Benefits Administration: The payroll system integrates the administration of various employee benefits, including health insurance, retirement plans, and paid time off.

Tax Withholding and Reporting: We adhere to federal and state tax regulations, withholding the appropriate taxes from employee wages and reporting these to the relevant authorities. For example, the average withholding rate for federal tax is currently 22% for our employees.

Payroll Accounting Software: We utilize a sophisticated payroll accounting software system that automates many of our payroll processes, from calculating wages and deductions to generating pay stubs and tax forms.

Audit and Compliance: Regular audits are conducted to ensure accuracy and compliance with all payroll-related laws and regulations.

Payroll Legislation and Compliance

The integrity and efficiency of our payroll system are underpinned by strict adherence to various payroll legislations. Understanding and complying with these laws are paramount to ensure the fair treatment of employees and to avoid legal repercussions.

Relevant U.S. Legislation

Fair Labor Standards Act (FLSA): The FLSA establishes minimum wage, overtime pay eligibility, recordkeeping, and child labor standards affecting full-time and part-time workers. We ensure compliance by paying at least the federal minimum wage and overtime at 1.5 times the regular pay rate for hours worked over 40 per week.

Federal Insurance Contributions Act (FICA): This act requires us to withhold Social Security and Medicare taxes from employees' wages and pay a matching amount. Currently, Social Security tax is 6.2% on earnings up to the applicable taxable maximum amount, and Medicare tax is 1.45% of all earnings.

Employee Retirement Income Security Act (ERISA): ERISA regulates employers who offer pension or welfare benefit plans. Our compliance involves maintaining plan solvency and providing fiduciary responsibilities to manage and control the plans.

Compliance Strategies and Practices

Regular Training: Conducting regular training sessions for our payroll staff to stay updated on current laws and regulations.

Auditing and Monitoring: Implementing rigorous auditing processes to ensure accuracy in tax calculations and benefit disbursements.

Collaboration with Legal Advisors: Working closely with legal advisors to interpret complex legislation and implement necessary changes.

Employee Communication: Keeping transparent communication with employees regarding their payroll, taxes, and any changes that may affect them.

Updates on Recent Legal Changes Affecting Payroll

Tax Cuts and Jobs Act Adjustments: Adjustments to withholding tables and standard deductions as a result of the Tax Cuts and Jobs Act.

Increase in Minimum Wage: Following the recent federal update, we have adjusted our minimum wage rates accordingly.

Changes in Overtime Regulations: Updates to the criteria for overtime eligibility, expanding the number of employees who qualify for overtime pay.

Our organization remains vigilant and proactive in adapting our payroll systems to meet the changing legal landscape, ensuring that we not only comply with the law but also uphold the highest standards of fairness and responsibility towards our employees.

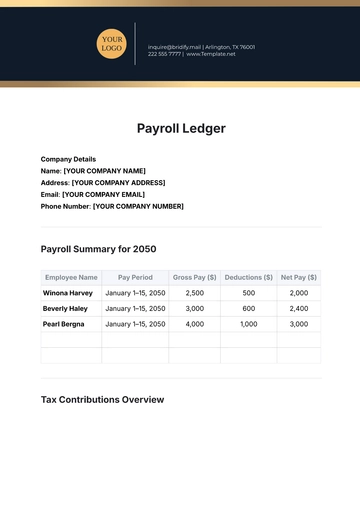

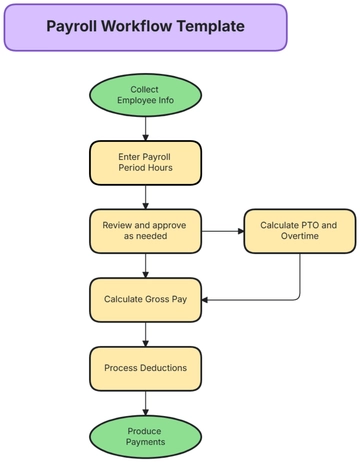

Payroll Accounting Procedures

Our payroll accounting procedures are meticulously crafted to ensure accuracy, compliance, and efficiency in employee compensation. These procedures encompass a series of steps, each critical to the overall payroll process, and are regularly reviewed for potential improvements.

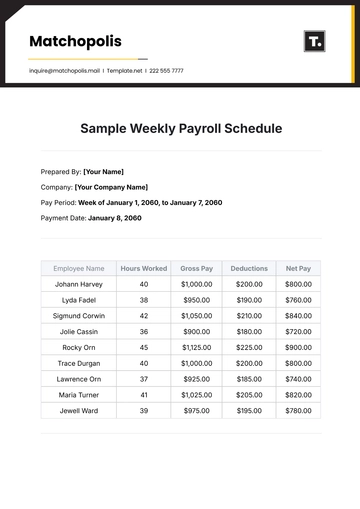

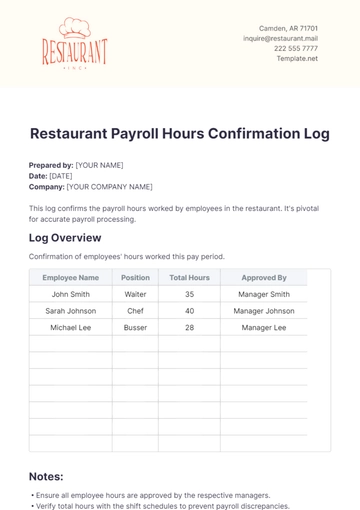

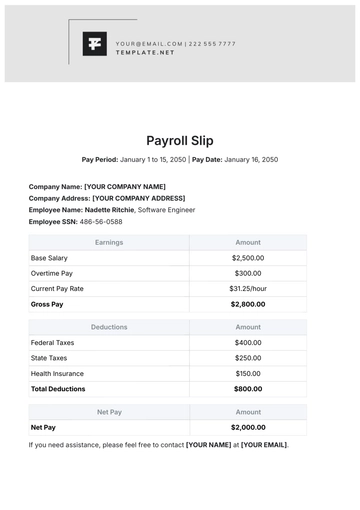

Time and Attendance Tracking: Employees record their working hours using a digital timekeeping system. This system automatically feeds data into the payroll software, ensuring accuracy in the calculation of hours worked, including overtime.

Payroll Calculation: The payroll software processes the time and attendance data to calculate gross pay. This includes base pay, overtime, bonuses, and any other forms of compensation, in accordance with employee contracts and company policies.

Deductions and Withholdings: Automatic deductions for taxes, health insurance, retirement contributions, and other statutory or voluntary deductions are calculated. This ensures compliance with tax laws and employee benefit programs.

Payroll Approval: Once the preliminary payroll is calculated, it undergoes a thorough review and approval process by the payroll department to ensure accuracy and compliance.

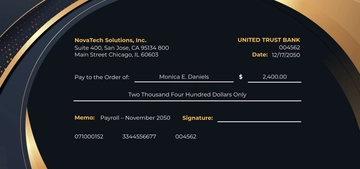

Payment Disbursement: Upon approval, payments are disbursed to employees via direct deposit or other agreed-upon methods on the scheduled payday.

Record Keeping and Reporting: Detailed payroll records are maintained for each employee. Regular reports are generated for internal use and compliance with governmental reporting requirements.

Payroll Audits: Regular audits are conducted to ensure the integrity and accuracy of the payroll process.

Checklists for Routine Payroll Activities

Pre-Payroll Processing Checklist

Verify time and attendance data for accuracy.

Confirm employee salary or wage updates.

Update employee personal and tax information, if necessary.

Payroll Processing Checklist

Calculate gross pay for each employee.

Apply appropriate deductions and withholdings.

Review and approve the payroll calculations.

Confirm the total payroll amount and funding.

Post-Payroll Processing Checklist

Disburse payments to employees.

Distribute pay stubs or statements.

Complete and file payroll taxes with appropriate authorities.

Update payroll records and reports.

Conduct a post-payroll audit for discrepancies.

Employee Compensation Structures

Our organization's approach to employee compensation is designed to be fair, competitive, and in alignment with industry standards. We offer various types of compensation structures to cater to the diverse roles and responsibilities within our workforce. Each structure is carefully formulated to ensure that it motivates and rewards employees effectively.

Breakdown of Different Types of Compensation

Type of Compensation | Description | Eligibility Criteria |

Hourly Wages | Payment based on the number of hours worked. | Part-time and contract employees |

Salaries | Fixed payment irrespective of hours worked. | Full-time employees |

Bonuses | Additional compensation based on performance. | All employees, based on eligibility criteria |

Commission | Earnings based on sales or performance targets. | Sales and target-based roles |

Tips | Voluntary payments received from customers. | Service-oriented positions |

Overtime Policies and Calculations

Overtime is paid at 1.5 times the regular hourly rate for hours worked over 40 in a workweek. For salaried employees, overtime is calculated based on their equivalent hourly rate. Overtime must be pre-approved by the department manager.

Benefits Administration

Benefit Type | Description | Eligibility Criteria |

Health Insurance | Coverage for medical, dental, and vision care. | Full-time employees after 90 days of employment |

Retirement Plans (e.g., 401(k)) | Retirement savings plan with optional employer matching. | All employees, with immediate eligibility for contributions; matching after 1 year |

Paid Time Off (PTO) | Paid leave for vacations, illness, or personal matters. | All employees, accrual based on tenure |

Life Insurance | Basic life insurance coverage. | Full-time employees after 90 days of employment |

Disability Insurance | Short-term and long-term disability coverage. | Full-time employees after 90 days of employment |

Our compensation structures and benefits are regularly reviewed to ensure they remain competitive and meet the needs of our employees. We believe in rewarding our workforce not just through monetary means but also through comprehensive benefits that support their overall well-being and financial security.

Taxation and Deductions

In our payroll process, careful attention is given to the accurate calculation and withholding of taxes, along with other mandatory and voluntary deductions. This ensures compliance with legal requirements and helps manage employees' financial responsibilities effectively.

Detailed Overview of Tax Withholding Procedures

Employee Tax Information Collection: We collect W-4 forms from all employees to determine their federal tax withholding status. This form indicates the employee's filing status, number of allowances, and any additional amount they wish to withhold.

Calculation of Withholdings: Based on the information from W-4 forms, federal, state, and, if applicable, local taxes are calculated using the latest tax tables. We also factor in Social Security and Medicare taxes under FICA.

Regular Review and Adjustment: Tax withholdings are regularly reviewed and adjusted if necessary, especially when employees experience life changes (e.g., marriage, childbirth) that affect their tax status.

Mandatory and Voluntary Deductions

Mandatory Deductions: These are legally required deductions that include federal and state taxes, FICA taxes (Social Security and Medicare), and, in some cases, local taxes. Other mandatory deductions can include wage garnishments or child support orders as required by law.

Voluntary Deductions: Employees have the option to elect various voluntary deductions. These typically include contributions to retirement savings plans (e.g., 401(k) plans), health, dental, and vision insurance premiums, and contributions to flexible spending accounts. Voluntary deductions are made pre-tax, reducing the employee's taxable income.

Year-End Tax Reporting Practices

As the financial year closes, we adhere to the following guidelines for year-end tax reporting:

Ensure all payroll records are accurate and up-to-date.

Reconcile W-2 forms with the year's payroll records for accuracy.

Distribute W-2 forms to employees no later than January 31.

Report all payroll-related taxes to the IRS and state/local tax authorities as required.

Prepare and file all necessary forms, such as Form 940 for federal unemployment tax and Form 941 for quarterly tax filings.

Our approach to taxation and deductions is comprehensive and meticulous, aimed at maintaining accuracy and ensuring both the organization and its employees are compliant with tax laws and regulations. This careful management is vital for the financial well-being of both our employees and the organization.

Payroll Accounting Software and Technology

In our quest to streamline payroll operations and enhance accuracy, we leverage advanced payroll accounting software and technology. These tools are pivotal in automating and optimizing our payroll processes, ensuring efficiency and compliance with the latest payroll standards and regulations.

Overview of Payroll Software Used

We utilize a robust payroll accounting software system that serves as the backbone of our payroll operations. This software automates key tasks such as calculating wages, deducting taxes and other withholdings, and generating payslips. It features a user-friendly interface that allows our payroll team to efficiently manage and process payroll data. Security features are embedded to protect sensitive employee information, and the system is regularly updated to remain compliant with the latest tax laws and payroll regulations.

Integration with Other Accounting Systems

Our payroll software is fully integrated with our broader financial accounting systems. This integration ensures seamless data flow and consistency across various financial functions. It allows for real-time updating of financial records, reflecting payroll expenses in our overall financial statements without manual intervention. This level of integration is critical for accurate financial reporting, budgeting, and planning, as it provides a holistic view of the organization's financial health.

Updates and Upgrades to Payroll Software

Regular Compliance Updates: Ensuring that the software is updated in line with changes in tax laws and payroll regulations. This includes adjustments to tax tables, contribution limits, and reporting requirements.

Security Enhancements: Implementing advanced security features to safeguard sensitive payroll data against cyber threats and unauthorized access.

Feature Upgrades: Adding new features to improve functionality, such as enhanced reporting capabilities, employee self-service portals, and mobile access.

System Performance Improvements: Regular updates to improve system speed, reliability, and user experience, reducing processing times and enhancing overall efficiency.

Integration Capabilities: Upgrading the system to enhance its integration capabilities with other business systems, such as HR management and time tracking software, for a more unified operational approach.

Payroll Auditing and Reconciliation

Maintaining the integrity and accuracy of our payroll system is a top priority. Regular payroll auditing and reconciliation are essential practices to ensure that all payroll transactions are accurate and compliant with regulatory standards.

Methods and Frequency of Payroll Audits

Audit Type | Description | Frequency |

Internal Audit | Conducted by our internal audit team to review payroll accuracy, compliance with laws, and internal controls. | Quarterly |

External Audit | Performed by an independent external auditor, focusing on compliance with external regulations and financial reporting accuracy. | Annually |

Random Audit | Unannounced audits on randomly selected payroll records to ensure ongoing compliance and accuracy. | Bi-Annually |

Reconciliation Procedures

Cross-Checking Records: Regular comparison of payroll records with bank statements to ensure that the amounts disbursed match the payroll amounts recorded.

Reviewing Employee Files: Ensuring that employee salaries, benefits, and deductions align with their employment contracts and company policies.

Verifying Tax Payments and Filings: Confirming that all payroll-related tax payments and filings are accurate and submitted on time.

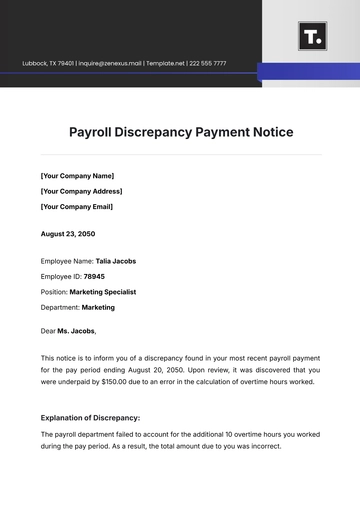

Handling and Documenting Discrepancies

Immediate Investigation: Any discrepancies found during audits or reconciliation are immediately investigated to determine the cause.

Corrective Actions: Implement corrective measures to rectify any errors or inconsistencies identified.

Documentation and Reporting: Document the findings and the corrective actions taken for future reference and compliance purposes.

Employee Data Management

The confidentiality and security of payroll information are paramount in our payroll processes. We are committed to protecting sensitive employee data from unauthorized access and ensuring its accuracy and integrity.

Confidentiality and Security of Payroll Information

We employ stringent security measures, including data encryption, secure access controls, and regular security audits, to safeguard employee payroll information. Regular training is provided to our payroll staff on data privacy laws and best practices in handling confidential information.

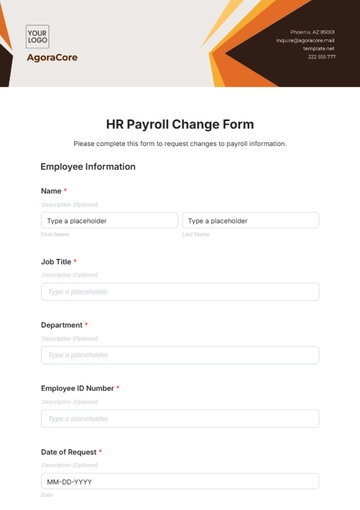

Employee Data Collection and Management Procedures

Employee payroll data is collected through secure channels, ensuring privacy and compliance with data protection laws. Our payroll system is updated regularly with any changes in employee information, such as tax status, benefit elections, or salary adjustments.

Collect data through secure, confidential forms and systems.

Regularly verify the accuracy of the data with the employees and update it as necessary.

Restrict access to sensitive payroll data to authorized personnel only.

Maintain payroll records for the legally required duration and securely dispose of them when they are no longer needed.

Training and Development

Recognizing the importance of continuous learning and professional growth, we invest significantly in the training and development of our payroll staff. Our training programs are designed to enhance skills, ensure compliance with changing regulations, and improve overall payroll management efficiency.

Program | Duration | Description |

Payroll Compliance Training | 2 Days | Covers updates on payroll laws and regulations. |

Payroll Software Utilization | 3 Days | Training on new features and efficient use of our payroll software. |

Data Security and Privacy | 1 Day | Focuses on the handling and protection of sensitive payroll data. |

Taxation and Deductions | 2 Days | Detailed training on tax withholding and deductions. |

Advanced Payroll Techniques | 5 Days | Covers advanced payroll concepts and strategic planning. |

Performance Metrics and Improvement

Our payroll department continuously strives for excellence and efficiency. To measure our performance and drive improvements, we have identified key performance indicators (KPIs) that are regularly monitored and reviewed.

KPI | Target Metric |

Payroll Processing Accuracy | 99.5% |

On-time Payroll Completion | 100% |

Employee Queries Resolution | Within 24 hours |

Payroll Cost Reduction | 5% Yearly |

Compliance Audit Success | 100% |

Conclusion

Throughout this Payroll Accounting Practices Journal, we have outlined our key practices, from payroll legislation and compliance to the advanced technologies we use. Our commitment to maintaining a robust, efficient, and compliant payroll system is unwavering. Looking to the future, we plan to continue investing in technology upgrades, staff training, and process improvements to enhance our payroll services further. By adhering to these practices and continuously seeking ways to improve, we ensure that our payroll system not only meets but exceeds the expectations of our organization and its employees. This commitment to excellence is at the heart of our approach, as we strive to maintain our status as a forward-thinking, responsible, and efficient organization in the realm of payroll accounting.

Accounting Templates @ Template.net

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Payroll Accounting Practices Journal Template from Template.net, your key to documenting payroll procedures effectively. This template, highly editable and customizable, adapts seamlessly to your organization's standards. Utilize our AI Editor tool for easy modifications, ensuring your journal reflects current payroll practices accurately. Choose Template.net for professional and organized payroll accounting record-keeping.