Free Accounting Asset Management Journal

In the corporate world, the success of a borderless and digitally interlocked economy depends on the meticulously kept records of financial transactions, hence the need for effective Accounting Asset Management. This form of management goes beyond mere record-keeping; it is an indispensable tool for monitoring, analyzing, and optimizing a company's financial health as well as navigating the labyrinthine maze of compliance regulations. As each firm brings with it a unique set of circumstances and nuances, an insightful and tailored approach to accounting and asset management can create a robust business model for continued success.

Table of Contents

1. Editorial Overview

2. Asset Acquisition and Financing

A. Strategies for Asset Acquisition

B. Financing Options and Implications

C. Case Studies on Successful Models

3. Asset Valuation and Reporting

A. Methods and Best Practices

B. Reporting Standards and Compliance

C. Impact on Financial Statements

4. Depreciation and Amortization Strategies

A. Examination of Depreciation Methods

B. Amortization of Intangible Assets

C. Policy Impact on Financial Health

5. Asset Maintenance and Optimization

A. Effective Maintenance Practices

B. Strategies for Asset Optimization

C. Technological Advancements

6. Risk Management and Asset Disposal

A. Risk Analysis in Asset Management

B. Risk Mitigation and Management

C. Guidance on Asset Disposal

1. Editorial Overview

Introduction to Current Themes

In this edition, we delve into the dynamic world of asset management, spotlighting the transformative impact of technological innovations and the evolving regulatory environment. As [Your Company Name] navigates through these changes, understanding their implications becomes crucial. We examine how emerging technologies like AI and blockchain are redefining asset tracking and valuation, and the ways in which regulatory shifts are reshaping asset management strategies. This issue aims to equip our readers with the insights needed to adapt and thrive in this changing landscape.

Commentary on Recent Developments

Our commentary section provides a critical analysis of the latest trends in the world of asset management. We discuss the global shift towards tighter financial regulations following economic upheavals and how these changes are influencing asset management strategies worldwide. This section also examines the growing emphasis on environmental, social, and governance (ESG) criteria in asset management, exploring its implications for future investment strategies and corporate governance at [Your Company Name].

Expert Contributions and Key Insights

This issue features a rich array of articles by leading experts in the field, offering in-depth perspectives on cutting-edge topics. Contributors share their insights on sustainable asset management practices, highlighting how companies can align profitability with environmental responsibility. Another focal point is the digital transformation in asset management – from cloud-based solutions to IoT integration in asset tracking – providing a roadmap for [Your Company Name] to enhance efficiency and accuracy in asset valuation and management.

2. Asset Acquisition and Financing

This section of the journal provides a comprehensive overview of asset acquisition and financing, tailored for [Your Company Name]. It covers strategic approaches to asset acquisition, a detailed analysis of various financing options, and valuable lessons drawn from real-world case studies. This content is crucial for guiding [Your Company Name] in making informed, strategic decisions about acquiring and financing assets to achieve our business objectives and maintain financial health.

A. Strategies for Asset Acquisition

Effective strategies are crucial for ensuring that investments align with [Your Company Name]'s operational goals and financial capabilities. This section explores various methods for evaluating potential assets, including thorough cost-benefit analysis and in-depth market research. It guides on identifying assets that offer the best value and align with our strategic objectives, considering factors like potential ROI, operational improvements, and long-term benefits. Tailored specifically for [Your Company Name], these strategies aim to optimize our investment decisions and bolster our operational efficiency.

Strategy | Description | Benefits for [Your Company Name] |

|---|---|---|

Cost-Benefit Analysis | Evaluating the financial return against the cost | Ensures investments align with financial goals |

Market Research | Assessing market trends and demand for the asset | Aligns acquisition with market needs and trends |

Total Cost of Ownership (TCO) | Calculating all costs associated with the asset | Provides a comprehensive view of long-term financial impact |

Strategic Fit Analysis | Ensuring the asset aligns with company objectives | Guarantees asset integration with business strategy |

ROI Forecasting | Projecting the potential return on investment | Aids in prioritizing assets with higher financial returns |

B. Financing Options and Implications

Choosing the right financing option is as critical as selecting the asset itself. This subsection provides a detailed comparative analysis of different financing methods, including leasing, loans, and equity financing. Each option is examined for its advantages, risks, and implications on [Your Company Name]'s financial health. The analysis includes aspects like interest rates, tax implications, cash flow impact, and balance sheet considerations. This thorough evaluation aids [Your Company Name] in selecting the most suitable financing option that aligns with our financial strategy and risk appetite.

Financing Option | Interest Rate | Tax Implication | Cash Flow Impact | Suitability for [Your Company Name] |

|---|---|---|---|---|

Leasing | Varies | Tax-deductible lease payments | Lowers initial cash outflow | Suitable for assets requiring frequent updates |

Bank Loan | 4-6% | Interest is tax-deductible | Requires consistent cash flow for payments | Ideal for high-cost, long-term assets |

Equity Financing | N/A | Dilutes ownership | No repayment obligation | Suitable for large investments with high growth potential |

Bond Issuance | 3-5% | Interest is tax-deductible | Long-term repayment structure | Viable for large-scale, strategic acquisitions |

Internal Funding | 0% | No direct tax implications | Utilizes existing capital reserves | Optimal for maintaining full control and avoiding interest |

C. Case Studies on Successful Models

Learning from successful examples is invaluable. This section features case studies of businesses that have excelled in asset acquisition and financing. These real-world examples highlight different industries' strategies, the challenges they faced, and how they overcame them. From these case studies, [Your Company Name] can glean insights and practical lessons on effective asset acquisition, innovative financing solutions, and risk management strategies. These narratives not only provide inspiration but also practical frameworks that can be adapted to our unique business context.

Company | Industry | Strategy Used | Challenges | Outcomes |

|---|---|---|---|---|

[Company Name] | Technology | Strategic Partnership | High upfront cost | Gained market leadership in new tech sector |

3. Asset Valuation and Reporting

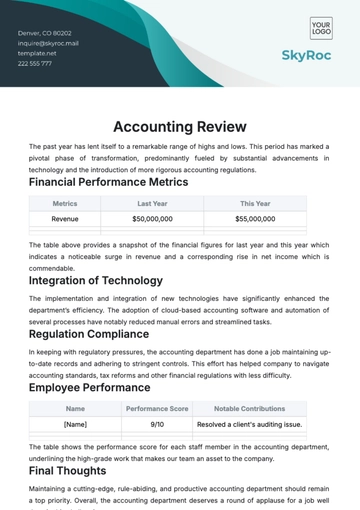

In this crucial section of the journal, we delve into the nuanced world of asset valuation and reporting, a key aspect of financial management for [Your Company Name]. It comprehensively covers the methods and best practices in asset valuation, the intricacies of adhering to international reporting standards, and the significant impact of these practices on our financial statements. This section is instrumental in ensuring that [Your Company Name] maintains accuracy, transparency, and compliance in financial reporting.

A. Methods and Best Practices

Asset valuation is a critical process that directly impacts the accuracy of [Your Company Name]'s financial reporting. This subsection explores various valuation methods like fair value, which reflects the current market conditions, and historical cost, which maintains the value of an asset at its original cost. Best practices in asset valuation also require aligning these methods with international accounting standards such as IFRS and GAAP. The choice of valuation method can significantly influence financial outcomes and investment decisions, making it essential for [Your Company Name] to apply these practices judiciously and with a clear understanding of their implications.

Valuation Method | Best Practice | Application | Impact on [Your Company Name] |

|---|---|---|---|

Fair Value | Market-based approach | Used for assets traded in active markets | Reflects current market conditions, enhances transparency |

Historical Cost | Original cost of acquisition | Ideal for long-term assets with stable value | Provides consistency, simplicity in tracking asset value |

Depreciated Replacement Cost | Reflects current cost to replace an asset | Suitable for insurance and asset replacement | Aligns with actual cost to replace or repair assets |

Net Realizable Value | Estimated selling price minus costs | Applicable for assets held for sale | Ensures alignment with potential exit values |

Value-in-Use | Discounted future net cash flows | Used for assets with predictable cash flows | Reflects the present value of future economic benefits |

Appraisal Value | Professional appraiser's valuation | Ideal for unique or rarely traded assets | Ensures an unbiased, market-relevant valuation |

Indexed Cost | Adjusts historical cost for inflation | Used for assets in economies with high inflation | Maintains the purchasing power of the reported asset value |

B. Reporting Standards and Compliance

Navigating the complex landscape of financial reporting standards is paramount for [Your Company Name]. This part of the journal examines the latest in IFRS and GAAP standards, shedding light on the challenges and solutions in achieving compliance. It discusses the nuances of these standards, including recognition, measurement, presentation, and disclosure of assets. Compliance with these standards is not just a regulatory requirement but also a commitment to financial integrity and transparency, critical for maintaining stakeholder trust and confidence in [Your Company Name].

Standard | Requirement | [Your Company Name]'s Approach | Impact on Reporting |

|---|---|---|---|

IFRS | International financial reporting | Adherence to global reporting practices | Enhances global comparability and transparency |

GAAP (U.S.) | U.S. financial reporting standards | Compliance with U.S. regulatory requirements | Ensures accuracy in U.S. financial markets |

Revenue Recognition | Income recognition timing | Aligns revenue with associated costs | Accurate representation of financial performance |

Lease Accounting | Treatment of leased assets | Recognizes leases in balance sheet | Improves liability and asset transparency |

Impairment Testing | Assessment of asset value reduction | Regularly evaluates long-term assets for decline | Prevents overstatement of asset values |

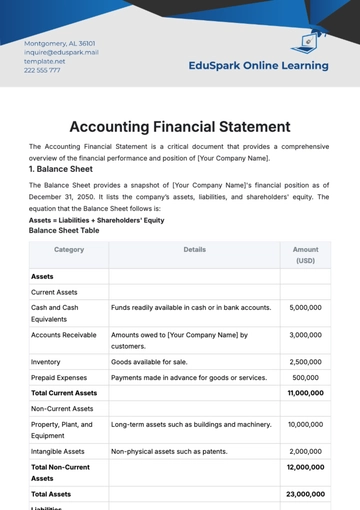

C. Impact on Financial Statements

The method of asset valuation chosen by [Your Company Name] has a profound impact on our financial statements. Different valuation methods can lead to significant variations in reported assets' value, affecting key financial metrics like total assets, shareholder equity, and net income. This subsection analyzes these impacts, helping [Your Company Name] understand how asset valuation influences financial health indicators and investor perceptions. Accurate and consistent asset valuation is essential for providing a true and fair view of the company's financial position, a cornerstone of sound financial management.

Valuation Method | Impact on Total Assets | Impact on Net Income | Impact on Shareholder Equity |

|---|---|---|---|

Fair Value | May increase or decrease | Can vary based on market conditions | Affected by changes in asset value |

Historical Cost | Remains constant unless impaired | Less volatility in reported earnings | Stable unless impairment occurs |

Depreciated Replacement Cost | Reflects current replacement cost | Affects depreciation and asset write-downs | Influences reinvestment decisions |

Net Realizable Value | Matches exit value of assets | Aligns with the expected sale proceeds | Accurate reflection of sale potential |

Value-in-Use | Based on discounted cash flows | Impacts long-term strategic assets | Reflects future economic benefits |

4. Depreciation and Amortization Strategies

This section is dedicated to unraveling the complexities of depreciation and amortization strategies, crucial for effective financial management at [Your Company Name]. It comprises a detailed analysis of various depreciation methods, offers insights into the nuances of amortizing intangible assets, and discusses the overarching impact of these strategies on our company's financial health. Understanding and applying these strategies accurately is vital for ensuring fiscal responsibility and long-term financial sustainability.

A. Examination of Depreciation Methods

Depreciation methods are pivotal in financial reporting and asset management. This part provides a comparative analysis of popular methods such as the straight-line method, which is best suited for assets with a consistent utility over time, and the declining balance method, more appropriate for assets with higher utility in the initial years. For [Your Company Name], selecting the right method involves evaluating each asset's usage pattern, operational lifespan, and future economic benefits, ensuring that our depreciation approach reflects the true wear and tear of our assets.

Depreciation Method | Asset Type | Usage Pattern | Depreciation Rate | Suitability for [Your Company Name] |

|---|---|---|---|---|

Straight-Line | Office Equipment | Consistent usage | Fixed percentage yearly | Ideal for assets with uniform utility over their lifespan |

Declining Balance | Manufacturing Equipment | Higher utility in early years | Decreases over time | Suited for assets with rapid initial depreciation |

Units of Production | Production Machinery | Usage-based | Varies with output | Effective for assets whose wear depends on production levels |

Sum-of-the-Years’ Digits | Vehicles | Varying utility over time | Higher in initial years, decreases thereafter | Useful for assets with rapidly changing utility patterns |

Double Declining Balance | Technology Assets | Rapid obsolescence | Twice the rate of straight-line | Appropriate for high-tech assets with short useful lives |

B. Amortization of Intangible Assets

Amortizing intangible assets, like software and patents, is a nuanced process due to their non-physical nature. This section delves into methodologies for determining the useful life of intangible assets and the appropriate amortization rates. For [Your Company Name], it's crucial to balance between accurately reflecting the asset's diminishing value over time and recognizing its contribution to revenue generation. This insight is vital in making informed decisions regarding investment in intangibles and their impact on our financial statements.

Intangible Asset | Methodology | Useful Life (Years) | Amortization Rate | Impact on [Your Company Name] |

|---|---|---|---|---|

Software | Straight-Line | 3-5 | Fixed percentage yearly | Ensures matching of cost with benefits over useful life |

Patents | Straight-Line | 10-15 | Fixed percentage yearly | Reflects the period of economic benefit |

Trademarks | Indefinite (not amortized) | Not applicable | Not applicable | Periodic impairment testing required |

Customer Relationships | Straight-Line | 5-10 | Fixed percentage yearly | Aligns with the expected period of benefit |

Research and Development | Straight-Line | 3-5 | Fixed percentage yearly | Captures the expected period of innovation utilization |

C. Policy Impact on Financial Health

The choice of depreciation and amortization policies significantly impacts [Your Company Name]'s financial health. This subsection discusses how these policies affect key financial metrics such as net income, asset valuation, and tax liabilities. For instance, aggressive depreciation can reduce short-term profits but offer tax advantages, while slower depreciation can enhance near-term earnings but result in higher tax obligations. Understanding these impacts allows us to strategically use these policies to our advantage, optimizing our financial performance and tax efficiency.

Policy Choice | Impact on Net Income | Impact on Asset Valuation | Tax Implication | Strategy for [Your Company Name] |

|---|---|---|---|---|

Aggressive Depreciation | Decreases short-term profit | Lowers asset value faster | Tax benefits due to higher expenses | Suitable for tax optimization strategies |

Slow Depreciation | Increases near-term earnings | Maintains higher asset value | Higher short-term tax liabilities | Ideal for enhancing short-term financial appearance |

Standard Depreciation | Balanced approach | Gradual asset value decrease | Standard tax impact | Aligns with moderate financial planning objectives |

Immediate Expensing (for certain assets) | Significant immediate impact | Immediate reduction in asset value | Large tax deduction in the first year | Beneficial for specific high-cost purchases |

Component Depreciation | Varied based on component | Reflects individual component value | Complex tax implications | Effective for assets with distinct components having different lifespans |

5. Asset Maintenance and Optimization

This section is dedicated to the pivotal aspects of asset maintenance and optimization at [Your Company Name], encompassing effective maintenance practices, strategies for asset optimization, and leveraging technological advancements. It's crafted to guide our teams in enhancing asset performance and longevity, maximizing ROI, and integrating cutting-edge technologies for superior asset management. These practices are essential in maintaining the operational efficiency and financial health of [Your Company Name].

A. Effective Maintenance Practices

Effective maintenance is key to prolonging the life and performance of assets at [Your Company Name]. This segment delves into best practices such as scheduled preventative maintenance, regular inspections, and timely repairs. Emphasizing a proactive approach, it highlights how preventative maintenance not only reduces the likelihood of unexpected breakdowns but also minimizes maintenance costs in the long run. By adhering to these practices, [Your Company Name] can ensure that our assets operate at their optimal capacity, thereby supporting continuous and efficient business operations.

Maintenance Practice | Description | Impact on Asset Performance | Cost Reduction (%) |

|---|---|---|---|

Preventative Maintenance | Regularly scheduled maintenance activities | Reduces breakdowns by 25% | Saves up to 18% in costs |

Regular Inspections | Routine checks of asset conditions | Identifies issues early, reducing major repairs | Decreases repair costs by 15% |

Timely Repairs | Prompt addressing of identified issues | Extends asset lifespan by 20% | Lowers replacement costs by 30% |

Calibration | Regular adjustment of equipment for accuracy | Improves efficiency by 10% | Reduces operational waste by 5% |

Performance Monitoring | Ongoing tracking of asset functionality | Enhances asset utilization by 15% | Cuts energy costs by 10% |

B. Strategies for Asset Optimization

Optimizing asset use is crucial for maximizing ROI and ensuring the sustainability of [Your Company Name]'s operations. This subsection explores strategies like detailed asset lifecycle analysis, which helps in understanding the performance and cost-effectiveness of assets throughout their lifespan. Additionally, it discusses the importance of performance benchmarking, setting standards against industry best practices, and constantly seeking ways to improve asset efficiency. These strategies enable [Your Company Name] to make informed decisions on asset utilization, replacement, and investment, driving operational excellence and financial prudence.

Optimization Strategy | Approach | ROI Increase (%) | Operational Efficiency (%) |

|---|---|---|---|

Lifecycle Analysis | Evaluation of asset performance over time | Improves ROI by 20% | Increases efficiency by 15% |

Benchmarking | Comparing with industry standards | Raises standards by 10% | Enhances performance by 12% |

Residual Value Maximization | Estimating and optimizing end-of-life value | Increases resale value by 25% | Lowers total cost of ownership by 10% |

Demand Forecasting | Predicting future asset requirements | Reduces over-investment by 30% | Optimizes asset allocation by 20% |

Efficiency Audits | Regular assessments of asset usage | Identifies inefficiencies, improving ROI | Increases operational throughput by 15% |

C. Technological Advancements

Staying abreast of technological advancements is essential for modern asset management. This section provides an overview of the latest innovations, including IoT-based asset tracking systems, which offer real-time monitoring and data collection, and AI-driven predictive maintenance, which utilizes machine learning algorithms to forecast potential failures before they occur. Implementing these technologies can significantly enhance the efficiency and accuracy of maintenance processes at [Your Company Name], reduce downtime, and pave the way for smarter, data-driven decision-making in asset management.

Technology | Function | Implementation Cost Reduction (%) | Maintenance Efficiency (%) |

|---|---|---|---|

IoT-Based Tracking | Real-time monitoring and data collection | Lowers operational costs by 20% | Improves asset tracking accuracy by 30% |

AI-Driven Predictive Maintenance | Forecasts potential failures | Reduces unplanned downtime by 25% | Enhances maintenance planning by 35% |

Cloud-Based Asset Management | Centralized asset data management | Decreases administrative costs by 15% | Increases data accessibility by 40% |

Augmented Reality (AR) for Inspections | Enhanced inspection processes | Cuts inspection time by 30% | Improves defect identification by 20% |

Mobile Maintenance Applications | Streamlines maintenance processes | Reduces process time by 25% | Increases field service efficiency by 30% |

6. Risk Management and Asset Disposal

In this essential section, we address the critical aspects of risk management and asset disposal for [Your Company Name]. It encompasses a thorough risk analysis in asset management, effective strategies for risk mitigation, and provides comprehensive guidance on asset disposal. This section is vital in equipping [Your Company Name] with the knowledge to navigate risks adeptly and manage asset disposal processes efficiently, ensuring financial stability and compliance.

A. Risk Analysis in Asset Management

Risk analysis in asset management at [Your Company Name] involves identifying and assessing various risks that could impact our asset portfolio. This includes market risks like fluctuations in asset values due to market volatility, operational risks such as asset breakdowns or inefficiencies, and credit risks associated with financing assets. Understanding these risks helps us to anticipate potential challenges and their impacts, such as financial losses or operational disruptions. This comprehensive risk assessment forms the foundation for developing robust risk management strategies, ensuring the resilience and stability of our asset management approach.

Risk Type | Potential Impact | Likelihood | Affected Asset Types | Potential Financial Loss (%) |

|---|---|---|---|---|

Market Risk | Fluctuation in asset value | Moderate | Investments, Real Estate | Up to 20% |

Operational Risk | Asset breakdowns, inefficiencies | High | Machinery, Technology | 10-30% |

Credit Risk | Financing default risks | Low | Leased Assets | 5-15% |

Compliance Risk | Non-compliance penalties | Moderate | All Assets | 5-20% |

Environmental Risk | Damages due to environmental factors | Low | Physical Properties | 10-25% |

B. Risk Mitigation and Management

To effectively mitigate the identified risks, [Your Company Name] employs several strategies. Insurance coverage is procured for critical assets to safeguard against unforeseen losses. Diversification of assets is another key approach, reducing our exposure to market volatility. Additionally, asset hedging techniques are utilized to manage financial risks associated with asset value fluctuations. These strategies collectively strengthen our risk management framework, enhancing our ability to manage risks proactively and maintain financial and operational stability.

Strategy | Risk Type Addressed | Effectiveness | Implementation Cost (%) | Benefit to [Your Company Name] |

|---|---|---|---|---|

Insurance Coverage | All Risks | High | 2-5% of asset value | Protects against unforeseen losses |

Diversification | Market Risk | Moderate | Varies | Reduces impact of market volatility |

Hedging | Financial Risk | High | 1-3% of hedged value | Protects against value fluctuations |

Regular Audits | Compliance Risk | Moderate | 0.5-2% of operational costs | Ensures regulatory compliance |

Environmental Safeguards | Environmental Risk | Moderate | 2-5% of property value | Protects physical assets from environmental damage |

C. Guidance on Asset Disposal

The disposal of assets is a crucial aspect of asset management, with significant implications for our financial statements and tax liabilities. This subsection outlines best practices for disposing of assets, including the appropriate methods for asset write-offs and sales. It covers the procedures for determining when an asset should be disposed of, calculating its residual value, and the financial reporting requirements for disposals. This guidance ensures that [Your Company Name] manages asset disposal processes in a compliant and fiscally responsible manner, minimizing potential financial impacts and maximizing returns from asset sales.

Disposal Method | Asset Type | Residual Value (%) | Tax Implication | Impact on Financial Statements |

|---|---|---|---|---|

Direct Sale | Machinery, Vehicles | 30-50% of initial cost | Capital Gains Tax | Income from sales, loss on disposal |

Write-offs | Obsolete Technology | 0-10% of initial cost | Tax Deduction | Reduction in asset value, expense on P&L |

Trade-ins | Equipment, Vehicles | 20-40% of initial cost | Varies | New asset acquisition, loss/gain on exchange |

Auctions | Excess Inventory | 50-70% of market value | Sales Tax | Revenue generation, inventory reduction |

Recycling/Scrapping | Non-functional Assets | 5-15% of material value | Varies | Minor income, removal of asset from books |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Organize your asset management with Template.net's Accounting Asset Management Journal Template. Providing a professional format for tracking and analyzing, this template is key to informed decision-making. With this template, you position your business at the forefront of asset management excellence. Elevate your asset management capabilities with this organizational tool.