Free Internal Audit Accounting Policies & Procedures Manual

Introduction

Welcome to the comprehensive guide embodied in the Internal Audit Accounting Policies & Procedures Manual. This pivotal resource has been meticulously crafted to serve as the cornerstone for conducting internal audits within your organization, with a laser focus on the scrutinization of accounting policies and procedures. The essence of this manual transcends mere guidance; it is a beacon that ensures your company's financial operations are not just in alignment but are a testament to the highest standards, regulations, and best practices that govern financial reporting.

In the dynamic and often turbulent sea of financial operations, the integrity and accuracy of financial reporting are akin to the lighthouse for navigating ships, providing clarity, direction, and safety. This manual is engineered to be that lighthouse, ensuring that each financial transaction and report is a reflection of unwavering accuracy and unimpeachable integrity. It is an essential tool designed not only to guide your internal audit team through the complexities of financial evaluations but also to instill a culture of transparency, accountability, and excellence in financial reporting.

Scope

This manual is not just a document; it is a mandate for excellence within the internal auditing department of your organization. It prescribes a methodical approach to the examination and evaluation of the entirety of your financial accounting framework, encompassing policies, procedures, and controls. The breadth of this manual's scope is expansive, covering the critical domains of transaction processing, financial reporting, and compliance with the labyrinth of relevant laws and regulations that govern financial practices.

Moreover, this manual delves into the intricate world of financial risk management practices, offering a blueprint for identifying, assessing, and mitigating financial risks. It is a holistic tool designed to ensure that no stone is left unturned in the quest to uphold the highest standards of financial integrity and compliance. Whether it's the minutiae of daily transactions or the overarching strategies of financial reporting, this manual covers the gamut, ensuring that every aspect of your organization's financial operations is under the purview of rigorous internal auditing.

Purpose

Standardization of Internal Audit Processes

The bedrock of any robust financial accounting system lies in its processes and procedures. This manual serves as the standard-bearer for internal audit processes, ensuring a harmonized approach that is both rigorous and methodical. By standardizing these processes, the manual not only facilitates a consistent audit approach across the organization but also ensures that every audit is conducted with precision, depth, and a focus on quality. This standardization is the key to unlocking efficiency and effectiveness in internal audits, providing a clear roadmap for auditors to follow and ensuring that audits are thorough, comprehensive, and aligned with best practices.

Ensuring Compliance

In the complex tapestry of financial operations, compliance is not just a requirement; it is the very fabric that holds everything together. This manual is your compass in navigating the intricate maze of financial regulations and internal controls. It is crafted to ensure that your organization not only meets but exceeds the compliance requirements set forth by regulatory bodies and internal standards. Through detailed guidelines and procedures, the manual empowers auditors to identify areas of non-compliance, recommend corrective actions, and ensure that every aspect of your financial operations is in harmony with legal and regulatory standards.

Risk Identification and Mitigation

The realm of financial accounting is fraught with risks, from operational pitfalls to strategic vulnerabilities. This manual is designed to be your shield, offering robust mechanisms for identifying and assessing potential risks within your financial accounting practices. But identification is just the first step; the manual goes further to provide structured approaches for risk mitigation, ensuring that risks are not just recognized but are effectively addressed and managed. Through proactive risk management strategies, the manual helps safeguard your organization against financial uncertainties, ensuring stability and resilience in your financial operations.

Enhancing Efficiency and Effectiveness

At its core, this manual is a catalyst for enhancing the efficiency and effectiveness of your organization's financial accounting procedures. By providing clear guidelines, standardized processes, and best practices, the manual streamlines audit activities, reducing redundancies and optimizing resource utilization. It fosters an environment where audits are not only thorough but are also conducted with an eye toward continuous improvement. This focus on efficiency and effectiveness not only elevates the quality of audits but also contributes to the overall financial health and performance of the organization.

This Internal Audit Accounting Policies & Procedures Manual is more than just a set of guidelines; it is a comprehensive framework designed to elevate your internal audit process to the highest standards of excellence. By adhering to this manual, your organization can ensure that its financial operations are not only compliant and risk-averse but are also characterized by unparalleled accuracy, integrity, and efficiency.

Procedure Steps

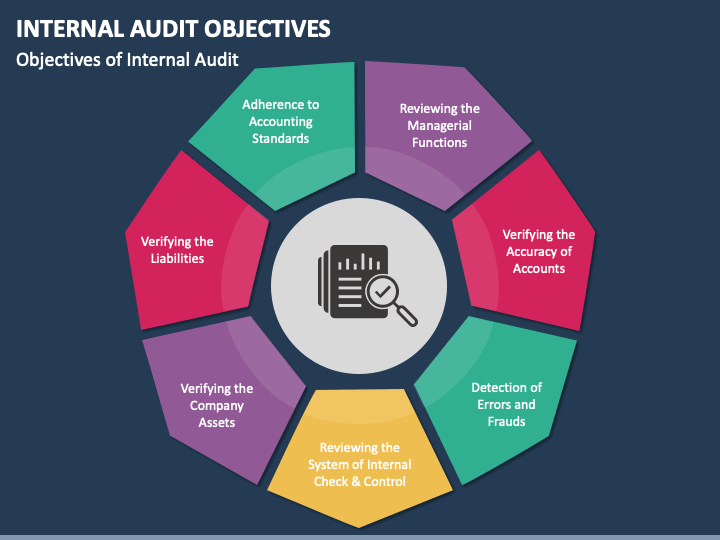

Fig 1: Illustration Example of Internal Audit Procedure

1. Pre-audit Activities

1.1 Planning:

Define Audit Objectives: Clearly outline the goals of the audit, focusing on areas of risk and compliance.

Scope Determination: Specify the boundaries of the audit, including the departments, functions, and processes to be examined.

Timeline and Resources: Establish a realistic timeline and allocate the necessary resources, including the selection of a skilled audit team.

1.2 Preparation:

Team Assembly: Form an audit team with members possessing the requisite knowledge and skills.

Document Review: Obtain and review relevant policy documents, financial records, and previous audit reports.

2. Data Gathering

2.1 Collection of Evidence:

Financial Documents: Gather invoices, receipts, bank statements, ledgers, and financial statements.

Interviews and Observations: Conduct interviews with key personnel and observe processes to gain insights into the practical application of policies and procedures.

2.2 Documentation:

Record Keeping: Maintain detailed and organized records of all collected evidence for reference and review.

3. Audit Execution

3.1 Evaluation:

Policy and Procedure Review: Assess the adequacy, effectiveness, and compliance of financial accounting policies and procedures.

Risk Assessment: Identify any gaps, risks, or areas of non-compliance within the financial framework.

3.2 Documentation of Findings:

Evidence-Based Reporting: Document all findings with clear references to the collected evidence, highlighting areas of concern and instances of non-compliance.

4. Post-audit Activities

4.1 Reporting:

Audit Report: Compile a comprehensive report detailing the audit findings, conclusions, and recommendations for improvement.

4.2 Follow-up:

Management Review: Present the audit findings to the management team and discuss potential corrective actions.

Implementation and Re-evaluation: Work with relevant departments to implement recommended changes and plan for follow-up audits to assess the effectiveness of those changes.

Best Practices

Confidentiality

Confidentiality is the cornerstone of trust and integrity in the internal audit process. Maintaining the highest level of confidentiality ensures that sensitive information is protected, which is crucial in fostering a secure and trusting environment within the organization. This practice involves several key actions:

Secure Handling of Information: Implement stringent measures to safeguard all audit-related information, employing encryption for digital files and secure storage for physical documents.

Confidentiality Agreements: Ensure that all members of the audit team, including external consultants if any, sign confidentiality agreements that bind them to discretion regarding the audit details and findings.

Need-to-Know Basis: Limit access to sensitive information strictly to individuals whose roles necessitate it, thereby minimizing the risk of information leakage.

Training and Awareness: Regularly conduct training sessions to reinforce the importance of confidentiality and to update the team on best practices in information security.

Detailed Documentation

The foundation of a credible audit lies in its documentation. Meticulous documentation not only provides a clear audit trail but also supports the audit's conclusions and recommendations. This entails:

Comprehensive Record-Keeping: Document every step of the audit process, from planning and execution to the final reporting, ensuring that all decisions, methodologies, and findings are thoroughly recorded.

Evidence Collection: Maintain a systematic approach to collecting and organizing evidence, ensuring that all documentation is accurate, relevant, and verifiable.

Standardized Templates: Utilize standardized templates for recording findings and recommendations to ensure consistency and completeness across different audits.

Digital Archiving: Leverage digital tools for archiving documents, which enhances accessibility and retrieval while ensuring long-term preservation.

Clear Communication

Effective communication is imperative to the success of the audit process, ensuring that all stakeholders have a clear understanding of the audit's scope, objectives, findings, and recommendations. This involves several strategies:

Stakeholder Engagement: Engage with stakeholders at the onset of the audit to align expectations and to understand their perspectives and concerns.

Regular Updates: Provide regular updates to keep relevant parties informed about the audit's progress and any preliminary findings.

Feedback Mechanisms: Establish channels for receiving feedback from various departments, allowing for a two-way communication flow that can provide valuable insights and foster cooperation.

Transparent Reporting: Ensure that the audit report is clear, concise, and free of technical jargon, making it accessible to all stakeholders, thereby facilitating informed decision-making.

Continuous Improvement

Viewing the audit process through the lens of continuous improvement fosters a culture of excellence and adaptation. This perspective encourages not only the identification of issues and risks but also the proactive pursuit of opportunities for enhancement. This can be achieved through:

Benchmarking: Regularly compare your audit practices and findings against industry standards and best practices to identify areas for improvement.

Lessons Learned: After each audit cycle, conduct a review session to discuss what went well and what could be improved, turning each audit into a learning opportunity.

Innovation: Stay abreast of advancements in audit methodologies and technologies, and be open to adopting innovative practices that can enhance the audit process.

Risk Management: Integrate risk management into the audit process, identifying not just current but also emerging risks, and recommending strategies to mitigate them.

Conclusion

The Internal Audit Accounting Policies & Procedures Manual is not just a document; it is a dynamic blueprint for conducting audits that are not only effective and efficient but also aligned with the highest standards of integrity and professionalism. By adhering to the outlined procedures and embracing the best practices of confidentiality, detailed documentation, clear communication, and continuous improvement, the internal audit team is empowered to conduct audits that truly make a difference.

This manual ensures that the audit process is not seen as a mere compliance exercise but as a vital component of the organization's governance framework, contributing significantly to its financial health and stability. Through rigorous audits, the team can ensure compliance with relevant standards and regulations, identify and mitigate potential risks, and uncover opportunities for enhancing the efficiency and effectiveness of financial accounting practices.

Ultimately, the value of the internal audit function, as guided by this manual, extends beyond the audit reports it generates. It lies in the assurance it provides to management, the board, and stakeholders that the organization's financial operations are underpinned by a robust framework of policies and procedures. It reassures them that the organization is not only capable of navigating the complexities of today's financial landscape but is also poised for future growth and success, grounded in a culture of transparency, accountability, and continuous improvement.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net offers an Internal Audit Accounting Policies & Procedures Manual Template that's fully editable and customizable in our AI editor tool. This comprehensive template streamlines your internal audit processes, ensuring compliance and accuracy. Tailor it to your company's needs effortlessly. Simplify policy documentation with our user-friendly, AI-powered solution for efficient financial management.