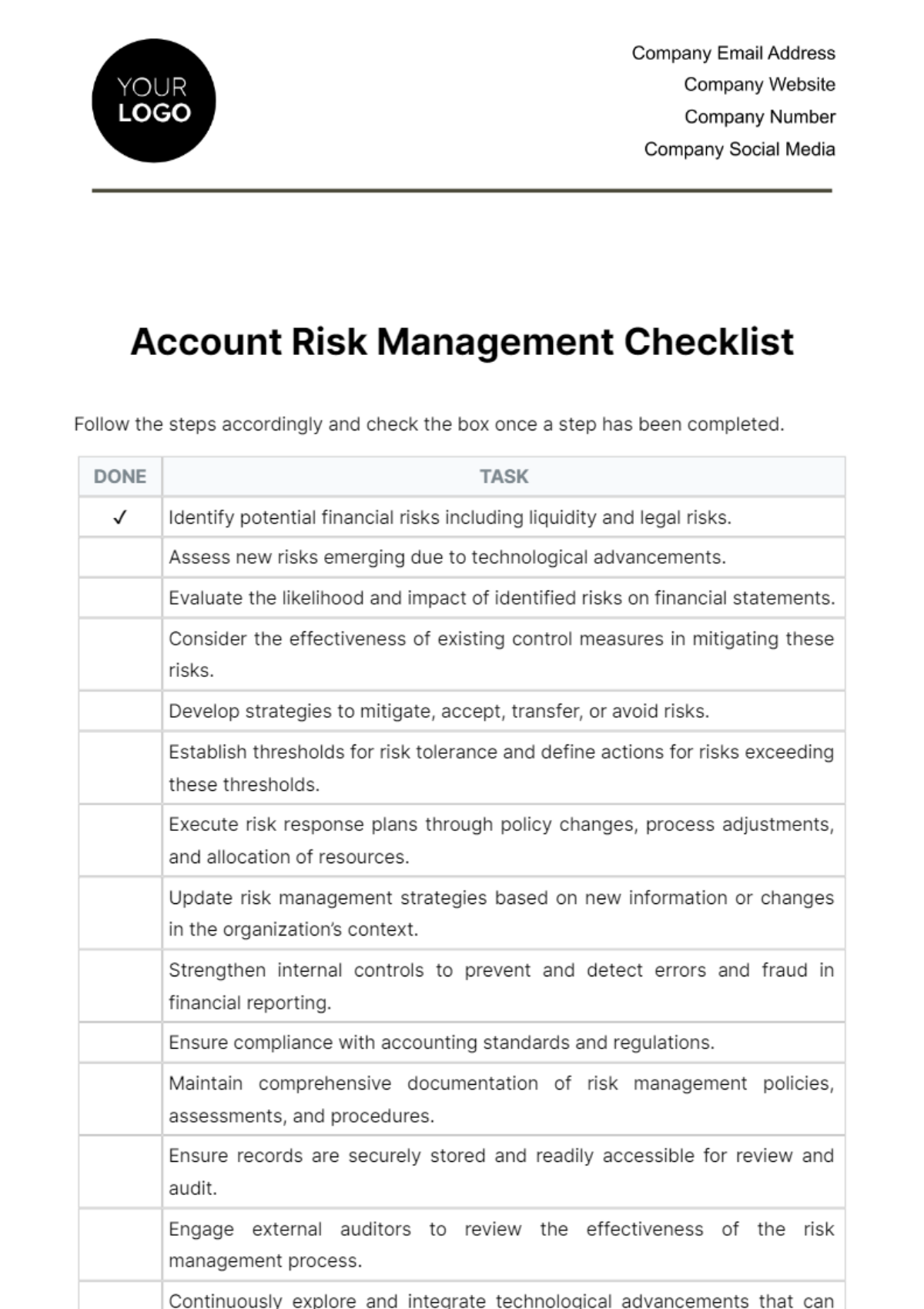

Free Account Risk Management Checklist

Follow the steps accordingly and check the box once a step has been completed.

DONE | TASK |

|---|---|

✔ | Identify potential financial risks including liquidity and legal risks. |

Assess new risks emerging due to technological advancements. | |

Evaluate the likelihood and impact of identified risks on financial statements. | |

Consider the effectiveness of existing control measures in mitigating these risks. | |

Develop strategies to mitigate, accept, transfer, or avoid risks. | |

Establish thresholds for risk tolerance and define actions for risks exceeding these thresholds. | |

Execute risk response plans through policy changes, process adjustments, and allocation of resources. | |

Update risk management strategies based on new information or changes in the organization’s context. | |

Strengthen internal controls to prevent and detect errors and fraud in financial reporting. | |

Ensure compliance with accounting standards and regulations. | |

Maintain comprehensive documentation of risk management policies, assessments, and procedures. | |

Ensure records are securely stored and readily accessible for review and audit. | |

Engage external auditors to review the effectiveness of the risk management process. | |

Continuously explore and integrate technological advancements that can enhance risk detection and management capabilities. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Safeguard your business finances with Template.net's Account Risk Management Checklist Template. This customizable resource is editable in our Ai Editor Tool, ensuring an easy-to-use experience. Its practical design lets users amend specific details to align with their business needs. Keep your accounts guarded and organized with this highly editable and precise tool from Template.net.

You may also like

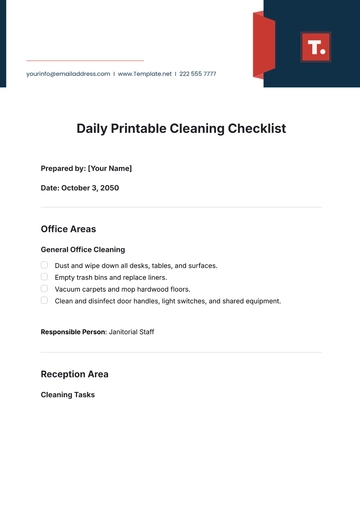

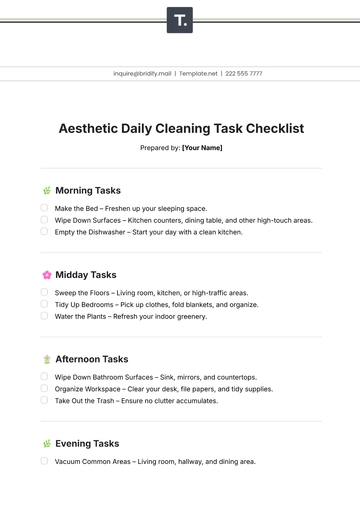

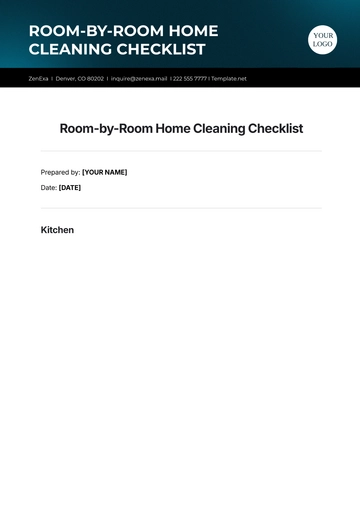

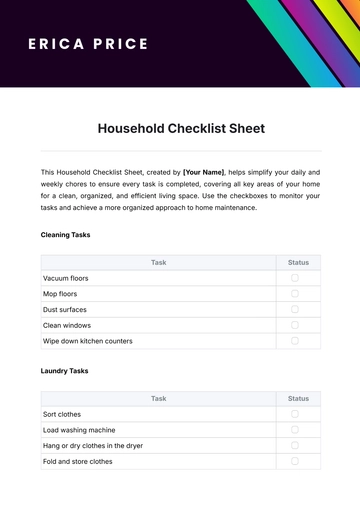

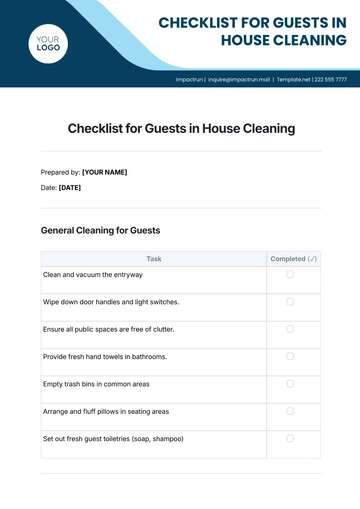

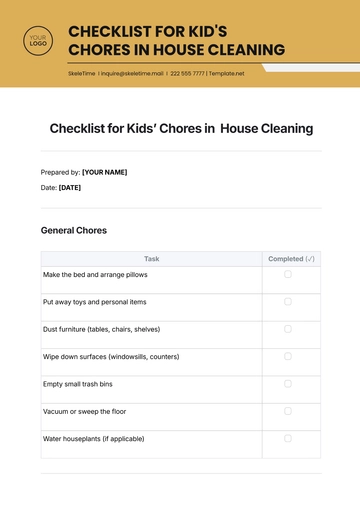

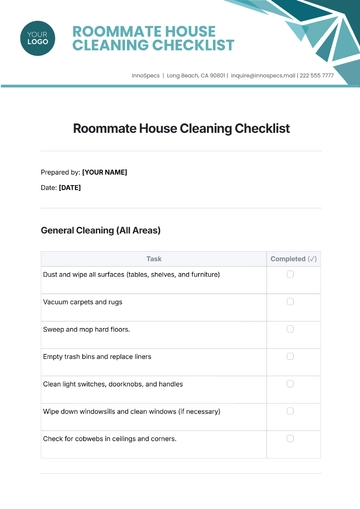

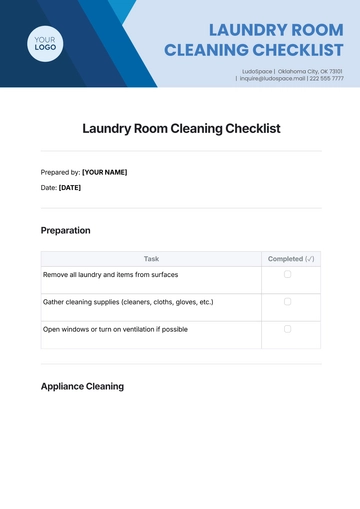

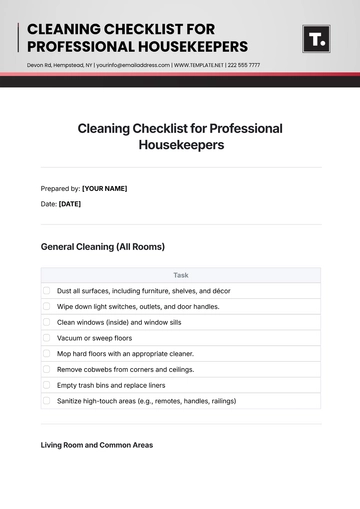

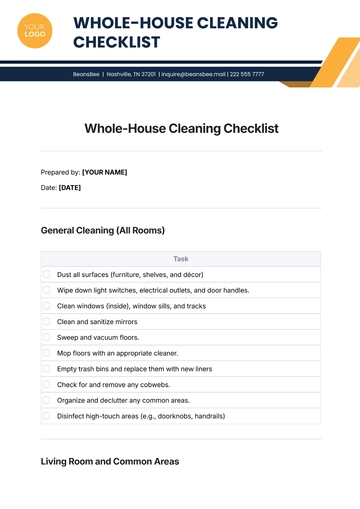

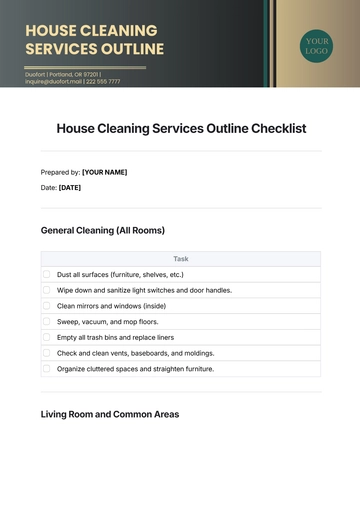

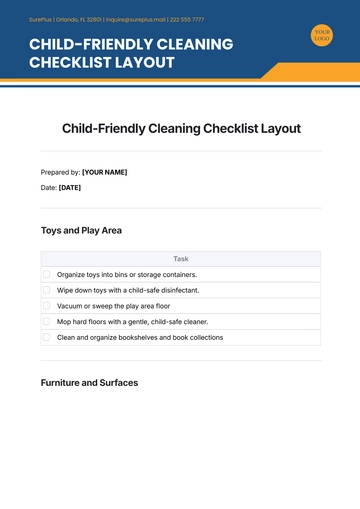

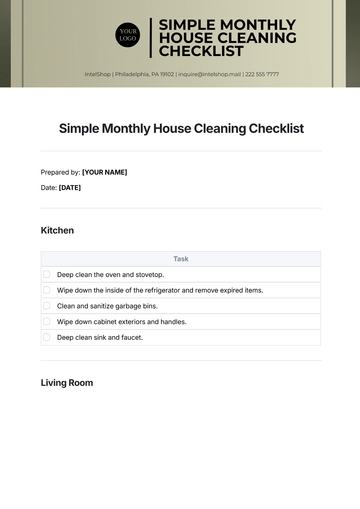

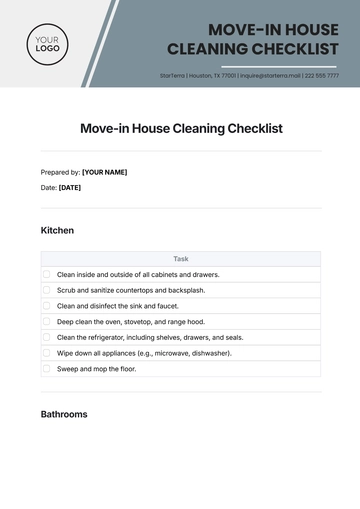

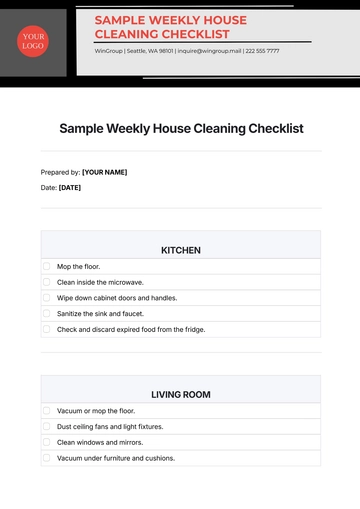

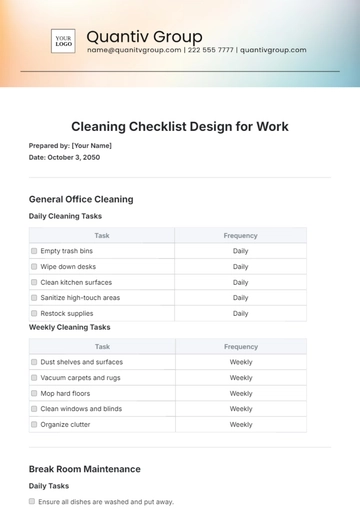

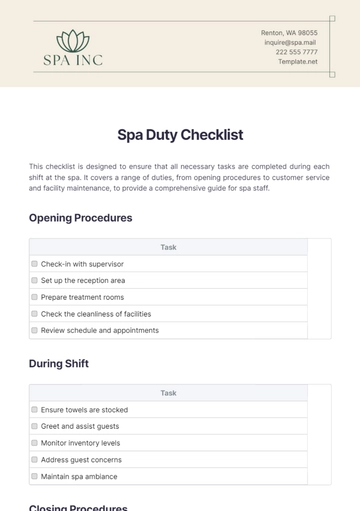

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

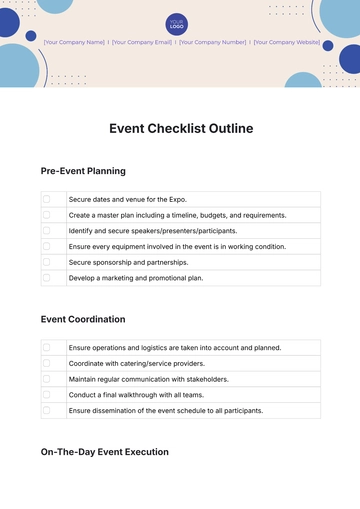

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

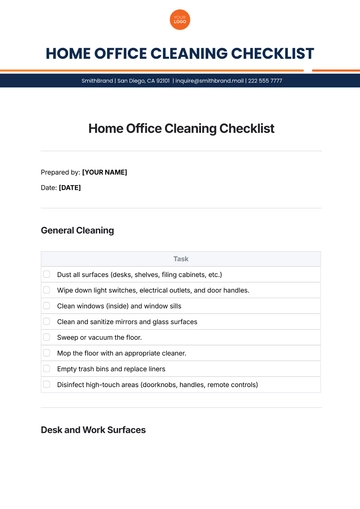

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist