Free Startup Capital Raising Guide

Introduction

This guide is thoughtfully designed to assist entrepreneurs in effectively navigating the complex process of raising capital for their startups. It offers a step-by-step framework intended to simplify the journey, providing straightforward guidance that you can follow with confidence.

About Capital Raising

Raising capital is a fundamental step for the success of any startup. It involves obtaining the necessary funding to cover the startup's initial costs and ongoing expenses until the business becomes self-sustaining. Securing this funding is a significant challenge for many entrepreneurs. It requires a clear understanding of the business's vision and a well-structured plan to present to potential investors.

This plan should clearly explain the business idea, how it will generate profit, and why it is a worthwhile investment, using simple and clear terms to convey the potential for long-term success.

Getting Started

Before embarking on a capital raising journey, thorough preparation is crucial to pave the way for success. Below are key steps to undertake:

Define Your Vision: Crafting a clear and inspiring vision for your company is the foundational step in this process. Your vision not only sets the direction for your business's future growth but also acts as a beacon for attracting investors. It should succinctly convey the essence of what your company stands for and its aspirations, helping to create a strong emotional and logical appeal to potential backers.

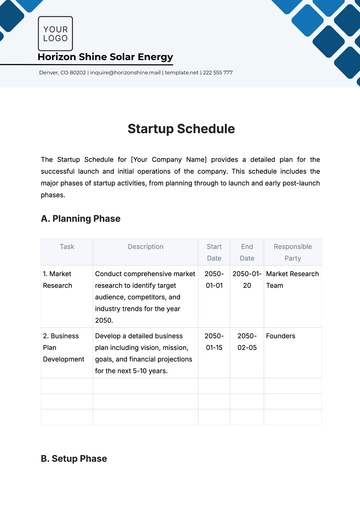

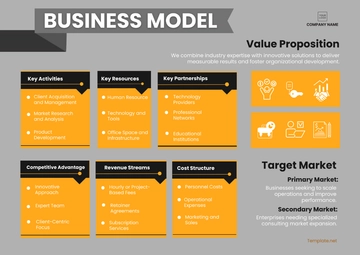

Create a Robust Business Plan: A detailed and well-constructed business plan is indispensable. This document should encompass an in-depth analysis of the market, a clear outline of your business model, detailed operational strategies, realistic financial projections, and an explanation of your product or service's unique value. A convincing business plan reassures investors of your company's potential for profitability and your competence in navigating business challenges.

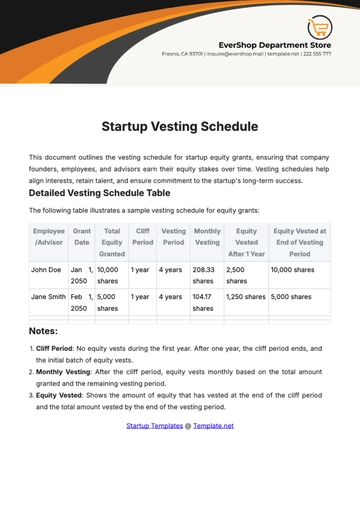

Identify Potential Investors: Carefully selecting suitable investors is crucial for your capital raising efforts. Consider a broad spectrum of sources, including personal contacts like family and friends, angel investors who specialize in early-stage startups, venture capitalists looking for scalable and high-growth opportunities, and traditional financial institutions offering business loans. Understanding the preferences and investment strategies of each type of investor will enable you to tailor your pitch to meet their specific interests and increase your chances of securing funding.

Successfully initiating a capital raising campaign hinges on a clear vision, a robust business plan, and identifying the right investors. By meticulously preparing each of these components, you position your startup not just to attract investment but to form strategic partnerships that foster long-term growth and success. Remember, the goal is not only to secure funding but also to build a foundation for a sustainable and thriving business.

Step-by-Step Instruction

Following the initial preparations, you are poised to embark on the detailed capital-raising journey, delineated as follows:

1. Determine Your Capital Requirements

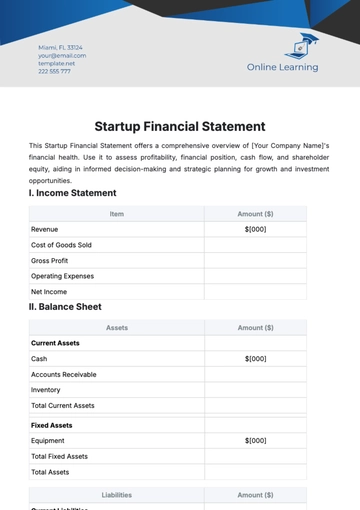

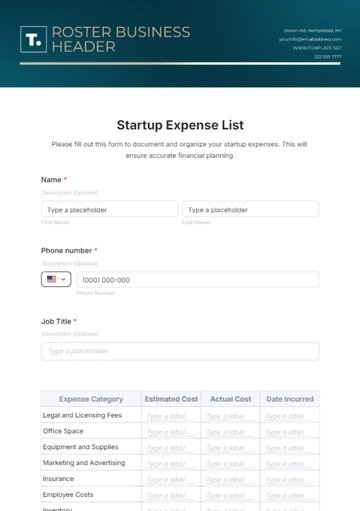

Firstly, assess and quantify the amount of funding your startup necessitates and elucidate on its allocation. This critical step involves a thorough analysis of your financial needs, including operational costs, product development, marketing, and any other expenses that will enable your business to grow. A clear understanding of your financial requirements not only strengthens your position but also assures potential investors of your strategic planning and financial acumen.

2. Conduct a Company Valuation

Accurately valuing your company is a cornerstone of the capital raising journey. A comprehensive and realistic valuation underpins negotiations with potential investors by offering a quantifiable gauge of your business's financial worth. This valuation is pivotal, as it influences the equity you offer in exchange for funding. It should encapsulate a holistic view of your enterprise, considering not only its present financial health but also its future growth prospects, market positioning, and the risks involved.

A company valuation is influenced by several factors, each contributing to the overall assessment of your business's worth. Here is a simplified table that outlines key components of a company valuation:

Component | Description |

|---|---|

Financial Performance | Analysis of historical revenue, profit margins, cash flow, and other financial metrics. |

Growth Potential | Evaluation of the company's future growth prospects based on market size, trends, and strategies. |

Market Position | Assessment of the company's competitive position within the industry and its market share. |

Intellectual Property | Consideration of proprietary technologies, patents, trademarks, and brand value. |

Operational Capabilities | Review of the company's infrastructure, team, processes, and technological assets. |

Risks and Liabilities | Analysis of potential risks, including market competition, regulatory challenges, and liabilities. |

Employing a multi-faceted approach to valuation, incorporating these components, allows for a more nuanced and accurate valuation. This process often involves several valuation methods, such as:

Discounted Cash Flow (DCF) Analysis: Projects the company's future cash flows and discounts them back to their present value, accounting for the time value of money.

Comparing Analysis: Compares the company with similar businesses in the industry based on key financial ratios and metrics.

Asset-Based Valuation: Focuses on the company's net asset value, considering its total assets minus its liabilities.

Each of these methods can provide different perspectives on the value of your company, and a combination may be used to arrive at a well-rounded valuation. Engaging with a valuation expert can help you navigate these methodologies, ensuring that your valuation reflects both the tangible and intangible assets of your business. This careful and informed approach to valuation not only aids in negotiations with investors but also enhances your understanding of your business's true worth, setting a firm foundation for growth and investment discussions.

3. Pitch to Potential Investors

With your valuation in hand, it’s time to pitch your business idea to potential investors. This step is about storytelling as much as it is about numbers. Your pitch should vividly articulate your company vision, business model, market opportunity, competitive advantage, and how the investment will be utilized. The goal is to captivate your audience, making your business an irresistible investment opportunity. It's crucial to adapt your pitch to suit the interests and investment focus of each potential investor to maximize its impact.

4. Negotiate and Finalize the Agreement

The negotiation phase is pivotal in the capital-raising process, setting the stage for a deal that aligns with both the startup's and the investors' expectations. It is vital to enter negotiations with a mindset of flexibility and openness, armed with a well-defined understanding of your startup's bottom-line terms. Engaging in transparent and forthright discussions can pave the way to an agreement that benefits all parties involved.

Enlisting the aid of legal counsel is not just beneficial but essential. A seasoned attorney can ensure that the terms of the agreement safeguard your interests and foster your business's long-term objectives. Achieving a comprehensive grasp of the agreement's specifics, including equity distribution and any contingent stipulations, is imperative before finalizing the deal. To facilitate a clearer understanding, here is a table outlining key components to consider during the negotiation and agreement finalization process:

Component | Description |

|---|---|

Equity Offered | The percentage of equity being offered to investors in exchange for capital. |

Valuation | The pre-money valuation of the startup, affecting how much equity is given away. |

Investment Amount | The total amount of capital the investor will provide. |

Use of Funds | Specific allocations of the investment, such as product development, marketing, or expansion efforts. |

Milestones & Triggers | Agreed-upon business milestones or events that might trigger additional funding, equity adjustments, or other conditions. |

Rights & Protections | Investor rights such as voting rights, anti-dilution protections, and rights of first refusal. |

Exit Strategy | Potential strategies for investors to liquidate their stake, including IPO, acquisition, or buyback scenarios. |

Legal and Compliance | Any legal and regulatory compliance issues relevant to the investment and the business operations. |

Embarking on the capital raising process is a significant undertaking that requires detailed preparation, strategic financial planning, and adept negotiation skills. By methodically following these steps, you enhance your chances of securing the necessary funding and establishing a solid foundation for your business's future growth and success. Remember, the quality of your preparations and the clarity of your vision can significantly influence the outcome of your capital raising efforts.

Sustaining Investor Relationships

After successfully securing capital, the journey with your investors does not end; it evolves into a new phase of sustaining and nurturing these relationships. This ongoing engagement is crucial for future rounds of funding and the overall success of your startup. Here are strategies to maintain positive and productive relationships with your investors:

Regular Updates and Communication: Keep your investors informed about your company's progress, challenges, and milestones through regular updates. Transparent communication builds trust and keeps investors engaged with your journey.

Seek and Value Investor Feedback: Your investors are more than just a source of capital; they can be a wealth of knowledge, experience, and networks. Actively seek their feedback and consider their advice in decision-making processes. This not only helps in refining your strategy but also shows investors that their input is valued.

Involve Investors in Strategic Discussions: When appropriate, involve your investors in significant business decisions or strategic discussions. This inclusion can provide you with valuable insights and affirms their role as partners in your business's growth.

Deliver on Your Promises: The foundation of a strong investor relationship is built on meeting or exceeding the expectations set during the fundraising process. Work diligently to achieve the goals and milestones you have communicated to your investors.

Plan for the Future Together: Engage your investors in discussions about the future direction of the company and potential follow-on investment rounds. Planning for the future together can align your visions and ensure continued support.

Host Investor Meetings or Events: Organize periodic meetings or events where you can present your progress, celebrate achievements, and discuss future plans. These gatherings provide a platform for personal interaction, strengthening your relationship with investors.

By implementing these strategies, you can cultivate a strong, supportive network of investors who are genuinely invested in your startup's success. Remember, the relationships you build with your investors can be one of your most valuable assets, providing not just financial support but also strategic advice, mentorship, and access to broader networks. Maintaining these relationships with care and professionalism will serve your startup well, not only in its current phase but also as it grows and evolves in the future.

Troubleshooting and FAQs

This section aims to address common concerns and provide practical solutions to frequently encountered obstacles. Our goal is to equip you with the knowledge and strategies needed to overcome these hurdles, enhancing your ability to secure funding successfully.

How can [Your Company Name] assist in the process of raising startup capital? |

|---|

[Your Company Name] offers a comprehensive suite of services designed to support startups in their quest to secure capital. Our expertise includes crafting compelling business plans that highlight your startup's potential for success, refining your pitch to ensure it resonates with investors, and providing access to our extensive network of potential investors. We specialize in identifying and articulating the unique strengths of your business, thereby improving your chances of attracting investment. Our team works closely with you to navigate the fundraising process, offering personalized advice and strategic insights that leverage your company's strengths. Through our support, startups can enhance their visibility, appeal, and readiness to engage with investors, significantly improving their prospects for securing the necessary capital to grow. |

What should I do if no one seems interested in investing in my startup? |

|---|

Encountering difficulties in attracting investors is not uncommon and can often be an opportunity for refinement and growth. If you find that investors are not showing interest in your venture, the first step is to critically review and enhance your pitch and business plan. Ensure that your presentation clearly articulates your value proposition, market potential, and competitive advantage. Sometimes, even slight adjustments in your approach or strategy can significantly impact investor perceptions. Additionally, consider seeking feedback from mentors, industry experts, or even the investors who passed on the opportunity. This feedback can provide invaluable insights into areas for improvement. Persistence and resilience are crucial; many successful companies faced initial rejections before securing the right investment. |

What are the most effective ways to network with potential investors? |

|---|

Effective networking is essential in connecting with potential investors. Start by attending industry conferences, workshops, and networking events where you can meet investors who have an interest in your sector. Utilize online platforms such as LinkedIn to connect with investors directly and participate in industry-specific forums and discussions. Engaging with local entrepreneur groups and startup incubators can also provide valuable networking opportunities. Remember, the key to effective networking is not just to meet investors but to build meaningful relationships by demonstrating the value and potential of your startup. |

How important is the timing of seeking investment? |

|---|

Timing can significantly impact the success of your capital-raising efforts. Ideally, seek investment when your startup can showcase a proven concept, initial traction, or other indicators of potential success. This evidence not only strengthens your position but also reduces the perceived risk for investors. Avoid seeking investment too early, before you have a clear value proposition or too late, when the company might be facing financial difficulties. Aligning your fundraising efforts with milestones achieved can provide a compelling narrative for why your startup is an attractive investment opportunity at that time. |

By addressing these frequently asked questions and employing strategic approaches to common challenges, we aim to demystify the process and empower entrepreneurs. Remember, resilience, strategic networking, and a compelling presentation of your business's value are your best tools on this journey.

[Your Company Name] is here to support you at every step, ensuring that you have the resources, knowledge, and network to turn your vision into reality. Together, we can navigate the complexities of raising startup capital and lay the foundation for a successful and sustainable business.

Conclusion

In closing, let us highlight several crucial insights and final pieces of advice to enhance your capital-raising efforts:

Transparency Is Key: Always maintain an open and honest dialogue with potential investors regarding both the opportunities and risks associated with your startup. This level of transparency fosters trust and credibility, laying the groundwork for a solid partnership.

Maintain Rigorous Financial Documentation: Keeping accurate and detailed records of all financial transactions is essential. This practice not only simplifies financial management and reporting but also assures investors of your commitment to accountability and fiscal responsibility.

Seek Expert Advice When Necessary: Navigating the capital raising process can be complex and, at times, overwhelming. Do not hesitate to seek professional guidance. Consulting with experts who can offer strategic advice and practical support will enhance your chances of success and can mitigate potential challenges.

Partner with [Your Company Name] for Expert Support: At [Your Company Name], our team of seasoned professionals is dedicated to guiding startups through the capital raising journey with expertise and ease. Our experience in business planning, investor networking, and strategic advisory positions us as an ideal partner to support your venture. Working with us ensures you have access to the knowledge, tools, and networks necessary to secure funding efficiently and effectively.

By incorporating these strategies into your approach, you equip your startup with a stronger foundation for engaging with investors and securing the capital necessary for growth. Remember, the path to successful capital raising is paved with persistence, preparation, and the right partnerships. [Your Company Name] is committed to being part of your journey, providing the support and guidance needed to achieve your financial and business objectives.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Navigate the capital raising process with confidence using the Startup Capital Raising Guide Template from Template.net. This editable and customizable template offers step-by-step advice on engaging potential investors, structuring deals, and negotiating terms. Adapt the guide to fit your startup's unique capital requirements with our Ai Editor Tool, ensuring a successful fundraising effort.

You may also like

- Startup Agreement

- Non Profit

- Transport and Logistics

- Education

- IT Services and Consulting

- Startup Presentation

- Startup Business Plan

- Startup Proposal

- Startup Plan

- Startup Brochure

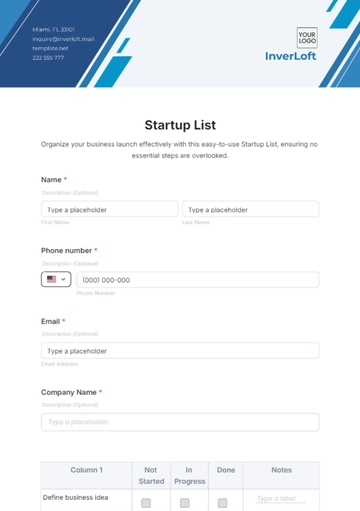

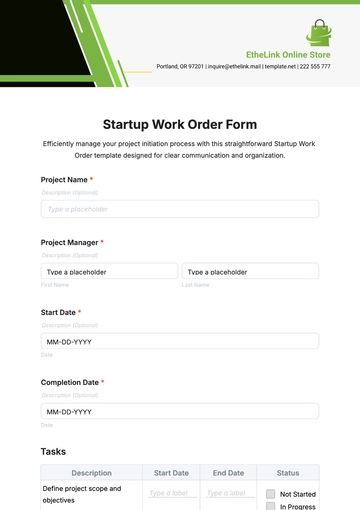

- Startup Form

- Startup Flyer

- Startup Checklist

- Startup Budget

- Startup Poster

- Startup Contract

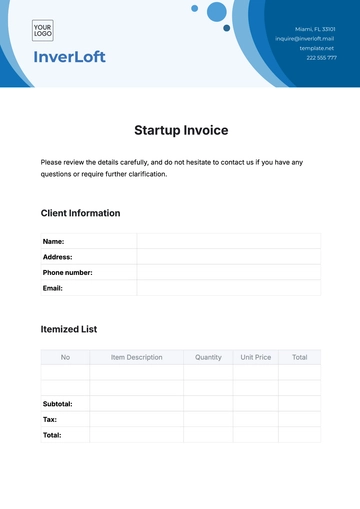

- Startup Invoice

- Startup Letterhead

- Startup Quotes