Free Startup Angel Investor Pitch Program Plan

Introduction

The Startup Angel Investor Pitch Program is an initiative aimed at bridging the gap between promising startups and angel investors. This program is designed to provide startups with the necessary skills, resources, and connections to successfully pitch their business ideas and secure funding from angel investors. By facilitating meaningful interactions between startups and investors, the program aims to fuel innovation and drive economic growth.

Program Goals

Secure funding for [10] startups within [6] months.

Facilitate networking between startups and [20] angel investors.

Provide mentorship and guidance to startups to enhance their pitch presentation skills and business acumen.

Program Structure

Duration: [6] months.

Frequency of sessions: Bi-weekly workshops and monthly pitch events.

Format: Workshops covering pitch training, financial modeling, legal aspects, etc. Pitch events featuring startup presentations followed by investor feedback sessions. One-on-one mentoring sessions as needed.

Networking events: Monthly networking mixers to foster connections between startups and investors.

Participant Criteria

A. Startups:

Early-stage or seed-stage startups with scalable business models.

Industry agnostic, but preference given to technology-driven ventures.

Must have a minimum viable product (MVP) or prototype.

B. Angel Investors:

Individuals with a net worth exceeding [$1 million] or annual income over [$200,000].

Experience in entrepreneurship or specific industries.

Willingness to provide mentorship and support to startups beyond funding.

Program Content

Pitch training: Crafting compelling pitch decks, refining presentation skills, and storytelling techniques.

Investor expectations: Understanding investor criteria, valuation methodologies, and negotiation tactics.

Financial modeling: Creating financial projections, understanding key metrics, and valuation methodologies.

Legal aspects: Fundraising regulations, term sheet negotiations, and intellectual property protection.

Team building: Recruiting and retaining talent, building advisory boards, and fostering a culture of innovation.

Market analysis: Conducting market research, identifying target markets, and analyzing competitors.

Pitch practice: Mock pitch sessions with feedback from mentors and peers.

Mentorship and Support

Matching startups with experienced mentors and advisors based on industry and specific needs.

Providing ongoing support through regular check-ins, office hours, and virtual communication channels.

Encouraging peer-to-peer learning through networking events and community forums.

Pitch Events

Quarterly pitch events featuring [5] startups presenting to a panel of angel investors.

Feedback sessions immediately following each pitch event to provide constructive criticism and actionable advice.

Opportunities for investors to express interest in participating startups and schedule follow-up meetings.

Networking Opportunities

Monthly networking mixers bringing together startups, investors, and industry experts.

Online networking platform for participants to connect, share resources, and collaborate.

Introductions facilitated by program coordinators based on mutual interests and objectives.

Evaluation and Selection Process

Evaluation criteria include the scalability of the business idea, the strength of the team, market potential, and alignment with investor preferences.

Selection committee comprising experienced investors, industry experts, and program coordinators.

Transparent selection process with clear communication of criteria and expectations to applicants.

Program Promotion

Marketing campaign targeting startup communities, incubators, and accelerators.

Social media outreach, email newsletters, and partnerships with relevant organizations.

Information sessions and webinars to educate potential participants about the program and its benefits.

Budget and Resources

Budget allocation for venue rental, catering, marketing materials, and guest speakers.

Seeking sponsorships from corporate partners, venture capital firms, and local government agencies.

Leveraging existing resources within [Your Company Name] for program logistics and administration.

Timeline

Program launch: | [March 1, 2050] |

Application deadline: | [April 15, 2050] |

Pitch events: | Quarterly starting [May 1, 2050] |

Program conclusion: | [August 31, 2050] |

Monitoring and Evaluation

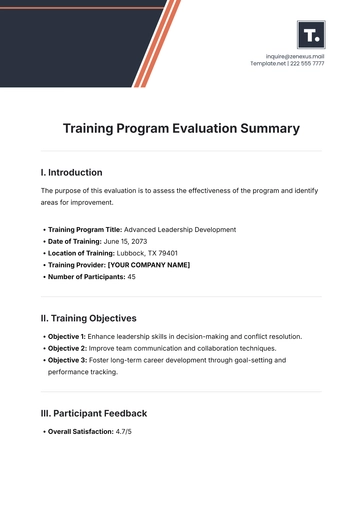

Regular progress reports tracking key performance indicators such as funding raised, investor engagement, and participant satisfaction.

Feedback surveys distributed to participants, mentors, and investors to assess program effectiveness and identify areas for improvement.

Iterative approach to program management, with adjustments made based on feedback and evaluation results.

Sustainability and Follow-up

Alumni network established to facilitate ongoing collaboration and support among program participants.

Continued access to mentorship and resources beyond the program duration.

Opportunities for follow-up funding rounds or introductions to additional investors as startups progress.

Conclusion

The Startup Angel Investor Pitch Program is poised to make a significant impact on the startup ecosystem by connecting entrepreneurs with the resources and support they need to succeed. With a structured curriculum, experienced mentors, and opportunities for networking and funding, the program sets the stage for innovation and growth. We invite all aspiring entrepreneurs and angel investors to join us on this journey of discovery and opportunity.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Startup Angel Investor Pitch Program Plan Template on Template.net, your premier destination for top-quality business resources. This comprehensive template is fully editable and customizable, empowering startups to craft compelling pitches tailored to angel investors. Utilize our user-friendly Ai Editor Tool to refine your plan and captivate potential investors. Elevate your pitch and secure crucial funding for your startup's growth.