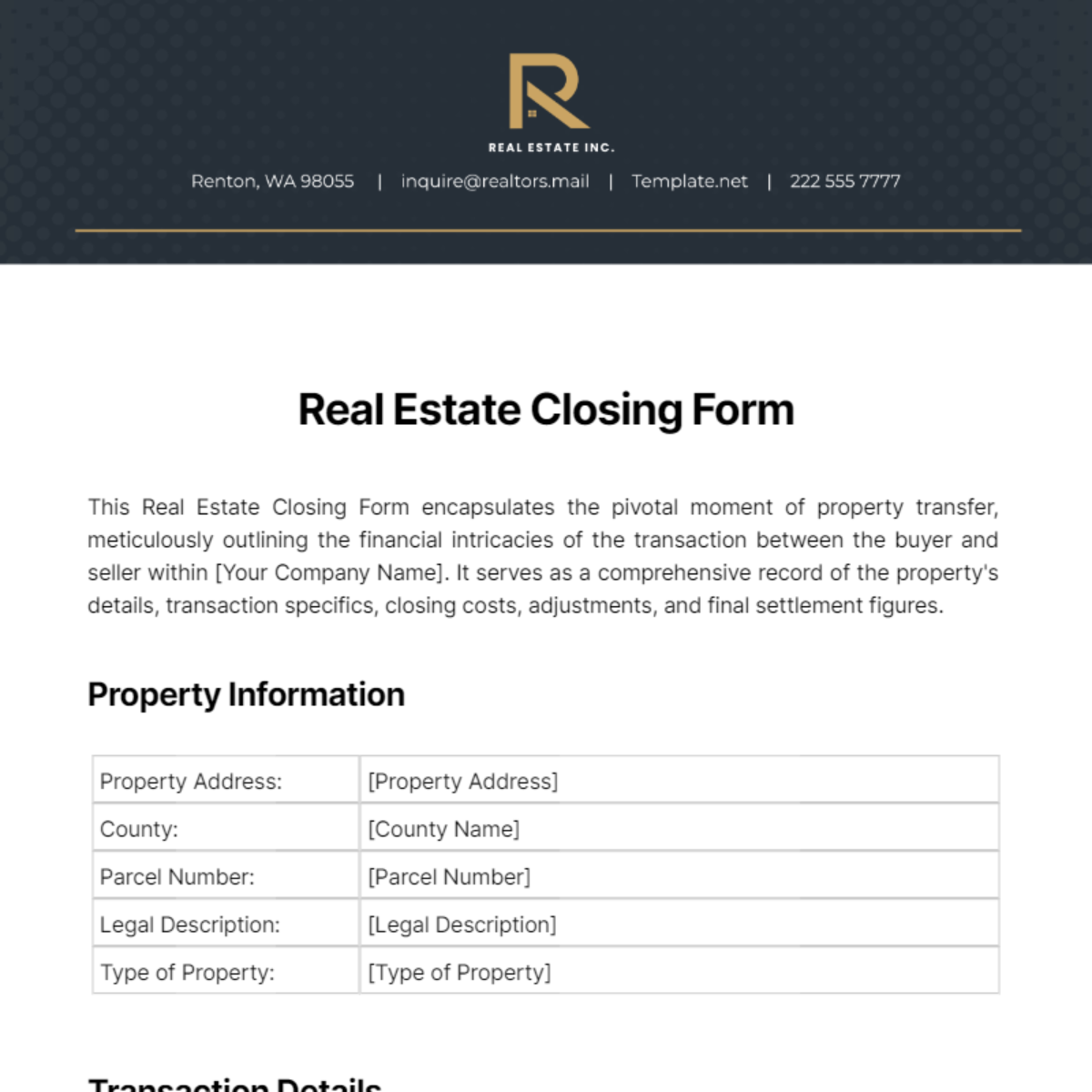

Free Real Estate Closing Form

This Real Estate Closing Form encapsulates the pivotal moment of property transfer, meticulously outlining the financial intricacies of the transaction between the buyer and seller within [Your Company Name]. It serves as a comprehensive record of the property's details, transaction specifics, closing costs, adjustments, and final settlement figures.

Property Information

Property Address: | [Property Address] |

County: | [County Name] |

Parcel Number: | [Parcel Number] |

Legal Description: | [Legal Description] |

Type of Property: | [Type of Property] |

Transaction Details

Purchase Price: | $250,000 |

Earnest Money Deposit: | $5,000 |

Loan Amount: | $200,000 |

Down Payment: | $50,000 |

Closing Date: | March 31, 2024 |

Closing Costs

Item | Buyer's Cost | Seller's Cost |

|---|---|---|

Title Insurance | $1,200 | $800 |

Recording Fees | $300 | $200 |

Inspection Fees | $350 | $0 |

Appraisal Fees | $500 | $0 |

Attorney Fees | $1,000 | $1,200 |

Property Taxes | $1,500 | $0 |

Prorated HOA Fees | $200 | $0 |

Other Fees | $300 | $150 |

Total Closing Costs | $5,350 | $2,350 |

Credits and Adjustments

Item | Buyer's Adjustment | Seller's Adjustment |

|---|---|---|

Prorated Property Taxes | $300 | $0 |

Home Warranty Contribution | $500 | $0 |

Repairs/Improvements | $0 | $1,000 |

Other Adjustments | $100 | $0 |

Total Adjustments | $900 | $1,000 |

Final Transaction Details

Total Funds Due at Closing: | $4,450 |

Total Funds Due to Seller: | $1,350 |

Cash to Close (or from Seller): | $3,100 |

Total Net Proceeds to Seller: | $1,350 |

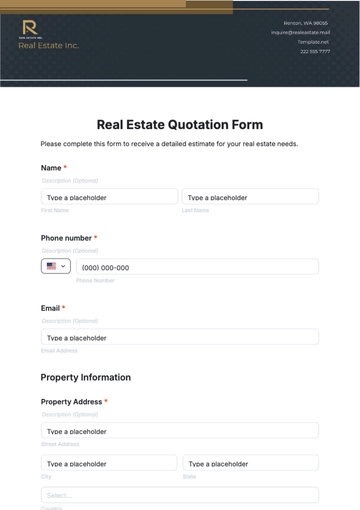

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure smooth real estate transactions with Template.net's Closing Form Template. Editable in our AI Editor Tool, this customizable template streamlines the final steps of property sales, facilitating accurate documentation and efficient communication between all parties involved. Elevate your closing process and enhance client satisfaction with this user-friendly from Template.net!