Free Auditing Summary Notes

Organization: [CLIENT NAME]

Audit Period: [AUDIT PERIOD]

Lead Auditor: [LEAD AUDITOR]

Audit Team Members: [AUDIT TEAM MEMBERS]

Introduction:

This report presents the findings of the audit conducted at [CLIENT NAME] during the period [AUDIT PERIOD]. The primary objective of this audit was to evaluate the organization's compliance with regulatory requirements and internal policies, with a focus on financial processes and controls. The audit team, led by [LEAD AUDITOR], conducted a thorough examination of key operational areas to identify risks and opportunities for improvement.

Audit Scope:

The audit scope encompassed [PROCESSES OR AREAS COVERED] within [CLIENT NAME], ensuring comprehensive coverage of key operational functions. All relevant departments and stakeholders were included in the scope to provide a holistic view of the organization's operations. The audit also considered recent changes or developments that may impact audit findings and conclusions, ensuring relevance and accuracy.

Key Risks Identified:

During the audit, several key risks were identified, including [EXAMPLES OF SIGNIFICANT RISKS IDENTIFIED]. These risks were assessed based on their potential impact on organizational objectives and financial integrity. Risk assessments were conducted using both qualitative and quantitative methods to prioritize risk mitigation efforts effectively. The identification of key risks provided valuable insights into areas requiring enhanced controls and oversight.

Control Assessments:

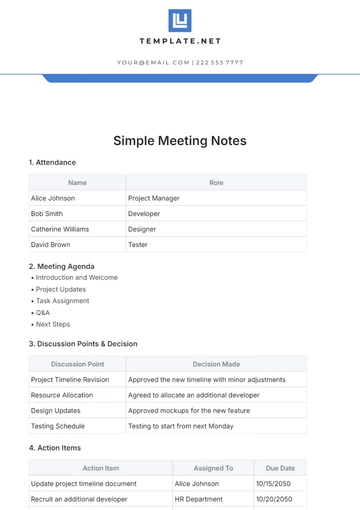

Control Aspect | Assessment | Findings |

|---|---|---|

Access Controls | Strengths | Access controls were generally well-defined and enforced, with limited instances of unauthorized access detected. |

Weaknesses | Some areas lacked proper segregation of duties, increasing the risk of fraud or errors going undetected. | |

Observations | Access privileges were not always promptly revoked upon employee termination, indicating a need for improved access management processes. | |

Financial Reporting | Strengths | Financial reporting processes demonstrated adequate documentation and review procedures, ensuring accuracy and reliability of reported data. |

Controls | Weaknesses | Instances of manual journal entries without appropriate review and approval were noted, raising concerns about the integrity of financial reporting. |

Observations | Lack of documentation regarding changes to financial reporting templates made it challenging to track and validate changes made. | |

IT Controls | Strengths | IT controls, including system access controls and data encryption, were robust, reducing the risk of unauthorized access and data breaches. |

Weaknesses | Outdated software versions were identified on some systems, increasing susceptibility to security vulnerabilities and potential breaches. | |

Observations | Limited monitoring and logging of user activities were observed, hindering the ability to detect and respond to potential security incidents promptly. |

Procedures Conducted:

Audit procedures included [DESCRIBE AUDIT TESTING METHODS] to address identified risks and ensure the reliability of audit findings. Comprehensive testing was conducted to validate the effectiveness of controls and identify any deviations from expected outcomes. Deviations from planned procedures occurred in [ANY DEVIATIONS AND REASONS], with appropriate adjustments made to ensure the integrity of audit results.

Audit Findings:

Key findings highlighted deficiencies in [AREAS OF CONCERN], ranging from minor discrepancies to significant control failures impacting financial reporting. These findings were carefully documented and categorized based on their severity and impact on organizational objectives. Root causes of findings were identified to facilitate targeted corrective actions and prevent recurrence of similar issues in the future.

Recommendations for Improvement:

Recommendations were provided to address identified weaknesses, focusing on [PRIORITIZE RECOMMENDATIONS BASED ON RISK]. These recommendations were tailored to the organization's specific context and objectives, ensuring relevance and feasibility of implementation. Benefits of implementing recommendations include [LIST POTENTIAL BENEFITS], such as improved operational efficiency and strengthened internal controls.

Audit Conclusion:

Overall, the audit concluded [SUMMARIZE OVERALL AUDIT RESULTS], providing stakeholders with a clear understanding of the audit findings and their implications. The significance of findings and recommendations underscores the importance of [MENTION RELEVANT ASPECTS], highlighting areas where immediate action is required to safeguard organizational interests. The audit conclusion reaffirms the commitment to continuous improvement and effective risk management, driving positive change and value creation within the organization.

Management Response:

Management acknowledged audit findings and outlined corrective actions planned or implemented, demonstrating a commitment to addressing identified weaknesses. Target completion dates and responsible parties were identified for each recommendation, ensuring accountability and transparency in the remediation process. Management's proactive response to audit findings reflects a culture of accountability and continuous improvement, fostering trust and confidence among stakeholders.

Follow-Up Actions:

Follow-up procedures will be implemented to monitor the implementation of recommendations and track progress towards remediation. Future audits or reviews will be scheduled as needed to ensure ongoing compliance and improvement, with a focus on monitoring the effectiveness of corrective actions. Continuous communication and collaboration between audit stakeholders will be maintained to facilitate timely resolution of outstanding issues and promote organizational resilience.

Conclusion:

Supporting documentation, such as detailed test results and analysis, are appended for reference, providing additional context and evidence to support audit findings and recommendations. Additional information relevant to the audit engagement is included for clarity, ensuring comprehensive documentation of audit procedures and outcomes.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing our Auditing Summary Notes Template, meticulously crafted to distill critical information from auditing processes effectively. Accessible on Template.net, this editable and customizable template ensures clarity and organization. Utilize our Ai Editor Tool to structure your notes according to audit objectives, findings, and recommendations. Simplify your auditing documentation process and enhance clarity with our meticulously crafted template. Elevate your auditing practices with Template.net.

You may also like

- Delivery Note

- Notes Release

- Concept Note

- Class Note

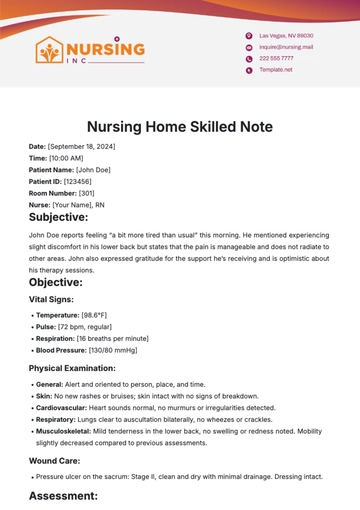

- Hospital Note

- Apology Note

- Credit Note

- Handover Note

- Personal Note

- Excuse Note

- Case Note

- Sample Doctor Note

- Lesson Note

- Appointment Note

- Piano Note

- School Note

- Progress Note

- Business Note

- SOAP Note Templates

- Therapy Note

- Briefing Note

- Summary Note

- Sample Note

- Printable Note