Free Investment Summary

Overview:

This investment summary provides an analysis of potential investment opportunities in the renewable energy sector. It aims to assist individual investors and clients in making informed decisions regarding their investment portfolios.

Market Overview:

The renewable energy sector continues to experience robust growth driven by increasing environmental awareness, government incentives, and technological advancements. Renewable energy sources such as solar, wind, and hydroelectric power offer sustainable alternatives to traditional fossil fuels, positioning the sector for long-term growth and profitability.

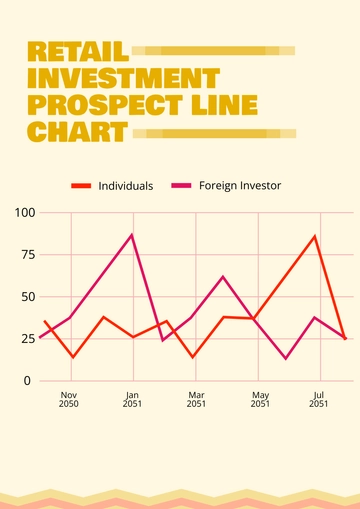

Performance Analysis:

The performance of renewable energy investments has been impressive in recent years, outpacing broader market indices. Here is a summary of key performance metrics:

Performance Metrics

Metric | Renewable Energy Sector | S&P 500 Index |

|---|---|---|

Annual Return | [INSERT ANNUAL RETURN] | [INSERT ANNUAL RETURN] |

Volatility (Std. Deviation) | [INSERT VOLATILITY] | [INSERT VOLATILITY] |

Sharpe Ratio | [INSERT SHARPE RATIO] | [INSERT SHARPE RATIO] |

Investment Opportunities:

Solar Energy:

The solar energy sector presents significant investment opportunities, driven by declining costs of solar panels and increasing adoption worldwide.

Key companies in the solar industry, such as [INSERT COMPANY NAMES], offer exposure to this growing market segment.

Wind Energy:

Wind energy projects, both onshore and offshore, continue to attract investment due to their reliability and scalability.

Investors may consider allocating funds to leading wind energy companies like [INSERT COMPANY NAMES] to capitalize on this trend.

Battery Technology:

Battery technology plays a crucial role in renewable energy storage and grid stability.

Companies involved in battery manufacturing and energy storage solutions, such as [INSERT COMPANY NAMES], offer compelling investment opportunities.

Risks and Considerations:

While the renewable energy sector presents attractive investment prospects, investors should be aware of certain risks and considerations, including regulatory changes, technological advancements, and market volatility. Conducting thorough due diligence and diversifying investments can mitigate these risks and enhance long-term returns.

Conclusion:

The renewable energy sector offers promising investment opportunities for individual investors and clients seeking exposure to sustainable and high-growth industries. By carefully evaluating potential investments and staying informed about market trends, investors can position themselves to benefit from the transition towards clean energy and contribute to a more sustainable future.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing our Investment Summary Template, exclusively from Template.net. Crafted for efficiency, it's both editable and customizable, offering seamless adaptability to your financial needs. Tailor your summaries effortlessly using our Ai Editor Tool. Elevate your presentations with precision and professionalism. Get started today and make your data speak volumes.