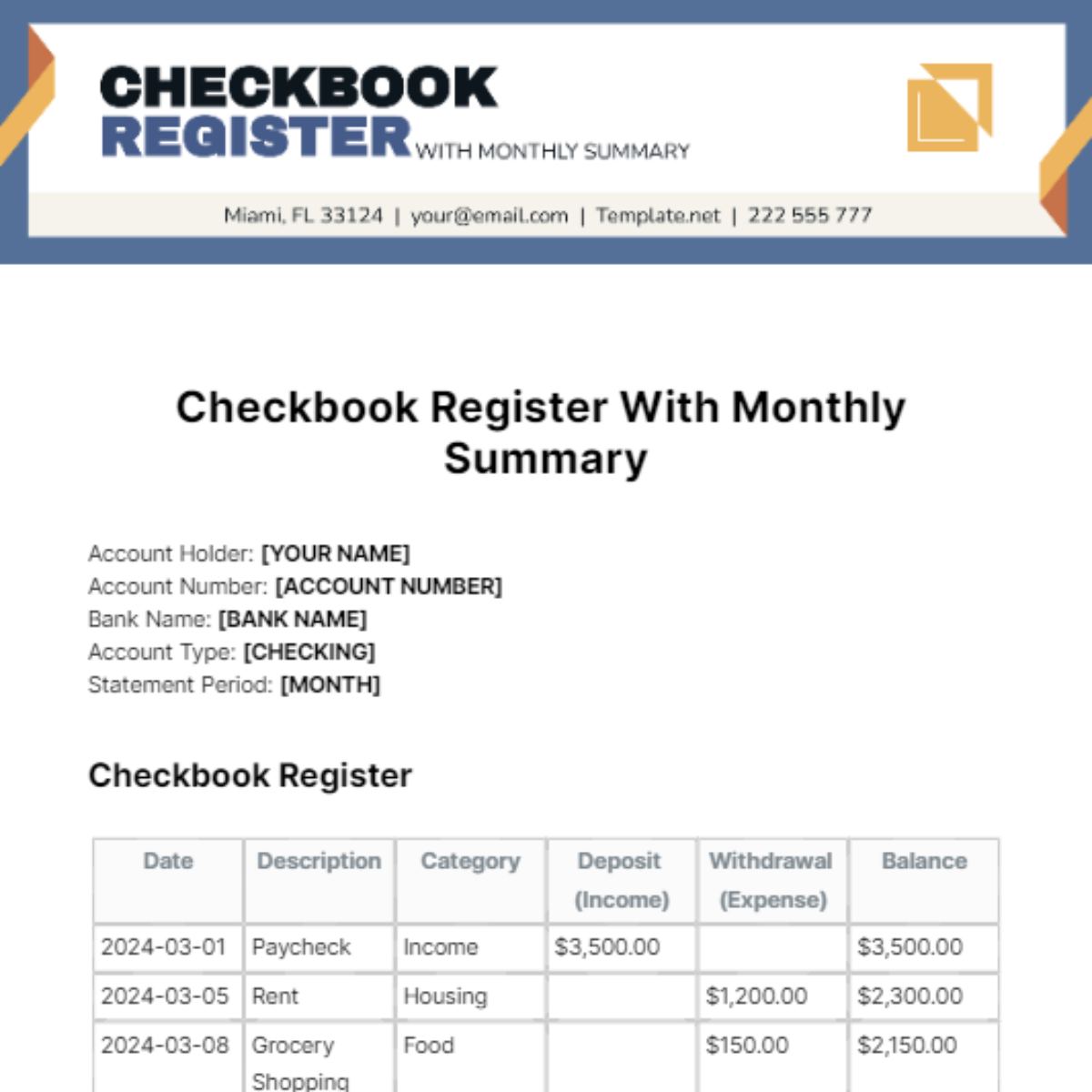

Free Checkbook Register With Monthly Summary

Account Holder: [YOUR NAME]

Account Number: [ACCOUNT NUMBER]

Bank Name: [BANK NAME]

Account Type: [CHECKING]

Statement Period: [MONTH]

Checkbook Register

Date | Description | Category | Deposit (Income) | Withdrawal (Expense) | Balance |

|---|---|---|---|---|---|

2024-03-01 | Paycheck | Income | $3,500.00 | $3,500.00 | |

2024-03-05 | Rent | Housing | $1,200.00 | $2,300.00 | |

2024-03-08 | Grocery Shopping | Food | $150.00 | $2,150.00 | |

2024-03-15 | Electricity Bill | Utilities | $100.00 | $2,050.00 | |

2024-03-20 | Dining Out | Entertainment | $50.00 | $2,000.00 | |

2024-03-25 | Gasoline | Transportation | $80.00 | $1,920.00 | |

2024-03-30 | Internet Bill | Utilities | $70.00 | $1,850.00 |

Monthly Summary

Income:

Total Income: $3,500.00

Expenses:

Housing: $1,200.00

Food: $150.00

Utilities: $170.00

Entertainment: $50.00

Transportation: $80.00

Total Expenses: $1,650.00

Net Income (Income - Expenses): $1,850.00

Notes:

Make sure to reconcile this register with your bank statement regularly to ensure accuracy.

Properly categorize each transaction to gain insights into your spending habits.

Adjust your budget accordingly based on the monthly summary to meet your financial goals.

Conclusion:

Regularly reconciling your checkbook register with bank statements ensures financial accuracy. Proper categorization provides insights into spending habits, facilitating informed budget adjustments. March's summary reveals a net income of $1,850.00 after $1,650.00 in expenses, emphasizing the importance of budgeting for financial stability and goal attainment.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the ultimate solution for managing your finances seamlessly! Template.net presents the Checkbook Register With Monthly Summary Template. This editable and customizable tool simplifies tracking expenses and income. Crafted for convenience, it's easily editable in our Ai Editor Tool, ensuring efficiency and precision in your financial management.