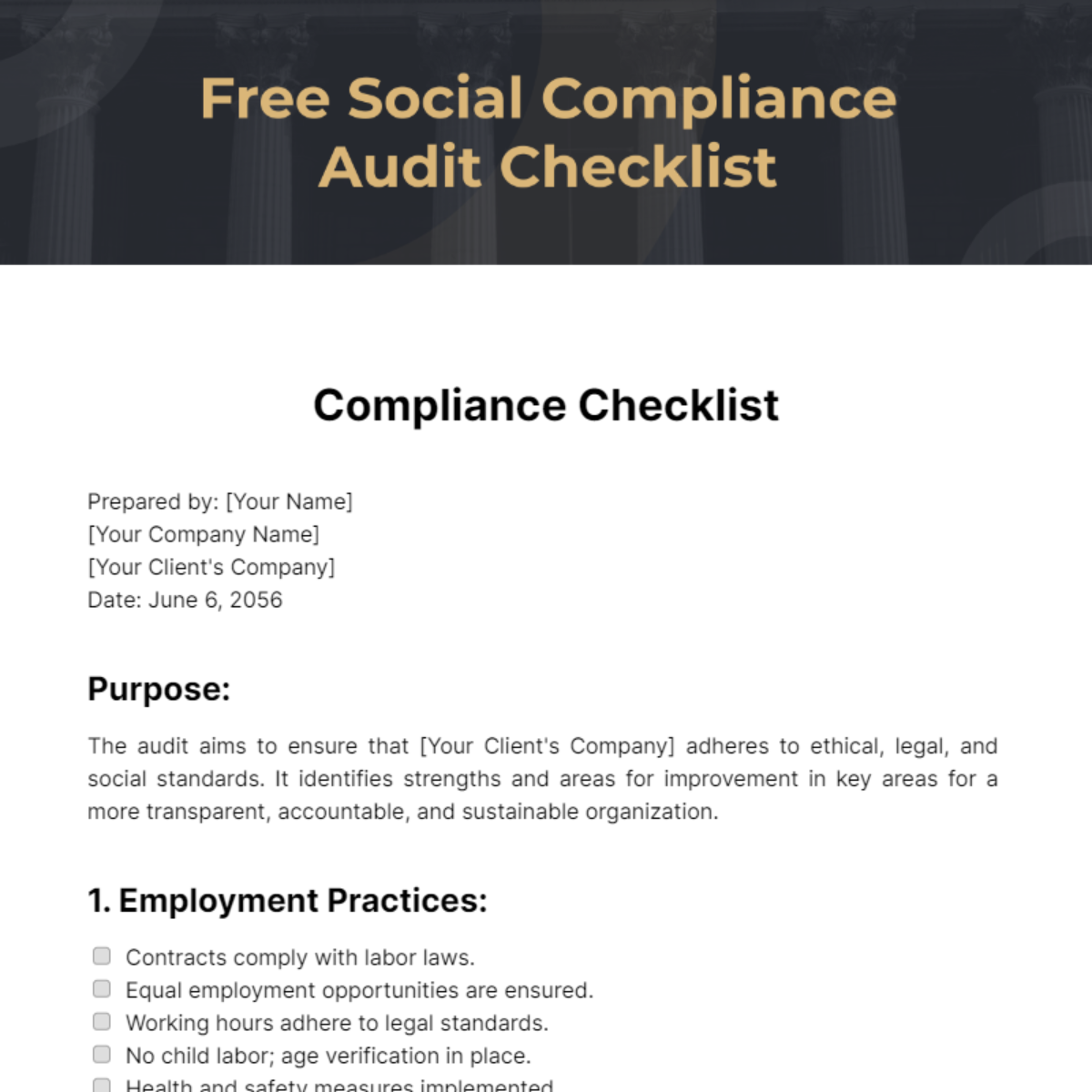

Free Social Compliance Audit Checklist

Prepared by: [Your Name]

[Your Company Name]

[Your Client's Company]

Date: June 6, 2056

Purpose:

The audit aims to ensure that [Your Client's Company] adheres to ethical, legal, and social standards. It identifies strengths and areas for improvement in key areas for a more transparent, accountable, and sustainable organization.

1. Employment Practices:

Contracts comply with labor laws.

Equal employment opportunities are ensured.

Working hours adhere to legal standards.

No child labor; age verification in place.

Health and safety measures implemented.

Adequate facilities for breaks provided.

2. Compensation and Benefits:

Wages and benefits meet legal standards.

Transparent and accurate payroll records.

Deductions comply with laws.

Adequate employee benefits.

3. Supplier and Contractor Compliance:

Suppliers and contractors meet social compliance standards.

Contracts include social responsibility clauses.

Regular compliance audits conducted.

Procedures for addressing non-compliance.

4. Ethical Business Practices:

Anti-corruption policies in place.

Compliance with ethical standards and anti-bribery laws.

Transparent financial practices.

Whistleblower protection mechanisms.

5. Community Engagement:

Active engagement in social responsibility initiatives.

Consideration of environmental impact.

Contributions to community development.

Positive relationships with stakeholders.

6. Diversity and Inclusion:

Policies promoting diversity and inclusion.

Diverse workforce demographics.

Regular diversity and inclusion training.

Inclusive recruitment and promotions.

7. Data Protection and Privacy:

Compliance with data protection and privacy laws.

Secure handling of customer and employee data.

Procedures for data breach response.

Employee awareness and training.

8. Monitoring and Reporting:

Regular internal social compliance audits.

Clear reporting mechanisms for employees.

Periodic external audits by third parties.

Continuous improvement plans based on audit findings.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline social compliance checks effortlessly with Template.net Social Compliance Audit Checklist Template. Offered by Template.net, this downloadable resource is customizable and editable in our AI Editor Tool. Ensure your business adheres to social responsibility standards by downloading this versatile and user-friendly template. Optimize social compliance practices and uphold ethical standards with ease.

You may also like

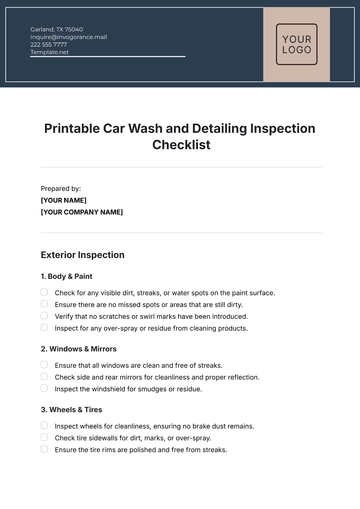

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

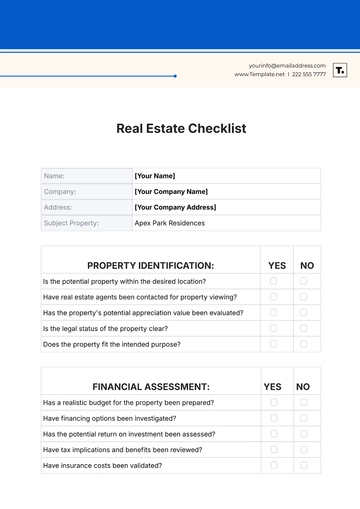

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

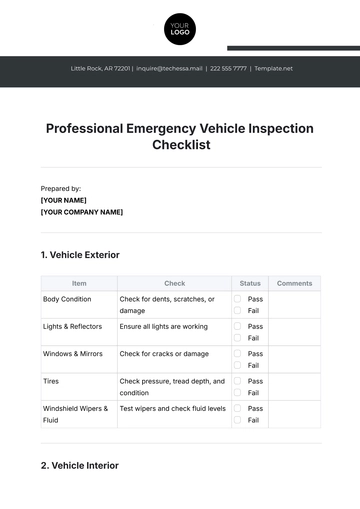

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

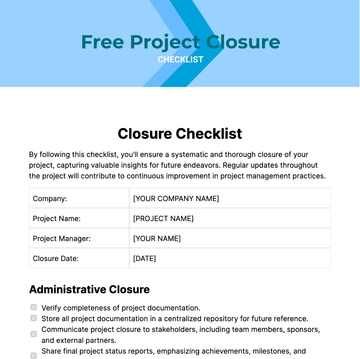

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

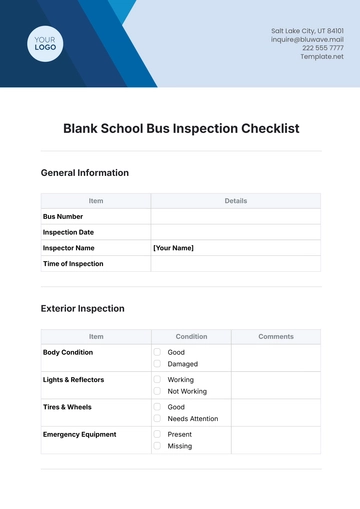

- School Checklist

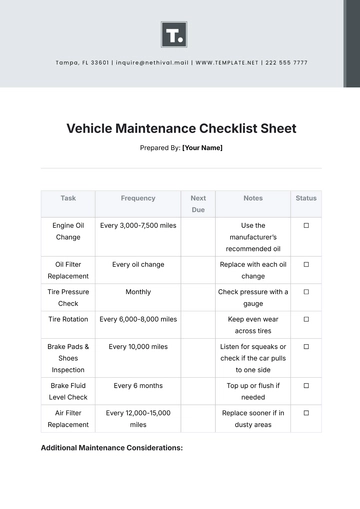

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

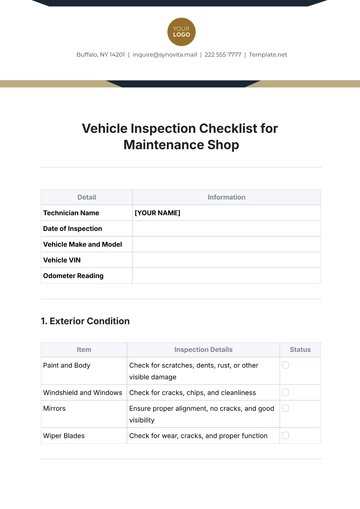

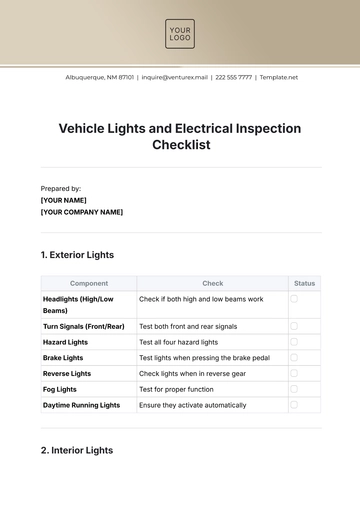

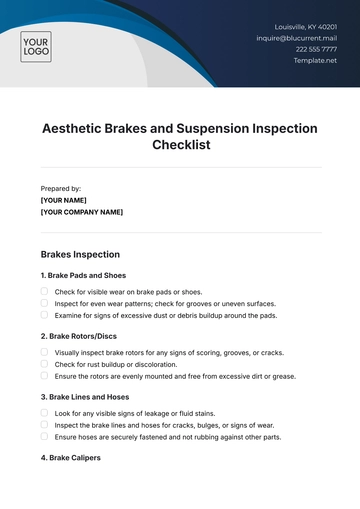

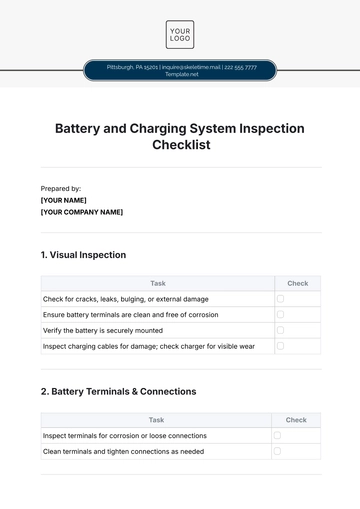

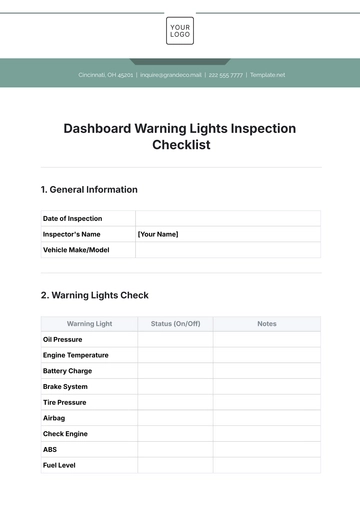

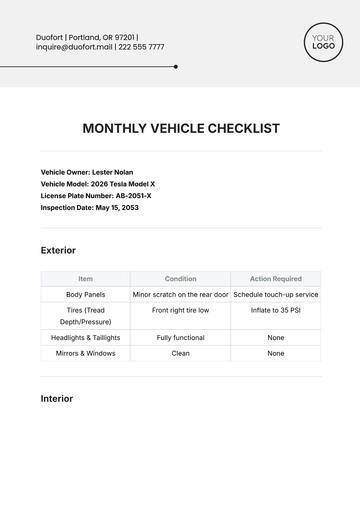

- Vehicle Checklist

- Travel Agency Checklist

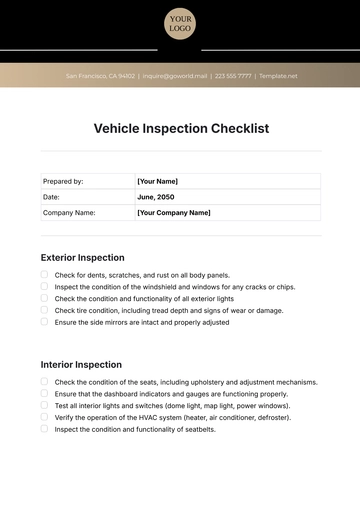

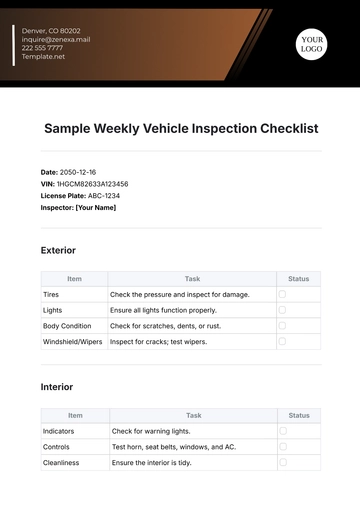

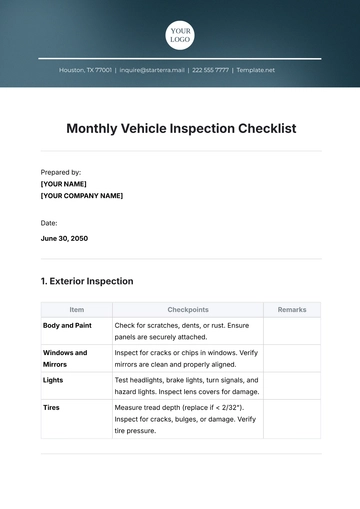

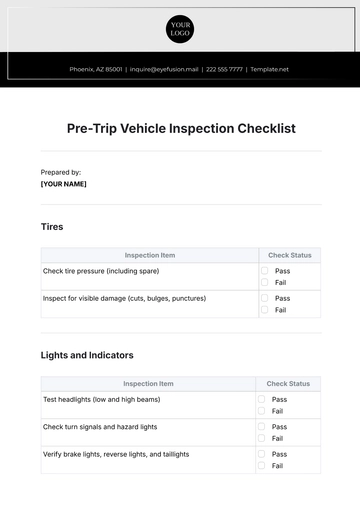

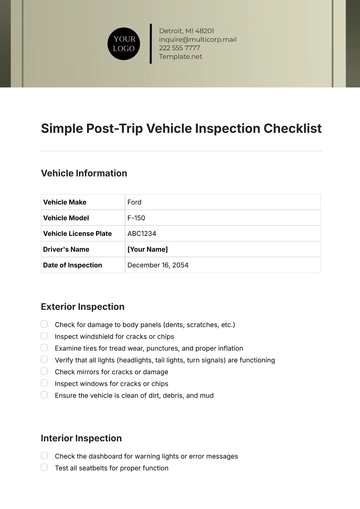

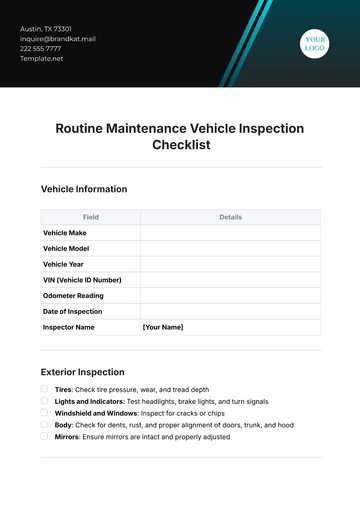

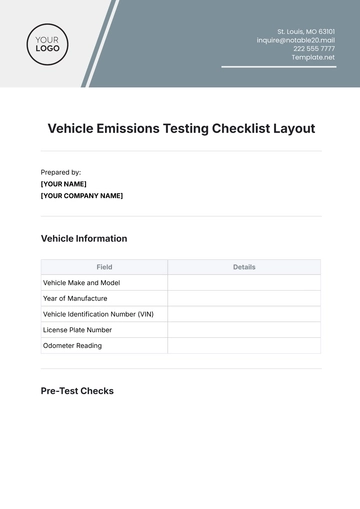

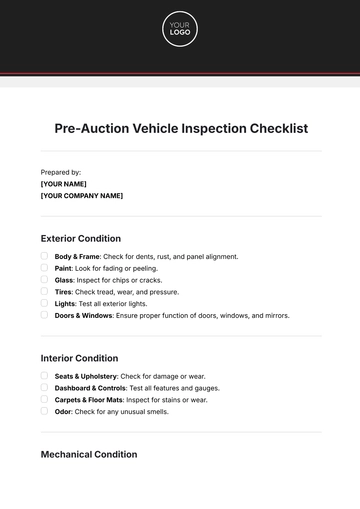

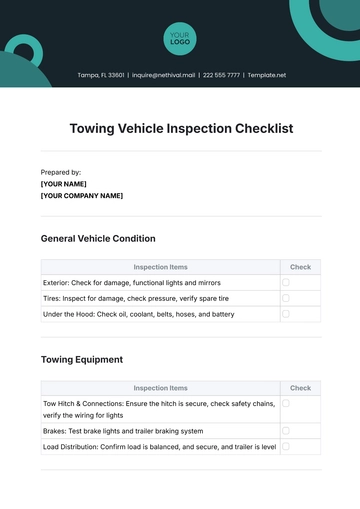

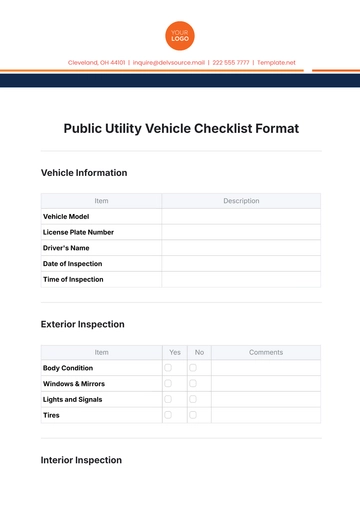

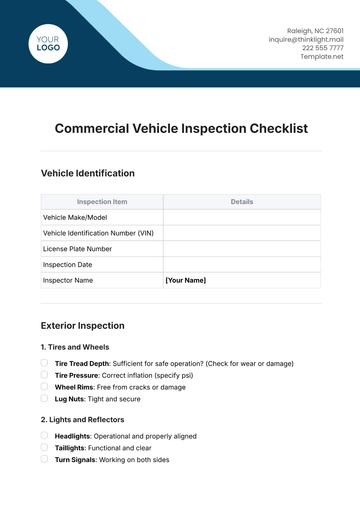

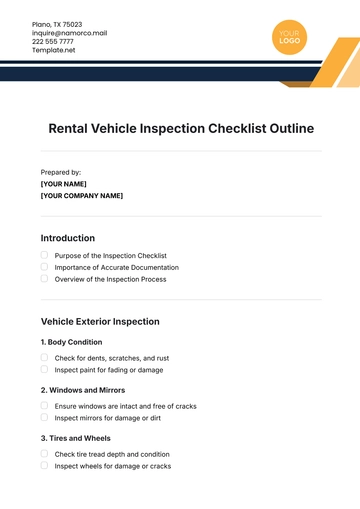

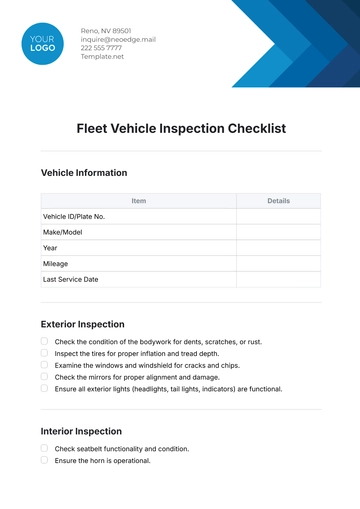

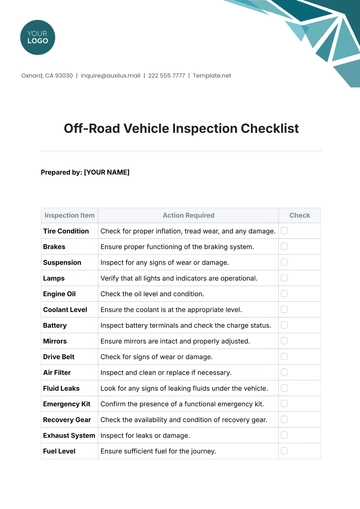

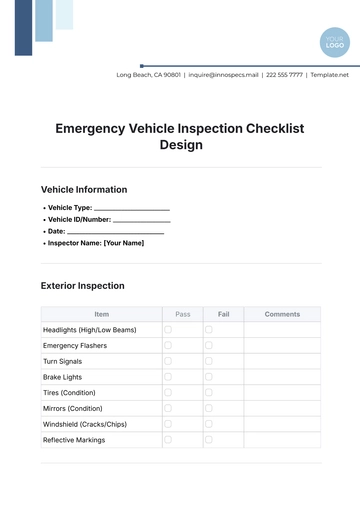

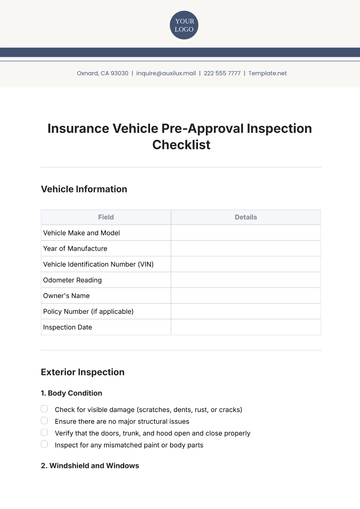

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

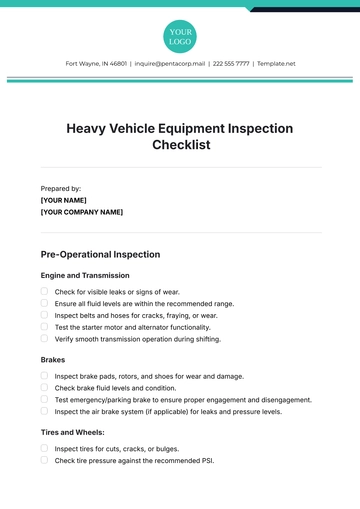

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist