Free Recruitment KPIs Guide HR

Table of Contents

1. Executive Summary………………………………………………………………………………………. 2

2. Introduction……………………………………………………………………………………………………. 2

3. Objectives………………………………………………………………………………………………………. 3

4. Key Performance Indicators (KPIs).................................................................. 4

5. KPI Measurement Methods …………………………………………………………………………..4

6. Data Sources …………………………………………………………………………………………………..5

7. Interpretation of KPIs …………………………………………………………………………………….6

8. Recommendations ………………………………………………………………………………………..7

9. Conclusion ………………………………………………………………………………………………………9

10. Appendices …………………………………………………………………………………………………9

Executive Summary

In today's competitive talent landscape, the importance of an effective and efficient recruitment strategy cannot be overstated. [Company Name] is committed to optimizing its recruitment process to attract, hire, and retain top-tier talent that aligns with our corporate values and objectives. This guide serves as a comprehensive manual for identifying, measuring, and evaluating Recruitment Key Performance Indicators (KPIs) within [Company Name]. Developed in consultation with industry experts, this guide aims to provide HR professionals, recruitment specialists, and hiring managers with a toolkit for making data-driven decisions.

Our objective is multi-faceted. Firstly, we aim to standardize the key metrics that are pivotal in evaluating the efficiency and effectiveness of the recruitment process. Secondly, the guide offers practical methods for accurately measuring these KPIs, providing a uniform evaluation framework. Thirdly, we delve into how to interpret these metrics in the context of broader business goals, thereby aligning the recruitment process with the strategic objectives of the organization. Ultimately, the overarching goal is to ensure that the recruitment process is not only effective but also efficient, leading to the selection of the most qualified candidates who will contribute to the organization's success in the long term.

Introduction

The process of recruitment is one of the most vital functions within an organization, acting as the gateway for new talent and innovation. A well-structured recruitment strategy not only impacts the quality of hires but also significantly influences employee retention, job satisfaction, and by extension, the overall productivity and effectiveness of [Company Name]. Given the critical nature of recruitment, there is a growing need to approach this function with analytical rigor and strategic foresight. This guide is developed to fill that exact gap for [Company Name].

The guide outlines the key performance indicators (KPIs) that are essential for monitoring the health and effectiveness of our recruitment pipeline. It provides a structured framework that serves as a baseline for measuring, assessing, and subsequently improving the various stages of the recruitment process. This guide will help HR managers, recruitment officers, and team leaders understand what metrics matter the most, how to measure them, and how to interpret the data for actionable insights. By focusing on these KPIs,

[Company Name] aims to build a more streamlined, efficient, and result-driven recruitment process that aligns closely with our organizational goals and long-term vision. It serves as a roadmap for achieving recruitment excellence and, in turn, organizational success.

Objectives

The objectives of this Recruitment KPIs Guide are multi-faceted but ultimately focused on enriching the recruitment process at [Company Name]. Below are the key goals that this guide aims to achieve:

To Establish Standardized KPIs for Evaluating Recruitment Effectiveness

Setting uniform metrics for evaluation is the first step toward systematic improvement. By standardizing KPIs across the recruitment function, we ensure that all teams and departments are aligned in their performance goals. This also provides a common language that facilitates inter-departmental communication and decision-making.

To Outline Methods for Measuring These KPIs

Measuring KPIs accurately is as important as establishing them. This guide will delve into the specific tools, software, and methodologies that can be used to measure each KPI effectively. By doing so, it minimizes discrepancies in data collection, ensuring that the insights drawn are reliable and actionable.

To Provide Guidelines for Interpreting and Implementing the Findings

Raw data is only as good as the insights drawn from it. This guide will provide a framework for interpreting the measured KPIs, turning them into actionable insights. It will offer best practices on how to implement these insights into actionable changes, thereby driving continual improvement in [Company Name]'s recruitment process.

By fulfilling these objectives, this guide serves as an instrumental resource for enhancing the quality, efficiency, and effectiveness of recruitment activities at [Company Name].

Key Performance Indicators (KPIs)

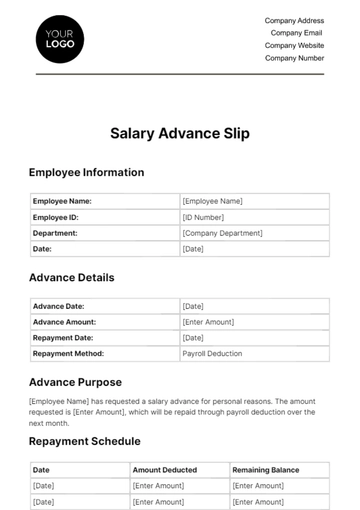

Table: List of Key Performance Indicators

KPI | Description | Target |

Time-to-Hire | Time taken to fill a vacancy | <30 days |

Cost-per-Hire | Overall cost involved in hiring a candidate | <$2000 |

Quality of Hire | Performance and tenure of the new hire | >80% |

Applicant-to-Interview Ratio | Number of applicants per interview | 10:1 |

Offer-to-Acceptance Ratio | Number of offers accepted | >90% |

KPI Measurement Methods

Understanding how to accurately measure each Recruitment Key Performance Indicator (KPI) is crucial for deriving actionable insights. This section provides a detailed explanation of the methods used to measure each KPI, ensuring uniformity and accuracy in data collection across [Company Name].

Time-to-Hire: Calculated from the time a job requisition is opened until the candidate starts.

Time-to-Hire is a critical metric to measure the efficiency of your recruitment process. To calculate this, mark the date and time when a job requisition is formally opened and compare it to the candidate's actual start date. This duration can be recorded in days or business days, depending on your company’s preference. By tracking Time-to-Hire, [Company Name] can identify bottlenecks in the recruitment process and aim to shorten the time taken to fill a vacancy, thereby reducing lost productivity.

Cost-per-Hire: Includes advertising costs, interviewer time, and any other recruitment costs.

Cost-per-Hire encompasses a broad range of expenses, making it a comprehensive metric for evaluating the financial efficiency of your recruitment process. This includes not only the obvious costs like job advertising and agency fees but also subtler costs like the time spent by interviewers, onboarding costs, and any administrative expenses. These should be summed up and divided by the number of hires made in a given period to derive the average Cost-per-Hire. This KPI helps [Company Name] allocate its recruitment budget more effectively and identify areas for cost-saving.

Quality of Hire: Evaluated through performance reviews and tenure data after a certain period.

Quality of Hire is perhaps one of the most crucial but challenging KPIs to measure. This metric is often a long-term evaluation that considers performance reviews, tenure data, and even the cultural fit of a new employee. By collating performance scores from periodic reviews and correlating them with the longevity of each hire, the company can get a clearer picture of how effective its recruitment methods are in attracting quality talent. This KPI is invaluable for continuous improvement and long-term success in recruitment strategies.

By adhering to these measurement methods, the company ensures that its KPI data is both accurate and consistent, providing a reliable basis for strategic decision-making in recruitment.

Data Sources

Reliable data is the cornerstone of effective KPI measurement. To ensure the accuracy and comprehensiveness of the Recruitment KPIs at [Company Name], multiple data sources are utilized. This section outlines each source and explains its relevance to the specific KPIs in question.

HR Management Software:

The HR Management Software serves as the primary source for most recruitment-related data. From time stamps indicating when job requisitions are opened to details about candidates who have been processed, this software provides the raw data required for calculating KPIs like Time-to-Hire and Quality of Hire. It is crucial to ensure that this software is regularly updated and audited for accuracy.

Finance Department for cost-related data:

The Finance Department plays a key role in deriving the Cost-per-Hire KPI. They provide comprehensive financial data, including the costs of job advertisements, recruitment agencies, onboarding processes, and other related expenditures. By liaising closely with the Finance Department, the HR team can collate this financial data to accurately calculate Cost-per-Hire and thereby evaluate the economic efficiency of the recruitment process.

Performance review scores:

Performance review scores are primarily used to evaluate the Quality of Hire. These scores, often collected quarterly or annually, provide insights into how well a new hire is performing in their role. They are sourced from direct supervisors or through a 360-degree review process and can be pulled from performance management software or internal review documentation. This data is critical for assessing the long-term effectiveness of the recruitment process, helping the company fine-tune its strategies for future hires.

Each of these data sources contributes to a multifaceted view of recruitment effectiveness. By consolidating data from these diverse sources, the company can ensure a more holistic and accurate understanding of its Recruitment KPIs, thereby enabling more informed decision-making.

Interpretation of KPIs

Interpreting the Recruitment Key Performance Indicators (KPIs) is not merely about data collection; it's about translating that data into actionable insights that can drive improvements in the recruitment process. Accurate interpretation helps the organization to make well-informed decisions, optimize strategies, and ultimately, acquire the best talent. Below are some guidelines on how to interpret various KPIs:

Time-to-Hire:

A longer Time-to-Hire often suggests inefficiencies in the recruitment process. It could be due to bottlenecks in screening, interviewing, or decision-making stages. A protracted hiring process may also result in losing top candidates to competitors. However, it's crucial to balance speed with quality; rushing may compromise the caliber of the new hires.

Cost-per-Hire:

A low Cost-per-Hire might initially appear as a sign of an efficient recruitment process, but this could be misleading. Cutting corners on candidate sourcing or skimping on assessments may lead to poor-quality hires that cost the company more in the long run through higher turnover or reduced productivity. On the other hand, an excessively high Cost-per-Hire could indicate wasteful spending and calls for a review of the recruitment budget and strategies.

Quality of Hire:

This KPI is generally measured through performance reviews and tenure data after a specific period (e.g., 90 days, one year). A high Quality of Hire score signifies that the recruitment process is effective in identifying candidates who not only have the necessary skills but also align well with the company's culture and goals. Low scores may indicate a misalignment and necessitate a review of the recruitment criteria, interview process, or onboarding methods.

Composite Interpretation:

Often, these KPIs are interconnected. For instance, a quick Time-to-Hire might contribute to a lower Cost-per-Hire but can adversely affect the Quality of Hire. Therefore, it's essential to interpret these KPIs collectively rather than in isolation, taking into account the overall recruitment goals and the specific needs of the company.

By understanding what each KPI signifies and how they relate to each other, the company can more effectively identify areas for improvement, streamline the recruitment process, and ensure that the organization is consistently attracting and retaining top-tier talent.

Recommendations

Improving the recruitment process is an ongoing endeavor that requires strategic planning, precise execution, and continuous monitoring. The Recruitment KPIs provide critical insights into the effectiveness of the company’s current recruitment strategies. Based on the interpretations of these KPIs, here are some targeted recommendations to enhance the recruitment process:

Streamline the Application Process to Reduce Time-to-Hire:

Time is of the essence in recruitment. Streamlining the application process not only enhances the candidate experience but also allows the company to secure top talent before competitors do. Recommendations include:

Implementing a user-friendly Applicant Tracking System (ATS) that automates mundane tasks like resume screening.

Establishing a set timeline for each stage of the recruitment process.

Conducting panel interviews where feasible to expedite decision-making.

Allocate Budget Wisely to Manage Cost-per-Hire Effectively:

Effective budget allocation can significantly impact the Cost-per-Hire. While it's tempting to reduce costs, it's essential to ensure that quality isn't compromised.

Allocate funds judiciously between different sourcing channels based on their past performance.

Utilize social media and employee referrals, which often cost less than traditional job boards and recruitment agencies.

Periodically review and renegotiate contracts with third-party service providers to ensure cost-effectiveness.

Use Structured Interviews to Improve Quality of Hire:

The interview process is a critical stage in determining the Quality of Hire. A structured interview process can significantly improve the chances of selecting candidates who are not only skilled but are also a good culture fit.

Develop a set of standard questions focused on the skills and competencies essential for the role.

Incorporate situational and behavioral questions that align with the company's values and job requirements.

Train interviewers to eliminate bias and make objective evaluations based on predefined scoring criteria.

By implementing these recommendations, the company aims to optimize its recruitment process, aligning it more closely with organizational goals and ensuring a more efficient and effective approach to acquiring top talent.

Conclusion

The imperative of strategic, data-driven recruitment cannot be overstated in today's competitive business landscape. This Recruitment KPIs Guide serves as a comprehensive blueprint, setting forth robust metrics that are not only measurable but also aligned with the company's overarching objectives. The guide helps to establish a common language and set of criteria that can be universally applied across all departments and stages of the recruitment process, thus ensuring consistency and objectivity.

The KPIs outlined herein—Time-to-Hire, Cost-per-Hire, and Quality of Hire—serve as critical markers that can either signify the success of the existing recruitment strategies or highlight areas in need of improvement. But the true value of this guide lies in its practical applicability; it provides actionable recommendations that are designed to enhance the efficacy of the recruitment process at the company.

By adhering to the guidelines and recommendations of this guide, the company will be better equipped to make informed decisions, manage its recruitment resources more efficiently, and ultimately secure high-caliber talent that contributes positively to the company's growth and culture.

Appendices

Sample KPI Report (Attached)

Interview Scorecards (Attached)

Cost Calculation Templates (Attached)

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize your recruitment strategy with our Recruitment KPIs Guide HR Template. This comprehensive guide offers a detailed framework for defining, measuring, and interpreting essential KPIs like Time-to-Hire, Cost-per-Hire, and Quality of Hire. Gain actionable insights to make data-driven decisions and enhance recruitment outcomes. Ideal for HR professionals and team leaders.