Free Payroll Accounting Risk Management Manual

Welcome to [Company Name]'s Payroll Accounting Risk Management Manual. This document is designed to guide you through effectively managing the risks associated with payroll accounting to ensure its smooth and efficient operation within our organization. For any inquiries, please reach out via email at [Company Email] or call us at [Phone Number].

Overview of Payroll Accounting Risks

Payroll accounting is a critical function within any organization, responsible for ensuring that employees are paid accurately and on time. However, this area is susceptible to various risks that can lead to significant financial losses, legal penalties, and damage to the organization's reputation. Understanding these potential risks is the first step toward mitigating them effectively.

Fraud in payroll can take many forms, from the creation of ghost employees, where paychecks are issued to nonexistent workers, to the misappropriation of funds by altering the amount on paychecks or embezzling direct deposit funds. Such fraudulent activities not only lead to financial losses but can also erode trust within the organization.

Errors in payroll accounting, such as mistakes in data entry, incorrect tax withholdings, or miscalculations of overtime pay, can result in employee dissatisfaction, incorrect tax filings, and potential legal issues. These errors often stem from complex payroll systems, manual data entry, and inadequate review processes.

Non-compliance with tax laws and labor regulations is another significant risk. This includes failing to adhere to minimum wage laws, overtime payments, tax withholdings, and reporting requirements. Non-compliance can lead to hefty fines, legal disputes, and damage to the organization's reputation.

System Failures, such as software malfunctions, data corruption, or loss due to inadequate cybersecurity measures, can disrupt payroll processing. In today's digital age, the threat of cyber attacks, such as ransomware, poses a significant risk to the integrity and confidentiality of payroll data.

Risk Identification and Assessment

Identifying and assessing risks in payroll accounting involves a thorough examination of the payroll process to pinpoint potential vulnerabilities and the likelihood of adverse events occurring. This process is crucial for developing effective strategies to manage and mitigate these risks.

Types of Risks:

Fraud: This includes any intentional deception made for personal gain within the payroll process. Examples include:

Ghost employees: Paychecks are issued to employees who do not exist.

Unauthorized alterations: Changes made to payroll records or amounts without proper authorization.

Embezzlement: Diverting payroll funds for personal use.

Identifying fraud involves looking for discrepancies in payroll records, unexplained changes in payroll costs, and conducting regular audits.

Errors: These unintentional mistakes can have significant repercussions. Common errors include:

Data entry mistakes: Incorrect input of hours worked, pay rates, or personal information.

Calculation errors: Mistakes in computing tax withholdings, benefits deductions, or overtime pay.

Incorrect record-keeping: Failing to maintain accurate or up-to-date employee records.

Preventing errors requires implementing robust verification and review processes, using automated payroll systems, and providing adequate training to payroll staff.

Non-compliance: This involves failing to meet legal and regulatory requirements related to payroll. It includes:

Tax violations: Incorrect tax withholdings or failures to report payroll taxes accurately.

Labor law breaches: Not complying with minimum wage laws, overtime rules, or worker classification.

Regular updates on legal changes, conducting compliance audits, and seeking legal advice are critical to managing compliance risks.

System Failures: Dependence on payroll software and systems introduces risks such as:

Software malfunctions: Bugs or glitches in payroll software that lead to incorrect payroll processing.

Data loss: Loss of payroll data due to hardware failure, data corruption, or cyber-attacks.

Security breaches: Unauthorized access to payroll information leading to data theft or ransomware attacks.

Mitigating these risks involves implementing robust IT security measures, regular software updates, data backup procedures, and disaster recovery plans.

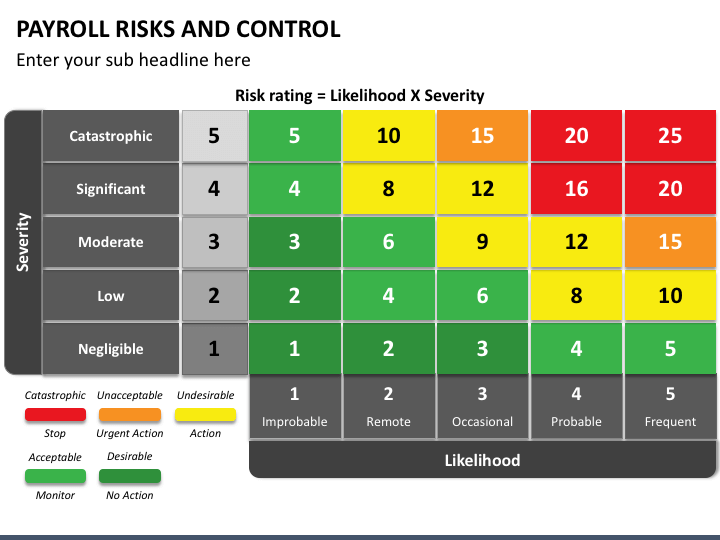

Risk Assessment Matrix

A valuable tool in risk assessment is the Risk Assessment Matrix, which evaluates the probability of each risk occurring against the potential impact on the organization. This helps prioritize risks and allocate resources effectively to areas of highest concern.

Fig. 1: Risk Assessment Visual Table (For Illustration Purposes Only)

Risk Management Strategies

Effective risk management in payroll accounting requires a multifaceted approach, combining technological advancements, stringent internal controls, comprehensive employee training, and robust disaster recovery planning. By implementing these strategies, organizations can significantly mitigate the risks associated with payroll processes.

Technological Solutions

The adoption of advanced payroll systems equipped with fraud detection algorithms, data validation tools, and automated compliance checks is essential in today's digital era. These systems can significantly reduce the likelihood of errors and fraudulent activities by:

Automating routine tasks: Minimizing human intervention in tasks such as calculations and data entry reduces the risk of errors.

Fraud detection capabilities: Implementing algorithms that can detect unusual patterns or discrepancies indicative of fraudulent activities.

Ensuring compliance: Automated updates to payroll systems can help ensure that payroll processing remains compliant with the latest tax laws and regulations.

Investing in cloud-based payroll solutions can also enhance data security and accessibility, ensuring that payroll data is securely stored and backed up, reducing the risk of data loss.

Internal Controls Enhancement

Developing and enforcing stringent internal controls is crucial for preventing and detecting errors and fraud within the payroll process. Key controls include:

Segregation of duties: Ensuring that no single individual has control over all aspects of the payroll process to prevent fraud.

Regular reconciliation: Performing regular reconciliations of payroll records with bank statements and financial accounts to detect discrepancies early.

Authorization controls: Implementing strict authorization protocols for payroll changes and ensuring that all modifications are well-documented and approved by the appropriate personnel.

These controls provide a framework for a secure and transparent payroll process, reducing the likelihood of fraudulent activities and errors.

Employee Training Programs

Educating employees about potential payroll risks, proper use of payroll software, and compliance requirements is fundamental. Training programs should cover:

Risk awareness: Making employees aware of the various types of payroll risks and the impact they can have on the organization.

Software proficiency: Ensuring employees are proficient in using payroll software, including understanding its security features and reporting capabilities.

Compliance: Educating employees about relevant tax laws, labor regulations, and compliance protocols to prevent non-compliance issues.

Regular training updates are essential to keep pace with changes in payroll software, technologies, and regulations.

Disaster Recovery Planning

A well-defined disaster recovery plan is crucial for ensuring business continuity in the event of a system failure or data loss. The plan should include:

Recovery objectives: Defining clear recovery time objectives (RTOs) and recovery point objectives (RPOs) for payroll functions.

Responsible personnel: Assigning specific roles and responsibilities to staff members in the event of a disaster.

Backup procedures: Implementing regular backup procedures for payroll data and ensuring backups are stored in a secure, off-site location.

Testing the disaster recovery plan regularly ensures that the organization is prepared to respond effectively to disruptions.

Implementation of Risk Management Measures

Implementing risk management measures effectively is crucial for their success. This involves clear communication, comprehensive training, and the consistent application of measures across all departments.

Communication and Training

Effective communication channels are essential to ensure that all employees are aware of the risk management measures and their roles in supporting these efforts. Training sessions tailored to different roles within the organization can enhance understanding and compliance with risk management practices. These sessions should be interactive, allowing employees to ask questions and provide feedback.

Application of Measures

Consistency is key in the application of risk management measures. Regular updates to these measures are necessary to reflect changes in payroll processes, technologies, and regulatory requirements. This adaptive approach ensures that risk management practices remain effective and relevant.

Monitoring and Reviewing

Ongoing monitoring and reviewing of risk management strategies are critical to assess their effectiveness and make necessary adjustments.

Performance Indicators

Setting clear Key Performance Indicators (KPIs) such as the number of payroll discrepancies, fraud incidents, and audit findings can provide measurable benchmarks to evaluate the effectiveness of the risk management program. Regularly reviewing these KPIs allows for timely identification of areas that may require improvement.

Feedback Mechanisms

Creating an open environment where employees feel comfortable reporting potential risks or suggesting improvements is vital. This can be facilitated through regular meetings, suggestion boxes, or anonymous reporting channels. Actively engaging employees in the risk management process can provide valuable insights and foster a culture of continuous improvement.

Regular Audits

Conducting regular internal and external audits is essential for verifying compliance with internal controls, regulatory requirements, and the effectiveness of risk management strategies. Audits provide an objective review of payroll processes, identifying potential weaknesses and areas for enhancement.

By implementing these strategies, organizations can create a robust framework for managing payroll accounting risks, ensuring the integrity and efficiency of payroll processes.

Fig. 2: Payroll Audit Flowchart Example

Regulatory Compliance

Regulatory compliance is a cornerstone of effective payroll management, ensuring that an organization adheres to all legal and statutory requirements related to payroll processing. This encompasses a wide array of obligations, including tax withholdings, employee classification, minimum wage standards, overtime compensation, and record-keeping practices, among others.

To maintain compliance, organizations must stay abreast of the ever-evolving legal landscape, which may vary significantly across different jurisdictions. This includes federal and state laws in the United States, for instance, or corresponding regional and national laws in other countries. Key compliance areas include:

Tax Laws: Adhering to the correct withholding and remittance of employee income taxes, social security contributions, and other statutory deductions.

Labor Laws: Ensuring compliance with laws governing minimum wage, overtime pay, leave entitlements, and termination procedures.

Employee Classification: Correctly classifying workers as employees or independent contractors to adhere to applicable tax and labor laws.

Record-Keeping: Maintaining accurate and comprehensive payroll records for the required duration as stipulated by law.

Organizations should implement a compliance program that includes regular training for payroll and HR personnel on relevant laws and regulations, periodic internal audits to ensure adherence to legal standards, and consultation with legal experts specializing in employment and tax law. Such proactive measures can help mitigate the risk of legal penalties, financial liabilities, and damage to the organization's reputation.

Conclusion

Effective risk management in payroll accounting is not a one-time task but a continuous cycle of identifying, assessing, mitigating, and monitoring risks. As the business environment, technology, and regulatory frameworks evolve, so too must the strategies for managing payroll risks. This manual has outlined the foundational elements of a comprehensive risk management approach, from understanding the types of risks involved to implementing measures to mitigate these risks and ensuring compliance with regulatory requirements.

Organizations are encouraged to view payroll risk management as an integral part of their overall business strategy, requiring ongoing attention, resources, and commitment from all levels of the organization. Regular training, clear communication, and a culture that promotes transparency and accountability are key to fostering an environment where risks are promptly identified and addressed.

Moreover, the involvement of technology in mitigating risks cannot be overstated. Leveraging advanced payroll systems that offer automation, fraud detection, and compliance checks can significantly reduce the potential for errors and fraud. However, technology should be complemented by robust internal controls, comprehensive employee training, and effective disaster recovery planning to create a resilient payroll framework.

In conclusion, this manual is intended to serve as a dynamic tool, adaptable to the changing needs and complexities of payroll accounting. Organizations should regularly review and update their risk management practices to reflect new challenges and legal requirements, ensuring the smooth operation of payroll processes and the protection of the organization's assets and reputation. By adopting a proactive and strategic approach to payroll risk management, organizations can not only mitigate risks but also enhance their operational efficiency and employee satisfaction.

Contact Information

For further information or to provide feedback on this manual, please contact:

Payroll Department: [Payroll Department Email] | [Phone Number]

Risk Management Officer: [Officer Name] | [Officer Email] | [Phone Number]

IT Support: [IT Support Email] | [Phone Number]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover Template.net's Payroll Accounting Risk Management Manual Template! This versatile resource is your key to efficient risk management in payroll accounting. With our intuitive AI editor, customization is a breeze. Tailor this template to your unique requirements and safeguard your financial stability. Say goodbye to payroll worries and enhance your risk management strategies today!