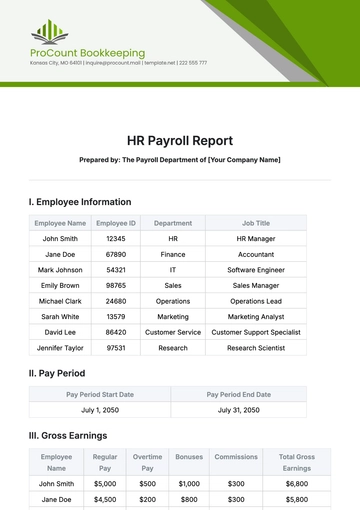

Free Payroll Tax Compliance Document HR

This Payroll Tax Compliance Document outlines the procedures and responsibilities for ensuring compliance with federal and state payroll tax laws and regulations by [Your Company Name] ("the Company"). Compliance with payroll tax laws is essential to avoid penalties and maintain the Company's reputation for ethical and legal business practices.

1. Purpose

The purpose of this document is to establish clear guidelines for:

Withholding and remitting payroll taxes.

Reporting payroll tax information to the appropriate tax authorities.

Maintaining accurate payroll tax records.

Conducting periodic payroll tax compliance reviews.

2. Responsibilities

Payroll Department

The Payroll Department is responsible for:

Calculating and withholding federal income tax, Social Security tax, and Medicare tax in accordance with IRS guidelines.

Withholding state and local income taxes where applicable.

Ensuring accurate and timely payroll tax deposits.

Preparing and submitting required payroll tax forms and reports.

HR Department

The HR Department is responsible for:

Ensuring compliance with state and federal labor laws regarding payroll.

Maintaining employees' tax withholding forms (Form W-4).

Providing employees with annual Form W-2.

Coordinating with the Payroll Department to address employee payroll tax inquiries.

Finance Department

The Finance Department is responsible for:

Managing and reconciling payroll tax accounts.

Ensuring accurate and timely payment of payroll taxes.

Preparing financial reports related to payroll taxes for internal and external stakeholders.

3. Payroll Tax Withholding

The Company will withhold federal income tax, Social Security tax, and Medicare tax from employee paychecks based on IRS guidelines. State and local income tax withholding will also be conducted in accordance with applicable laws.

Employees are responsible for providing accurate and up-to-date tax withholding information by completing Form W-4.

4. Filing and Reporting

The Payroll Department will:

File Form 941 (Employer's Quarterly Federal Tax Return) with the IRS.

File Form 940 (Employer's Annual Federal Unemployment (FUTA) Tax Return) with the IRS.

Comply with all state and local payroll tax reporting requirements.

5. Recordkeeping

The Company will maintain complete and accurate payroll tax records, including:

Employee tax forms

Payroll tax returns and filings

Payment receipts

Tax correspondence

Records of tax compliance reviews

6. Tax Compliance Reviews

The Company will conduct periodic reviews of payroll tax compliance to ensure adherence to all applicable laws and regulations. These reviews will be conducted by [Department Name] or [Name].

7. Penalties

Non-compliance with payroll tax laws can result in penalties and fines. The Company is committed to preventing payroll tax-related penalties by following all applicable laws and regulations.

8. Amendments

This Payroll Tax Compliance Document may be amended as needed to reflect changes in tax laws, regulations, or Company policies. Amendments will be communicated to relevant departments and employees.

9. Contact Information

For questions or concerns regarding payroll tax compliance, please contact:

Payroll Department: [Contact Number]

HR Department: [Your Company Number]

Finance Department: [Contact Number]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline tax adherence with Template.net's Payroll Tax Compliance Document HR Template. This editable, customizable template ensures precise and timely tax submissions, simplifying compliance complexities. Its customizability, editable in our Ai Editor Tool, is essential for managing intricate payroll tax obligations, offering peace of mind to HR departments. Download now!