Free Financial Assessment

[Your Company Name], a global leader in [AI and renewable energy technologies], has demonstrated remarkable financial performance in [2055]. The company has capitalized on the booming demand for sustainable technology solutions and AI-driven services worldwide.

Financial Highlights

Revenue: [Your Company Name] reported a record revenue of [$250 billion] in [2055], marking a [15%] increase from the previous year. This growth is attributed to the expansion in AI services and the introduction of groundbreaking renewable energy products.

Net Income: The net income soared to [$40 billion], a [20%] increase, driven by efficient cost management and high-margin AI solutions.

R&D Expenditure: Continued commitment to innovation was evident with an R&D spend of [$30 billion], focused on AI, quantum computing, and sustainable energy sources.

Market Share: [Your Company Name] strengthened its position in the global market, now holding a [35%] share in the technology sector, thanks to its advanced AI algorithms and renewable energy patents.

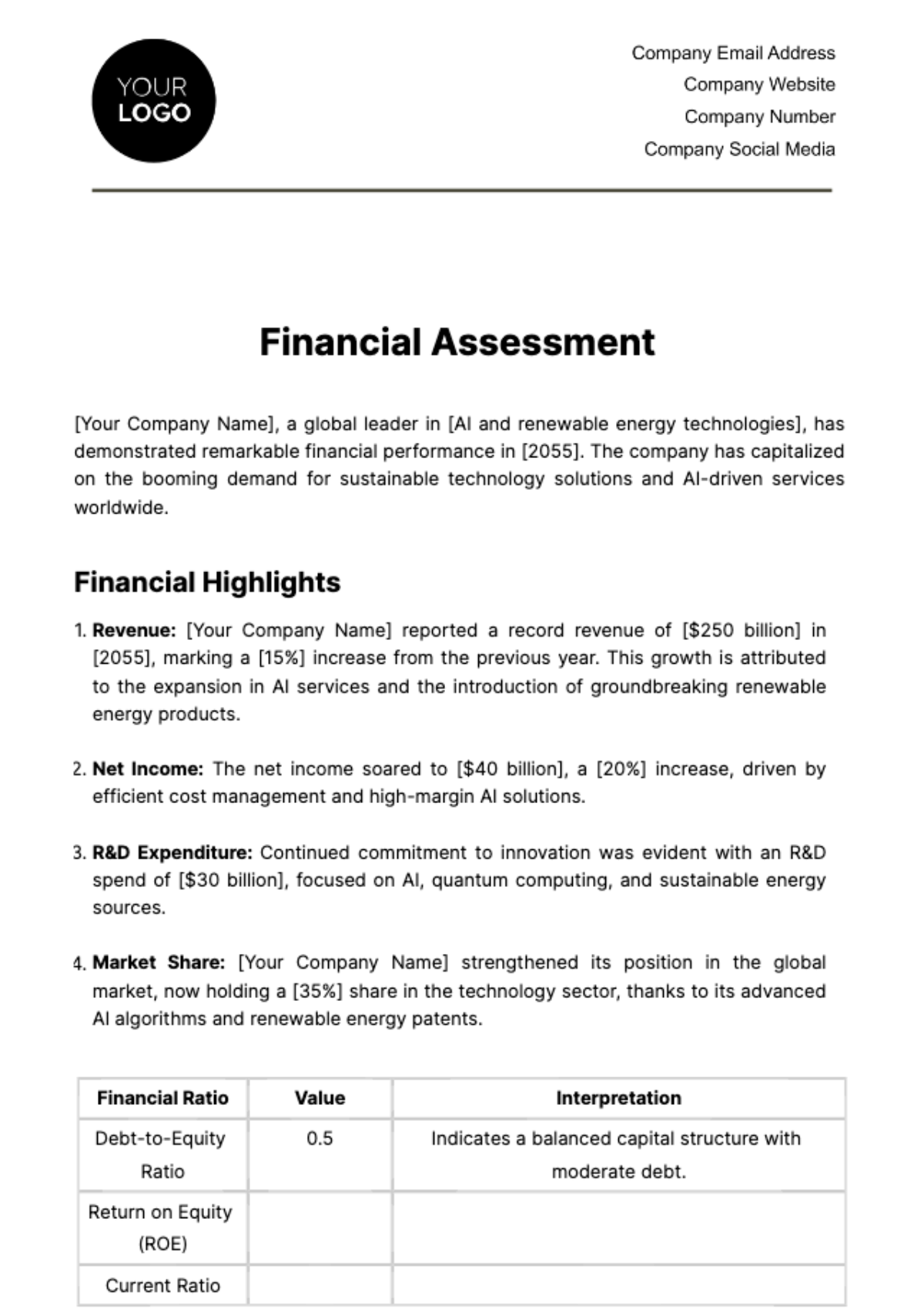

Financial Ratio | Value | Interpretation |

Debt-to-Equity Ratio | 0.5 | Indicates a balanced capital structure with moderate debt. |

Return on Equity (ROE) | ||

Current Ratio |

Future Outlook

The outlook for [2056] remains positive, with expectations of further growth in AI services and sustainable technologies. The company plans to expand its global footprint and invest in next-generation quantum computing.

Risks and Challenges

[Your Company Name] faces potential risks from regulatory changes, particularly in data security and AI ethics. Additionally, intense competition in the tech industry and rapid technological changes pose ongoing challenges.

[Your Company Name]’s financial performance in [2055] results of a robust, forward-thinking company that is well-positioned for continued growth and innovation in the global technology industry.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Financial Assessment Template, a comprehensive tool for evaluating financial health. Fully customizable and editable in our Ai Editor Tool, this template enables businesses to conduct detailed assessments tailored to their needs. Streamline financial analysis processes and make informed decisions with ease. Simplify financial assessment and ensure accuracy with our user-friendly platform.