Free Finance Investment Proposal

I. Executive Summary

A. Project Overview:

Embark on a visionary journey with [Project Name], a premier real estate development nestled in [City, State]. This project seeks to redefine urban living by enhancing community connectivity and sustainability. Positioned for success, [Project Name] promises prime location, innovative design, and unparalleled returns.

B. Investment Highlights:

1. Prime Location

Nestled in the vibrant heart of [City], [Project Name] boasts a prime location that ensures not only accessibility but also a coveted address. Surrounded by key amenities, transportation hubs, and cultural attractions, this strategic positioning enhances the property's long-term value, making it an enticing choice for investors seeking sustained demand and desirability.

2. Market Demand

Aligned with current market trends, [Project Name] responds to the escalating demand for residential properties in [City]. Extensive market research underscores the robust demand for precisely the type of offering [Project Name] represents. This alignment with market needs positions the project for strong and sustained interest, providing a solid foundation for investment success.

3. Experienced Team

At the helm of [Project Name] is a seasoned and dynamic development team with a proven track record of successful projects, including:

a. [Skyview Residences]:

A luxury residential complex renowned for its architectural elegance and breathtaking views.

Completed ahead of schedule, setting a benchmark for timely project delivery.

b. [Metropolis Plaza]:

A thriving commercial hub that has become a landmark in [City].

Notable for attracting high-profile tenants and contributing significantly to the local economy.

4. Attractive Returns

Investors can anticipate an impressive return on investment with a projected [10%] ROI over the following timeline:

a. [Year 1 - 2]: Planning and Approval:

During this phase, we will focus on meticulous planning, obtaining necessary permits, and securing approvals.

Investors can expect initial groundwork to be laid, setting the stage for the active development phase.

b. [Year 3 - 4]: Construction and Development:

Groundbreaking will mark the commencement of construction activities.

Strategic project management aims to complete construction within this timeframe, ensuring timely delivery and cost-effectiveness.

c. [Year 5 - 7]: Marketing and Sales:

As construction nears completion, marketing efforts will intensify to showcase the project to potential buyers or tenants.

Sales and leasing initiatives will be in full swing during these years, generating revenue and ensuring a swift return on investment.

d. [Year 8 Onwards]: Ongoing Returns and Value Appreciation:

Post the initial development phase, investors can continue to enjoy returns through sales, leasing, and potential appreciation.

Our commitment to ongoing value creation ensures a steady stream of returns well into the future.

II. Business Description

A. Company Background:

Founded on a commitment to excellence, [Your Company Name] stands as a distinguished real estate development firm with a rich history of delivering transformative projects. Established in [2050], our company has consistently demonstrated a dedication to quality, innovation, and sustainable development practices. Over the years, we have earned a stellar reputation for our unwavering commitment to delivering projects that not only meet but exceed the expectations of our clients and investors.

B. Project Details:

[Project Name] represents the latest chapter in our legacy of excellence. As a residential and commercial development, it spans [50,000] square feet, embodying the principles that define [Your Company Name]. The project's architectural design reflects our commitment to aesthetic appeal and functionality, offering [300] meticulously designed to create a harmonious living or working environment.

C. Project Goals and Objectives:

Beyond the physical aspects, [Project Name] aligns with our broader vision to transform [City] with [Project Name], enhancing community living through sustainable and innovative development. We aim not just to construct buildings but to craft communities that inspire, innovate, and endure. By integrating sustainable practices and community-centric features, our goal is to contribute positively to the fabric of [City, State] and enhance the quality of life for its residents.

III. Market Analysis

A. Market Overview:

Situated in the cityscape of [City, State], the local real estate market is characterized by dynamic growth and sustained demand. Our thorough market overview reveals a landscape marked by population growth positioning [Project Name] at the forefront of a flourishing market poised for continued expansion.

B. Trends and Opportunities:

In analyzing current market trends, we've identified key opportunities for residential developments that cater to the evolving needs of modern living. Emerging trends such as remote work preferences present unique opportunities that [Project Name] is strategically poised to capitalize on, ensuring the project's relevance in a rapidly changing market.

C. Competitive Market:

An assessment of the competitive market reveals a demand-supply gap for upscale urban living spaces remains high in [City]. With limited offerings that align with the preferences of our target audience, [Project Name] is positioned to not only meet but exceed market expectations, establishing itself as a premier choice in the local real estate market.

D. Target Audience:

Our target audience comprises discerning individuals and families seeking smart living solutions. Through detailed market segmentation analysis, we've identified the specific needs and preferences of our target demographic, allowing us to tailor [Project Name] to meet and surpass their expectations.

E. Regulatory Environment:

Navigating the regulatory environment is crucial in any real estate endeavor. Our analysis indicates a favorable regulatory climate in [City, State], supported by a favorable zoning policy that encourages sustainable urban development, providing a stable foundation for the successful development and timely delivery of [Project Name].

IV. Financial Projections

A. Project Costs:

With meticulous financial planning, we estimate the total project cost for [Project Name] to be [$80,000,000 million]. This comprehensive figure includes:

Land Acquisition | $[10,000,000] |

Construction | |

Marketing | |

Permits and Contingency |

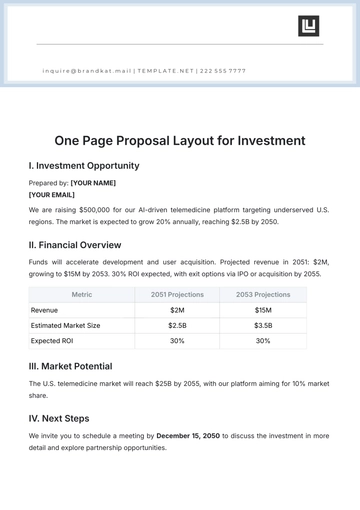

B. Revenue Projections:

The heart of our financial forecast lies in the revenue projections, where we anticipate generating [$80,000,000 million] in total. Leveraging the strategic positioning and unique selling points of [Project Name], we have developed a robust sales/leasing strategy that aligns with market demand, ensuring steady revenue streams throughout the project lifecycle.

C. Return on Investment (ROI):

Investors can confidently anticipate an attractive ROI of [40%] over the project’s timeline. Our projections factor in market fluctuations, cost variations, and unforeseen challenges, offering a conservative yet promising outlook for investors. The transparency of our financial modeling reinforces our commitment to delivering not just a project, but a lucrative investment opportunity.

D. Financing Request:

In line with our financial projections, we are seeking an investment of [$80 million] to realize the full potential of [Project Name]. These funds will be strategically allocated, with a significant portion dedicated to land acquisition and construction to expedite project commencement and mitigate potential delays.

E. Investment Structure:

The investment structure for [Project Name] is designed to be mutually beneficial. We offer options for equity, debt, or a joint venture, providing flexibility and tailored terms to suit the preferences of our investors. The accompanying documents comprehensively outline the terms and conditions, ensuring clarity and aligning the interests of all stakeholders.

V. Investment Details

A. Funding Request:

Our carefully calculated funding request of [$30 million] is intricately tied to the success of [Project Name]. This investment is pivotal for securing the prime location, covering construction costs, implementing an effective marketing strategy, obtaining necessary permits, and establishing a contingency fund. Each dollar invested is strategically allocated to ensure optimal resource utilization and to propel the project seamlessly through each development phase.

B. Investment Structure:

The investment structure for [Project Name] is crafted to align the interests of investors and the project's long-term success. Investors can choose from various structures, including equity, debt, or participation in a joint venture. The flexibility in our investment structure is designed to accommodate the preferences and risk tolerance of our diverse investor base, fostering a collaborative and mutually beneficial partnership.

C. Use of Funds:

Transparent and accountable fund utilization is paramount to our commitment to investor confidence. The breakdown of funds is as follows:

Land Acquisition | $[10,000,000] |

Construction | |

Marketing | |

Permits and Contingency |

D. Terms and Conditions:

The terms and conditions accompanying this proposal provide a comprehensive framework for our partnership. These include details on investor rights, project milestones, profit distribution mechanisms, and exit options. Our commitment to transparency extends to the terms and conditions, ensuring a clear understanding of the expectations and benefits associated with investing in [Project Name].

E. Risk Mitigation:

Acknowledging the inherent risks associated with real estate development, our investment strategy incorporates robust risk mitigation measures. These include contingency funds, thorough due diligence, and strategic diversification to buffer against unforeseen challenges. By proactively addressing potential risks, we aim to instill confidence in our investors and safeguard their interests throughout the project's lifecycle.

VI. Risk Assessment

A. Market Overview:

While [City, State] boasts a thriving real estate market, we recognize the inherent sensitivity to economic fluctuations, geopolitical events, and regulatory changes. Our risk assessment delves into potential market volatilities, offering contingency plans that enable us to adapt swiftly to shifting conditions. By actively monitoring market dynamics, we aim to position [Project Name] to withstand external influences and remain resilient in the face of unforeseen challenges.

B. Target Audience:

Understanding the preferences of our target demographic is crucial, and we acknowledge the dynamic nature of consumer preferences. To mitigate the risk of shifting trends, our marketing strategy incorporates ongoing market research and adaptability, allowing us to tailor our offerings to evolving demands. This proactive approach ensures that [Project Name] maintains its appeal and relevance to the ever-changing needs of our target audience.

C. Financial Projections:

The financial status is subject to uncertainties such as inflation, interest rate fluctuations, and unexpected cost escalations. Our financial projections undergo rigorous stress testing to account for potential deviations from the anticipated figures. Furthermore, our risk mitigation strategy includes a contingency fund designed to absorb unforeseen cost overruns, ensuring the financial resilience of [Project Name] throughout its development.

D. Return on Investment (ROI):

Investments inherently carry risks, and the projected ROI for [Project Name] is contingent on market conditions, economic variables, and successful project execution. Our risk assessment includes scenario analyses, sensitivity testing, and strategic diversification to safeguard investor returns. By transparently communicating potential risks and actively addressing them, we aim to foster investor confidence and ensure a stable path to realizing returns.

VII. Management Team

A. [Name] - CEO:

Bringing visionary leadership to [Your Company Name], [Name] guides the overall strategic direction and growth initiatives. With a successful track record in real estate development, [Name] oversees the executive decisions, ensuring the alignment of [Project Name] with the company's mission and values. Responsibilities include executive leadership, strategic planning, and maintaining key stakeholder relationships.

B. [Name] - COO:

As the Chief Operating Officer, [Name] is instrumental in translating strategic plans into actionable and efficient operational processes. Leveraging [their] expertise in project management, [Name] plays a pivotal role in coordinating the various facets of [Project Name]'s development, ensuring timelines are met, and resources are optimized.

C. [Name] - Chief Marketing Officer:

Heading our marketing efforts is [ Name], a seasoned professional with a proven track record in creating impactful marketing strategies. Responsible for promoting [Project Name], [Name] oversees the market positioning, branding, and customer engagement initiatives. Their role involves crafting compelling narratives that resonate with our target audience and drive demand.

D. [Name] - Chief Development Officer:

At the helm of our development endeavors is [Name], who brings a wealth of experience in real estate project execution. Responsible for overseeing the entire development lifecycle of [Project Name], [Name] ensures that construction meets quality standards, stays on schedule, and aligns with the architectural vision. Their attention to detail and commitment to excellence are pivotal in delivering a project that exceeds expectations.

E. [Name] - Chief Financial Officer:

Guiding our financial strategies is [Name], our Chief Financial Officer. With a strong background in finance and real estate investments, [Name] is responsible for financial planning, budgeting, and risk management. Their role is crucial in maintaining the financial health of [Project Name], ensuring optimal utilization of funds and providing transparent financial reporting to our investors.

VIII. Exit Strategy

A. Initial Public Offering (IPO):

A potential avenue for investors seeking a significant return on their investment is an Initial Public Offering (IPO). As [Project Name] progresses and establishes itself as a successful and scalable venture, we will evaluate the feasibility of going public. This strategic move provides an opportunity for investors to realize substantial gains by selling their shares on the public market.

B. Strategic Acquisition:

Another exit strategy involves positioning [Project Name] for a strategic acquisition by a key player in the real estate or related industry. We will actively explore partnerships and collaboration opportunities, creating an environment conducive to acquisition interest. This exit option not only provides investors with a timely and profitable exit but also ensures the seamless integration of [Project Name] into a larger network for sustained growth.

C. Private Sale or Equity Buyback:

For investors seeking a more direct and customizable exit, we propose the option of a private sale or equity buyback. This approach allows investors to negotiate a favorable agreement directly with [Your Company Name], providing flexibility and a quicker route to liquidity. We are committed to maintaining open communication and exploring mutually beneficial arrangements to accommodate individual investor preferences.

D. Dividends and Profit Distribution:

Throughout the development and operational phases, we are dedicated to delivering ongoing value to our investors through regular dividends and profit distributions. While this approach does not represent a complete exit, it offers investors a consistent stream of returns, providing liquidity and a tangible realization of the financial benefits associated with their investment in [Project Name].

IX. Conclusion

[Your Company Name] is excited to present [Project Name] as a compelling investment opportunity that blends strategic vision with proven expertise. Our Finance Investment Proposal outlines the robust market analysis, meticulous financial projections, and adaptive risk mitigation strategies that underpin the success of [Project Name]. With an experienced and dedicated management team at the helm, we are confident in our ability to deliver exceptional results.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your investment proposals with the Finance Investment Proposal Template by Template.net. This editable and customizable tool empowers you to craft compelling pitches for potential investors. With the Ai Editor Tool, tailor your proposals to suit various investment opportunities, ensuring professionalism and clarity in your financial presentations.

You may also like

- Research Proposal

- Proposal Request

- Project Proposal

- Grant Proposal

- Photography Proposal

- Job Proposal

- Budget Proposal

- Marketing Proposal

- Branding Proposal

- Advertising Proposal

- Sales Proposal

- Startup Proposal

- Event Proposal

- Creative Proposal

- Restaurant Proposal

- Blank Proposal

- One Page Proposal

- Proposal Report

- IT Proposal

- Non Profit Proposal

- Training Proposal

- Construction Proposal

- School Proposal

- Cleaning Proposal

- Contract Proposal

- HR Proposal

- Travel Agency Proposal

- Small Business Proposal

- Investment Proposal

- Bid Proposal

- Retail Business Proposal

- Sponsorship Proposal

- Academic Proposal

- Partnership Proposal

- Work Proposal

- Agency Proposal

- University Proposal

- Accounting Proposal

- Real Estate Proposal

- Hotel Proposal

- Product Proposal

- Advertising Agency Proposal

- Development Proposal

- Loan Proposal

- Website Proposal

- Nursing Home Proposal

- Financial Proposal

- Salon Proposal

- Freelancer Proposal

- Funding Proposal

- Work from Home Proposal

- Company Proposal

- Consulting Proposal

- Educational Proposal

- Construction Bid Proposal

- Interior Design Proposal

- New Product Proposal

- Sports Proposal

- Corporate Proposal

- Food Proposal

- Property Proposal

- Maintenance Proposal

- Purchase Proposal

- Rental Proposal

- Recruitment Proposal

- Social Media Proposal

- Travel Proposal

- Trip Proposal

- Software Proposal

- Conference Proposal

- Graphic Design Proposal

- Law Firm Proposal

- Medical Proposal

- Music Proposal

- Pricing Proposal

- SEO Proposal

- Strategy Proposal

- Technical Proposal

- Coaching Proposal

- Ecommerce Proposal

- Fundraising Proposal

- Landscaping Proposal

- Charity Proposal

- Contractor Proposal

- Exhibition Proposal

- Art Proposal

- Mobile Proposal

- Equipment Proposal

- Student Proposal

- Engineering Proposal

- Business Proposal