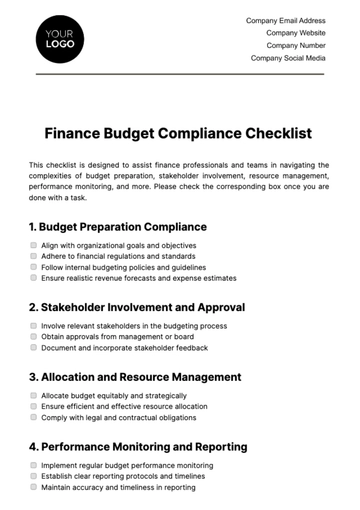

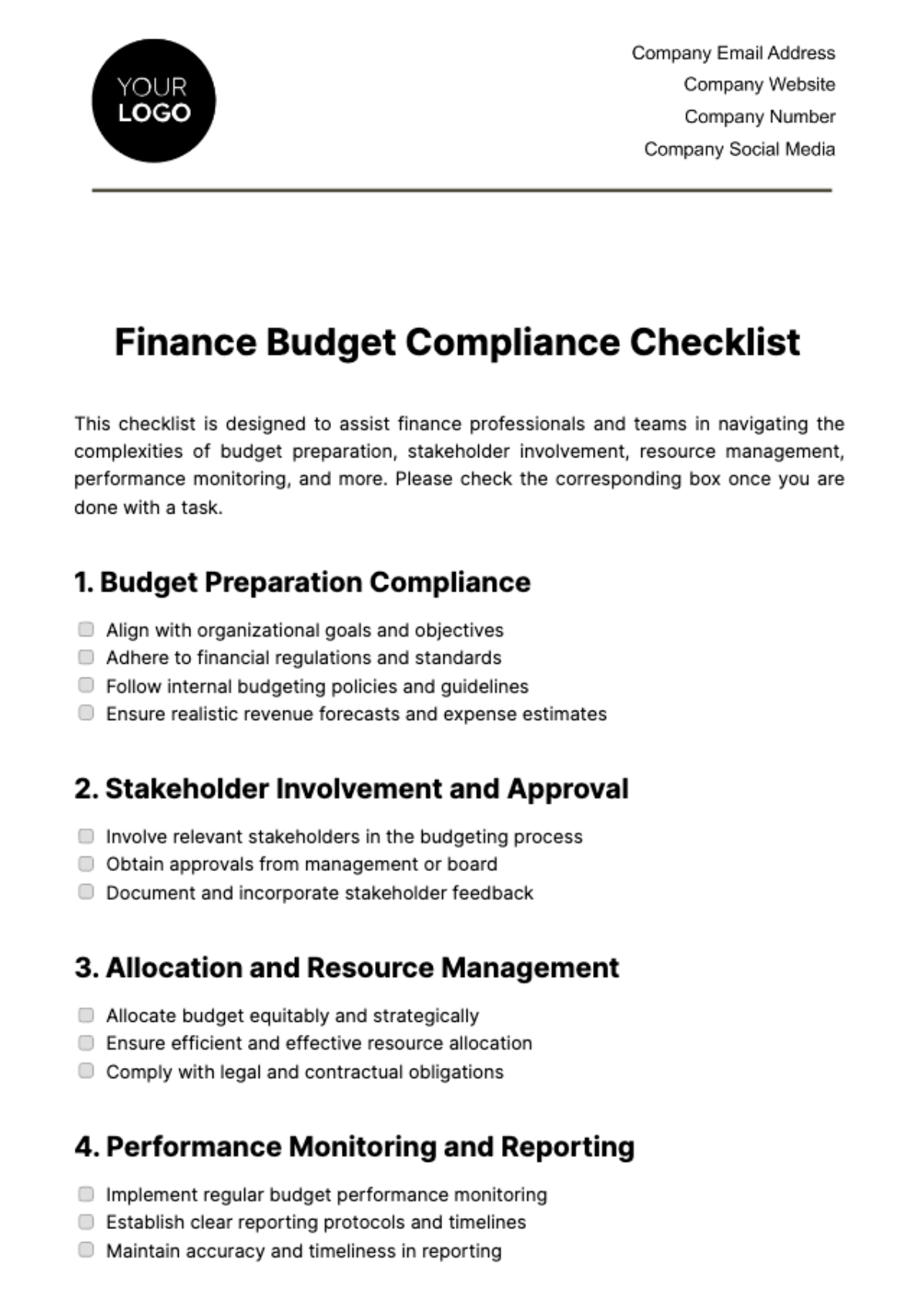

Free Finance Budget Compliance Checklist

This checklist is designed to assist finance professionals and teams in navigating the complexities of budget preparation, stakeholder involvement, resource management, performance monitoring, and more. Please check the corresponding box once you are done with a task.

1. Budget Preparation Compliance

Align with organizational goals and objectives

Adhere to financial regulations and standards

Follow internal budgeting policies and guidelines

Ensure realistic revenue forecasts and expense estimates

2. Stakeholder Involvement and Approval

Involve relevant stakeholders in the budgeting process

Obtain approvals from management or board

Document and incorporate stakeholder feedback

3. Allocation and Resource Management

Allocate budget equitably and strategically

Ensure efficient and effective resource allocation

Comply with legal and contractual obligations

4. Performance Monitoring and Reporting

Implement regular budget performance monitoring

Establish clear reporting protocols and timelines

Maintain accuracy and timeliness in reporting

5. Variance Analysis

Compare actual vs. budgeted figures regularly

Investigate and document variances

Implement corrective actions as needed

6. Internal Controls and Audit Compliance

Ensure effective internal controls

Comply with audit requirements

Review and update controls regularly

7. Risk Management

Identify and assess financial risks

Implement risk mitigation strategies

Reassess risks and adjust budget

8. Policy and Regulation Updates

Stay updated on financial regulations

Update processes and documentation

Train staff on new compliance requirements

9. Technology and Data Management

Use appropriate financial planning tools

Ensure data security and confidentiality

Maintain data backups and integrity

10. Continuous Improvement

Gather feedback on budgeting processes

Evaluate and enhance budgeting effectiveness

Implement process improvements

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Finance Budget Compliance Checklist Template, the essential tool for ensuring financial adherence and accuracy. Fully customizable and editable in our Ai Editor Tool, this template empowers businesses to streamline budget monitoring processes. With detailed checkpoints and user-friendly features, maintain compliance effortlessly and optimize financial performance. Simplify budget management and enhance financial control with our comprehensive checklist template.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist