Free Financial Planning Journal

I. Introduction

Welcome to your Financial Planning Journal, a bespoke roadmap crafted to guide you through the intricate landscape of personal finance. This document serves as a compass, assisting you in navigating financial complexities while empowering you to make informed decisions aligned with your unique aspirations. Our collaborative journey begins with a comprehensive exploration of your financial landscape, laying the foundation for a strategic and tailored approach to achieving your short-term and long-term financial objectives. Together, we will embark on a path that combines thoughtful planning, prudent investment strategies, and continuous adaptation to ensure your financial success.

II. Personal Information

A. Client's Personal Details

Name: | [Client’s Name] |

Age: | [Client’s Age] |

Contact Information: | [Client’s Contact Details] |

Spouse: | [Name of Client’s Spouse] |

Children: | [Name of the Child/Age] |

B. Current Financial Situation

Income Sources:

Annual Salary: | $[0] |

Additional Income: | Rental Property ($[0]/year) |

Expenses and Lifestyle:

Monthly Household Expenses: | $[0] |

Debt Payments: | $[0]/month (Car Loan, Credit Cards) |

III. Financial Goals

A. Short-Term Goals (1-3 years)

In the next 1-3 years, our primary focus is on establishing a robust emergency fund equivalent to three months of living expenses. This safety net provides financial resilience, ensuring you're well-prepared for any unforeseen circumstances and can navigate unexpected challenges with confidence.

B. Medium-Term Goals (3-5 years)

Over the next 3-5 years, your medium-term objectives include saving for a down payment on a family home. We will delve into mortgage options, explore potential tax advantages, and craft a savings strategy that aligns with your lifestyle while moving you closer to the milestone of homeownership.

C. Long-Term Goals (5+ years)

Looking ahead to the next 5 years and beyond, our long-term goals encompass crafting a comprehensive retirement plan. This involves a detailed analysis of your retirement income needs, exploration of Social Security and pension benefits, and the implementation of a savings strategy tailored to secure a comfortable retirement.

IV. Risk Assessment

A. Risk Tolerance

After conducting a thorough risk assessment, it's evident that you possess a moderate risk tolerance. This means we can strategically balance your investment portfolio to optimize returns while ensuring a level of risk that aligns with your comfort zone.

B. Risk Capacity

Considering your stable income and financial situation, your risk capacity is robust. This provides us with the flexibility to explore investment opportunities that may offer higher potential returns in line with your financial goals.

C. Risk Management Strategies

To mitigate risks effectively, we will implement a diversified investment strategy. This involves spreading your investments across various asset classes, minimizing the impact of market fluctuations on your overall portfolio.

V. Investment Strategy

A. Asset Allocation

Our recommended asset allocation strategy involves a balanced mix of [0]% equities, [0]% bonds, and [0]% cash. This diversified approach aims to optimize returns while managing the impact of market volatility.

B. Investment Vehicles

For your investment portfolio, we propose a combination of low-cost index funds and individual stocks. This blend provides a strategic balance between stable, broad-market exposure and the potential for targeted growth.

C. Investment Timeline

Aligning with your financial goals, our investment timeline will be tailored to the specific objectives of each goal. Short-term goals will be supported by more conservative investments, while a long-term focus allows for a more growth-oriented approach.

VI Retirement Planning

A. Retirement Income Needs

To ascertain your retirement income needs, we will conduct a comprehensive analysis of your current expenses, factoring in inflation and anticipated lifestyle changes. This detailed examination will enable us to tailor a retirement plan that ensures financial security and supports the lifestyle you envision during your retirement years.

B. Social Security and Pension Analysis

Our approach involves a meticulous examination of your Social Security benefits and any existing pension plans. By optimizing these income streams, we aim to maximize your overall retirement income, providing a stable financial foundation for your post-employment years.

C. Retirement Savings Strategies

To secure a comfortable retirement, we will develop a savings strategy that involves maximizing contributions to tax-advantaged accounts such as your 401(k) and Roth IRA. This proactive approach ensures tax efficiency while building a robust retirement nest egg.

VII. Tax Planning

A. Current Tax Situation

A detailed assessment of your current tax situation will guide our tax planning strategies. By identifying potential deductions, tax credits, and optimizing your overall tax structure, we aim to minimize your tax liability and enhance your after-tax returns.

B. Tax-Efficient Investment Strategies

Our investment strategy will prioritize tax efficiency by incorporating tax-sensitive investment vehicles. This approach seeks to minimize capital gains taxes and optimize returns within the context of your overall financial plan.

C. Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged accounts, including Health Savings Accounts (HSAs) and Individual Retirement Accounts (IRAs), will be a central element of your tax planning. This strategic use of tax-advantaged accounts aims to enhance your overall financial well-being.

VIII. Estate Planning

A. Will and Testament

Crafting a comprehensive will and testament involves a meticulous discussion to understand your wishes for asset distribution, guardianship arrangements for dependents, and other critical considerations. This legal document forms the cornerstone of your estate plan.

B. Power of Attorney

Assigning a durable power of attorney for financial and healthcare decisions ensures that your wishes are respected and your affairs are managed according to your preferences, especially in unforeseen circumstances.

C. Trusts

For certain assets and specific goals, establishing trusts will be explored. Trusts offer a flexible and efficient means to protect and distribute assets in line with your unique estate planning objectives.

D. Beneficiary Designations

Regularly reviewing and updating beneficiary designations on accounts ensures that your assets are distributed according to your wishes. This proactive measure is crucial for maintaining alignment with your evolving estate planning goals.

IX. Insurance Planning

A. Life Insurance

A comprehensive review of your life insurance coverage will involve assessing your family's financial needs in the event of unforeseen circumstances. We will explore the adequacy of your coverage, considering factors such as outstanding debts, income replacement, and your family's long-term financial well-being.

B. Health Insurance

Our analysis of health insurance coverage will focus on ensuring you have comprehensive and cost-effective protection. We will explore different health insurance options, considering factors such as coverage limits, deductibles, and any supplementary coverage needed for you and your family.

C. Disability Insurance

Ensuring adequate disability insurance coverage is paramount. This analysis will involve assessing your ability to maintain financial stability in the event of a disability, safeguarding against potential disruptions to your income and overall financial plan.

D. Long-Term Care Insurance

As part of a holistic approach to insurance planning, we will explore long-term care insurance options. This consideration aims to protect your financial well-being in later years, providing resources for potential healthcare needs without depleting your accumulated assets.

X. Monitoring and Review

A. Regular Portfolio Review

Scheduled periodic reviews of your investment portfolio will involve a comprehensive analysis of performance, risk exposure, and alignment with your financial goals. Regular adjustments will be made to capitalize on opportunities and address any changes in market conditions.

B. Adjustments to Financial Plan

As life circumstances evolve, we will conduct regular reassessments of your financial plan. Adjustments will be made to accommodate changes in income, expenses, and other factors, ensuring your financial strategy remains agile and responsive.

C. Reassessment of Goals and Objectives

Annual reviews will include a thorough reassessment of your financial goals and objectives. This process allows us to align your financial plan with evolving life priorities, ensuring that your personalized strategy continues to reflect your aspirations and values.

XI. Conclusion

A. Summary of Financial Plan

In summarizing your comprehensive financial plan, we acknowledge the alignment of your short-term and long-term goals with a tailored strategy. This summary encapsulates the meticulous analysis undertaken to optimize your financial well-being, encompassing prudent investment choices, tax-efficient planning, and a robust risk management approach. By distilling complex financial concepts into actionable steps, this summary aims to provide you with a clear and concise overview of your path to financial success.

B. Next Steps and Action Items

Outlined below are specific action items and recommendations derived from our collaborative analysis. These actionable steps serve as the foundation for your journey toward financial objectives. From implementing strategic investment adjustments to initiating tax planning measures, each action item is crafted with your unique circumstances in mind, ensuring a proactive and dynamic approach to achieving your financial aspirations.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

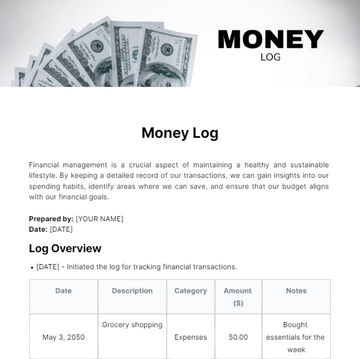

Enhance your financial planning journey with the Financial Planning Journal Template from Template.net. This editable and customizable journal empowers users to track expenses, set savings goals, and monitor investments. With the Ai Editor Tool, personalize your journal to suit your unique financial goals and preferences, making it your indispensable companion for fiscal success.