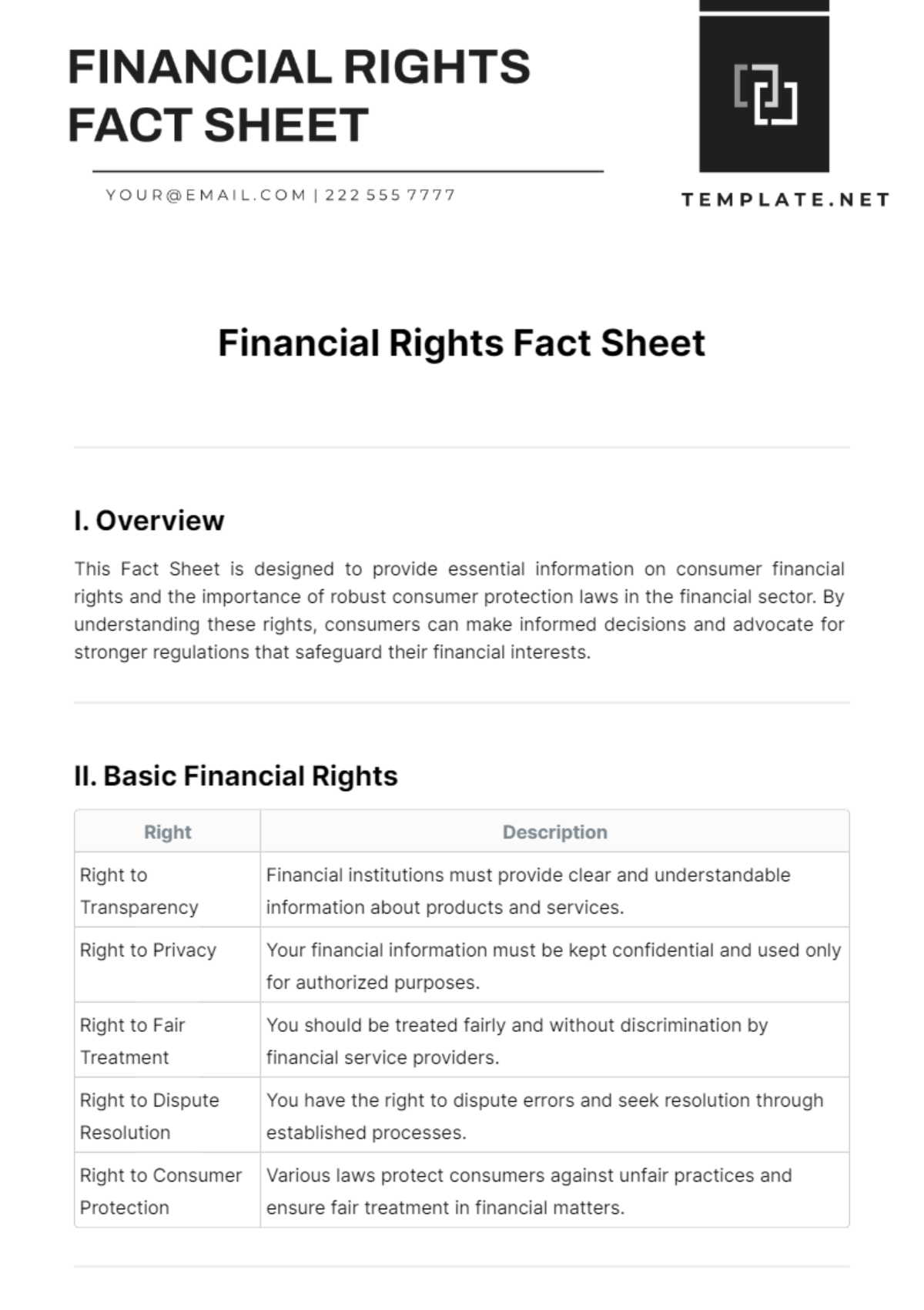

Free Financial Rights Fact Sheet

I. Overview

This Fact Sheet is designed to provide essential information on consumer financial rights and the importance of robust consumer protection laws in the financial sector. By understanding these rights, consumers can make informed decisions and advocate for stronger regulations that safeguard their financial interests.

II. Basic Financial Rights

Right | Description |

|---|---|

Right to Transparency | Financial institutions must provide clear and understandable information about products and services. |

Right to Privacy | Your financial information must be kept confidential and used only for authorized purposes. |

Right to Fair Treatment | You should be treated fairly and without discrimination by financial service providers. |

Right to Dispute Resolution | You have the right to dispute errors and seek resolution through established processes. |

Right to Consumer Protection | Various laws protect consumers against unfair practices and ensure fair treatment in financial matters. |

III. Importance of Strong Consumer Protection Laws

Prevent Exploitation: Robust laws deter financial institutions from engaging in exploitative practices that harm consumers.

Promote Fair Competition: Fair regulations ensure a level playing field and encourage healthy competition, benefiting consumers.

Enhance Consumer Confidence: Strong laws build trust in the financial system, encouraging consumer participation and economic growth.

Protect Vulnerable Consumers: Laws can safeguard vulnerable groups from predatory lending and other financial abuses.

IV. Policy Advocacy for Stronger Consumer Protection Laws

A. Objectives

Raise Awareness: Educate policymakers and the public about the importance of consumer protection in financial transactions.

Advocate for Legal Reforms: Lobby for legislative changes that strengthen consumer rights and increase accountability in the financial sector.

Collaborate with Stakeholders: Work with regulatory bodies, consumer groups, and industry stakeholders to draft and implement effective regulations.

B. Strategies

Research and Analysis: Conduct studies and gather data to support the need for stronger consumer protection laws.

Engagement and Outreach: Organize campaigns, workshops, and seminars to engage stakeholders and garner public support.

Policy Recommendations: Develop clear, actionable policy recommendations based on best practices and international standards.

V. Conclusion

It is imperative to advocate for stronger consumer protection laws in the financial sector to ensure fairness, transparency, and accountability. By empowering consumers and advocating for robust regulations, we can foster a more equitable and trustworthy financial environment.

For more information or assistance, please contact [YOUR COMPANY NAME] at [YOUR COMPANY NUMBER].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

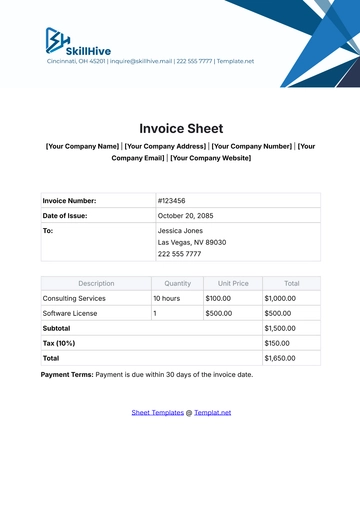

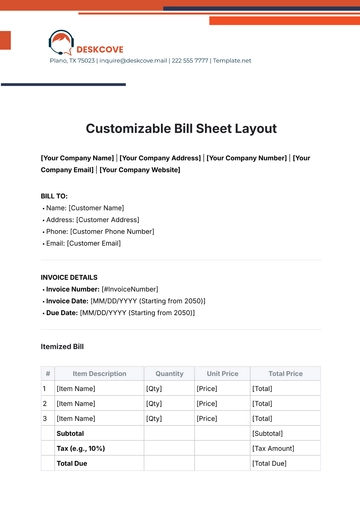

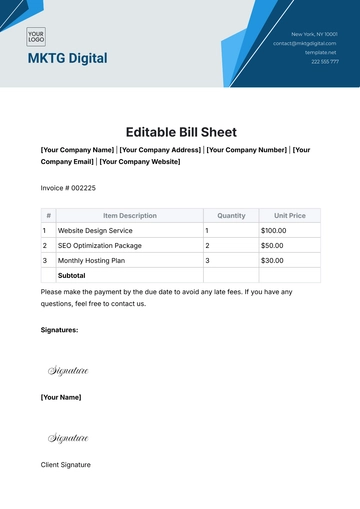

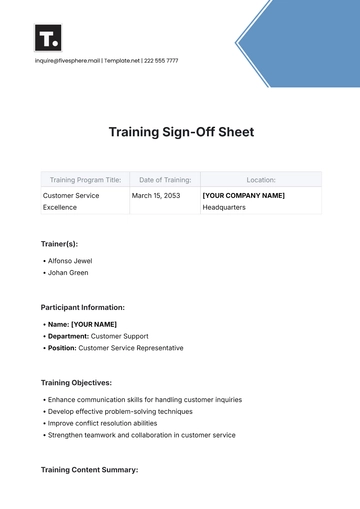

Explore the Financial Rights Fact Sheet Template on Template.net for comprehensive guidance on financial empowerment. This editable and customizable template simplifies information dissemination, enabling tailored content creation. Compatible with our Ai Editor Tool, personalize your fact sheets effortlessly. Streamline your advocacy efforts with this user-friendly template, ensuring clear and accessible education on financial rights and responsibilities.

You may also like

- Attendance Sheet

- Work Sheet

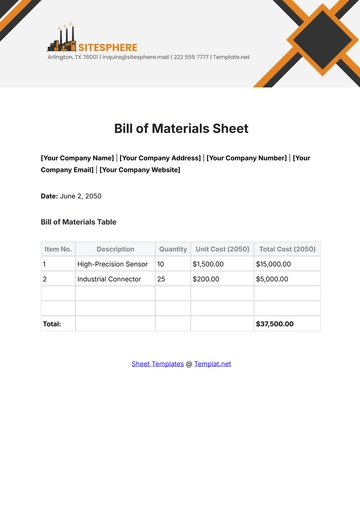

- Sheet Cost

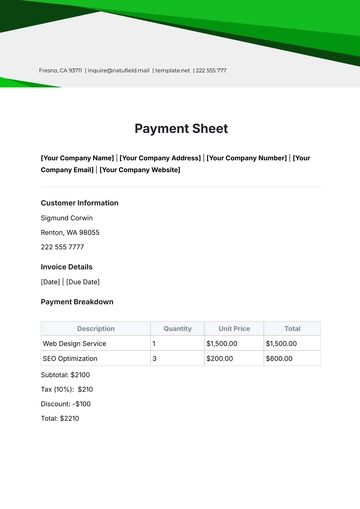

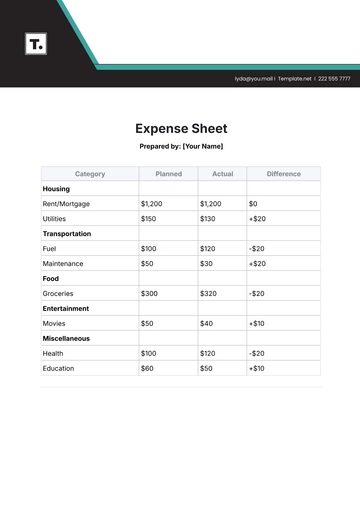

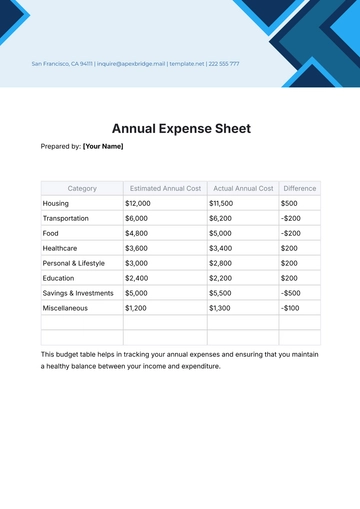

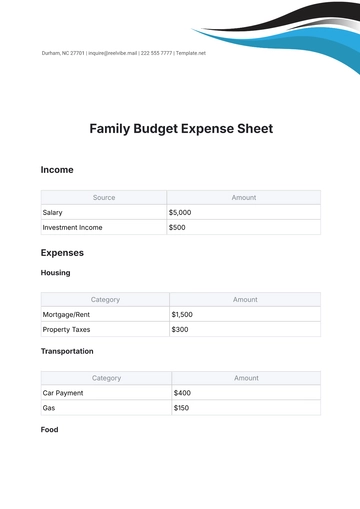

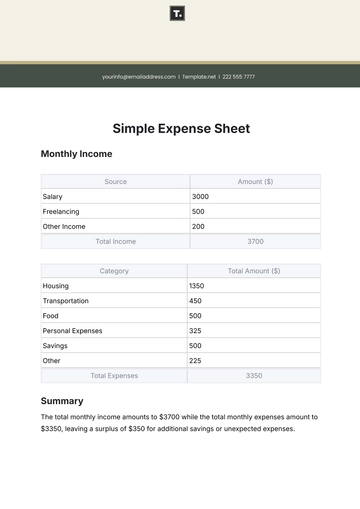

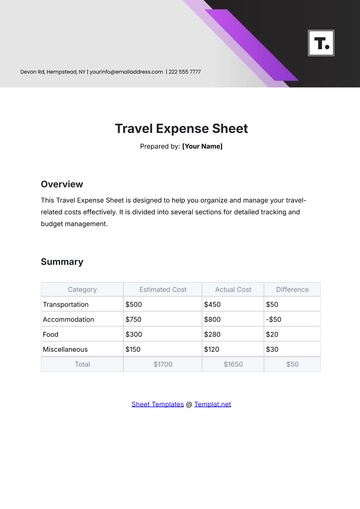

- Expense Sheet

- Tracker Sheet

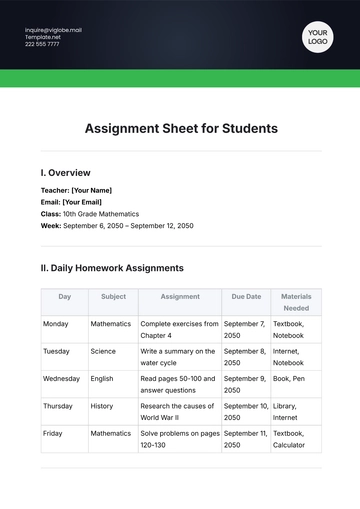

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

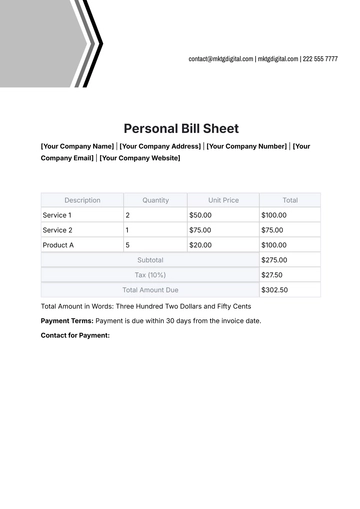

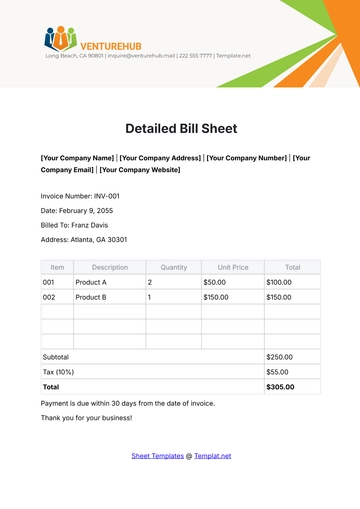

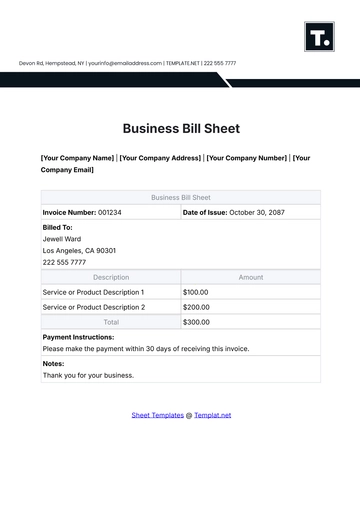

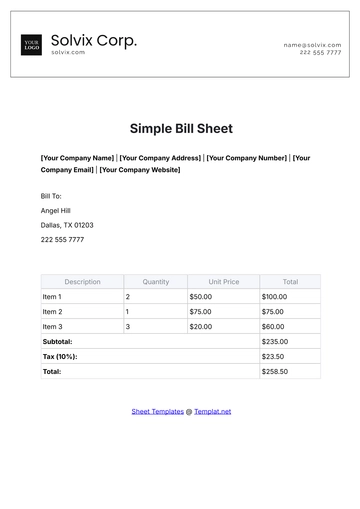

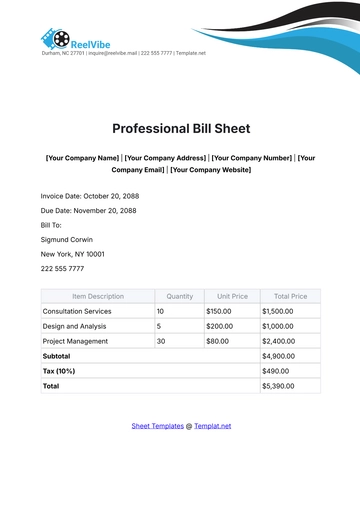

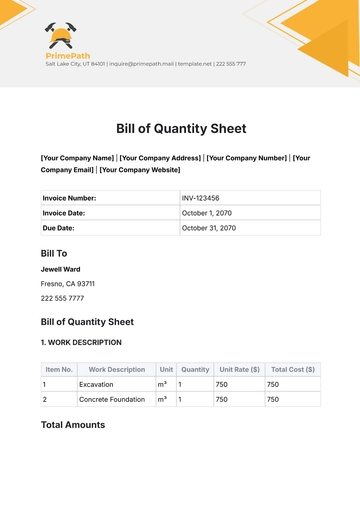

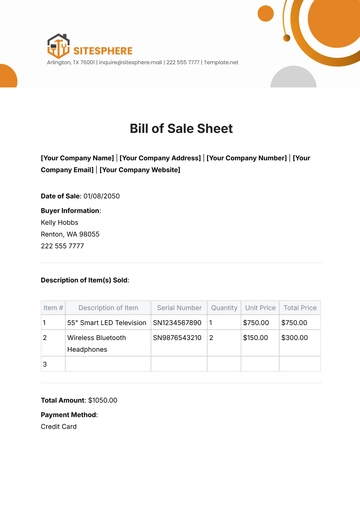

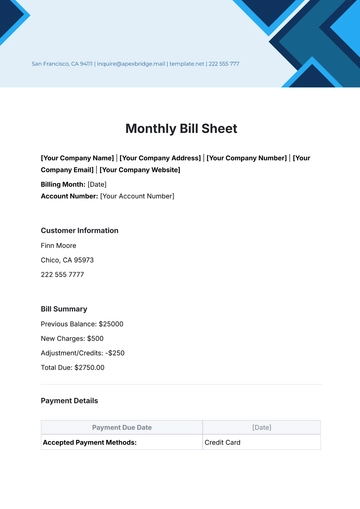

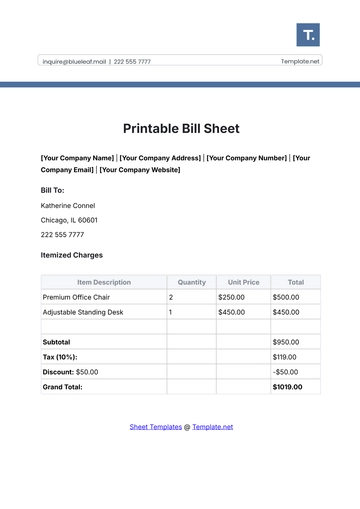

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

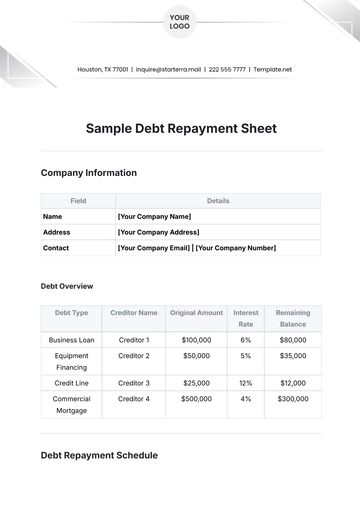

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

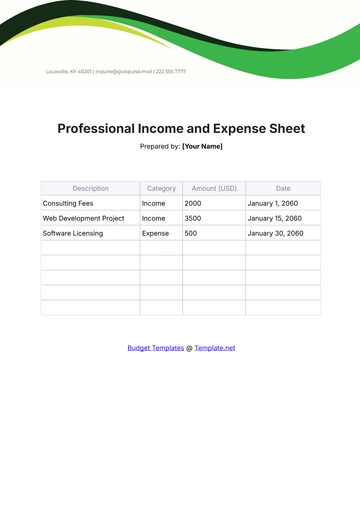

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

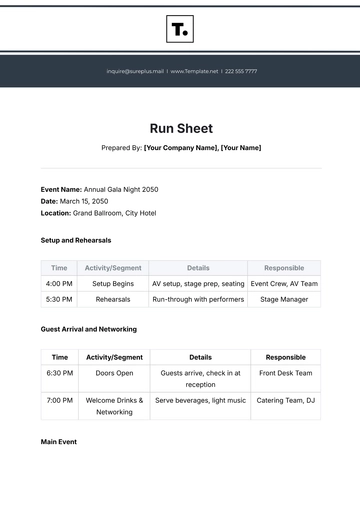

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet