Free Student Loan Fact Sheet

I. Introduction

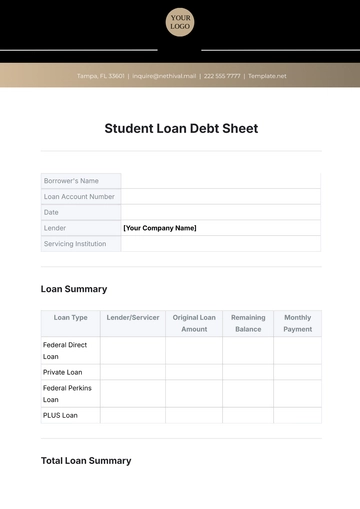

This fact sheet provides essential information regarding [Your Name]'s Federal Direct Subsidized Loan, including loan details, repayment information, loan terms, and available repayment options. It also offers contact details for the loan servicer and additional resources for managing student loans effectively.

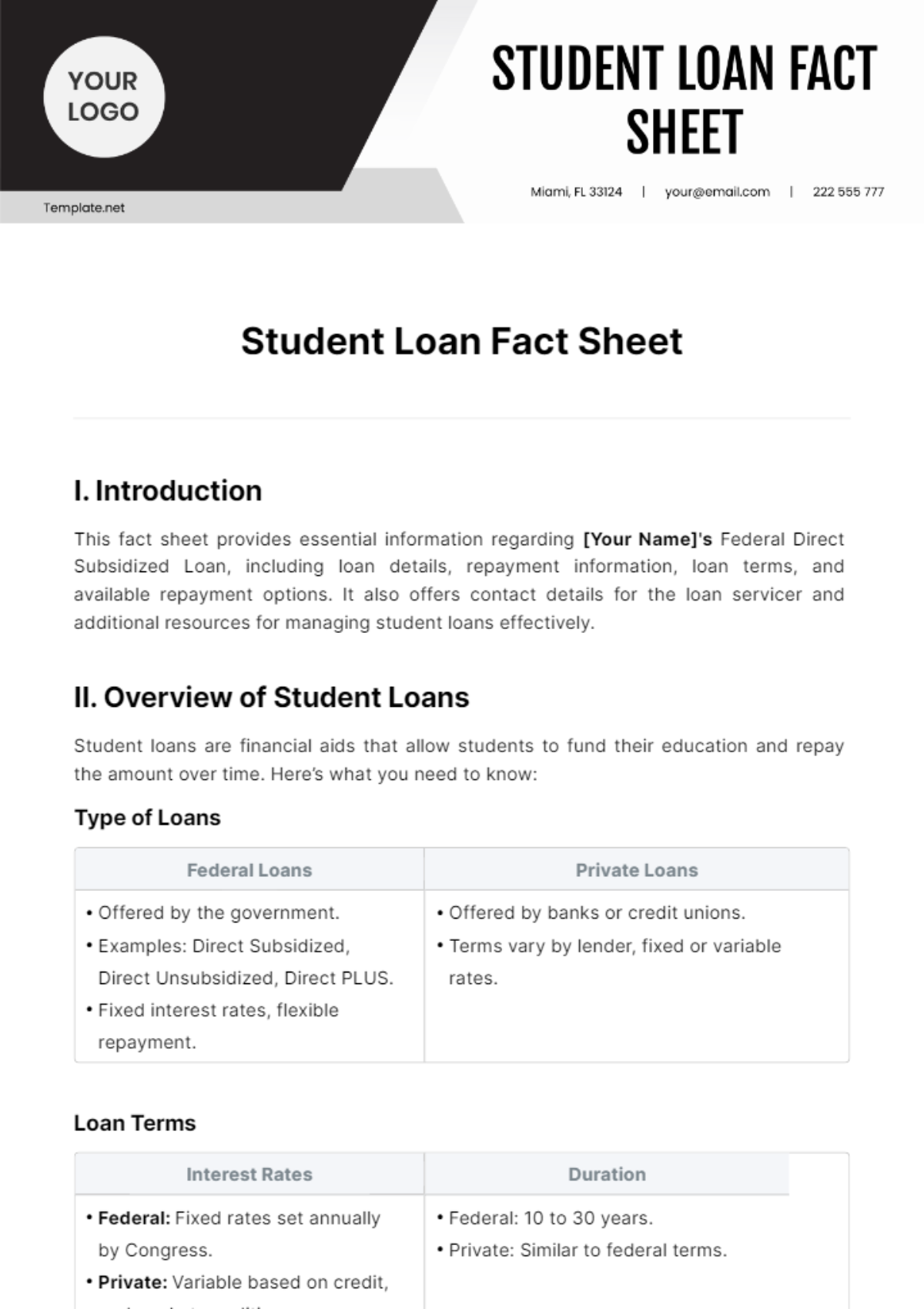

II. Overview of Student Loans

Student loans are financial aids that allow students to fund their education and repay the amount over time. Here’s what you need to know:

Type of Loans

Federal Loans | Private Loans |

|---|---|

|

|

Loan Terms

Interest Rates | Duration |

|---|---|

|

|

Eligibility Criteria

Federal Loans | Private Loans |

|---|---|

|

|

Application Process

Federal Loans | Private Loans |

|---|---|

|

|

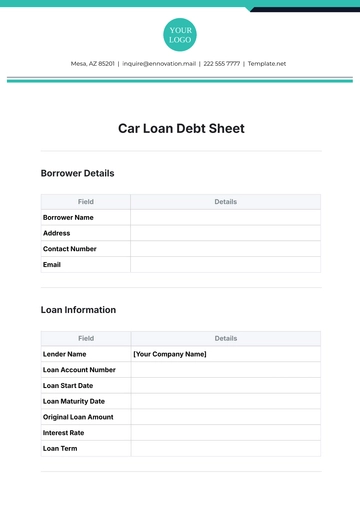

III. Borrower Information

Name: [Your Name]

Student ID: [Your Student ID]

Contact Information:

Address: [Your Address]

Phone: [Your Phone Number]

Email: [Your Email ]

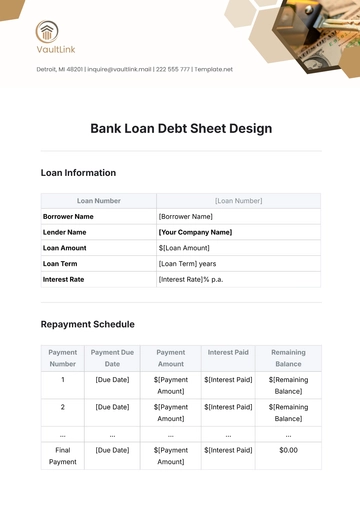

IV. Loan Details

Loan Type: Federal Direct Subsidized Loan

Loan Amount: $10,000

Interest Rate: 3.5%

Loan Disbursement Date: August 15, 2050

Loan Term: 10 years

V. Repayment Options

Several repayment options are available to manage your student loan effectively. These options include:

Standard Repayment Plan: Fixed monthly payments over 10 years covering both principal and interest.

Graduated Repayment Plan: Payments start low and increase every two years, suitable for expected income growth.

Income-Driven Repayment Plans: Payments based on income, family size, and loan amount; examples are IBR, PAYE, and REPAYE.

Loan Forgiveness Programs: Forgives remaining balances after meeting criteria; examples include PSLF, Teacher Loan Forgiveness, and Income-Driven Plan Forgiveness.

VI. Responsibilities of the Borrower

As a borrower, it is crucial to understand and fulfill your responsibilities:

Monthly Payment Submission: Submit monthly payments to the lender on time to avoid penalties.

Notifying Lender of Changes: Updating the lender about address or enrollment changes promptly.

Maintaining Eligibility: Meeting academic requirements to keep receiving financial aid.

VII. Additional Resources

Financial Aid Office: [Your School's Financial Aid Office Contact Information]

Loan Counseling Services: [Counseling Service Name and Contact Information]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Need to inform students about loans? Template.net offers an editable Student Loan Fact Sheet Template. Customizable with our Ai Editor Tool, it simplifies complex loan terms, repayment options, and eligibility criteria and empowers students with clear and concise information to make informed financial decisions and plan their educational journey effectively.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

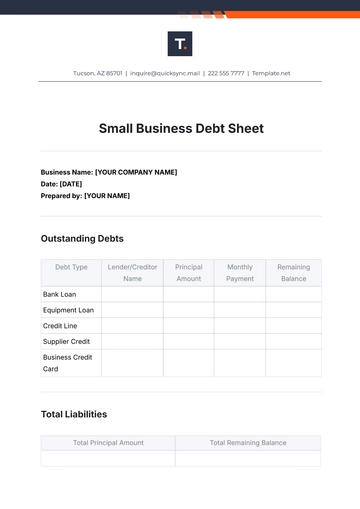

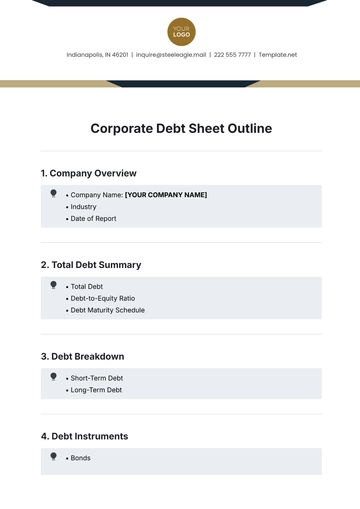

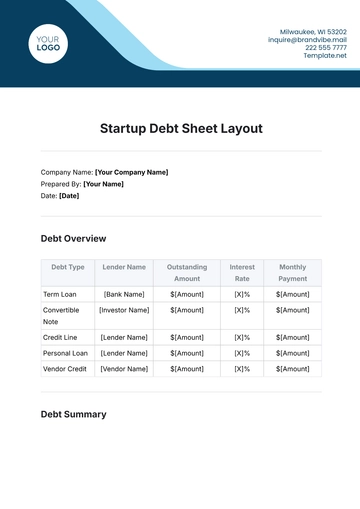

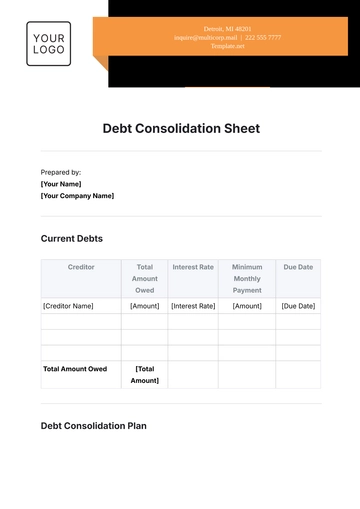

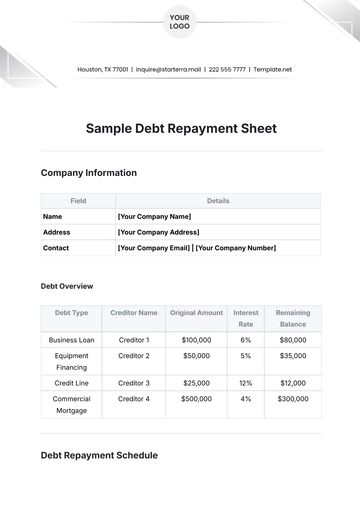

- Debt Spreadsheet

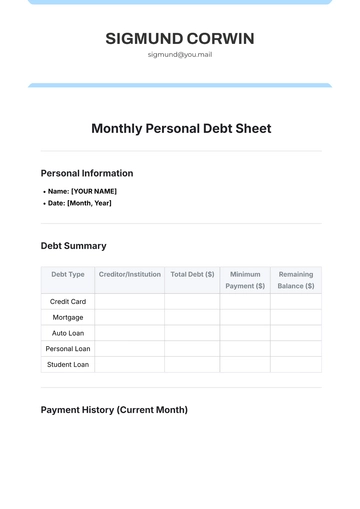

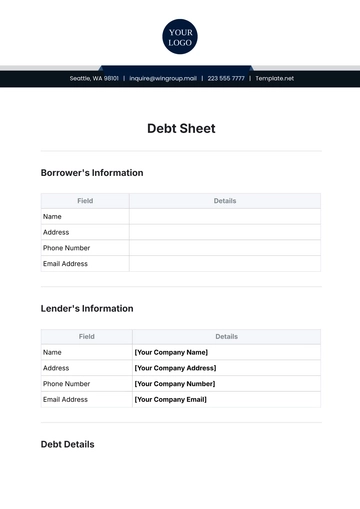

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet