Free Financial Budget Portfolio

Executive Summary

This Financial Budget Portfolio, meticulously prepared for [Your Company Name], provides a comprehensive overview of the financial strategy and projections for the upcoming fiscal year. The document is structured to give stakeholders a clear understanding of the company's financial direction, incorporating detailed forecasts, budgets, and strategic financial planning.

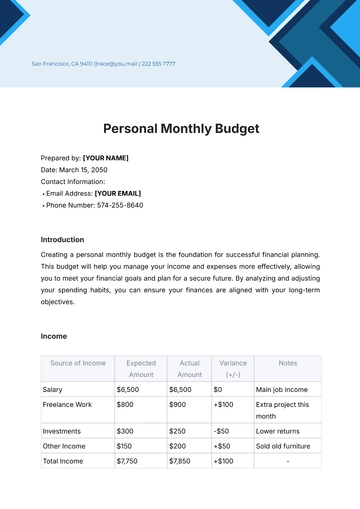

The portfolio commences with an Income Statement Forecast, meticulously projecting the company's revenue, cost of goods sold, gross profit, and net income across each quarter. This forecast is grounded in realistic assumptions about market conditions and internal efficiency measures, enabling stakeholders to gauge expected profitability and financial health.

Next, the Cash Flow Forecast delves into the liquidity aspect, detailing the anticipated cash inflows and outflows. This section is crucial for understanding the company's operational efficiency and its ability to sustain and grow its operations without liquidity constraints.

A Balance Sheet Forecast follows, offering a snapshot of the company's financial position at year-end. It includes current and fixed assets, liabilities, and shareholder equity, providing a comprehensive view of the company's financial stability and capital structure.

Critical to the company's growth is the Capital Expenditure Budget, which outlines planned investments in equipment, facilities, and technology, essential for long-term growth and competitiveness. This section aligns with the company's strategic objectives, ensuring resources are efficiently allocated towards value-creating assets.

The Sales and Revenue Forecast, alongside the Marketing and Advertising Budget, illustrate the company's strategies for generating revenue and brand visibility. These sections detail expected sales from various products and services and the budget allocated for marketing and advertising efforts.

Operating and Human Resources Budgets provide insights into the company's operational and personnel expenses, ensuring that the day-to-day activities align with the overall financial strategy.

Finally, the Risk Analysis and Mitigation Plan identifies potential financial and operational risks, offering strategies to mitigate these risks, thus safeguarding the company's interests.

Income Statement

This serves as a roadmap, outlining our financial performance expectations for the upcoming fiscal year. The income statement, often referred to as the profit and loss statement, is a key financial document that reflects the company's profitability and financial health over a specific period. It provides insights into our revenue streams, cost structures, and ultimately, the net income we anticipate generating. This forecast will be instrumental for stakeholders, investors, and management in assessing the company's financial performance and making informed strategic decisions.

Key Assumptions:

Revenue Growth: We assume a steady quarterly increase in revenue, reflecting our strategic marketing efforts and market expansion.

Cost of Goods Sold (COGS): The COGS is projected to rise in proportion to revenue, maintaining a consistent gross margin.

Expense Management: Operating expenses are expected to increase marginally due to inflation and expansion but will be closely monitored for efficiency.

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) are anticipated to follow a positive trajectory, indicating healthy operational profitability.

Interest Expense: Interest expense remains constant, reflecting stable financing conditions and existing loan agreements.

Depreciation: Depreciation is based on the systematic allocation of the cost of tangible assets over their useful lives and is projected to remain consistent.

Tax Rate: The income tax calculation is based on the prevailing corporate tax rate and the company's estimated pre-tax income.

Net Income: The net income figure is derived after accounting for all expenses, interest, depreciation, and taxes, reflecting the company's actual profitability.

Cash Flow

Cash Flow is a pivotal financial tool that outlines the expected flow of cash in and out of the business over the upcoming fiscal year. This forecast is essential for understanding the liquidity position of the company, enabling effective cash management, and ensuring that the business has sufficient cash to meet its obligations. It also assists in identifying periods of cash surplus or shortage, thus facilitating better financial planning and decision-making.

Key Assumptions:

Opening Balance: The starting cash balance for each quarter is based on the closing balance of the previous quarter.

Cash Inflows: This includes all expected cash receipts from operations, investments, and financing activities. The projection assumes a consistent increase in inflows due to growth in sales and other income sources.

Cash Outflows: All anticipated cash payments, including operating expenses, capital expenditures, and debt payments, are accounted for. The increase in outflows is aligned with the expected growth of the business.

Closing Balance: The closing balance for each quarter is calculated by adding the cash inflows to the opening balance and subtracting the cash outflows. This balance is carried over as the opening balance for the next quarter.

Seasonal Variations: The forecast takes into account any seasonal fluctuations in business operations that may affect cash flows.

Capital Expenditures: Significant investments in assets or technology, planned for specific quarters, are incorporated into the cash outflow projections.

Debt and Financing Activities: Any known or anticipated changes in debt levels or equity financing are factored into the cash flow projections.

Contingency Funds: Assumptions include maintaining a contingency reserve to manage unforeseen expenses or shortfalls in cash inflows.

Balance Sheet

The balance sheet is a crucial financial statement that provides a snapshot of the company's financial position at a specific point in time. It reflects what the company owns (assets) and owes (liabilities), as well as the shareholders' equity. This forecast is essential for stakeholders to assess the financial health and stability of the business, understand its asset base, and evaluate its capital structure. It also aids in strategic decision-making, particularly in areas of asset management, debt management, and equity financing.

Asset Valuation: The assets are valued based on their current market value or the historical cost less depreciation, as applicable.

Current vs. Fixed Assets: Current assets include cash and other resources that are expected to be converted to cash within a year, whereas fixed assets represent long-term investments.

Liability Management: The balance sheet reflects both current liabilities, due within one year, and long-term liabilities, due in more than one year.

Shareholder's Equity: This represents the owner's interest in the company, calculated as the difference between total assets and total liabilities.

Liquidity and Solvency: The balance sheet provides insights into the company's liquidity (ability to meet short-term obligations) and solvency (ability to meet long-term obligations).

Financial Ratios: Important ratios such as the current ratio, debt-to-equity ratio, and return on equity can be derived from the balance sheet, offering deeper insights into the company's financial position.

The Balance Sheet Forecast is a vital tool for evaluating the company's financial standing at a specific point in time. It is essential for making informed decisions regarding investments, financing, and operational strategies. The data will be regularly reviewed and updated to reflect the changing financial circumstances of [Your Company Name].

Capital Expenditure Budget

Capital Expenditure refers to the funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, technology, or equipment. This budget is crucial for strategic planning as it directly impacts the company's operational capacity, efficiency, and long-term growth. It is a reflection of the company's commitment to investing in its future and maintaining a competitive edge in the market.

Equipment: The allocation for equipment includes purchasing new machinery and upgrading existing tools vital for improving production efficiency and product quality.

Facilities: This significant investment is aimed at expanding the physical space to accommodate growing operations, enhancing work environments, or renovating existing facilities for efficiency improvements.

Technology: Investment in technology is critical to stay abreast with digital advancements. This includes upgrading software, hardware, and implementing new IT systems to streamline operations and improve cybersecurity.

Other CapEx: This category covers miscellaneous capital expenditures such as investments in research and development, acquisition of intellectual property, or other strategic assets.

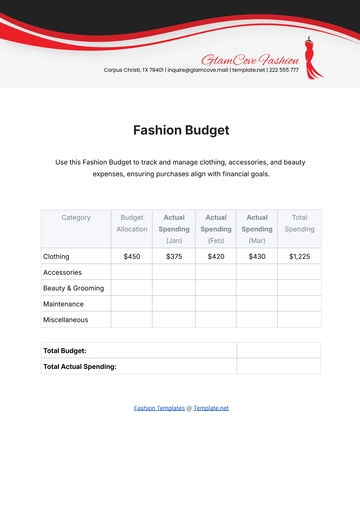

Sales and Revenue Forecast

This forecast is pivotal in outlining the expected financial performance based on the sales of products and services. It provides a clear picture of the revenue generation capabilities of the company and is crucial for setting realistic financial goals, aligning business strategies, and making informed decisions regarding resource allocation, marketing efforts, and product development.

Sales and Revenue Forecast Table

Product/ Service | Q1 Sales [$00.00] | Q2 Sales [$00.00] | Q3 Sales [$00.00] | Q4 Sales [$00.00] | Total Year [$00.00] |

|---|---|---|---|---|---|

Product A | $12,000.00 | $14,000.00 | $16,000.00 | $18,000.00 | $6,000.00 |

Service A | $12,000.00 | $12,000.00 | $12,000.00 | $12,000.00 | $1,000.00 |

Sales Strategies and Initiatives:

Market Expansion: Expanding the market reach of Product A and Product B through new channels and entering untapped geographical markets.

Enhanced Marketing Efforts: Increasing investment in marketing, particularly in digital channels, to boost the visibility and appeal of Service 1 and Service 2.

Product Innovation: Continuously improving and innovating our products to meet changing customer needs and to stay ahead of competition.

Customer Loyalty Programs: Implementing loyalty programs to retain existing customers and attract new ones, especially for our services.

Strategic Partnerships: Forming alliances with complementary businesses to cross-promote products and services, thereby widening the customer base.

Quality Improvement: Focusing on enhancing the quality of products and services to increase customer satisfaction and repeat business.

Data-Driven Sales Tactics: Utilizing customer data and market analysis to tailor sales strategies and to identify new opportunities for growth.

Marketing and Advertising Budget

The Marketing and Advertising Budget for [Your Company Name] for the upcoming fiscal year is an essential component of our strategic planning, focusing on allocating resources towards promotional activities that aim to enhance brand visibility, market reach, and customer engagement. It encompasses various channels and tactics, including online advertising, print media, promotions, and events. This detailed budgeting helps in ensuring that marketing and advertising efforts are well-coordinated, cost-effective, and aligned with the company's overall business objectives.

Specific Marketing Goals:

Increase Brand Awareness: Utilizing online advertising and print media to enhance the visibility and recognition of our brand in the market.

Drive Customer Engagement: Developing promotions and interactive events to engage with our target audience, foster brand loyalty, and build a strong customer community.

Expand Market Reach: Using targeted advertising campaigns to reach new demographics and geographies, thereby expanding our customer base.

Boost Sales Revenue: Aligning marketing efforts with sales objectives to drive an increase in sales, particularly focusing on new product launches and seasonal promotions.

Enhance Online Presence: Significantly investing in online advertising, including social media and search engine marketing, to strengthen our digital footprint.

Measure and Optimize ROI: Implementing robust analytics to measure the return on investment (ROI) of various marketing channels and strategies, enabling data-driven decision-making.

Innovate Marketing Tactics: Staying abreast of the latest marketing trends and technologies to innovate and keep our marketing strategies effective and relevant.

Operating Expense Budget

The Operating Expense Budget is critical for effective financial management and strategic planning, as it encompasses the day-to-day expenses that are necessary for maintaining the business operations. It includes key expense categories such as rent, utilities, supplies, and other miscellaneous expenses.

Rent: This is a fixed cost for the business premises, assuming a stable lease agreement with no expected changes throughout the year.

Utilities: Includes expenses for electricity, water, gas, and other utilities essential for the operation of the business. This may vary slightly due to seasonal changes but is largely consistent.

Supplies: This category covers the cost of office supplies, maintenance materials, and other small items necessary for daily operations. The budget is based on historical usage patterns and anticipated needs.

Other Expenses: This includes miscellaneous operational costs such as maintenance and repair, office expenses, and any other non-categorized operational outlays. This category provides flexibility to cover unforeseen or irregular expenses.

Human Resources Budget

The Human Resources Budget for [Your Company Name] is a crucial element of our fiscal planning for the upcoming year. It encompasses the financial allocation for various HR-related activities across different departments, including Administration, Sales, Marketing, and Research & Development (R&D).

Strategic Initiatives:

Workforce Development: Investing in training and development programs to enhance the skills and capabilities of our workforce, particularly in the Sales and Marketing departments.

Talent Acquisition and Retention: Allocating resources towards competitive compensation packages and benefits to attract and retain top talent, especially in the R&D and Sales departments.

Performance Management: Implementing robust performance management systems to align employee objectives with the company's strategic goals, with a focus on efficiency and productivity in Administration.

Employee Wellness and Engagement: Prioritizing initiatives that promote employee wellness and engagement, which are key to maintaining a motivated and productive workforce.

Risk Analysis and Mitigation Plan

The Risk Analysis and Mitigation Plan for [Your Company Name]. is a critical component of our broader strategic planning process, designed to identify potential risks that could impact our business operations and financial performance.

Risks Identified:

Market Risk: This includes fluctuations in market demand, changes in consumer preferences, and increased competition.

Operational Risk: Risks related to internal processes, systems, and people, such as supply chain disruptions, technology failures, or human resource challenges.

Financial Risk: Including credit risk, liquidity risk, and interest rate fluctuations that could affect the company's financial stability.

Regulatory Risk: Changes in laws, regulations, or policies that could impact business operations or compliance requirements.

Cybersecurity Risk: Potential for data breaches, cyber-attacks, and other security threats to digital assets and sensitive information.

Mitigation Strategies:

Diversification: Diversifying product lines and entering new markets to reduce dependence on a single market segment.

Robust Supply Chain Management: Developing strong relationships with multiple suppliers and maintaining a contingency inventory to manage supply chain disruptions.

Financial Management: Regular financial analysis, maintaining healthy cash reserves, and prudent debt management to mitigate financial risks.

Regulatory Compliance: Staying informed about regulatory changes, engaging with legal experts, and ensuring timely compliance to avoid penalties and legal issues.

Investing in Cybersecurity: Implementing advanced cybersecurity measures, regular IT audits, and employee training to protect against digital threats.

Environmental Impact Assessment: Conducting regular environmental impact assessments and developing contingency plans for natural disasters.

Conclusion and Strategic Recommendations

This Financial Budget Portfolio for [Your Company Name] provides a comprehensive overview of our projected financial landscape for the upcoming fiscal year. It encompasses detailed forecasts and budgets across various critical areas, including income statements, cash flow, balance sheets, capital expenditures, sales and revenue, marketing and advertising, operating expenses, human resources, and a thorough risk analysis with mitigation strategies. Each section has been meticulously crafted to ensure alignment with our strategic objectives, operational goals, and market dynamics.

The document serves not only as a financial roadmap but also as a strategic guide, highlighting areas of opportunity, efficiency, and growth. It reflects our commitment to fiscal responsibility, prudent resource allocation, and proactive risk management.

Strategic Recommendations:

Growth and Diversification: Focus on expanding our market reach and diversifying our product and service offerings to mitigate market risks and enhance revenue streams.

Cost Optimization: Continuously monitor and optimize operating expenses and capital expenditures to ensure financial efficiency and sustainability.

Investment in Technology and Innovation: Prioritize investments in technology and innovation to improve operational efficiency, product quality, and competitive advantage.

Robust Risk Management: Maintain a proactive approach to risk management by regularly updating our risk analysis and mitigation strategies in line with evolving market and operational dynamics.

Employee Development and Engagement: Invest in our human capital through training, development, and engagement initiatives to foster a skilled and motivated workforce.

By adhering to these strategic recommendations and regularly reviewing and adjusting our financial and operational plans, [Your Company Name] is well-positioned to navigate the challenges of the upcoming fiscal year, capitalize on opportunities, and drive sustained growth and profitability. This document will serve as a living framework, adaptable to changes and instrumental in guiding our path forward.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

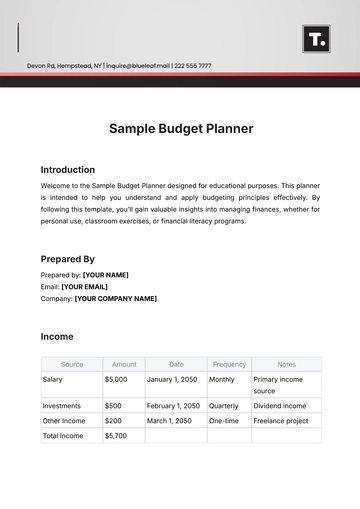

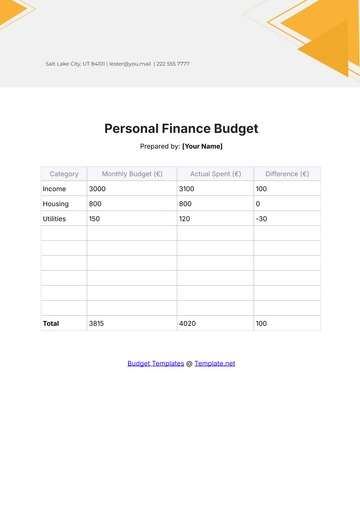

Presenting Template.net's editable Financial Budget Portfolio Template! This versatile tool simplifies financial planning. Tailor it effortlessly to match your business requirements. Effortlessly monitor expenses, forecast revenues, and make well-informed decisions. With user-friendly features such as our very own Ai editor tool, this template streamlines budget management. Elevate your financial strategy with ease using our template. Commence your path to financial success today!

You may also like

- Budget Sheet

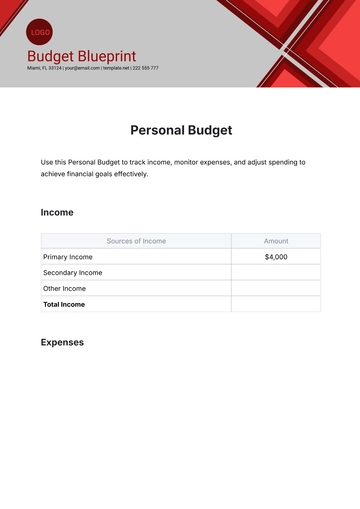

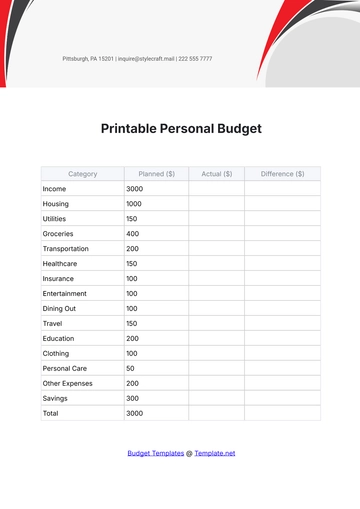

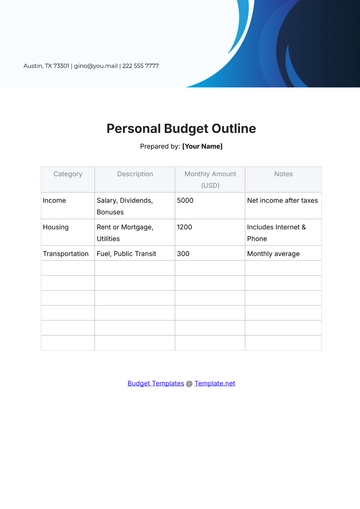

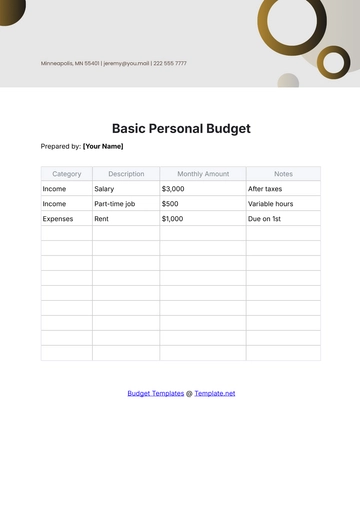

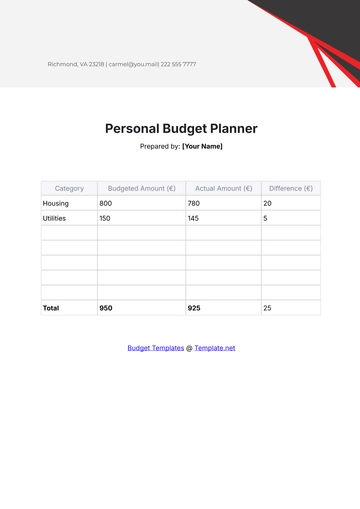

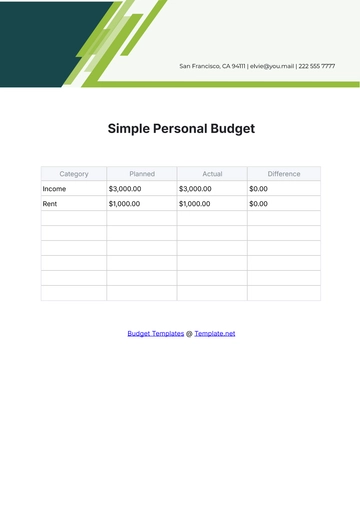

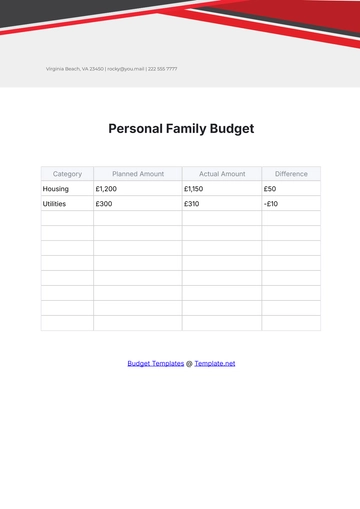

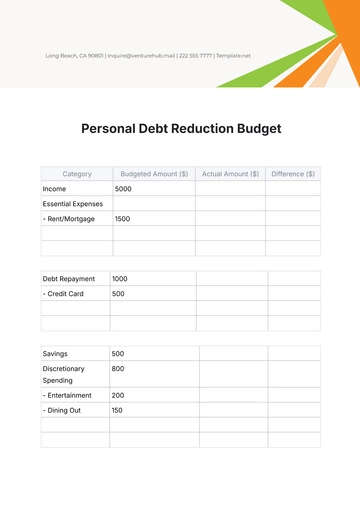

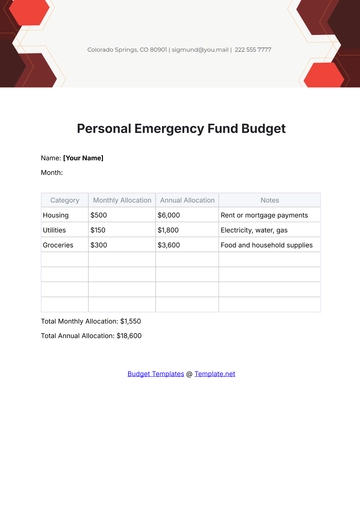

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

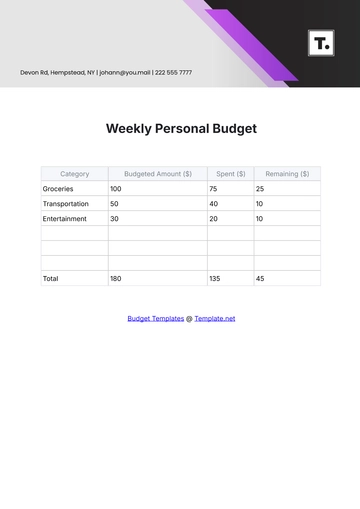

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

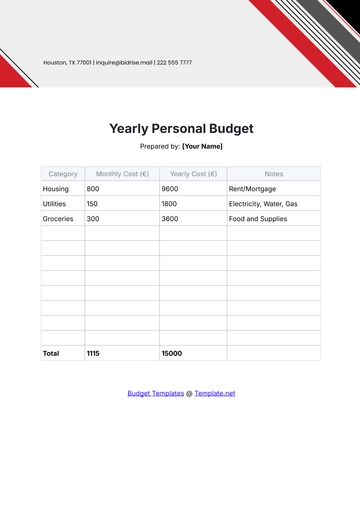

- Annual Budget

- Home Renovation Budget

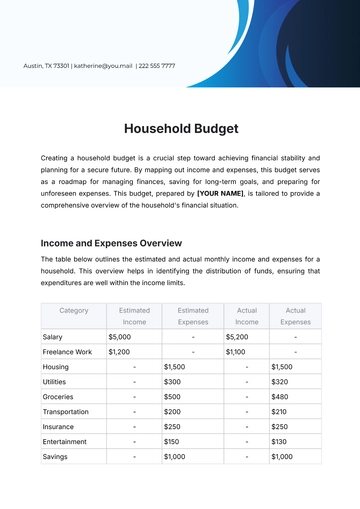

- Household Budget

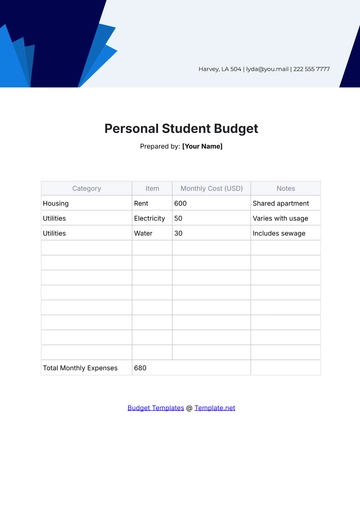

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

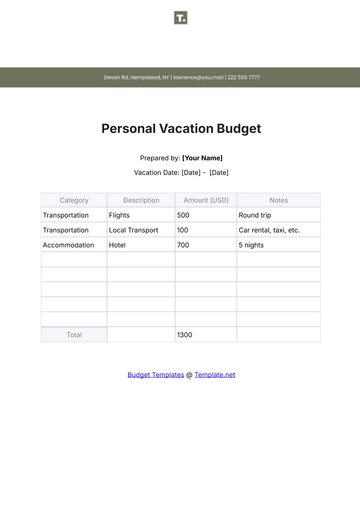

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising