Free Finance Budget Software User Guide

Introduction

Overview of [Finance Budget Software Name]

Welcome to [Finance Budget Software Name], a cutting-edge financial management tool designed to empower individuals and businesses in achieving their financial goals. This software provides a comprehensive solution for budgeting, expense tracking, and financial planning. With an intuitive interface and robust features, [Finance Budget Software Name] is your partner in navigating the complexities of personal and business finances.

Purpose and Benefits

Purpose

At the core of [Finance Budget Software Name] is the mission to simplify financial management. Whether you're creating a personal budget or overseeing the financial health of your business, this software is tailored to streamline your financial tasks, making them more accessible and actionable.

Key Benefits

Experience streamlined budget creation, real-time expense tracking, and in-depth analytics. [Finance Budget Software Name] offers a user-friendly interface, providing valuable insights and facilitating informed decision-making. Automation features reduce manual effort, ensuring accuracy in calculations and data entry.

Target Audience

[Finance Budget Software Name] caters to a diverse audience, ranging from individuals and small business owners to finance professionals and government agencies. Whether you're a student learning about personal finance, a consultant assisting clients, or a startup founder managing early-stage finances, this software is designed to meet your unique needs.

System Requirements

Before embarking on your financial journey with [Finance Budget Software Name], ensure your system meets the following requirements. Compatible with Windows 10 and macOS 10.15 or later, the software demands a dual-core processor, a minimum of 4 GB RAM, and 500 MB of free disk space. An internet connection is required for certain features and updates, ensuring you have access to the latest tools and improvements.

Getting Started

Installation and Setup

System Requirements

Before installing [Finance Budget Software Name], it's crucial to ensure your system meets the requirements. The software is compatible with Windows 10 and macOS 10.15 or later. Ensure your device has a dual-core processor, at least 4 GB of RAM, and a minimum of 500 MB of free disk space. An internet connection is required for specific features and updates to keep your software up-to-date with the latest enhancements.

Configuration SettingsUser Registration and Login

Once installed, configure the software settings to align with your preferences and financial goals. Set your default currency, language, and any other personalized configurations to enhance your overall user experience.

User Registration and Login

Creating a User Account

To unlock the full potential of [Finance Budget Software Name], create a user account by providing your email address, creating a secure password, and completing the registration process. This account ensures a personalized experience and allows you to access your financial data securely.

Login Procedures

After registration, log in to your account using your credentials. This secure login process ensures that your financial information remains confidential and accessible only to authorized users.

Password Management

For added security, [Finance Budget Software Name] recommends periodic password updates. Utilize strong, unique passwords and consider enabling two-factor authentication to enhance the protection of your financial data.

User Interface

Dashboard Overview

Key Metrics and Visualizations

Upon logging in, you'll be greeted by the [Finance Budget Software Name] dashboard—a centralized hub displaying key financial metrics and visualizations. Track your budget progress, view expense breakdowns, and access important financial insights at a glance.

Customization Options

Tailor the dashboard to your preferences by utilizing customization options. Arrange widgets, choose display themes, and adjust settings to create a personalized financial workspace that aligns with your unique needs.

Navigation

Main Menu

Explore [Finance Budget Software Name]'s main menu to access core features and functionalities. From budget creation to expense tracking and reporting, the main menu serves as your gateway to comprehensive financial management tools.

Submenus and Modules

Navigate through submenus and modules to delve deeper into specific aspects of financial management. Whether you're managing expenses, setting budget goals, or generating reports, [Finance Budget Software Name] provides an organized structure for efficient navigation.

Shortcuts and Hotkeys

Enhance your user experience by utilizing shortcuts and hotkeys. [Finance Budget Software Name] offers a range of keyboard shortcuts to expedite common tasks, ensuring a smoother and more efficient workflow as you navigate through the software.

Creating a Budget

Budget Basics

Definition and Importance

Before diving into the budget creation process, it's essential to understand the basics. A budget is a financial plan that outlines your income and expenditures over a specific period. It serves as a roadmap for managing your finances, ensuring that your spending aligns with your financial goals.

Types of Budgets

[Finance Budget Software Name] supports various budgeting approaches to cater to different needs. Explore options such as zero-based budgeting, incremental budgeting, or priority-based budgeting based on your preferred methodology and financial objectives.

Creating a New Budget

Setting Budget Parameters

Initiate the budget creation process by defining key parameters. Specify the budget duration, currency, and any other relevant settings to tailor the budget to your specific financial circumstances.

Defining Categories and Goals

Break down your budget into categories such as housing, utilities, entertainment, and savings. Allocate funds to each category based on your financial priorities and goals. [Finance Budget Software Name] offers flexibility in customizing categories to match your unique spending habits.

Allocating Funds

Once categories and goals are defined, allocate funds accordingly. Distribute your available budget to different categories, providing a clear outline of how much you plan to spend in each area. This step sets the foundation for effective financial management.

Editing and Managing Budgets

Modifying Budget Details

Life is dynamic, and so are your financial needs. [Finance Budget Software Name] allows you to modify budget details as circumstances change. Edit budget amounts, add or remove categories, and adjust goals to adapt to evolving financial situations.

Duplicate and Copy Functions

Save time by utilizing duplicate and copy functions. If you have recurring budgets or want to create variations based on existing templates, [Finance Budget Software Name] simplifies the process, ensuring efficiency and consistency in your budget management.

Expense Tracking

Recording Expenses

Manual Entry

Effortlessly track your expenditures by manually entering expenses into [Finance Budget Software Name]. Simply input the transaction amount, date, and category to maintain an accurate and up-to-date record of your spending.

Importing Transactions

For added convenience, [Finance Budget Software Name] supports the import of transactions from external sources such as bank statements or credit card records. Streamline your expense tracking process by syncing your financial accounts with the software.

Categorizing Expenses

Customizing Categories

Tailor your expense categories to match your unique spending habits. [Finance Budget Software Name] allows customization, letting you create, edit, or delete categories based on your specific needs.

Subcategories and Tags

Organize expenses with greater granularity by utilizing subcategories and tags. Dive deeper into spending details by assigning subcategories and tags to transactions, providing a more comprehensive overview of your financial activities.

Monitoring Spending Patterns

Visualizing Expense Trends

Leverage visualizations and graphs within [Finance Budget Software Name] to gain insights into your spending patterns. Track fluctuations, identify trends, and make informed decisions to optimize your budget.

Alerts and Notifications

Stay on top of your budget by setting up alerts and notifications. Receive real-time notifications when you approach or exceed budget limits, allowing for proactive adjustments to your spending habits.

Income Management

Recording Income Sources

Manual Entry

Initiate the income management process by manually recording your income sources within [Finance Budget Software Name]. Enter details such as the source, amount, and date to maintain an accurate record of your financial inflows.

Importing Income Data

For seamless integration, [Finance Budget Software Name] allows you to import income data from external sources. Connect your bank accounts or other financial platforms to automatically sync and update your income records, reducing manual data entry efforts.

Income Projection and Forecasting

Setting Income Goals

Define your financial aspirations by setting income goals within [Finance Budget Software Name]. Establish realistic targets based on your expected earnings, allowing the software to provide insights into your progress over time.

Analyzing Income Trends

Leverage the software's analytics tools to analyze income trends. Identify peak earning periods, assess the impact of different income sources, and make informed decisions to enhance your overall financial stability.

Reports and Analytics

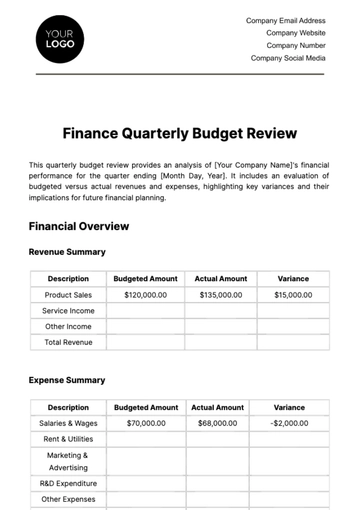

Generating Financial Reports

Income Statements

Access comprehensive income statements within [Finance Budget Software Name]. These statements provide a detailed breakdown of your earnings, allowing you to analyze sources of income and identify areas for potential growth.

Balance Sheets

Review your financial position with balance sheets that outline your assets, liabilities, and equity. [Finance Budget Software Name] offers insights into your net worth, aiding in strategic financial planning and decision-making.

Cash Flow Statements

Understand the flow of cash in and out of your finances with cash flow statements. Track the movement of funds, identify liquidity trends, and make informed decisions to optimize your cash management.

Analyzing Budget Performance

Comparative Analysis

Utilize comparative analysis tools to assess budget performance over different periods. [Finance Budget Software Name] allows you to compare actual spending against budgeted amounts, providing insights into variances and helping you refine your financial strategies.

Trend Analysis

Identify trends and patterns in your financial data through trend analysis features. Visualize changes in income, expenses, and budget adherence over time, empowering you to make proactive adjustments to your financial plan.

Budget Reconciliation

Reconciling Actual vs. Budgeted

Identifying Discrepancies

The budget reconciliation feature in [Finance Budget Software Name] allows you to reconcile actual expenses and income with the initially budgeted amounts. Identify discrepancies between planned and actual financial activities to gain insights into where adjustments may be needed.

Adjusting Budgets Accordingly

Upon identifying discrepancies, [Finance Budget Software Name] provides tools to adjust your budget accordingly. Whether it's reallocating funds between categories or revising overall budget goals, this functionality ensures that your budget remains aligned with your financial reality.

Customization Options

Personalizing Categories

Fine-tune your budget by personalizing expense categories. [Finance Budget Software Name] offers customization options that allow you to tailor categories to your evolving needs, ensuring that your budget accurately reflects your financial priorities.

Tailoring the Interface

Enhance your user experience by tailoring the software interface. Adjust settings, choose display preferences, and personalize your workspace to match your preferences, making [Finance Budget Software Name] a tool that adapts to your unique financial management style.

Integration and Data Management

Import and Export Functions

Importing Data from External Sources

Streamline your data entry process by importing financial data from external sources. [Finance Budget Software Name] supports importing transactions, expenses, and income from bank statements, credit card records, and other financial platforms, ensuring your data is up-to-date and accurate.

Exporting Data for Analysis

Export your financial data for further analysis or sharing purposes. [Finance Budget Software Name] allows you to export reports, budgets, and transaction details in various formats, facilitating seamless collaboration and integration with other financial tools.

Integration with Financial Institutions

Connecting Bank Accounts and Credit Cards

Simplify data entry by connecting [Finance Budget Software Name] with your bank accounts and credit cards. Integration with financial institutions enables automatic synchronization of transactions, minimizing manual effort and ensuring real-time accuracy.

Reconciling Transactions

Efficiently reconcile your transactions by matching imported data with your budget. [Finance Budget Software Name] provides reconciliation tools that help you identify and resolve discrepancies between your budgeted amounts and actual transactions.

Collaboration Features

Collaborative Budgeting

User Roles and Permissions

[Finance Budget Software Name] facilitates collaborative budgeting by allowing you to set user roles and permissions. Define roles such as "Admin," "Contributor," or "Viewer," controlling who can make changes to the budget, contribute data, or simply view financial information.

Sharing Budgets and Reports

Enhance collaboration by sharing budgets and reports with team members, family, or financial advisors. [Finance Budget Software Name] provides secure sharing options, ensuring that sensitive financial information is only accessible to authorized individuals.

Best Practices

Tips for Efficient Budgeting

Optimize your budgeting experience with tips and best practices provided by [Finance Budget Software Name]. Learn how to set realistic goals, track spending effectively, and make the most of the software's features for successful financial management.

Strategies for Effective Financial Management

Beyond budgeting, [Finance Budget Software Name] offers strategies for effective overall financial management. Explore insights on savings, investments, and debt management to achieve holistic financial wellness.

Security and Privacy

Data Security Measures

Encryption Protocols

Rest assured that your financial data is secure with [Finance Budget Software Name]. The software employs industry-standard encryption protocols to safeguard your information during transmission and storage, ensuring the confidentiality and integrity of your financial data.

Secure Authentication

Protect your account with secure authentication measures. [Finance Budget Software Name] implements robust login procedures and recommends the use of strong, unique passwords. Additionally, consider enabling two-factor authentication for an added layer of security.

Privacy Policies and Compliance

Privacy Standards

[Finance Budget Software Name] adheres to stringent privacy standards. Explore the software's privacy policies to understand how your data is collected, used, and stored. The commitment to privacy ensures that your sensitive financial information is handled responsibly.

Legal Compliance

Rest easy knowing that [Finance Budget Software Name] is designed to comply with relevant legal and regulatory requirements. The software aligns with data protection laws and industry standards, prioritizing the security and privacy of your financial information.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover financial clarity with the Finance Budget Software User Guide Template from Template.net. This editable and customizable guide, crafted with precision, empowers users to navigate their software seamlessly. Leverage the AI Editor Tool to tailor content effortlessly. Elevate your budgeting experience with a comprehensive guide that transforms complexity into simplicity. Download now for financial mastery.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising