Free Accounting Asset Management Case Study

I. Introduction

The focus of our case study on Accounting Asset Management is [Your Company Name], a company that is a leading player in the technology sector. In this case study, we explore the acquisition of assets by the company, along with their valuation, and also delve into the depreciation and disposal aspects of these assets. In addition to these, we take a look at the overall strategies employed by [Your Company Name] for managing their assets. By doing so, we hope to provide some insights into the financial health of the company. It also allows us to assess whether [Your Company Name]'s practices are in line with the compliance requirements of accounting standards.

II. Background Information

Company Overview:

[The corporation known as [Your Company Name] is recognized as a global entity and is consistently and avidly engaged in the progression and manufacturing of products predominantly regarding technology which are unquestionably regarded as being at the forefront of the industry. This corporation proudly presents an expansive and impressive catalog which includes a broad scope of both tangible and intangible assets. In recent years, the company experienced a strong surge of growth expanding at a particularly rapid pace. Consequently, this rapid expansion has resulted in a pressing need to carry out a comprehensive evaluation and analysis of the strategies which the company implements with the aim of effectively managing its voluminous assets.

Recent Developments:

In the recently concluded fiscal year, our company named [Your Company Name], has been fortunate enough to orchestrate a significant acquisition successfully. This strategic move has led to the seamless integration of an entirely new product range into our existing catalogue of offerings. This integration has not only expanded the breadth of our company's portfolio, but it has also markedly increased our presence in the prevalent market. As a result, [Your Company Name] is now better positioned as a key player within the industry. Furthermore, in our pursuit of innovation and excellence, [Your Company Name] made a deliberate effort to allocate a considerable amount of our budgets towards research and development initiatives. This investment, through dedicated and strategic implementation, has proven its value. These concentrated efforts have facilitated the development and accumulation of a range of intellectual property assets.

These assets are not just valuable in themselves, but they also serve to fortify [Your Company Name]'s competitive standing within the industry. We firmly believe that these innovative properties, borne out of our research and development endeavors, will prove pivotal in enhancing [Your Company Name]'s strength and competitiveness moving forward.

III. Analysis of Asset Acquisition and Valuation

Acquisition Methods:

At [Your Company Name], we place significant importance on employing an approach to asset acquisition with a strategic edge. This approach is characterized by a combination of in-house development, strategic partnerships, and highly selected and targeted acquisitions. Each method involved in this approach is meticulously evaluated and assessed in accordance with numerous factors which include but are not limited to cost-effectiveness, alignment with the overarching strategic objectives of the company, along with the potential for creating and nurturing synergies. The advantage of having such a diverse approach means that [Your Company Name] has the capacity to reach out to new technologies and markets, broadening our horizons while also lessening the risks associated with relying solely on any one strategy of acquisition.

Valuation Techniques:

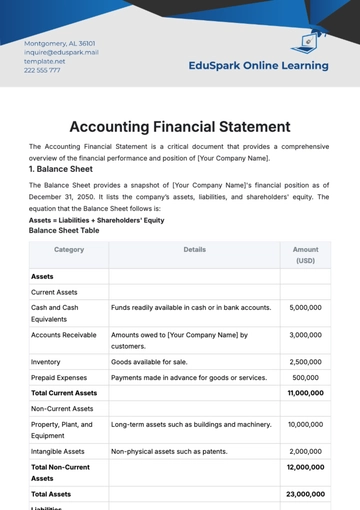

When it comes to quantifying the worth of its assets, [Your Company Name] applies a composite approach which merges both historical cost and fair value methods. This combined approach is deployed in order to ensure a holistic and accurate reflection of the company’s assets in the financial statements, thus providing a clear and comprehensive understanding of the company's financial position. In this process, tangible assets such as manufacturing equipment are generally recorded at their historical cost. This historical cost method is adopted to reflect the original acquisition cost of these assets, providing a clear indication of the initial outlay the company made to acquire these resources.

On the flip side of the coin, intangible assets, which primarily include patents and trademarks, are often evaluated at their fair value. The purpose of this valuation procedure is to capture their current market worth accurately. The fair value provides a current marketplace view of what these intangible assets are worth, reflecting fluctuations in value and ensuring they are not undervalued or overvalued in the company's financial statements.

The special blend of these two distinct valuation techniques is aimed at ensuring that the company’s financial statements provide an exhaustive and precise snapshot of the value of its asset base. This approach, therefore, allows for constant updating of asset values and contributes to the production of an accurate financial picture of the company.

IV. Depreciation and Amortization Practices

Depreciation of Tangible Assets:

[Your Company Name] employs the straight-line depreciation method for its tangible assets, spreading the cost evenly over their estimated useful lives. This method provides a systematic and straightforward approach to expense recognition, aligning with the matching principle of accounting. By depreciating assets over their useful lives, the company accurately reflects the consumption of economic benefits derived from these assets over time, facilitating better decision-making and financial analysis.

Amortization of Intangible Assets:

In contrast to tangible assets, [Your Company Name] amortizes its intangible assets over their estimated useful lives. This approach reflects the consumption of economic benefits associated with intangible assets, such as patents and copyrights, over time. Additionally, the company periodically assesses the recoverability of intangible assets and recognizes impairment losses if their carrying amounts exceed their recoverable amounts. This ensures that the company's financial statements accurately reflect the true value of its intangible asset portfolio.

V. Asset Disposal Strategies

Disposition Criteria:

[Your Company Name] has developed and put in place well-defined guidelines and standards when it comes to making decisions about disposing of assets. This process is not done in a haphazard manner, but rather involves a thorough evaluation and consideration of different factors. These include the potential obsolescence of technology, which could render an asset irrelevant or inefficient, significant fluctuations in the market's demand, as well as our long-standing and future strategic goals that the company has set in place.In this regard, we take time to carefully evaluate and identify assets that are no longer of value or relevancy to our core business operations. This extends also to those that no longer contribute or have the potential to contribute to our growth prospects. When such assets are identified, they are then earmarked for disposal. To arrive at this, [Your Company Name] undertakes a systematic and rigorous review process that is both fair and exhaustive. The underlying rationale and objective for these decisions is closely tied to and aligned with our strategic goals. In essence, by making disposal decisions that are directly in line with these strategic objectives, [Your Company Name] is able to optimize and maximize the efficiency and productivity of our asset base. This in turn leads to increased overall levels of profitability for the Company and ensures we remain competitive in the industry.

Accounting Treatment:

When disposing of assets, [Your Company Name] follows strict accounting guidelines to ensure accurate financial reporting. Gains or losses on disposal are recognized in the income statement, reflecting the difference between the net disposal proceeds and the carrying amount of the asset. This transparent approach provides stakeholders with a clear understanding of the financial impact of asset disposals on the company's performance. Additionally, the company discloses relevant information in the notes to the financial statements, providing additional context and transparency.

VI. Asset Management Strategies and Policies

Maintenance Programs and Capital Budgeting:

At [Your Company Name], the emphasis is significantly placed on proactive maintenance programs. These programs are designed to both optimize the performance of the company's assets and ensure their longevity. These maintenance procedures are not conducted once and forgotten, but rather, run on a consistent basis. Indeed, regular inspections, preventive maintenance schedules, and ongoing equipment upgrades are all integral components of these programs. These actions are taken in a systematic way, concentrating on mitigating potential issues before they pose a significant risk, thereby ensuring the sustained performance and life span of the assets. Furthermore, [Your Company Name] carefully evaluates all capital budgeting decisions. Emphasis is placed on carefully considering a range of key factors. Important components such as expected returns, the risk profiles associated, and how well the investment aligns with corporate strategic objectives are all considered in-depth before commitments are made. This disciplined approach to the management of the company's assets and the assessment of potential investments ensures that all investments in new assets are perfectly aligned with the company's long-term growth strategy. This aligned strategy helps guarantee that these investments deliver the maximum value possible to shareholders. All in all, these preventative strategies combined with detailed evaluations of potential investments help drive maximum value from existing assets, secure the best potential return on new investments, and support the company's strategic growth plan.

Investment in New Assets:

With a focus on innovation and market leadership, [Your Company Name] allocates significant resources to research and development (R&D) initiatives. Investments in new assets, including intellectual property and technology platforms, play a crucial role in driving future growth and competitiveness. The company evaluates R&D projects based on their potential to generate sustainable competitive advantages and long-term value creation. By investing in cutting-edge technologies and emerging markets, [Your Company Name] positions itself for continued success and leadership in the industry.

VII. Regulatory Compliance and Reporting

Compliance with Accounting Standards:

The company that is under your name, respects and diligently applies the internationally recognized accounting rules and regulations - both the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP) when conducting its financial reporting. It is through the dedicated adherence to these important standards that the company is able to ensure the accuracy of its financial results and therefore, guarantee the comparability and transparency of its financial statements. This not only allows all stakeholders to assess the company's financial health without any ambiguity but also facilitates benchmarking against other entities. To further improve the robustness of the company's financial reporting and to mitigate any potential risks of non-compliance with regulatory requirements, the company has been proactive in putting in place strong internal controls. Additionally, it has implemented comprehensive governance frameworks as further protective measures. All these efforts not only ensure the full integrity of the company's financial reporting processes but also position the company to seamlessly align with the dynamic regulatory landscape, thus giving a clear reflection of the company's actual financial position, performance, and changes in financial position in accordance with accepted principles, standards, and legal requirements.

Financial Disclosures:

In its financial disclosures, [Your Company Name] provides comprehensive information related to asset management practices, including detailed breakdowns of asset categories, valuation methodologies, and impairment assessments. These disclosures are presented in the notes to the financial statements, providing stakeholders with additional insights into the company's asset base and related accounting policies. By enhancing transparency and disclosure quality, [Your Company Name] fosters trust and confidence among investors, analysts, and other stakeholders.

VIII. Financial Analysis and Performance Evaluation

Quantitative Analysis:

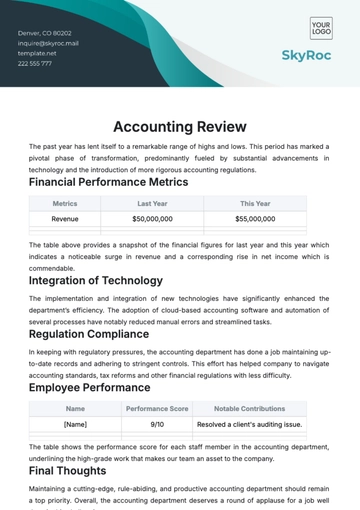

An in-depth quantitative evaluation of the financial performance of [Your Company Name] has yielded critical insights into how the company manages its assets. This type of analysis is instrumental in understanding how efficiently and effectively the company uses its resources, and it highlights several key performance indicators that help to illustrate this. These indicators include return on assets (ROA), asset turnover ratio, and fixed asset turnover ratio. The return on assets measurement is useful in depicting how profitable a company is in relation to its total assets, illustrating how efficiently management is using its assets to generate earnings. Similarly, the asset turnover ratio measures how successfully a company is using its assets to generate sales, which is an important indicator of operational efficiency. On the other hand, the fixed asset turnover ratio shows how many times a company turns its fixed assets into sales, indicating how well the company is using its long-term assets to generate revenue. To draw meaningful conclusions from these ratios, it's crucial to benchmark them against the performance metrics of businesses within the same sector. By comparing these metrics with those of industry peers and the company's own historical performance, stakeholders, including investors and executives, are able to evaluate [Your Company Name]'s relative performance. This side-by-side comparison provides an opportunity to identify the company's strengths and areas where it may be lagging behind its peers, calling for possible improvement. This comprehensive, detailed, and contextual analysis allows for more informed decision making, better financial planning, and ultimately, more strategic asset management practices within the company.

SWOT Analysis:

By undertaking a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis, one can carry out an all-inclusive evaluation of the practices employed by [Your Company Name] in managing its assets. A close look into the company's strengths, for example, reveals a wide range of assets, robust approaches to asset maintenance, as well as a solid research and development department - all of which significantly contribute to giving the company a competitive edge in its sector. Meanwhile, a meticulous examination of the company's weaknesses uncovers possible ineffectivities in utilizing assets or potential vulnerabilities to technological risks, indicating areas that could benefit from necessary improvements. The exploration of opportunities, such as prospects of penetrating new markets and venturing into cutting-edge technologies, offer promising paths for the company's growth. Lastly, candid identification of threats, which include the potential implications of changes in regulations or the emergence of disruptive competitors, emphasizes the importance of the firm proactively formulating and implementing sound strategies in managing risks.

IX. Recommendations and Conclusion

Key Findings:

In summary, the analysis reveals several key findings regarding [Your Company Name]'s asset management practices. The company demonstrates strength in strategic asset acquisition, proactive maintenance programs, and compliance with accounting standards. However, opportunities exist to enhance asset efficiency, improve transparency in financial reporting, and mitigate emerging risks.

Recommendations:

Based on the findings, several recommendations are proposed to optimize [Your Company Name]'s asset management practices. These recommendations include implementing advanced asset tracking systems to improve visibility and control, enhancing disclosure quality in financial reporting to provide stakeholders with more comprehensive information, and conducting regular reviews of asset portfolios to identify opportunities for optimization and divestment.

Conclusion:

In conclusion, effective asset management is critical to [Your Company Name]'s long-term success and competitiveness in the technology sector. By implementing the recommended strategies and continuously refining its asset management practices, the company can position itself for sustained growth, profitability, and value creation for its stakeholders.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Uncover insights and strategies with the Accounting Asset Management Case Study Template from Template.net. This editable and customizable template, enhanced by our AI Editor Tool, offers a structured framework for analyzing asset management scenarios. Seamlessly adapt the case study to your organization's needs, showcasing your expertise in financial management. Elevate your presentations with a template designed for precision and impact.