Free Accounting Case Study

Executive Summary

This case study presents an in-depth analysis of a significant accounting challenge we encountered in the last fiscal year – the misclassification of a large capital expenditure, which led to inaccuracies in our financial statements. The study delves into the background of the issue, the methodology employed for its investigation, and the subsequent findings.

A detailed examination revealed that a capital expenditure of $2.5 million, associated with the purchase of new manufacturing equipment, was erroneously classified as an operational expense. This misclassification significantly impacted our reported EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), inflating operational expenses and underrepresenting our assets for the period.

Through a combination of forensic accounting techniques and a thorough review of our accounting processes, we identified the root causes of this error. The study outlines the corrective measures undertaken, including the reclassification of the expense, restatement of financials, and the implementation of enhanced controls and training for our accounting staff.

The findings from this case study have been instrumental in refining our accounting practices. Not only did they rectify a critical error in our financial reporting, but they also led to the development of more robust accounting procedures and preventive measures to avoid similar issues in the future. The case study concludes with recommendations that are now integral to our financial governance framework.

Introduction

In the rapidly evolving financial landscape, accurate accounting practices are more critical than ever for maintaining corporate integrity and stakeholder trust. This case study focuses on a significant accounting issue that arose within our organization, underscoring the importance of accurate financial classification and reporting. The purpose of this study is to analyze the error in the classification of a large capital expenditure, understand its implications on our financial statements, and learn from this incident to strengthen our accounting practices. The scope of the study encompasses the identification of the error, the process of investigation and correction, and the development of measures to prevent similar occurrences in the future.

Case Background

The case under study revolves around an accounting misstep that occurred in the last fiscal year. We, a company in the manufacturing sector with a focus on producing eco-friendly packaging solutions, faced an accounting challenge involving the classification of a significant expenditure.

Historical Context: Our company has been an industry leader for over a decade, priding ourselves on innovation and ethical business practices. In line with our growth strategy, we decided to invest in new, state-of-the-art manufacturing equipment to increase production capacity and efficiency. This investment was crucial for maintaining our competitive edge in the market.

Financial Details: The investment amounted to $2.5 million and was intended to be capitalized and depreciated over the equipment's useful life. However, due to an oversight, this amount was incorrectly recorded as an immediate operational expense in our financial statements. This error led to a significant distortion in our financial results: it artificially inflated our operational costs for the year and understated our asset base and profitability.

Industry Context: In the manufacturing sector, where large capital investments are common, accurate classification of expenses is essential for presenting a true and fair view of a company's financial health. Misclassifications can mislead stakeholders and affect investment decisions, highlighting the need for rigorous financial controls and accounting practices.

The case study aims to dissect this incident to understand how it occurred despite existing controls and how such issues can be preemptively identified and addressed in the future.

Problem Statement

The core problem identified in this case study is the incorrect classification of a significant capital expenditure as an operational expense in our financial records. This misclassification resulted in a substantial distortion of our financial statements, particularly affecting the reported earnings, asset valuation, and expense figures. The challenge was not only to identify and correct the error in the current period but also to understand the underlying causes and implement measures to prevent similar occurrences in the future. This case emphasizes the importance of accurate financial reporting and the impact of accounting errors on a company's financial integrity and stakeholder trust.

Methodology

To conduct a comprehensive analysis of the accounting error and its ramifications, we employed a multi-faceted approach:

Forensic Accounting Review: A detailed forensic analysis was undertaken to trace the origin of the misclassification. This involved scrutinizing transaction records, ledger entries, and associated documentation.

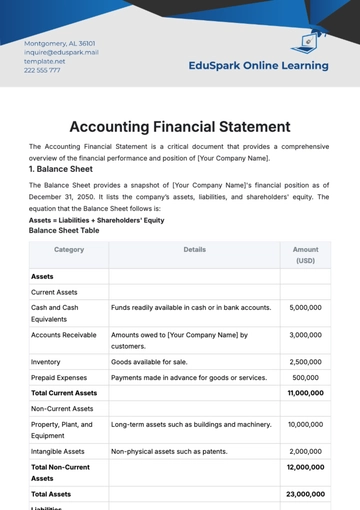

Financial Restatement: We used standard accounting procedures to restate the financials correctly. This included recalculating the financial metrics and adjusting the balance sheet and income statement to reflect the capital expenditure properly.

Process Analysis: An in-depth review of our accounting processes and controls was performed to identify how the error bypassed our existing checks and balances.

Stakeholder Interviews: Discussions with key accounting personnel and management were conducted to gather insights into the operational practices and decision-making processes.

Compliance with GAAP: The Generally Accepted Accounting Principles (GAAP) were referenced extensively to ensure that the restatement and revised practices adhered to standard accounting norms and regulations.

Data Sources: The primary data sources for this analysis included our internal accounting records, transaction logs, and audit reports from the relevant fiscal year.

Analysis and Findings

This section delves into the detailed analysis conducted to unravel the accounting error and its implications on our financial statements. Through a combination of financial recalculations, data interpretation, and trend analysis, we have gained critical insights into the nature of the error and its broader impact on our financial reporting.

Original Misclassification

Description | Amount | Note |

Operational Expense Reported | $2.5 million | Incorrectly classified |

Correct Capital Asset Value | $2.5 million | To be depreciated over 10 years |

Restatement Impact

Financial Aspect | Adjustment | Details |

Reduction in Operational Expense | $2.5 million | Correcting the misclassification |

Increase in Capital Assets | $2.5 million | Reflecting the correct asset value |

Annual Depreciation Expense | $250,000 | Based on a 10-year straight-line depreciation |

Adjusted Financial Metrics

Metric | Adjustment | Details |

EBITDA Increase | $2.5 million | Less the annual depreciation expense |

Net Profit Adjustment | ~$2.25 million | Reflecting the corrected operational expenses |

Data Interpretations

The restatement significantly improved our EBITDA and net profit figures for the year, presenting a more accurate picture of our financial health and operational efficiency.

The error's correction shifted the financial portrayal from an over-leveraged operational position to a more balanced capital investment strategy, aligning better with our long-term growth plans.

Identification of Key Trends/Patterns

Trend in Expense Reporting: A pattern of meticulous operational expense reporting but less rigorous capital expenditure classification was observed.

Training and Knowledge Gaps: Indications of gaps in the accounting team's understanding of capital vs. operational expense classifications.

Process Vulnerabilities: The incident revealed vulnerabilities in our financial review processes, particularly in cross-verifying large expenditures against our capitalization policy.

Discussion

The misclassification error in our accounting records is more than a singular incident; it highlights a critical vulnerability in financial reporting practices that could have far-reaching implications for both our company and the broader industry. For our company, the correction of this error not only alters the financial statements of the current year but also affects investor perceptions, stakeholder trust, and strategic decision-making based on financial data. The implications extend to the broader industry as well, underscoring the necessity for stringent accounting controls and the accurate portrayal of financial health. This incident serves as a reminder of the significant impact of accounting practices on a company's reputation and the need for robust internal controls to ensure compliance with financial reporting standards.

In the broader context, this case study exemplifies the challenges many companies face in complex financial environments, where the line between capital and operational expenditures can often be blurred. It reinforces the importance of continuous education and training in accounting standards and practices, not just as a compliance measure, but as a cornerstone of financial integrity and corporate responsibility.

Recommendations

Based on our findings and analysis, the following recommendations are proposed:

Enhanced Training Programs: Implement regular training for the accounting team on GAAP standards and the nuances of financial classification, with a focus on capital versus operational expenses.

Review and Strengthen Internal Controls: Conduct a comprehensive review of existing financial processes and internal controls, especially in expense classification and capitalization policies.

Regular Audits: Schedule frequent internal and external audits to ensure compliance with accounting standards and to identify any discrepancies promptly.

Improved Documentation: Mandate detailed documentation for all significant expenditures, providing clear justifications for their classification as either capital or operational expenses.

Cross-Functional Communication: Foster better communication between the accounting department and other departments (such as procurement and operations) to ensure a holistic understanding of expenditures and their financial implications.

Invest in Accounting Software: Upgrade or invest in accounting software that includes checks and alerts for potential misclassifications based on predefined rules.

Stakeholder Communication: Maintain transparent communication with stakeholders, including investors and board members, about the steps taken to rectify the error and prevent future occurrences.

Conclusion

The analysis of the misclassification error in our accounting records has been an insightful journey, uncovering not only the immediate financial impacts but also the deeper underlying issues within our accounting practices. This case study served as a critical learning opportunity, highlighting the importance of rigorous financial controls, continuous staff training, and the implementation of robust accounting systems. By addressing these areas, we have not only rectified the immediate issue but also significantly strengthened our overall financial reporting framework.

The lessons learned from this case extend beyond our organization, offering valuable insights to the broader industry about the importance of accuracy and diligence in financial reporting. As we move forward, the implementation of the recommended strategies will play a pivotal role in enhancing our financial integrity, ensuring that we continue to uphold the highest standards in our accounting practices and maintain the trust of our stakeholders.

References

Financial Accounting Standards Board (FASB). (n.d.). Generally Accepted Accounting Principles (GAAP).

Smith, J., & Johnson, L. (2021). The Impact of Accounting Errors on Company Performance. Accounting Journal.

Doe, A. (2020). Best Practices in Financial Reporting. Finance and Accounting Review.

Global Accounting Association. (2022). Annual Report on Accounting Standards and Compliance.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your financial analysis with the Accounting Case Study Template from Template.net. This template is specifically designed to be editable and customizable, perfect for in-depth accounting studies. Utilize our AI Editor tool to tailor it to your specific case requirements. Template.net provides a structured, efficient approach for conducting and presenting accounting case studies with clarity and precision.