Free Payroll Accounting Risk Statement

Introduction

In the complex landscape of modern business operations, the payroll accounting function stands as a critical component for ensuring financial stability and regulatory compliance. The aim of this Payroll Accounting Risk Statement is to delineate the myriad risks that [Company Name] may confront in its payroll accounting practices. This encompasses a broad spectrum of areas including, but not limited to, adherence to tax and compliance regulations, the efficacy of internal audits, the robustness of risk management strategies, the integrity of basic record-keeping practices, and the efficiency and accuracy of payroll processing systems.

Risk Identification

Payroll accounting is fraught with potential hazards that could undermine the financial and operational integrity of [Company Name]. These risks are multifaceted and can emerge from various sources:

Data Security Risks: In an era where data is as valuable as currency, the risk of breaches and unauthorized access to sensitive payroll information poses a significant threat.

Regulatory Compliance Risks: The ever-evolving landscape of labor laws and tax regulations demands constant vigilance to prevent non-compliance and the resultant penalties.

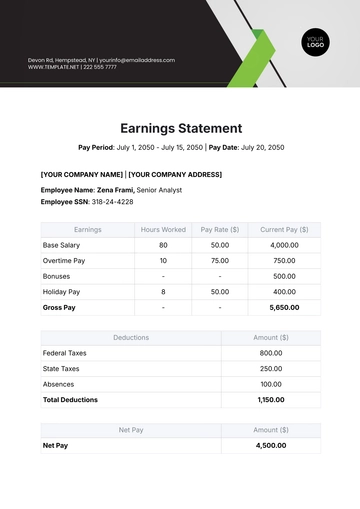

Payment Accuracy Risks: Errors in payroll calculations can lead to underpayments or overpayments, affecting employee satisfaction and financial accuracy.

Timeliness Risks: Delays in payroll processing can result in late payment penalties and damage employee morale.

Classification Risks: Incorrect classification of employees as independent contractors or vice versa can lead to serious tax and legal repercussions.

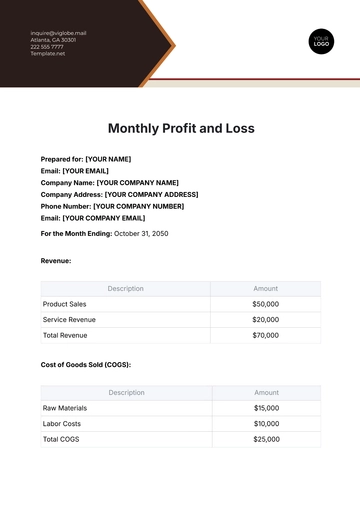

Risk Assessment

The effective management of the identified risks hinges on a thorough and ongoing assessment process. This involves evaluating each risk in terms of its likelihood of occurrence and the potential impact it may have on [Company Name]. Such an assessment helps in prioritizing the risks, thereby guiding the allocation of resources towards the mitigation of the most critical threats. The assessment criteria should consider factors such as historical data, industry trends, and changes in the external business environment.

Risk Management Strategies

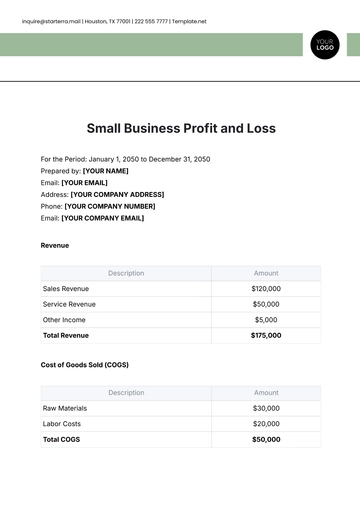

Upon the comprehensive assessment of identified risks, it becomes imperative to devise and implement strategies aimed at managing these risks effectively. The chosen strategies should align with [Company Name]'s overall risk appetite and business objectives. These strategies can be categorized as follows:

Avoidance: Taking proactive steps to prevent the occurrence of a risk. This could involve restructuring certain business practices or avoiding high-risk activities altogether.

Mitigation: Implementing controls and checks to reduce the likelihood or impact of a risk. This includes enhancing data security measures, conducting regular audits, and maintaining accurate and up-to-date records.

Transfer: Shifting the burden of a risk to a third party, such as through insurance or outsourcing certain functions to specialists.

Acceptance: In some cases, the cost of mitigating a risk may outweigh the potential impact. In such scenarios, a conscious decision may be made to accept the risk, with plans in place to address any fallout.

Effective risk management also involves the establishment of contingency plans to swiftly and effectively address any issues that may arise despite the implemented controls.

Review and Monitoring

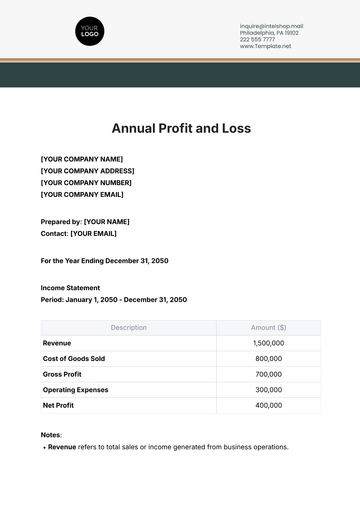

Given the dynamic nature of the business environment, it is crucial that [Company Name] maintains a vigilant stance through continuous monitoring and periodic review of its risk management practices. This ensures that the strategies remain relevant and effective in the face of changing circumstances. Regular audits, both internal and external, should be conducted to assess the effectiveness of the implemented measures. Additionally, feedback mechanisms should be established to gather insights from employees and other stakeholders, facilitating the identification of new risks and the continuous improvement of risk management strategies.

Conclusion

The proactive identification, assessment, and management of payroll accounting risks are vital for the sustained success and compliance of [Company Name]. By adhering to the structured approach outlined in this Payroll Accounting Risk Statement, [Company Name] can navigate the complexities of payroll accounting with confidence, ensuring both regulatory compliance and the safeguarding of its financial and operational interests.

For further information or clarification regarding this document, please contact [Contact Name] at [Contact Details].

Document Version: [Version Number]

Date of Issue: [Date]

Review Date: [Scheduled Review Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover peace of mind with Template.net's Payroll Accounting Risk Statement Template. Effectively identify, assess, and mitigate risks in your payroll processes. Our customizable template empowers businesses to create comprehensive risk statements effortlessly. With our AI editor, tailor it to your unique needs and safeguard your financial operations. Streamline risk management today for a more secure payroll system.