Free Accounting Wage Garnishment Analysis

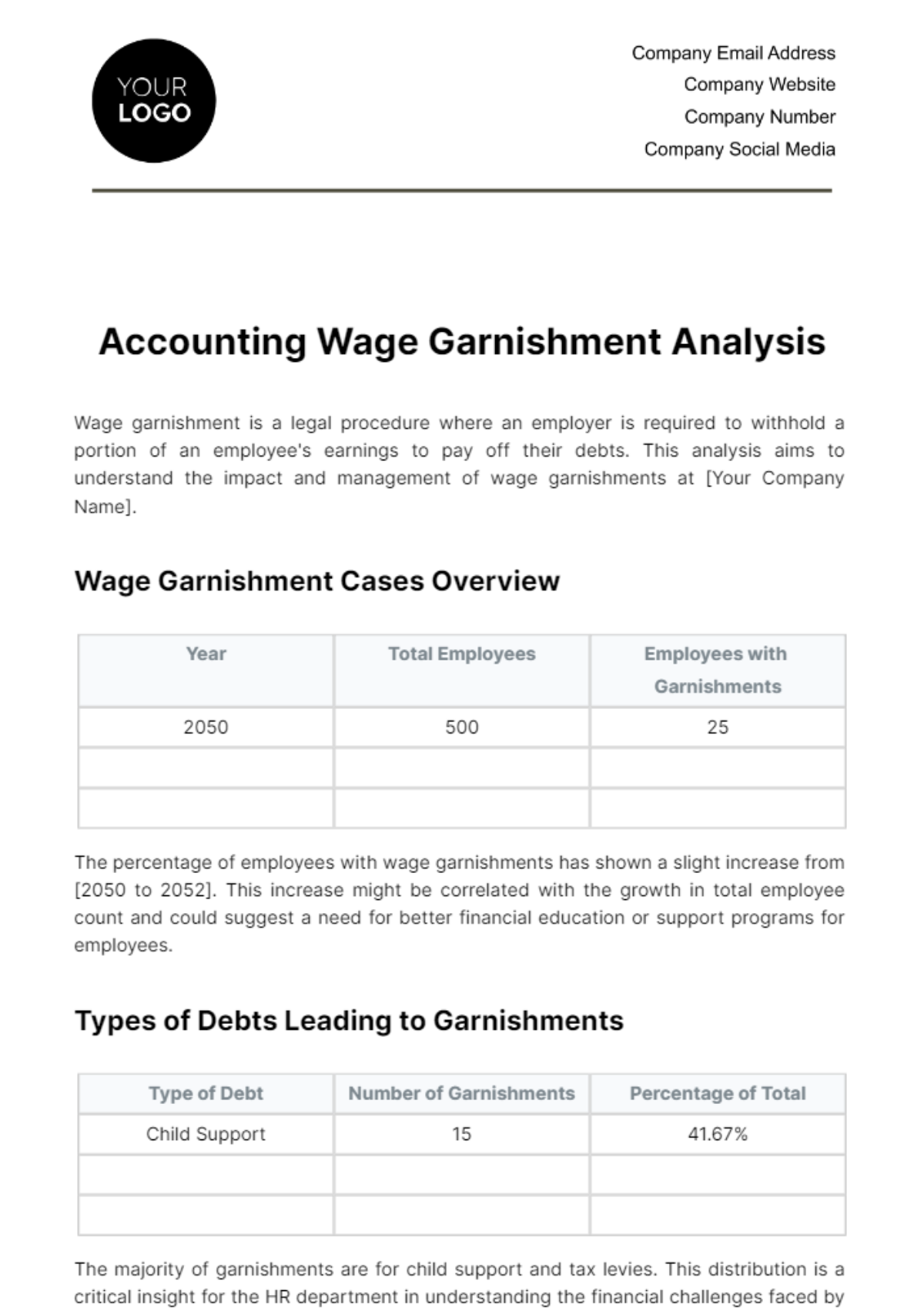

Wage garnishment is a legal procedure where an employer is required to withhold a portion of an employee's earnings to pay off their debts. This analysis aims to understand the impact and management of wage garnishments at [Your Company Name].

Wage Garnishment Cases Overview

Year | Total Employees | Employees with Garnishments |

|---|---|---|

2050 | 500 | 25 |

The percentage of employees with wage garnishments has shown a slight increase from [2050 to 2052]. This increase might be correlated with the growth in total employee count and could suggest a need for better financial education or support programs for employees.

Types of Debts Leading to Garnishments

Type of Debt | Number of Garnishments | Percentage of Total |

|---|---|---|

Child Support | 15 | 41.67% |

The majority of garnishments are for child support and tax levies. This distribution is a critical insight for the HR department in understanding the financial challenges faced by employees.

Impact on Payroll Processing

Year | Additional Hours | Incremental Cost |

|---|---|---|

2050 | 20 | $1,000 |

There is a gradual increase in the time and cost associated with processing garnishments. This trend suggests that the company might need to allocate more resources to manage this aspect efficiently.

While wage garnishments at [Your Company Name] have seen a modest increase, it remains a significant aspect of payroll processing that requires careful management. Adopting a proactive approach through employee support and efficient systems can mitigate the impact on both the organization and the affected employees.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify your wage garnishment concerns with Template.net's Accounting Wage Garnishment Analysis Template. Fully editable and customizable, this template allows users to tailor fit information to meet their specific business needs in the most efficient way. Conveniently editable with our Ai Editor Tool, staying organized with your wage garnishment analysis has never been easier!