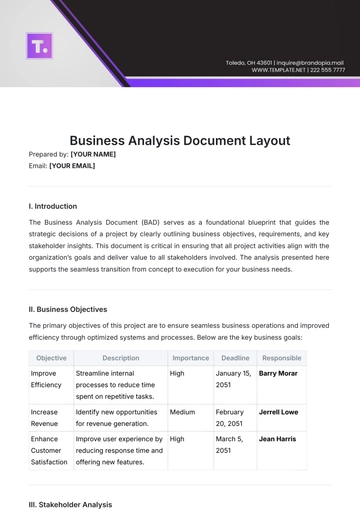

Free Account Analysis

I. Executive Summary

A. Brief Overview

The examination of [Your Company Name]'s Accounts Receivable uncovers crucial insights into the company's credit and collection management. This analysis delves into the historical performance of the Accounts Receivable account, focusing on key metrics such as Days Sales Outstanding (DSO) and bad debt ratios.

B. Key Findings

A meticulous review reveals a concerning uptrend in accounts receivable over the past fiscal year, signaling potential challenges in cash flow and credit risk. Notably, the DSO exceeds industry benchmarks, raising flags about the efficiency of collection processes. The analysis further identifies the risk of bad debt as a result of delayed receivables.

C. Recommendations

To address the identified challenges, it is recommended that [Your Company Name] implements tighter credit policies for new customers and enhances its collection processes to reduce DSO. Additionally, a proactive approach to monitoring aging reports and promptly addressing overdue accounts will contribute to a healthier financial position.

II. Introduction

A. Purpose of the Account Analysis

The primary objective of this account analysis is to evaluate the historical performance of [Your Company Name]'s Accounts Receivable, offering a comprehensive understanding of the company's credit management effectiveness and potential areas for improvement. By scrutinizing the trends in receivables, this analysis aims to provide actionable insights to optimize cash flow and minimize credit risks.

B. Scope and Limitations

The analysis spans the period from January 1, 2051, to December 31, 2053, utilizing audited financial statements and industry benchmarks. While this analysis provides a valuable snapshot of historical performance, it is essential to acknowledge that external factors and industry dynamics may impact the interpretation of the findings.

C. Background Information

[Your Company Name], operating in the manufacturing sector, relies on efficient credit and collection practices to sustain its cash flow. Understanding the historical context of the company's credit management policies is crucial for evaluating the effectiveness of its current practices.

III. Methodology

A. Data Collection

Financial data for the account analysis was sourced from [Your Company Name]'s audited financial statements, including balance sheets and income statements for the specified period. The reliance on audited data ensures the accuracy and reliability of the information used in the analysis.

B. Tools and Techniques Used

To extract meaningful insights, various tools and techniques were employed, including trend analysis for historical performance assessment, comparative analysis against industry benchmarks, and the calculation of key financial ratios. These methods provide a holistic view of the Accounts Receivable account and its impact on the overall financial health of the company.

IV. Account Overview

A. Name of the Account

The focus of this analysis is the "Accounts Receivable" account, a crucial component of [Your Company Name]'s current assets. This account represents amounts owed by customers for goods and services provided by the company, reflecting its effectiveness in managing customer credit and collecting outstanding receivables.

B. Nature of the Account

Accounts Receivable, as a current asset, plays a pivotal role in [Your Company Name]'s working capital. It embodies the financial obligations from customers, indicating the company's sales on credit and the timing of cash inflows.

C. Significance to Overall Financial Health

Given its direct impact on liquidity and cash flow, the health of the Accounts Receivable account significantly influences [Your Company Name]'s overall financial well-being. Efficient credit policies and timely collection efforts are imperative for sustaining the company's operational activities and profitability. Understanding the dynamics of this account is fundamental for strategic financial decision-making.

V. Historical Analysis

A. Historical Trends

The historical trends in [Your Company Name]'s Accounts Receivable reveal a consistent increase over the past three years:

Year | Accounts Receivable (USD) |

|---|---|

2051 | $500,000 |

2052 | $600,000 |

2053 | $800,000 |

This escalating pattern suggests a potential challenge in managing customer credit and collecting receivables efficiently. Further investigation is warranted to understand the factors contributing to this trend.

B. Identification of Key Events or Changes

The surge in accounts receivable from 2052 to 2053 warrants attention, as it may signify shifts in customer payment behavior, adjustments to credit terms, or operational changes impacting the timing of cash inflows. Identifying the key events influencing this increase is essential for devising targeted strategies to address the underlying issues.

VI. Comparative Analysis

A. Industry Benchmarks

Benchmarking [Your Company Name]'s performance against industry standards is vital for assessing the effectiveness of its credit and collection practices. The industry benchmark for Days Sales Outstanding (DSO) is typically 45 days. [Your Company Name]'s DSO over the past three years is as follows:

Year | DSO |

|---|---|

2051 | 30 |

2052 | 40 |

2053 | 50 |

These figures highlight a consistent deviation from industry norms, emphasizing the need for a closer examination of collection processes.

B. Peer Company Comparisons

Limited data on peer companies is available for direct comparisons. Further research is recommended to gather relevant insights into industry best practices and identify potential areas for improvement based on the performance of comparable entities.

C. Comparative Ratios and Metrics

Examining key ratios provides additional context:

Year | DSO | Bad Debt Ratio |

|---|---|---|

2051 | 30 | 1% |

2052 | 40 | 2% |

2053 | 50 | 3% |

While the bad debt ratio remains relatively low, the increasing DSO raises concerns about the efficiency of the collection process and potential delays in cash conversion.

VII. Financial Ratios

A. Liquidity Ratios

Current Ratio: 2.5 (2053)

Quick Ratio: 1.8 (2053)

These liquidity ratios indicate the company's ability to meet its short-term obligations. While the current ratio is healthy, the quick ratio suggests a potential vulnerability in meeting immediate obligations, emphasizing the importance of improving accounts receivable turnover.

B. Profitability Ratios

Net Profit Margin: 12% (2053)

Return on Assets (ROA): 8% (2053)

Return on Equity (ROE): 15% (2053)

[Your Company Name] maintains a commendable level of profitability. However, the rising accounts receivable may impact the return on assets, underscoring the need to address efficiency in working capital management.

C. Efficiency Ratios

Inventory Turnover: 5 times (2053)

Receivables Turnover: 7 times (2053)

While inventory turnover is efficient, the receivables turnover suggests room for improvement. Streamlining the collection process may enhance overall operational efficiency.

D. Solvency Ratios

Debt-to-Equity Ratio: 0.6 (2053)

Interest Coverage Ratio: 6 (2053)

[Your Company Name] demonstrates a healthy capital structure and sufficient interest coverage, indicating a sound financial position despite the challenges in accounts receivable management.

VIII. Risk Assessment

A. Identification of Risks

The analysis has identified several risks associated with [Your Company Name]'s Accounts Receivable. First and foremost, there is a potential risk of bad debt due to the consistent increase in accounts receivable over the past year. The rising Days Sales Outstanding (DSO) also poses a risk, indicating a slower collection process that may impact cash flow. Additionally, inefficiencies in credit management and collection processes may lead to delays in receiving payments, affecting the overall financial stability of the company.

B. Mitigation Strategies

To address these risks, it is crucial for [Your Company Name] to implement targeted mitigation strategies. This includes a thorough review and revision of credit policies to minimize the risk of bad debt. Implementing a more proactive approach to collections, such as regular credit reviews for existing customers and employing robust customer relationship management (CRM) systems, will contribute to improved risk management. Regular monitoring of aging reports and swift action on overdue accounts should be integrated into operational practices to enhance overall risk mitigation efforts.

IX. Key Observations and Insights

A. Notable Changes or Patterns

One notable change is the consistent increase in accounts receivable, particularly from 2052 to 2053. This trend suggests a potential need for adjustments in credit policies and collection procedures to align with the evolving dynamics of customer behavior. Another observation is the discrepancy between the industry benchmark DSO and [Your Company Name]'s actual DSO, indicating room for improvement in the efficiency of collecting receivables.

B. Areas of Strength

While challenges exist, [Your Company Name] exhibits strengths in profitability, with a commendable net profit margin of 12% in 2053. Efficient inventory turnover is also a positive aspect, demonstrating sound operational management. Recognizing and leveraging these strengths can contribute to a comprehensive strategy for enhancing overall financial performance.

C. Areas Requiring Attention

The primary area requiring attention is the management of accounts receivable. The prolonged DSO, coupled with an increase in outstanding receivables, demands immediate action. Addressing credit policies, streamlining collection processes, and enhancing communication with customers are critical components to rectify these issues. A proactive approach to these challenges will contribute to sustained financial health.

X. Recommendations

A. Strategic Initiatives

To fortify the Accounts Receivable function, strategic initiatives should include a comprehensive review and potential revision of credit policies. This involves assessing creditworthiness before extending credit to new customers and regularly reviewing credit limits for existing ones. Instituting a robust customer relationship management (CRM) system will aid in tracking customer payment patterns and facilitating efficient communication.

B. Operational Improvements

Operational improvements are essential for optimizing the collection process. [Your Company Name] should consider implementing a proactive approach to collections, involving regular follow-ups on overdue accounts, implementing automated reminders, and exploring early payment incentives. Enhanced training for the accounts receivable team on effective communication and negotiation skills can also contribute to expedited collections.

C. Capital Allocation Strategies

Considering the impact of accounts receivable on cash flow, revisiting capital allocation strategies is crucial. Allocating additional resources to the accounts receivable management team and investing in technologies that facilitate automated invoicing and payment tracking can lead to more efficient operations. The goal is to strike a balance between maintaining liquidity and optimizing working capital.

XI. Conclusion

A. Summary of Key Findings

In summary, the analysis of [Your Company Name]'s Accounts Receivable highlights a pressing need for intervention to address rising receivables and extended DSO. While the company demonstrates strengths in profitability and inventory management, these positives may be overshadowed without prompt attention to the identified challenges.

B. Overall Implications for the Business

Addressing the challenges within the Accounts Receivable account is pivotal for sustaining [Your Company Name]'s financial health. Implementing the recommended strategies will not only mitigate risks but also contribute to enhanced cash flow, improved liquidity, and sustained profitability. The overall implications involve creating a resilient financial framework that aligns with industry best practices and ensures the company's long-term success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover financial insights effortlessly with the Account Analysis Template from Template.net. This editable and customizable template, powered by an intuitive AI Editor Tool, simplifies account scrutiny. Unveil historical trends, ratios, and risk assessments seamlessly. Elevate decision-making with this comprehensive tool, ensuring precision and efficiency in your financial analyses. Unlock your financial potential with Template.net today.