Free Tax Withholding Form HR

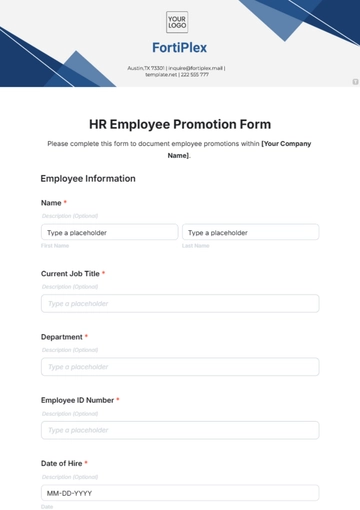

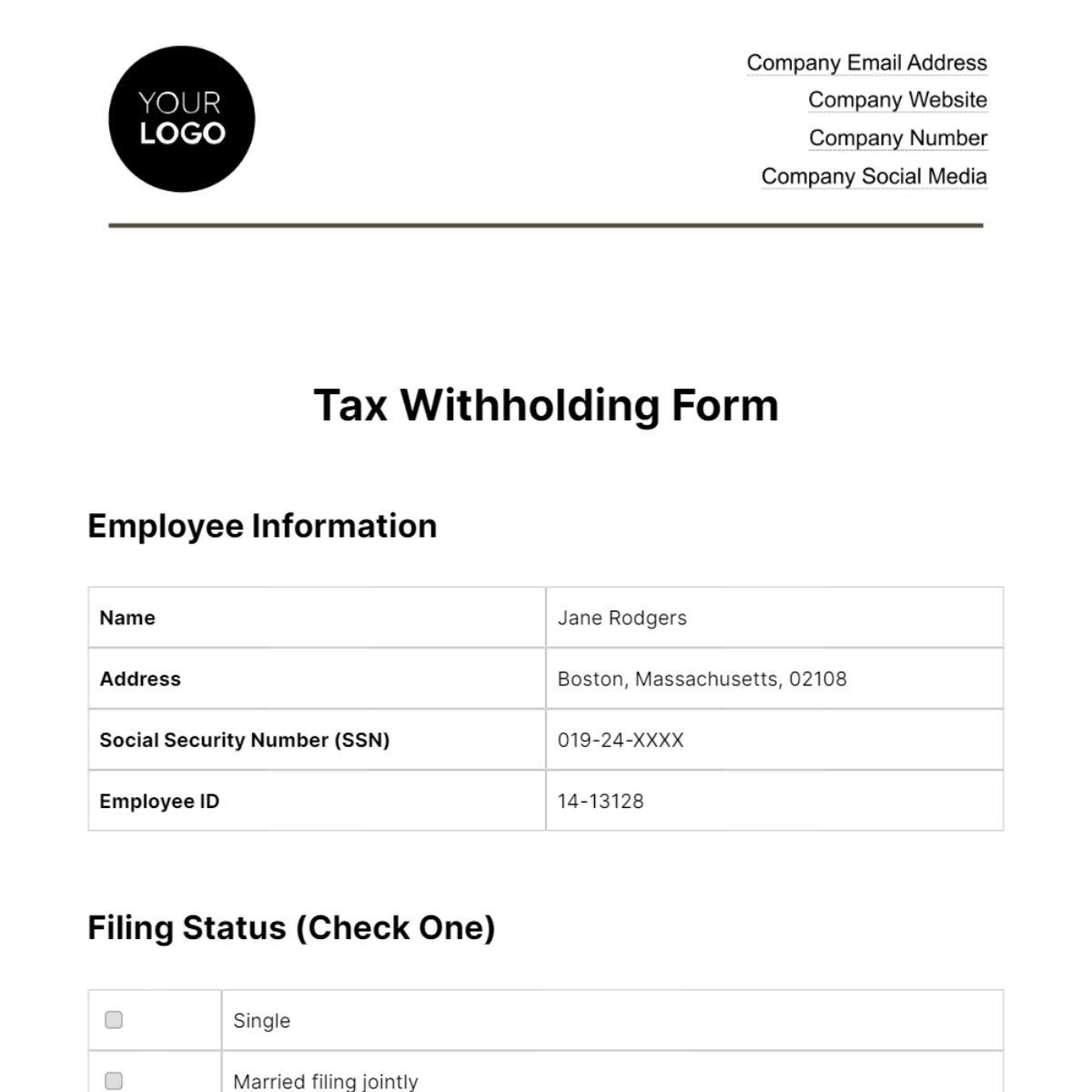

Employee Information

Name | Jane Rodgers |

Address | Boston, Massachusetts, 02108 |

Social Security Number (SSN) | 019-24-XXXX |

Employee ID | 14-13128 |

Filing Status (Check One)

Single | |

Married filing jointly | |

Married filing separately | |

Head of household | |

Qualifying widow(er) with dependent child |

Number Of Allowances (Enter the number of allowances you are claiming):

3 allowances

Additional Withholding (Optional)

If you want to request additional withholding, please specify the additional amount per pay period: [Amount]

Exemption From Withholding (If applicable)

I claim exemption from withholding because I had no tax liability last year and expect none this year. (If you meet these conditions, write "Exempt" here: )

[Signature]

Date: [MM/DD/YYYY]

Employee's Certification

I [Employee Name] certify that the information provided on this form is accurate to the best of my knowledge, and I understand that providing false information may result in penalties.

[Signature]

Date: [MM/DD/YYYY]

Employer Use Only

Tax Filing Status: | Married filing separately |

Number of Allowances Claimed: | |

Additional Withholding: |

[Signature]

Date: [MM/DD/YYYY]

Please return this completed form to the Payroll Department by [Month Day, Year]. If you have any questions or need assistance, please contact the HR Department.

[Your Company Name]

[Your Company Address]

[Your Company Number]

[Your Company Email]

[Your Company Website]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify tax processes with the Tax Withholding Form HR Template on Template.net! This fully adaptable form is designed for efficient tax withholding, ensuring alignment with your organization's policies. Utilize the AI Editor Tool strategically to empower employees in managing their tax information accurately. Grab your editable and customizable copy now!