Free Inventory Valuation Summary

Introduction:

This Inventory Valuation Summary offers a comprehensive insight into the methodologies employed to ascertain the value of our inventory assets throughout fiscal year [YEAR]. It delineates the crucial aspects of inventory valuation, including the methods utilized, adjustments made for obsolescence or impairment, and the resultant total inventory value. Such information is pivotal for the EXECUTIVE LEADERSHIP TEAM to gauge the financial health and efficiency of our inventory management practices.

Total Inventory Value:

Determining the total inventory value for fiscal year [YEAR] necessitates a meticulous aggregation of the costs associated with all inventory items held by the company at the close of the reporting period. This encompasses not only the valuation of raw materials but also work-in-progress and finished goods, providing a comprehensive snapshot of the company's investment in inventory assets over the fiscal year.

Valuation Methods Used:

In the valuation of our inventory assets for fiscal year [YEAR], a variety of methods have been employed to ensure accuracy and adherence to accounting standards. These methods include but are not limited to:

[METHOD 1]: Utilized for its suitability in situations where inventory costs experience frequent fluctuations, [METHOD 1] provides a reliable average cost valuation mechanism.

[METHOD 2]: Widely recognized for its simplicity and applicability, the FIFO method assumes that the first inventory items purchased are the first to be sold, thus influencing the cost of goods sold and the ending inventory valuation.

[METHOD 3]: Offering a highly specific and precise approach, the specific identification method is often employed for unique or high-value inventory items, allowing for accurate individual item valuation.

Adjustments for Obsolescence or Impairment:

In the course of fiscal year [YEAR], our inventory valuation process necessitated adjustments to account for instances of obsolescence or impairment.

Obsolescence: This adjustment reflects the reduction in the value of inventory items that have become obsolete or are no longer in demand, ensuring that inventory is valued at its lower of cost or market value.

Impairment: Inventory impairment adjustments were made where the carrying amount of inventory exceeded its recoverable amount due to factors such as damage, expiration, or changes in market conditions. These adjustments ensure that inventory is valued realistically, reflecting its true economic value.

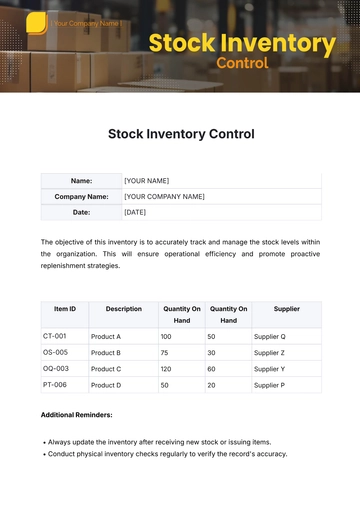

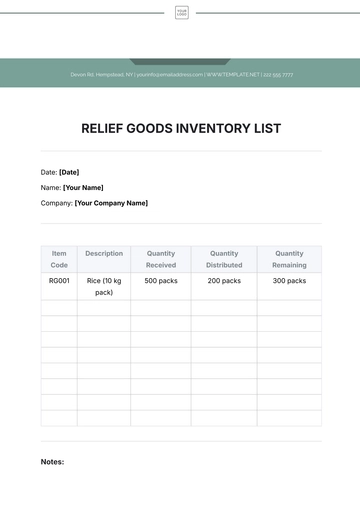

Summary Table:

VALUATION METHOD | TOTAL INVENTORY VALUE |

|---|---|

[METHOD 1] | [TOTAL VALUE] |

[METHOD 2] | [TOTAL VALUE] |

[METHOD 3] | [TOTAL VALUE] |

Additional Comments:

The accuracy and reliability of our inventory valuation practices have been paramount in ensuring the integrity of our financial reporting.

Regular assessments and adjustments for obsolescence and impairment are essential to maintain the relevance and accuracy of our inventory valuation.

Any significant changes in inventory valuation methods or adjustments are disclosed transparently in our financial statements' footnotes.

Conclusion:

The Inventory Valuation Summary for fiscal year [YEAR] provides a comprehensive overview of the valuation methodologies employed, adjustments made for obsolescence or impairment, and the resultant total inventory value. By adhering to rigorous valuation practices and maintaining transparency in reporting, we ensure the provision of accurate and reliable financial information to the EXECUTIVE LEADERSHIP TEAM, facilitating informed decision-making and strategic planning.

Summarized By: [YOUR NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover efficiency with the Inventory Valuation Summary Template from Template.net. This editable and customizable tool streamlines inventory management, providing a clear snapshot of valuation. Seamlessly adjust details to suit your needs using our Ai Editor Tool. Elevate your organization's inventory strategy effortlessly.