Free Valuation Summary

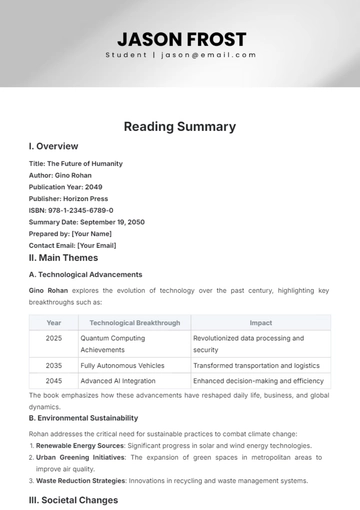

Overview:

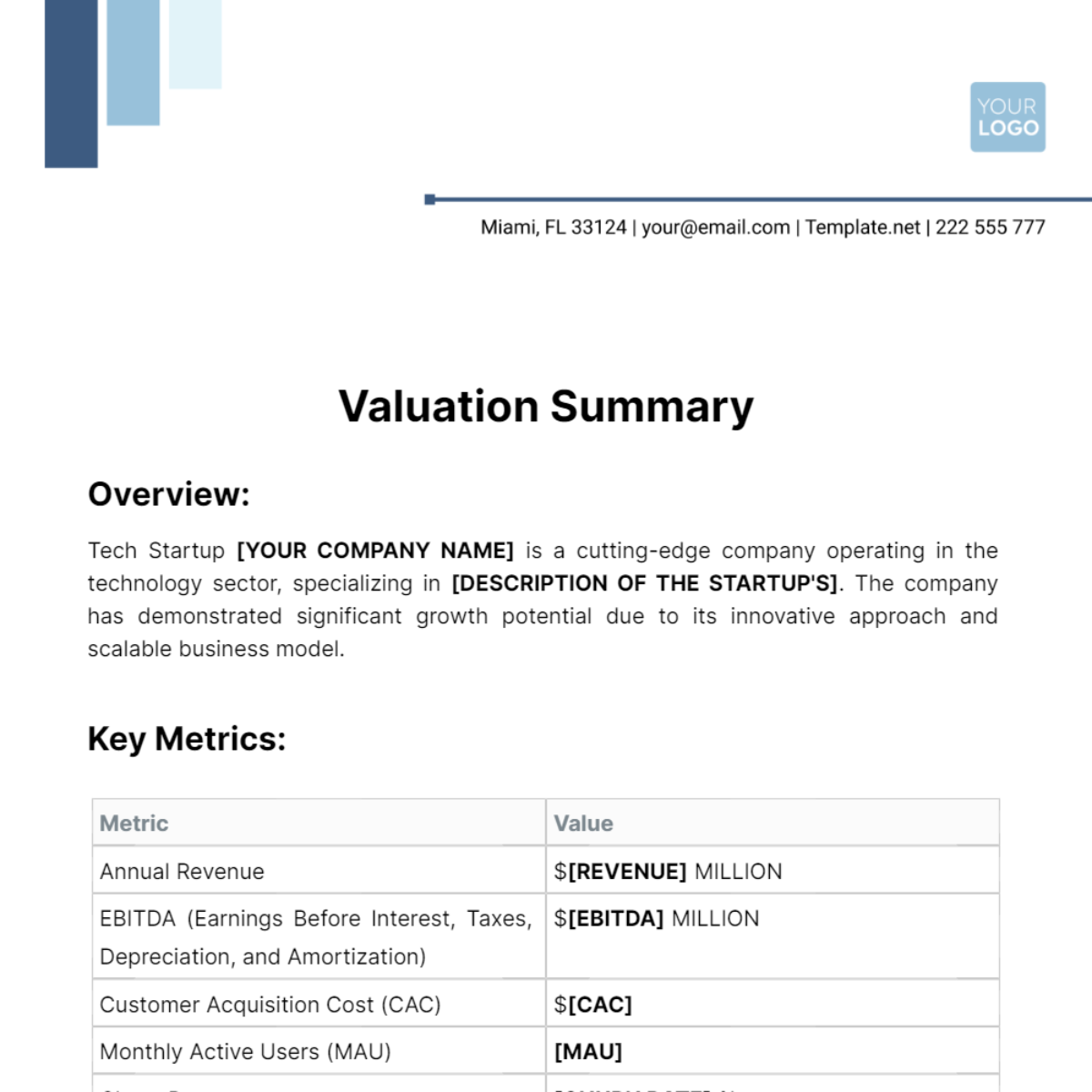

Tech Startup [YOUR COMPANY NAME] is a cutting-edge company operating in the technology sector, specializing in [DESCRIPTION OF THE STARTUP'S]. The company has demonstrated significant growth potential due to its innovative approach and scalable business model.

Key Metrics:

Metric | Value |

|---|---|

Annual Revenue | $[REVENUE] MILLION |

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) | $[EBITDA] MILLION |

Customer Acquisition Cost (CAC) | $[CAC] |

Monthly Active Users (MAU) | [MAU] |

Churn Rate | [CHURN RATE] % |

Valuation Methodology:

The valuation of Tech Startup [YOUR COMPANY NAME] was conducted using a combination of methods, including the Discounted Cash Flow (DCF) analysis, Comparable Company Analysis (CCA), and Venture Capital Method (VC Method).

Discounted Cash Flow (DCF) Analysis:

Projected future cash flows were discounted back to present value using a discount rate of [DISCOUNT RATE].

Terminal value was calculated using an appropriate multiple.

Sensitivity analysis was performed to account for various scenarios.

Comparable Company Analysis (CCA):

Comparable publicly traded companies in the technology sector were analyzed based on their financial metrics such as revenue, EBITDA, and growth rates.

Valuation multiples (e.g., EV/Revenue, EV/EBITDA) were applied to Tech Startup XYZ's financials to determine its implied valuation.

Venture Capital Method (VC Method):

Future projected revenues and EBITDA were estimated based on market trends and the company's growth trajectory.

A suitable discount rate and terminal value multiplier were applied to determine the startup's valuation.

Valuation Results:

Based on the conducted analysis, the estimated valuation of Tech Startup [YOUR COMPANY NAME] is approximately $[VALUATION] MILLION.

Investment Opportunity:

Investing in Tech Startup [YOUR COMPANY NAME] presents an exciting opportunity to participate in the growth potential of a disruptive technology company. With a strong track record of innovation and a scalable business model, the company is well-positioned to capture a significant market share in the [RELEVANT INDUSTRY OR MARKET SEGMENT].

Conclusion:

Tech Startup [YOUR COMPANY NAME]'s valuation reflects its potential to generate substantial returns for investors. With a solid foundation, innovative products/services, and a clear growth strategy, the company is poised for success in the dynamic tech industry. Investors are encouraged to consider this opportunity for potential investment.

Summarized By:

[YOUR NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate Valuation Summary Template on Template.net! Crafted to streamline your financial presentations, this editable and customizable template empowers you to showcase your valuation data with precision. Seamlessly edit in our Ai Editor Tool for a polished and professional summary every time. Elevate your financial reporting effortlessly!