Free Tax Return Summary

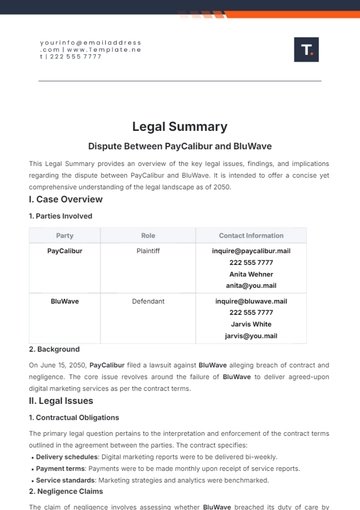

Taxpayer Information

Name: [TAXPAYER NAME]

SSN: [SOCIAL SECURITY NUMBER]

Filing Status: [FILING STATUS]

Address: [ADDRESS]

Overview

The Tax Return Summary is designed to provide individual taxpayers with a clear and concise overview of their annual tax obligations, financial status, and key components of their tax return. This document encapsulates the essential aspects of your tax return, including income, deductions, credits, and final tax liabilities or refunds for the fiscal year. The purpose of this summary is to demystify the tax return process, offering taxpayers a straightforward snapshot of their financial interactions with tax authorities over the specified period.

Income Summary

This section consolidates all sources of income for the taxpayer, providing a comprehensive view of earnings over the fiscal year.

Source of Income | Amount ($) |

Wages, Salaries, Tips | [AMOUNT] |

Interest Income | [AMOUNT] |

Dividends | [AMOUNT] |

State Tax Refund | [AMOUNT] |

Business Income | [AMOUNT] |

Total Income | [TOTAL INCOME] |

Deductions and Adjustments

Deductions reduce taxable income, based on either itemized deductions or the standard deduction, along with any other adjustments.

Type of Deduction | Amount ($) |

Standard/Itemized Deduction | [AMOUNT] |

Student Loan Interest | [AMOUNT] |

IRA Contributions | [AMOUNT] |

Health Savings Account | [AMOUNT] |

Total Deductions | [TOTAL DEDUCTIONS] |

Tax Credits

Tax credits directly reduce the amount of tax owed, not the taxable income. This section highlights applicable tax credits.

Tax Credit | Amount ($) |

Education Credits | [AMOUNT] |

Child Tax Credit | [AMOUNT] |

Earned Income Credit | [AMOUNT] |

Total Tax Credits | [TOTAL CREDITS] |

Tax Liabilities and Payments

This section outlines the taxpayer's final tax liabilities, including any additional taxes owed or refunds due after accounting for withholdings and estimated tax payments.

Description | Amount ($) |

Total Tax Liability | [AMOUNT] |

Federal Income Tax Withheld | [AMOUNT] |

Estimated Tax Payments | [AMOUNT] |

Net Tax (Owed/Refund) | [NET AMOUNT] |

Conclusion

The Tax Return Summary provides [TAXPAYER NAME] with an overview of their annual tax obligations and financial status for [YEAR]. It includes detailed information on income, deductions, credits, and tax liabilities, all organized in a clear, concise format for easy review. This summary serves as a valuable tool for understanding tax responsibilities and planning for future financial decisions.

Summarized By: [YOUR NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Tax Return Summary Template from Template.net. This meticulously crafted document simplifies tax reporting with its user-friendly design. It's fully editable and customizable, ensuring flexibility for all financial needs. Plus, effortlessly tailor it to your specifications using our Ai Editor Tool. Streamline tax preparation with ease.