Free Tax Information Summary

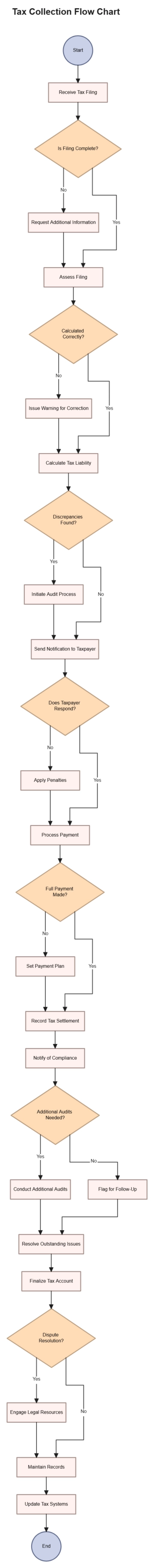

Overview:

As a tax accountant, it's essential to provide clear information to individual taxpayers regarding their annual tax filing. Below is a comprehensive summary to guide taxpayers through the process and ensure accurate and timely filing.

Important Dates:

Event | Date |

|---|---|

Tax Year End | December 31, [Year] |

Individual Tax Filing Deadline (for most taxpayers) | April 15, [Year] |

Extension Filing Deadline (with Form 4868) | October 15, [Year] |

Key Documents:

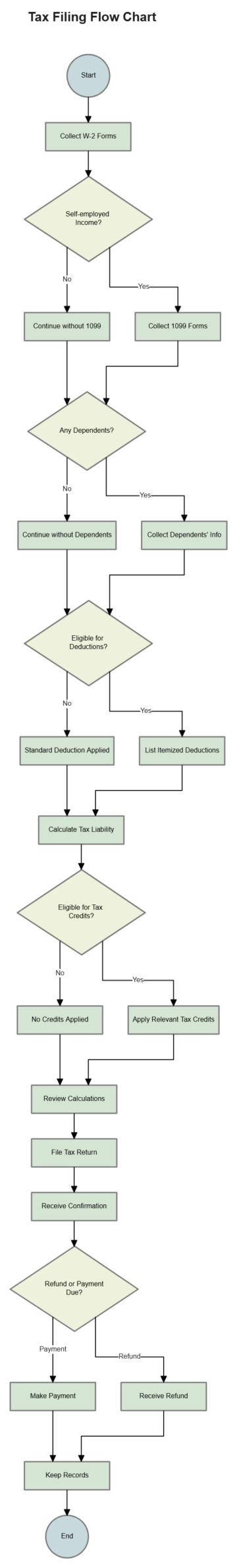

Before filing taxes, ensure you have the following documents:

W-2 Form: Wage and tax statement provided by your employer.

1099 Forms: For additional income such as interest, dividends, or freelance work.

Receipts and Records: For deductible expenses such as medical costs, charitable donations, and business expenses.

Previous Year's Tax Return: Useful for reference and to identify any carryover deductions or credits.

Tax Filing Options: Taxpayers have several options for filing their taxes:

Online Filing: Utilize tax preparation software or file directly through the IRS website for a convenient and efficient filing process.

Tax Professional: Consult with a certified tax professional for personalized guidance and assistance.

Paper Filing: Complete and mail paper tax forms to the IRS, available for taxpayers who prefer traditional methods.

Tax Deductions and Credits:

Deduction / Credit | Description |

|---|---|

Standard Deduction | A predetermined amount that reduces your taxable income, available if you don't itemize deductions. |

Itemized Deductions | Allowable deductions for specific expenses such as mortgage interest, medical expenses, and charitable contributions. |

Earned Income Tax Credit (EITC) | Credit for low-to-moderate-income individuals and families, potentially resulting in a refund even if no taxes are owed. |

Child Tax Credit | Credit for taxpayers with qualifying children under the age of 17, reducing tax liability dollar-for-dollar. |

Retirement Savings Contributions Credit | Credit for eligible contributions to retirement savings plans, encouraging retirement savings. |

Conclusion:

Filing taxes accurately and on time is crucial to avoid penalties and maximize your tax benefits. Ensure you have all necessary documents and consider your filing options carefully. If you need assistance or have questions, don't hesitate to consult with a tax professional. By staying informed and proactive, you can navigate the tax filing process with confidence.

Summarized By:

[YOUR NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Tax Information Summary Template from Template.net! Simplify tax reporting with this editable and customizable solution. Tailor it effortlessly to your needs using our Ai Editor Tool. Streamline your financial processes and ensure accuracy with this user-friendly template. Get organized and stay ahead with Template.net.