Free Subjective Summary

Summarized By: [YOUR NAME]

Introduction:

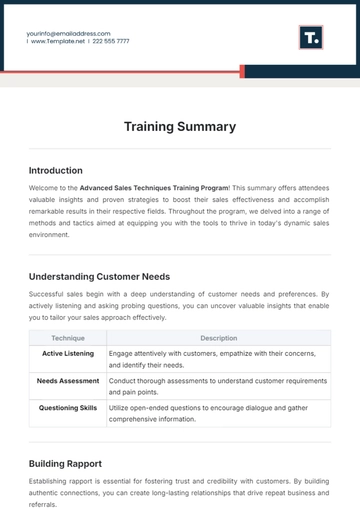

Welcome to the Subjective Summary Template for [SUBJECT TITLE]. This template serves as a comprehensive guide for [TARGET AUDIENCE], offering insights into key concepts and principles within [SUBJECT]. Whether you're a student, researcher, or enthusiast, this summary aims to enhance your understanding and facilitate deeper exploration of the subject matter.

Macroeconomic Indicators:

Gross Domestic Product (GDP): GDP measures the total value of all goods and services produced within a country's borders during a specific period. It is a key indicator of a nation's economic health and performance.

Unemployment Rate: The unemployment rate indicates the percentage of the labor force that is unemployed and actively seeking employment. It reflects the health of the labor market.

Inflation Rate: Inflation measures the rate at which the general level of prices for goods and services is rising. It erodes purchasing power and affects consumer behavior.

Consumer Price Index (CPI): The CPI measures changes in the price level of a basket of consumer goods and services purchased by households. It is a widely used indicator of inflation.

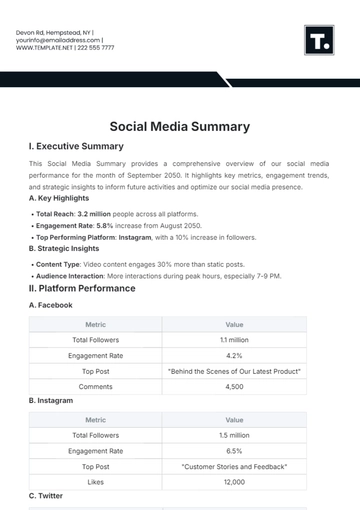

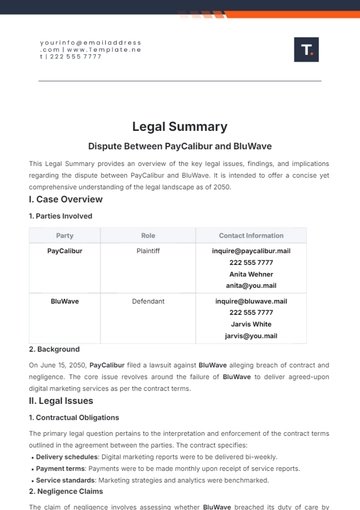

Table 1: Comparison of Macroeconomic Indicators

Indicator

Definition

Importance

Gross Domestic Product (GDP)

Total value of all goods and services produced within a country's borders

Measure of economic performance

Unemployment Rate

Percentage of the labor force that is unemployed and actively seeking employment

Indicator of labor market health

Inflation Rate

Rate at which the general level of prices for goods and services is rising

Affects purchasing power and consumer behavior

Consumer Price Index (CPI)

Measures changes in the price level of a basket of consumer goods and services

Indicator of inflation

Fiscal Policy:

Government Spending: Fiscal policy involves government expenditures on [SERVICES], as well as transfer payments such as [EXAMPLES OF TRANSFER PAYMENTS].

Taxation: Taxation is used by governments to raise revenue and influence economic behavior. Changes in tax rates can affect [SAVING DECISIONS].

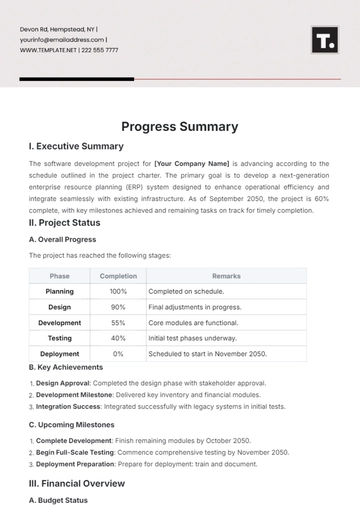

Table 2: Comparison of Fiscal and Monetary Policy

Policy | Description | Tools |

|---|---|---|

Fiscal Policy | Government spending and taxation | Government spending, taxation |

Monetary Policy | Central bank's control over money supply and interest rates | Money supply, interest rates |

Monetary Policy:

Central Bank: Monetary policy is conducted by a country's central bank, which controls the money supply and interest rates to achieve [MACROECONOMIC OBJECTIVES].

Interest Rates: Central banks use interest rates to regulate borrowing and lending in the economy. Lower interest rates stimulate economic activity, while higher rates can [ECONOMIC ACTIVITY].

Table 3: International Trade and Exchange Rates

Concept | Definition |

|---|---|

Balance of Trade | Difference between a country's exports and imports of goods and services |

Exchange Rates | Value of one currency relative to another |

International Trade and Exchange Rates:

Balance of Trade: The balance of trade quantifies the variance between a nation's exports and imports of goods and services. A trade surplus arises when [COUNTRY] exports surpass imports, whereas a trade deficit arises when imports exceed exports.

Exchange Rates: Exchange rates determine the value of one currency relative to another. They influence international trade, investment, and capital flows.

Conclusion:

In conclusion, grasping the principles of macroeconomics is crucial for [PURPOSE]. By comprehending fundamental concepts like macroeconomic indicators, fiscal and monetary policy, and international trade, [TARGET AUDIENCE] can gain insight into economic dynamics and trends, enabling them to [OUTCOME].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Subjective Summary Template from Template.net, a versatile solution for crafting engaging summaries effortlessly. This editable and customizable template empowers users to tailor summaries to their preferences, enhancing productivity. Seamlessly edit in our Ai Editor Tool for a streamlined experience. Elevate your summarizing game with this dynamic tool.