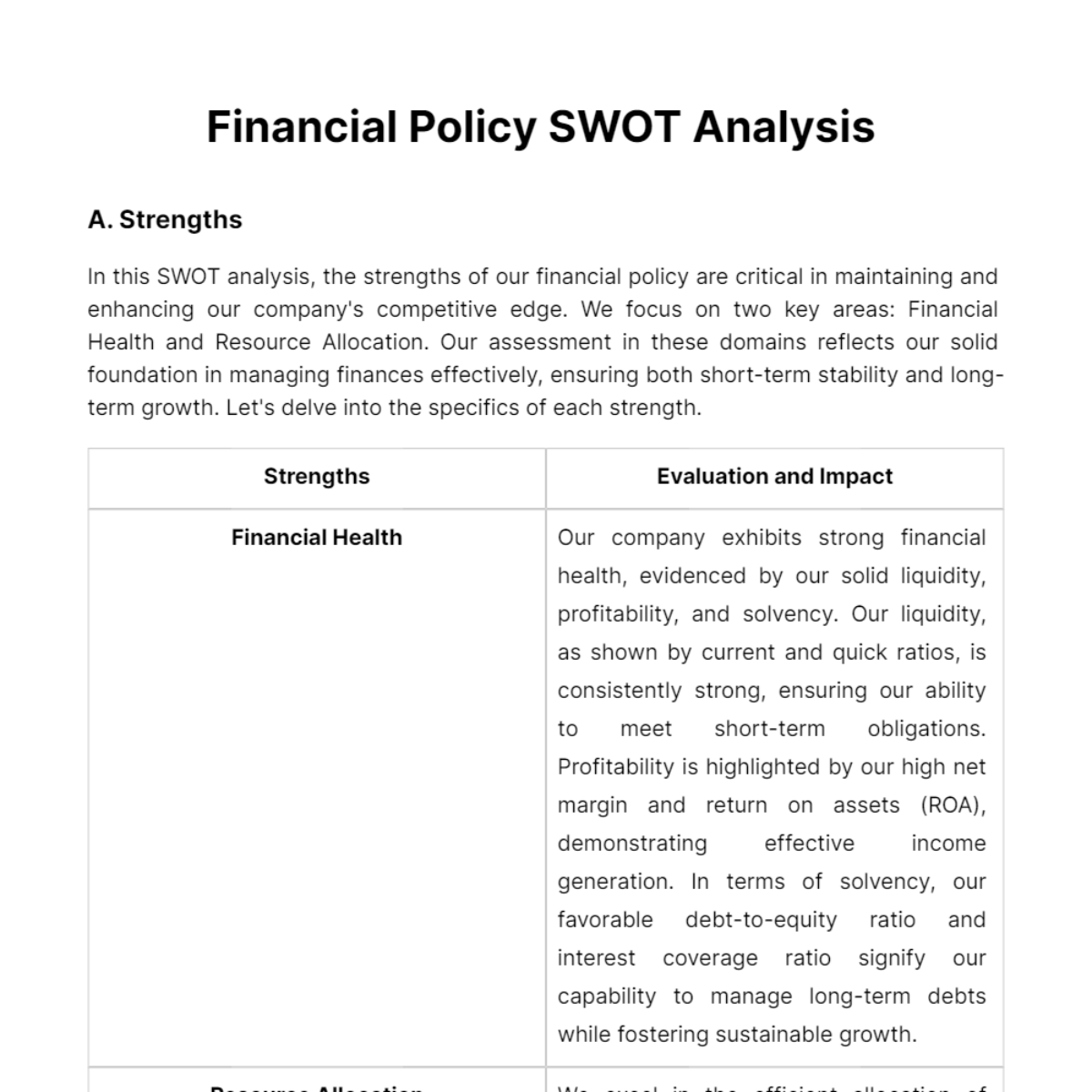

Free Financial Policy SWOT Analysis

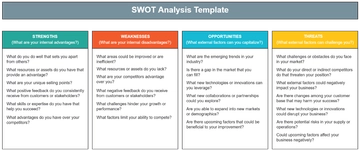

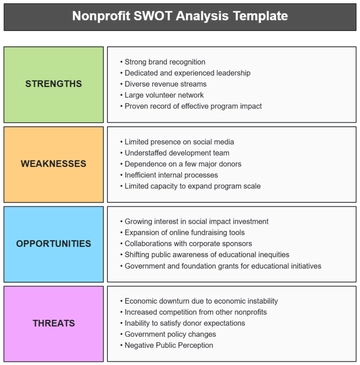

A. Strengths

In this SWOT analysis, the strengths of our financial policy are critical in maintaining and enhancing our company's competitive edge. We focus on two key areas: Financial Health and Resource Allocation. Our assessment in these domains reflects our solid foundation in managing finances effectively, ensuring both short-term stability and long-term growth. Let's delve into the specifics of each strength.

Strengths | Evaluation and Impact |

Financial Health | Our company exhibits strong financial health, evidenced by our solid liquidity, profitability, and solvency. Our liquidity, as shown by current and quick ratios, is consistently strong, ensuring our ability to meet short-term obligations. Profitability is highlighted by our high net margin and return on assets (ROA), demonstrating effective income generation. In terms of solvency, our favorable debt-to-equity ratio and interest coverage ratio signify our capability to manage long-term debts while fostering sustainable growth. |

Resource Allocation | We excel in the efficient allocation of financial resources and investments. Our strategic decision-making is data-driven, aligning with our long-term goals. This results in a well-diversified investment portfolio that balances risks and returns effectively. Regular performance evaluations against benchmarks ensure our resource allocation strategies adapt to market dynamics, supporting our competitive advantage and future growth potential. |

B. Weaknesses

In the SWOT analysis, recognizing weaknesses is crucial for fostering improvement and mitigating risks. In this section, we scrutinize two significant areas: Financial Risks and Debt Management. Identifying and understanding these weaknesses enables us to devise strategies to address potential challenges, thereby enhancing our financial stability and resilience. Here's a detailed examination of these weaknesses:

Weaknesses | Evaluation and Impact |

Financial Risks | Our financial risks include credit risk, market risk, and operational risk. Credit risk arises from potential defaults on loans extended. Market risk involves the volatility of financial markets impacting our investments. Operational risk is related to failures in our internal processes and systems. These risks require continuous monitoring and robust risk management strategies to mitigate potential negative impacts on our financial health. |

Debt Management | An analysis of our debt structure reveals certain vulnerabilities. While we maintain a manageable level of debt, there is a need to optimize our debt-to-equity ratio further. High levels of long-term debt could impact our financial stability during economic downturns. Continuous evaluation and strategic refinancing are necessary to ensure our debt levels support our growth objectives without imposing excessive financial strain. |

C. Opportunities

The opportunities section focuses on areas where our company can grow and improve. Specifically, we look at Market Expansion and Technological Advancements. These opportunities, if leveraged effectively, can drive significant growth and competitive advantage. Understanding and capitalizing on these aspects are crucial for our strategic development and long-term success. Below is a detailed presentation of these opportunities:

Opportunities | Potential and Strategy |

Market Expansion | There's significant potential for growth in new markets, both geographically and in terms of product diversification. Expanding into emerging markets or introducing new financial products can tap into new customer bases and revenue streams, driving overall growth. Strategic partnerships and market research are key to successful expansion. |

Technological Advancements | The advent of new financial technologies and digital transformation presents numerous opportunities. Embracing technologies like blockchain, AI, and machine learning can streamline operations, enhance customer experience, and create innovative financial products. Staying ahead in tech adoption can position us as a leader in the financial sector. |

D. Threats

Identifying potential threats is essential for proactive risk management and strategic planning. In this section, we focus on two critical threats: Regulatory Changes and Economic Fluctuations. Understanding the impact of these factors is crucial for maintaining compliance and financial stability. Effective management of these threats is key to safeguarding our company's position in the market.

Threats | Impact and Mitigation Strategies |

Regulatory Changes | Changes in financial regulations and compliance requirements pose significant challenges. These changes can affect operational processes and product offerings. Staying abreast of regulatory developments and maintaining flexibility in operations are crucial for compliance and minimizing disruptions. |

Economic Fluctuations | Our company is vulnerable to economic downturns, interest rate changes, and inflation. These factors can impact our profitability and investment strategies. Diversifying investments, prudent financial planning, and maintaining a strong liquidity position are essential to mitigate these risks. |

E. Strategic Financial Planning

In our Strategic Financial Planning, we emphasize two fundamental components: Long-term Goals and Budgeting and Forecasting. This section outlines our commitment to setting visionary yet achievable financial objectives and maintaining rigorous, accurate financial planning processes. These elements are vital in guiding our financial trajectory and ensuring sustained organizational growth.

Long-term Goals: Our strategic financial planning emphasizes setting and continuously evaluating long-term financial goals. These goals, aligning with our broader business vision, focus on sustained revenue growth, market share expansion, and capital investment efficiency. Regular assessments against industry benchmarks and internal performance indicators ensure these goals adapt to market shifts and internal developments, maintaining their relevance and achievability.

Budgeting and Forecasting: The effectiveness of our budgeting processes and the accuracy of financial forecasting are pivotal. Our comprehensive budgeting approach ensures alignment with strategic goals, while rigorous forecasting, using advanced analytical tools, enhances forecast precision. This process involves continuous monitoring and adjustments, enabling us to respond swiftly to economic changes, control costs effectively, and allocate resources optimally, supporting our strategic objectives.

F. Operational Efficiency

Operational efficiency is key to our financial strategy, focusing on Cost Management and Cash Flow Management. This section delves into our practices for optimizing expenses and ensuring robust liquidity, critical for maintaining a healthy financial state and supporting growth.

Cost Management

Expense Optimization: We continuously analyze and implement cost control measures, ensuring operational efficiency. This includes streamlining processes and leveraging technology for cost savings.

Operational Productivity: Regular assessment of operational productivity aids in identifying areas for cost reduction without compromising quality or output.

Cash Flow Management

Process Efficiency: Our cash flow processes are regularly reviewed for efficiency, ensuring smooth financial operations and timely fulfillment of obligations.

Liquidity Optimization: Effective liquidity management is maintained through proactive monitoring of cash reserves and working capital, ensuring financial agility and stability.

G. Investment Strategies

In our financial framework, Investment Strategies play a pivotal role, emphasizing Portfolio Diversification and Return on Investment (ROI). This section outlines our approach to optimizing our investment portfolio, ensuring it is well-diversified and yields substantial returns, contributing to our financial growth and stability.

Portfolio Diversification

Asset Allocation: We focus on diversifying asset allocation across various sectors and geographies to mitigate risks. This includes a mix of equities, bonds, and alternative investments.

Risk Management: Regular risk assessment ensures our portfolio aligns with our risk tolerance and market conditions, balancing potential returns against risks.

Return on Investment (ROI)

Performance Analysis: We rigorously evaluate the ROI of our investment ventures, considering both short-term gains and long-term growth potential.

Strategic Re-allocation: Insights from ROI evaluations guide our decisions in reallocating resources towards more profitable ventures, ensuring an optimal balance between risk and return in our investment strategy.

H. Credit and Lending Policies

In our approach to Credit Risk Management and Lending Practices, we prioritize the analysis of credit policies and the evaluation of lending practices for their impact on financial health. This detailed examination ensures responsible credit distribution and risk management, aligning with our commitment to financial stability and integrity.

Credit Risk Management

Policy Analysis

Criteria Setting: Establishing stringent credit criteria based on detailed risk assessments ensures responsible credit distribution.

Limits Determination: Setting and regularly revising credit limits to align with changing market conditions and risk appetite.

Risk Mitigation Strategies

Diversification: Spreading credit across various sectors and demographics to mitigate concentration risk.

Regular Monitoring: Implementing ongoing monitoring systems for early detection and management of credit risk exposures.

Lending Practices

Practice Review

Provision Adequacy: Ensuring sufficient provisions are made for potential loan losses.

Recovery Effectiveness: Assessing the effectiveness of loan recovery processes to maintain financial health.

Impact Assessment

Financial Stability Influence: Evaluating how lending affects the company's overall financial stability.

Regulatory Compliance: Ensuring lending practices meet all regulatory requirements, thereby safeguarding our reputation and avoiding potential legal ramifications.

I. Funding and Capital Raising

In our Funding and Capital Raising strategies, we focus on two critical aspects: evaluating our Capital Structure and analyzing our Funding Sources. This approach ensures that our financial strategy is both sustainable and aligned with our growth objectives.

Capital Structure

Our capital structure evaluation involves examining the mix of debt and equity financing. This assessment ensures the structure aligns with our risk tolerance and investment strategy.

The appropriateness of our capital structure is gauged in terms of cost of capital, financial flexibility, and market conditions. Regular re-evaluation allows us to adjust our capital strategy in response to internal performance and external economic changes, optimizing our financial leverage and overall financial health.

Funding Sources

Analysis of funding sources includes reviewing our current mix of internal and external financing options, such as retained earnings, equity, debt, and alternative funding methods.

We also explore potential new funding sources to diversify our financial base and reduce dependency on any single source. This includes assessing the viability and cost-effectiveness of new funding options, ensuring they align with our strategic goals and provide the flexibility needed for sustainable growth and innovation.

J. Compliance and Risk Management

Our approach to Compliance and Risk Management is twofold, focusing on Regulatory Compliance and Risk Mitigation Strategies. This section details our commitment to adhering to financial regulations and effectively managing financial risks, which is crucial for our operational integrity and reputational standing.

Regulatory Compliance

Adherence to Laws

Regular Updates: Keeping abreast of and complying with the latest financial regulations and laws.

Internal Audits: Conducting frequent internal audits to ensure continuous compliance.

Training and Awareness

Employee Education: Regular training for staff on regulatory changes and compliance requirements.

Compliance Culture: Fostering a culture of compliance throughout the organization.

Risk Mitigation Strategies

Identification and Assessment

Risk Analysis: Continuously identifying and assessing potential financial risks.

Impact Evaluation: Evaluating the potential impact of these risks on our operations.

Implementation and Review

Strategy Development: Developing and implementing effective risk mitigation strategies.

Continuous Monitoring: Regularly monitoring the effectiveness of these strategies and making adjustments as necessary to ensure they remain effective in mitigating identified risks.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your strategic planning with Template.net's Financial Policy SWOT Analysis Template. Fully editable and customizable, this template is perfect for in-depth analysis. Effortlessly editable in our Ai Editor Tool to suit your unique business needs. Ideal for identifying strengths, weaknesses, opportunities, and threats in financial policies.