Free Comprehensive Finance Credit Analysis

Executive Summary

Credit Analysis of [Your Company Name]

This report provides a comprehensive credit analysis of [Your Company Name], a leading [Industry, e.g., technology] company based in [Your Company Address]. The analysis is based on the financial data for the fiscal years [20xx-20xx], industry trends, operational strategies, and market positioning of the company.

The findings suggest that [Your Company Name] maintains a robust financial structure and demonstrates a strong market presence but faces challenges in increasing competition and regulatory changes. Based on our evaluation, we assign a credit rating of [X%] with a stable outlook.

Introduction

Purpose of the Credit Analysis

The primary objective of this analysis is to evaluate the creditworthiness of [Your Company Name] to determine the risk associated with extending credit. This report aims to provide a detailed insight into the company's financial stability, operational efficiency, and market position to facilitate informed decision-making for potential lenders or investors.

Scope and Limitations

The analysis covers a comprehensive review of financial statements, industry position, management effectiveness, and other qualitative and quantitative factors affecting [Your Company Name]'s creditworthiness. However, the future projections and recommendations are subject to market conditions and unforeseen economic factors.

Borrower Overview

Legal Name and Structure: [Your Company Name]

Incorporation: [Date and Place of Incorporation]

Type: [Publicly Listed/Private Corporation]

Industry: [Specific Industry, e.g., Software Development]

Major Activities: [Brief description of products, services, market segments]

Business Model:

[Your Company Name] operates a [type] model focusing on [core areas, e.g., software development, direct sales]. The company has diversified its portfolio by [activities, e.g., acquiring smaller firms, expanding into new markets].

Management Team:

CEO: [CEO Name] with [X years] of industry experience.

CFO: [CFO Name] with [X years] of financial management experience.

Others: [Include other key members relevant to the credit analysis].

Ownership Structure:

Major Shareholders: [List top shareholders and their stakes]

Affiliates and Subsidiaries: [List if applicable]

Industry Analysis

Overview of the [Your Industry]

Size and Growth: As of [Year], the [Your Industry] is valued at $X billion, with an annual growth rate of X%.

Key Players: [List major competitors and their market share]

Regulatory Environment: [Discuss any recent or upcoming regulations affecting the industry]

Industry Risks and Opportunities

Technological Changes:

In the rapidly evolving [e.g., technology/software] industry, [Your Company Name] faces the risk of its products or services becoming obsolete. Continuous innovation is crucial, but it comes with high R&D costs and execution risks. For instance, failure to adapt to emerging technologies like AI or blockchain could result in a loss of market share to more innovative competitors.

Regulatory Risks:

The [specific industry] is subject to stringent regulations, particularly concerning [e.g., data privacy, consumer protection, environmental standards]. Changes in regulations or non-compliance could lead to hefty fines, legal disputes, or operational disruptions. For example, global data protection laws like GDPR require [Your Company Name] to continuously update its data handling practices, imposing additional costs and compliance burdens.

Market Competition:

The industry is characterized by intense competition. [Your Company Name] competes with both established players and emerging startups. Price wars, rapid imitation of services/products, and shifts in consumer preferences pose constant threats. Maintaining a competitive edge requires continuous market analysis, innovation, and strategic pricing.

Market Expansion:

There is significant potential for [Your Company Name] to expand into emerging markets, where demand for [industry-specific products/services] is growing. For instance, expanding into Asian markets could provide access to a large customer base and contribute significantly to revenue growth.

Product Innovation:

Investment in R&D can lead to the development of new and improved products/services, catering to unmet market needs or enhancing customer experience.

Financial Analysis

Financial Statements Overview [20xx-20xx]

For [Your Company Name], the financial years [20xx-20xx] showed significant variation due to major product launches and market downturns due to economic conditions.

Financial Year | [20xx] | [20xx] | [20xx] |

|---|---|---|---|

Revenue | $[Amount] | $[Amount] | $[Amount] |

Net Income | $[Amount] | $[Amount] | $[Amount] |

Total Assets | $[Amount] | $[Amount] | $[Amount] |

Total Liabilities | $[Amount] | $[Amount] | $[Amount] |

Equity | $[Amount] | $[Amount] | $[Amount] |

Key Financial Ratios

Ratio | [20xx] | [20xx] | [20xx] |

|---|---|---|---|

Current Ratio | 1.5 | 1.6 | 1.7 |

Debt to Equity Ratio | 0.67 | 0.68 | 0.75 |

Gross Margin | 30% | 32% | 33% |

Net Profit Margin | 10% | 11% | 11.5% |

Return on Equity (ROE) | 8.3% | 9.5% | 10.5% |

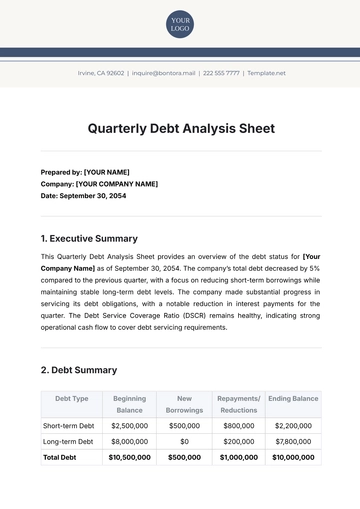

Over the three years, [Your Company Name] demonstrated consistent revenue growth. The increase in gross margin and net profit margin indicates improved operational efficiency and cost management. The steady rise in ROE suggests that the company is generating increased profits from its equity, showing a healthy return to shareholders. However, the increasing debt-to-equity ratio points towards a growing reliance on debt financing, which could be a concern if not managed properly.

Historical Performance and Trends

From [20xx-20xx], [Your Company Name] showed a consistent increase in revenue, attributed to expanded market reach and product innovation. Net income grew due to improved operational efficiencies and cost management strategies. The gradual increase in liabilities reflects strategic investments in business expansion, though it necessitates careful monitoring of the debt level.

Capital Structure and Debt Profile

[Your Company Name]'s capital structure has evolved, with an increasing reliance on debt to fuel its growth strategy. The company primarily uses term loans and corporate bonds with varying maturities. Recent activities include refinancing older, high-interest debt to take advantage of lower rates, indicative of proactive financial management. The maturity profile is staggered, mitigating the risks of large, simultaneous repayments.

Credit Risk Assessment

Borrower's Repayment Capacity

Cash Flow Analysis:

The detailed review of the cash flow statements for the past three years shows that [Your Company Name] has maintained a positive operating cash flow, ensuring sufficient cover for its current liabilities. Cash from operations has been steadily increasing, signifying strong earnings quality and working capital management. However, investing and financing activities have led to negative cash flows in certain years, primarily due to significant investments in expansion and high debt repayments.

Earnings Stability:

The company's earnings before interest and taxes (EBIT) have shown stability with a gradual upward trend, suggesting consistent performance and sound financial management. The stability is supported by diversified revenue streams and a broad customer base, reducing dependency on single products or markets.

Credit History and Previous Loan Performance

Credit Score/Rating: As of the latest assessment, [Your Company Name] holds a credit rating of BBB, reflecting good creditworthiness with some sensitivity to adverse economic conditions.

Past Defaults or Delinquencies: The company has no significant history of defaults or delinquencies, indicating a strong track record of meeting its financial obligations.

Collateral and Guarantees Provided

The company has secured its major loans with assets including property, plant, and equipment valued at approximately $150 million. The loan-to-value ratio remains conservative, providing lenders with sufficient coverage in case of default. Additionally, personal guarantees by major shareholders further enhance the security of the credit extended.

Operational Risk Assessment

Operational Efficiency and Effectiveness

Supply Chain Management: [Your Company Name] relies on a global supply chain which poses risks such as delays, quality control issues, and dependency on key suppliers. Efficient management is crucial to minimize costs and ensure timely delivery of products/services.

Technology Infrastructure: The company's operational effectiveness heavily depends on its IT systems for production, customer service, and internal communication. Any disruption or cybersecurity threat could lead to significant operational and financial damage.

Management Quality and Succession Planning

Leadership Team: The current leadership has been instrumental in steering the company through various market cycles. However, a clear succession plan is essential to ensure stability and continuity in leadership.

Employee Talent and Retention: [Your Company Name]'s ability to innovate and grow is significantly dependent on its skilled workforce. Strategies for talent acquisition, development, and retention are critical in maintaining a competitive edge.

Market and Environmental Risk Assessment

Market Demand and Competition

Consumer Behavior: Changing consumer preferences and spending patterns can affect the demand for [Your Company Name]'s products/services. Keeping a pulse on market trends and adapting quickly is crucial.

Competitive Landscape: The company needs to continuously evaluate its competitive position and strategy, especially with new entrants disrupting the market with innovative solutions.

Economic Conditions

Understanding how sensitive [Your Company Name] is to economic cycles helps in forecasting performance during different market conditions. For instance, during an economic downturn, the demand for luxury products might decrease.

Environmental, Social, and Governance (ESG) Factors

Environmental Impact: Assessing the company's environmental footprint and how it's managing its resources and waste is becoming increasingly important for stakeholders.

Social Responsibility: The company's role in society, including its labor practices, community involvement, and impact on the local economy, can significantly affect its reputation and operations.

Governance: Strong corporate governance practices are crucial in minimizing risks related to corruption, fraud, and operational inefficiency.

Legal and Compliance Review

Legal Status and Ongoing Litigations

Litigation History: Review any historical, ongoing, or potential litigations that might impact [Your Company Name]'s financial health or reputation.

Intellectual Property: Ensuring that intellectual property is protected and not infringing on others' rights is crucial to safeguarding the company's products and innovations.

Regulatory Compliance

Industry Regulations: Ensure compliance with industry-specific regulations to avoid fines, sanctions, or operational restrictions.

International Operations: If the company opts to operate globally, compliance with international laws and trade regulations is also critical.

Sensitivity Analysis

Model how changes in interest rates affect the company's debt servicing capabilities and overall financial condition. Assess the impact of a market downturn on sales, supply chain, and operational costs.

If involved in international trade, foreign exchange rate volatility can significantly impact profits. For companies dependent on commodities, price fluctuations can affect the cost of goods sold and margins.

Conclusion

In conclusion, the comprehensive finance credit analysis of [Your Company Name] provides a detailed insight into the company's financial and operational health, industry position, and risk factors. It highlights the company's strengths and areas for improvement, guiding informed decision-making for stakeholders. Continual monitoring and strategic adaptation are recommended to maintain and enhance the company's creditworthiness and market position.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Master credit assessments with Template.net's Comprehensive Finance Credit Analysis Template. This professional template is both editable and customizable, designed to provide an in-depth evaluation of creditworthiness. It offers a systematic approach to accurate financial reviews, crucial for making informed lending decisions. Ideal for financial institutions and analysts, this template is editable using our Ai Editor Tool.