Free Finance Mergers & Acquisitions SWOT Analysis

Introduction

The purpose of this document is to conduct a comprehensive SWOT (Strengths, Weaknesses, Opportunities, Threats) Analysis in the context of a proposed Mergers and Acquisitions (M&A) transaction. This analysis is intended to provide a strategic framework to evaluate the internal and external factors that will impact the success of the potential M&A. The scope of this analysis encompasses a thorough assessment of our company's current capabilities, market position, and financial health, as well as an evaluation of the broader industry trends, competitive landscape, and regulatory environment. This SWOT Analysis aims to identify key areas of advantage, areas requiring improvement, potential growth opportunities, and external risks that may affect the transaction.

M&A Transaction Under Consideration

We are currently considering an M&A transaction with a company that operates in the same industry as ours, offering complementary products and services. This potential acquisition is valued at approximately $300 million, based on preliminary financial assessments. The target company has a significant market presence in regions where we are looking to expand, particularly in the European and Asian markets. They also possess advanced technological capabilities that could enhance our product offerings and overall operational efficiency. This M&A transaction aims to consolidate our market position, expand our geographic reach, and enhance our technological capabilities, thereby enabling us to better serve our customer base and increase shareholder value.

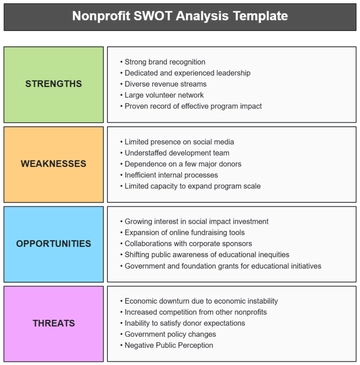

SWOT Overview

Strengths | Weaknesses | Opportunities | Threats |

Strong Market Position: We have a well-established market presence and a loyal customer base in our current operating regions. | Cultural Differences: Potential challenges in integrating diverse corporate cultures and operational practices with the target company. | Market Expansion: The acquisition provides an opportunity to expand into new geographic markets, particularly in Europe and Asia. | Market Competition: Increasing competition in the industry, especially from emerging and technologically advanced companies. |

Robust Financial Health: Our company maintains healthy cash reserves and has access to credit facilities, enabling us to finance the M&A transaction. | Operational Redundancies: Overlaps in operational areas between our company and the target, leading to potential redundancies. | Technological Advancement: Access to the target company's advanced technologies could significantly enhance our product and service offerings. | Regulatory Risks: Changes in international trade policies and regulatory environments in new markets could pose challenges. |

Experienced Management Team: Our leadership has a proven track record in successfully navigating complex M&A transactions. | Limited Experience in New Markets: Limited direct experience in some of the new markets that the target company operates in. | Synergies: Potential for significant cost savings and increased revenue through operational and technological synergies. | Integration Risks: Difficulties in the integration of systems, processes, and teams, impacting business continuity. |

Innovative R&D Capabilities: We have a strong focus on research and development, driving innovation in our product lines. | Resource Allocation: The need to allocate significant resources, both financial and human, for the integration process. | Strategic Partnerships: Opportunities for forming new strategic partnerships and alliances in the target's existing markets. | Economic Fluctuations: Global economic uncertainties that can impact market dynamics and investment outcomes. |

Strengths

Strong Market Position: Our company has established a formidable market presence, characterized by a substantial and loyal customer base. This strength is a result of years of consistent service quality, brand recognition, and customer satisfaction. Our current market share in our operating regions is a testament to this, with a 20% share in domestic markets and a growing presence internationally. This strong market position provides a solid foundation for the proposed M&A transaction, as it gives us leverage in negotiations and ensures a stable customer base to which we can offer expanded services and products post-merger.

Robust Financial Health: Financially, our company stands on solid ground with healthy cash reserves amounting to approximately $150 million and a strong credit rating, facilitating access to credit facilities at favorable terms. This financial robustness is crucial as it provides us with the necessary capital to finance the M&A transaction without over-leveraging our balance sheet. Our financial health also provides reassurance to stakeholders and investors about our ability to undertake and support this significant financial undertaking.

Experienced Management Team: One of our greatest strengths lies in our experienced management team, which has a track record of successful strategic planning and execution, including prior M&A transactions. The team's expertise in navigating complex deal structures, due diligence processes, and integration challenges is a critical asset. Their strategic vision and leadership will be invaluable in guiding this potential acquisition towards achieving our strategic objectives and ensuring a smooth integration process.

Innovative R&D Capabilities: Our commitment to innovation, particularly in research and development, has positioned us at the forefront of our industry. We allocate approximately 10% of our annual revenue to R&D activities, focusing on developing cutting-edge products and services. This focus on innovation not only enhances our current product offerings but also promises long-term growth and sustainability. The infusion of our R&D capabilities with the target company's technological assets can lead to breakthrough innovations and further solidify our market position.

Weaknesses

Cultural Differences: One of the significant challenges we anticipate in this M&A transaction is the integration of diverse corporate cultures and operational practices. Our company culture, which is deeply rooted in traditional values and standardized processes, may differ significantly from that of the target company, which has shown a more dynamic and flexible approach. This divergence could lead to potential friction and misunderstandings in the integration process. Successfully merging these differing cultures without disrupting employee morale and productivity will be a critical task, requiring thoughtful change management strategies.

Operational Redundancies: As we explore this acquisition, we must confront the potential for operational redundancies between our company and the target. Both entities currently have overlapping functions in several departments, such as marketing, human resources, and customer service. This overlap could lead to inefficiencies and the difficult decision of restructuring or downsizing post-merger. The challenge will be to streamline these operations in a manner that maximizes efficiency without compromising on service quality or employee well-being.

Limited Experience in New Markets: While the acquisition presents an exciting opportunity to expand into new geographic markets, our limited direct experience in some of these regions poses a weakness. The target company operates significantly in European and Asian markets, where we have had minimal exposure. This lack of experience could lead to challenges in understanding the new market dynamics, customer preferences, and regulatory environments, potentially hindering our ability to fully capitalize on these new opportunities.

Resource Allocation: The integration process post-acquisition will demand substantial resources - both financial and human. Allocating significant resources to this process might strain our existing operations, especially considering the need for extensive training, systems integration, and potential restructuring. Balancing the resource allocation between maintaining current operational excellence and focusing on integration will be a delicate task, requiring careful planning and management. This could divert attention and resources from our core business activities, at least in the short term, impacting our overall performance.

Opportunities

Market Expansion: The acquisition presents a significant opportunity for us to expand into new geographic markets, notably in Europe and Asia. These regions represent untapped potential with promising growth prospects. By leveraging the target company's established presence and local market knowledge, we can accelerate our entry and expansion in these markets. This expansion not only allows for increased market share but also diversifies our revenue streams and reduces dependency on our current markets. Furthermore, entering these new markets presents opportunities to cater to a broader customer base, adapt to new market trends, and enhance our global brand presence.

Technological Advancement: Acquiring the target company offers access to advanced technologies and innovative capabilities that we currently do not possess. This aligns well with our strategic goal of staying at the forefront of technological advancement in our industry. Integrating these new technologies can significantly enhance our product and service offerings, leading to improved efficiency, better customer service, and the development of new product lines. Additionally, this technological infusion can spur innovation within our R&D departments, potentially leading to breakthroughs and new intellectual property, further solidifying our competitive edge.

Synergies: The M&A transaction holds the potential for significant operational and financial synergies. By combining resources, we can achieve cost savings through economies of scale, streamlined operations, and shared administrative functions. On the revenue side, synergies could manifest in the form of cross-selling opportunities, expanded product offerings, and combined marketing efforts. These synergies are not just limited to financial metrics but also extend to knowledge sharing, best practices, and talent pooling, which can enhance overall organizational effectiveness and efficiency.

Strategic Partnerships: The expanded footprint and enhanced capabilities resulting from the merger can open doors to new strategic partnerships and alliances. These partnerships could be with other industry players, technology providers, or even cross-sector collaborations. Such alliances can lead to joint ventures, co-development of products, and expanded distribution channels. These partnerships are particularly valuable in new markets where local knowledge and networks play a critical role in business success. They provide opportunities for collaborative innovation, shared risks, and access to new customer segments.

Threats

Market Competition: The increasing intensity of competition in our industry poses a significant threat to our post-merger success. Emerging companies, especially those that are technologically advanced and agile, are continuously reshaping market expectations and dynamics. These competitors may offer more innovative products or services, potentially at lower prices, challenging our market position and profitability. The evolving competitive landscape requires us to continuously innovate and adapt to maintain our relevance and market share. Moreover, post-merger integration distractions could provide these competitors with an opportunity to capture our market share or strengthen their position.

Regulatory Risks: Our expansion into new international markets through this acquisition brings with it a complex web of regulatory challenges. Different countries have varied regulatory frameworks, particularly in areas like data privacy, consumer protection, and antitrust laws. Navigating these diverse and sometimes stringent regulations can be resource-intensive and may pose compliance risks. Additionally, there's always the potential for sudden regulatory changes or political instability in these markets, which could adversely affect our operations and strategic goals. Ensuring compliance while adapting to these regulatory environments will be a crucial aspect of our post-acquisition strategy.

Economic Fluctuations: Global economic uncertainties, such as fluctuations in currency exchange rates, interest rates, and economic downturns, can significantly impact our market and investment outcomes. Economic volatility can affect consumer spending, investment climates, and overall business growth. For instance, currency fluctuations can impact our profitability, especially in the new markets we are venturing into, where we might not have the same level of financial hedging or understanding as in our domestic market. These economic factors are outside our control and require us to have robust risk management and contingency planning in place.

Integration Risks: One of the most significant threats to the success of this M&A transaction is the risk associated with integrating the operations, systems, and cultures of two distinct companies. Integration challenges such as misalignment of objectives, communication breakdowns, and system incompatibilities can disrupt business continuity, employee morale, and customer satisfaction. There is also the risk of key talent attrition if the integration process is not managed carefully. Successfully navigating these integration challenges will require meticulous planning, effective change management, and ongoing stakeholder engagement.

Recommendations

Leveraging Strengths and Opportunities

Maximize Market Position and Expansion Opportunities: Our strong market position should be utilized as a foundation for aggressive expansion into new markets. This can be achieved by leveraging the target company's established presence in Europe and Asia, thereby accelerating our market penetration and customer base growth in these regions. Marketing campaigns and product launches tailored to these new markets will capitalize on our existing brand strength and the newly acquired local market insights.

Invest in Technological Advancement and Innovation: The acquisition's technological assets offer a unique opportunity to enhance our product and service offerings. We should invest in integrating these technologies into our current offerings and encourage collaborative innovation between our R&D team and the acquired company's tech experts. This approach will not only improve our competitive edge but also open up avenues for new product development and market offerings.

Realize and Optimize Synergies: To maximize the benefits of operational and financial synergies, a detailed plan should be implemented. This includes combining purchasing power, streamlining overlapping functions, and exploring cross-selling opportunities. Regular reviews should be conducted to ensure that these synergies are being effectively realized and contributing to cost savings and revenue growth.

Mitigating Weaknesses and Threats

Address Cultural Differences and Operational Redundancies: Initiatives like cross-cultural workshops and clear communication strategies will be vital in harmonizing differing corporate cultures. Additionally, a task force should be established to identify and address redundancies, ensuring a smooth transition with minimal disruptions.

Adapt to Regulatory Changes and Economic Fluctuations: Staying agile and informed about international regulatory changes is crucial. We should establish a dedicated team to monitor regulatory environments and ensure compliance. To safeguard against economic fluctuations, we should implement financial risk management strategies such as currency hedging and maintain a diversified investment portfolio.

Effective Integration Strategy: To overcome integration risks, a well-structured integration framework should be established, with clear timelines and milestones. This strategy should emphasize transparent communication, employee engagement, and a phased approach to systems integration. Retention plans for key talent and continuous monitoring of integration progress will be critical in mitigating these risks.

Action Plan

This action plan outlines a strategic roadmap for capitalizing on our identified strengths and opportunities, and effectively addressing our weaknesses and threats. This plan is designed to guide our steps in a structured manner, ensuring that we achieve the goals set out in our M&A strategy.

Steps for Seizing Opportunities and Strengths

Action Step | Suggested Timeline |

Expand Market Reach in Europe and Asia | 0-6 months post-acquisition |

Integrate and Leverage New Technologies | 0-12 months post-acquisition |

Implement Synergy Realization Plan | 0-6 months post-acquisition |

Develop and Initiate Strategic Partnerships | 6-18 months post-acquisition |

Launch Tailored Marketing Campaigns in New Markets | 3-9 months post-acquisition |

Foster Collaborative R&D Innovations | 0-12 months post-acquisition |

Steps for Addressing Weaknesses and Threats

Action Step | Suggested Timeline |

Develop and Implement Cultural Integration Program | 0-6 months post-acquisition |

Operational Redundancy Analysis and Restructuring | 0-6 months post-acquisition |

Establish Regulatory Compliance & Monitoring Team | Immediately post-acquisition |

Implement Risk Management for Economic Changes | Immediately post-acquisition |

Execute Effective Integration Strategy | 0-12 months post-acquisition |

Initiate Key Talent Retention and Engagement Plan | 0-3 months post-acquisition |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

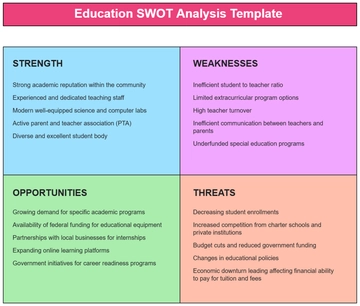

Presenting the Finance Mergers & Acquisitions SWOT Analysis Template from Template.net, an essential tool for financial strategists. Fully editable and customizable in our AI Editor tool, this template enables a detailed assessment of strengths, weaknesses, opportunities, and threats in M&A scenarios. Its adaptable format facilitates strategic planning and decision-making in finance. Enhance your analytical capabilities with this template now.